gopixa

The financial setting has been very fluid during the last a number of years. Whereas long-term traders do not change their targets yearly, folks nonetheless usually must undertake their methods whilst their targets stay the identical. With Covid severely impacting markets and international locations worldwide, inflation accelerating considerably beginning in early 2021, and development slowing this 12 months, enterprise cycles have been very quick during the last 3 years.

One well-known alternate traded fund that seeks to trace the general market by being listed to the CRSP US Complete Market Index is the Vanguard Complete Inventory Market Fund Index (NYSEARCA:VTI). This ETF has remained very talked-about even throughout the interval of current market turmoil.

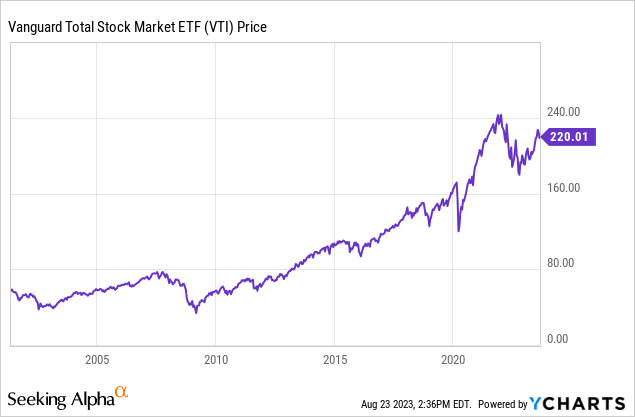

VTI has carried out nicely for the reason that fund’s inception in the midst of 2001. This ETF has supplied traders whole returns 456.54% during the last 2 many years, whereas the S&P 500 has supplied traders whole returns of 428.98% throughout the identical time interval.

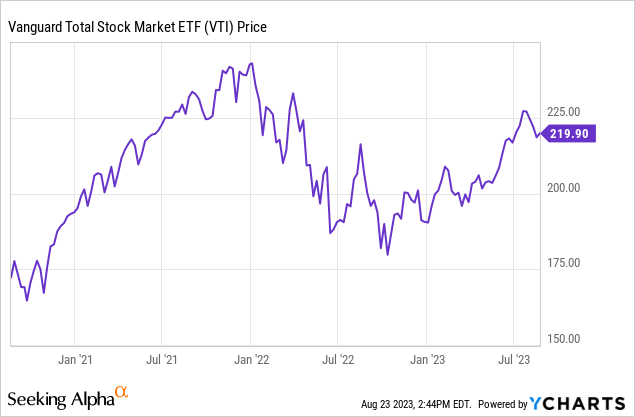

Nonetheless, this Vanguard fund has gone nowhere since costs started to rise considerably within the center 2021.

VTI has supplied traders whole returns of simply 7.42% since Could of 2021. The S&P 500 has additionally struggled throughout this timeframe, providing traders whole returns of 8.99% during the last 2 years.

I final wrote about this Vanguard fund in February of this 12 months. I rated this fund as promote primarily as a result of this ETF shouldn’t be nicely positioned for an inflationary setting due to the fund’s minimal holding within the power and fundamental materials sectors, as nicely the alternate traded fund’s heavy publicity to foreign exchange strikes. At the moment, I’m altering my ranking of this ETF to Maintain. Inflation ranges have fallen for 11 of the final 12 months, and the present charge of worth will increase at 3.2% is simply above the Fed’s long-term purpose of two%. The greenback can also be prone to weaken in opposition to the Euro and most main currencies as the present charge cycles involves a pause and the EU and China see development charges speed up. The financial system additionally seems doubtless to have the ability to keep away from a extreme recession.

The Vanguard Complete Inventory Market Fund Vanguard Complete Inventory Market Index Fund ETF Shares Holdings has 27.71% of the fund’s holdings in know-how shares, 13.14% of its property in well being care shares, 12.44% of the fund’s holding in financials, 10.86% of the fund’s property in client cyclicals, 9.47% within the industrial sector, 7.95% in communication, 6.09% in client defensive shares, 4.31% in power shares, 3.08% in the true property sector, 2.48% in utilities, and a couple of.48% in fundamental materials shares.

This fund has $309.10 billion in property underneath administration, the expense ratio is .03%, and the yield is 1.53%. The 4 largest holdings of this fund are Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), and NVIDIA Company (NVDA). This Vanguard ETF additionally holds .49% of the fund’s property Vanguard Complete Inventory Market Index Fund ETF Shares Holdings money and money equivalents. VTI seeks to trace the CRSP U.S. Complete Market index, which incorporates giant, medium, and smaller cap firms.

VTI is a extra aggressive development fund that has pretty minimal holdings in defensive sectors, and this ETF additionally a low quantity of publicity to commodities as nicely. This fund was not positioned nicely for an inflationary setting, and this ETF can also be prone to underperform different extra conservative funds if development charges have been to gradual considerably. VTI struggled during the last 2 years primarily due to the fund’s minimal holding within the power and fundamental materials sectors, in addition to this ETF’s vital publicity to foreign exchange strikes primarily due to the fund’s heavy publicity to giant cap tech.

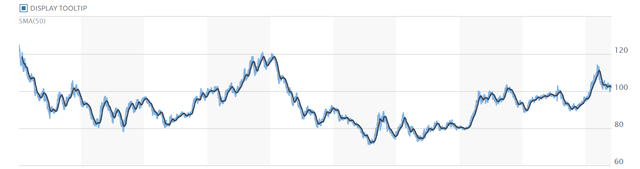

At the moment, inflation charges have fallen in 11 of the final 12 months, and the present charge of worth will increase is 3.2%, simply barely above the Fed’s said goal of two%, the present charge cycle is prone to be paused quickly. The power disaster in Europe can also be over, and China has lastly opened their financial system, international development charges ought to speed up subsequent 12 months. Predicting forex strikes within the short-term is all the time difficult, however these elements ought to trigger the greenback to fall in opposition to the Euro and most main currencies transferring ahead. The greenback has additionally already begun to drag again in opposition to the Euro after having reached a short-term peak in Could of this 12 months.

A chart of the US greenback’s efficiency in opposition to the Euro (Marketwatch)

The financial system additionally seems doubtless to have the ability to keep away from a extreme recession. The variety of economists forecasting a recession has dropped during the last quarter from 70% to 58%, and a current Philadelphia Fed survey of economists reveals that the majority are predicting 1% development this 12 months. Most shoppers nonetheless have financial savings from the pandemic that individuals can depend on, even with the current drawdown most households have seen primarily change into of inflation. Shopper financial savings stay at above common ranges and the current July and August jobs experiences confirmed the financial system stays regular as nicely.

VTI is a extra aggressive development fund that may doubtless be ideally suited for bullish traders who need heavy publicity to extra cyclical sectors. Whereas this fund predictably underperformed many extra conservative funding funds throughout the current interval of inflation, this Vanguard fund ought to outperform most different investments in an setting the place inflation ranges ease and development charge speed up, which seems just like the most probably situation transferring ahead.