Article by IG Senior Market Analyst Axel Rudolph

FTSE100, DAX 40, S&P 500 Evaluation and Charts

FTSE 100 restoration underway

The FTSE 100 is recovering from this week’s low at 7,369 amid rising oil and commodity costs and because the governor of the Financial institution of England (BoE), Andrew Bailey forged doubt on the necessity for additional price hikes. The breached July-to-September downtrend line, due to inverse polarity a help line – now at 7,366 – provided help this week with an try to succeed in the 55-day easy shifting common (SMA) at 7,474 at present underway. Above it lurks the July-to-September resistance line at 7,493 and likewise at Monday’s 7,524 excessive. This stage would must be bettered for the 200-day SMA to come back again into play.

Minor help sits on the late August 7,419 low.

FTSE 100 Each day Chart

Really helpful by IG

High Buying and selling Classes

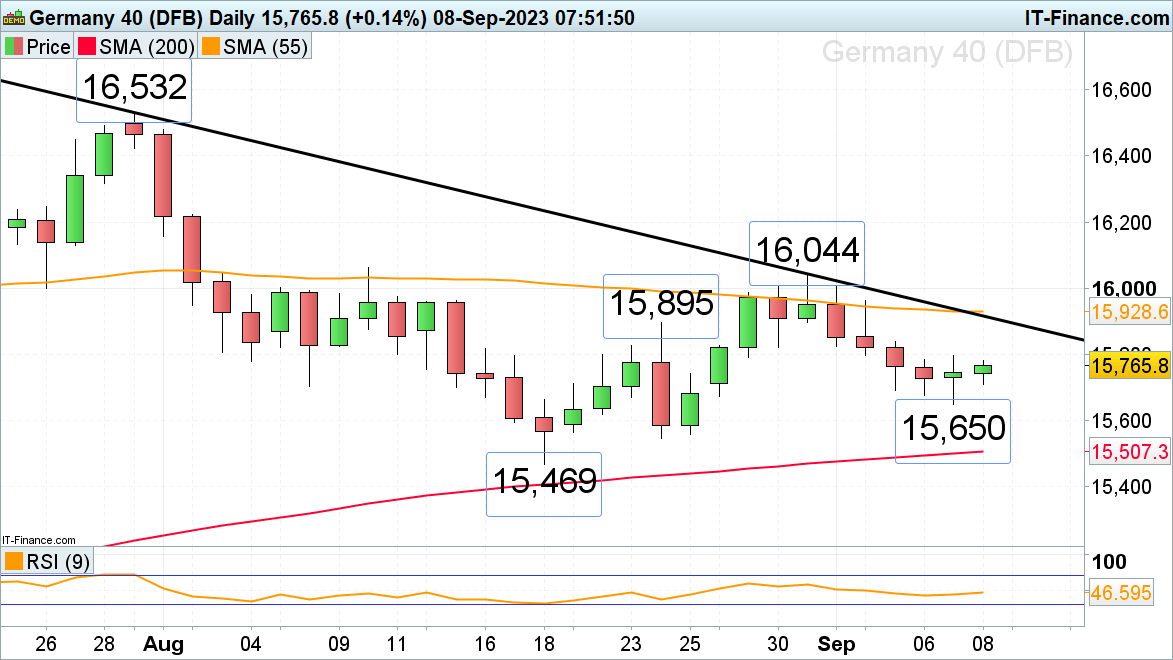

DAX 40 tries to stabilize

The DAX 40 had a tough week for bulls as Euro Zone development worries, a rising US greenback and yields weighed on sentiment and led to an over 2% drop within the index from its late August excessive at 16,044. Whereas Thursday’s 15,650 low holds on a each day chart closing foundation on Friday, although, the 24 August excessive at 15,895 could also be revisited. Barely additional up the July-to-September uptrend line and 55-day easy shifting common (SMA) will be noticed a 15,916 to fifteen,928.

Have been this week’s low at 15,650 to fall by means of on a each day chart closing foundation, the August lows and 200-day SMA at 15,545 to fifteen,469 can be in sight.

DAX 40 Each day Chart

Obtain the Free IG Sentiment Report

| Change in | Longs | Shorts | OI |

| Each day | 4% | -3% | 0% |

| Weekly | 42% | -17% | 2% |

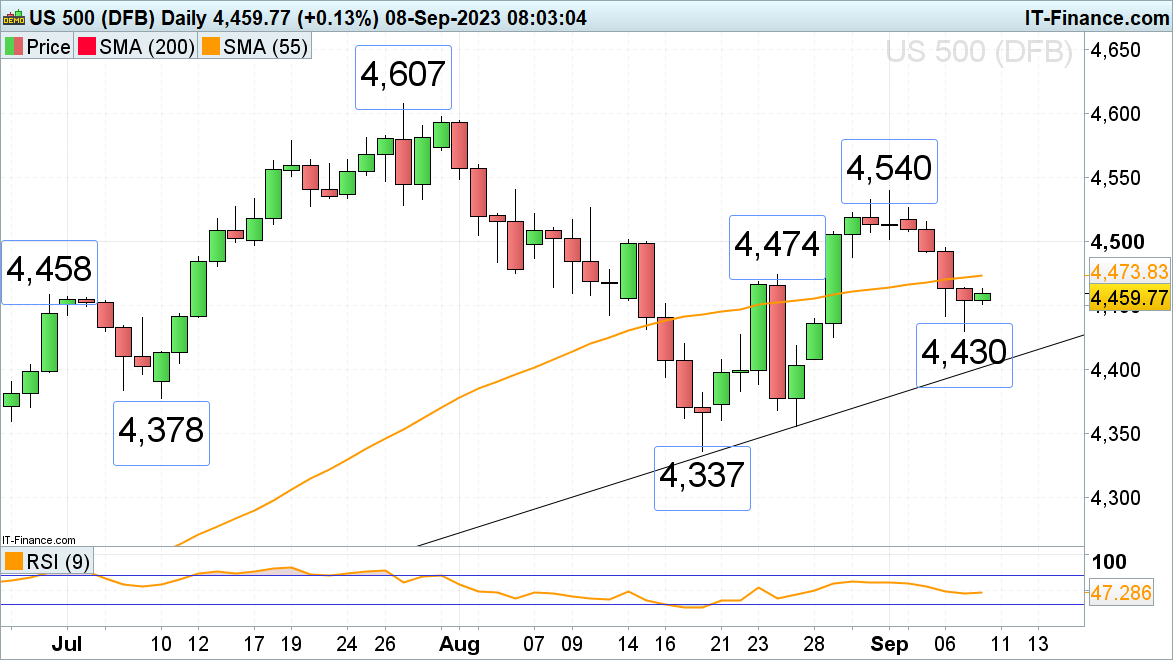

S&P 500 tries to stem decline forward of weekend

Following 4 straight days of declining costs, the S&P 500 could attempt to discover help above Thursday’s low at 4,430 amid short-covering forward of subsequent week’s US shopper value index publication. A rising US greenback and treasury yields, together with China’s ban on iPhone utilization for presidency officers weighed on the index this week as did rising chances of one other Federal Reserve (Fed) price hike earlier than the 12 months is out. On Thursday the previous Federal Reserve Financial institution of St. Louis President James Bullard mentioned that policymakers ought to persist with their plan for yet one more price hike.

Whereas this week’s low at 4,430 holds, a bounce again towards the 55-day easy shifting common (SMA) at 4,474 could ensue. This stage coincides with the 24 August excessive. Additional up lies the psychological 4,500 mark forward of the present September peak at 4,540.

A fall by means of 4,430 would push the March-to-September uptrend line at 4,402 to the fore.

S&P 500 Each day Chart

Really helpful by IG

The Fundamentals of Development Buying and selling