APAC shares traded combined as the frustration from China’s resolution on its Mortgage Prime Charges overshadowed its latest help efforts; Hong Kong underperformed. PBOC opted for a narrower-than-expected reduce to the 1-year LPR alongside a shock maintain on the 5-year LPR, which is the reference price for mortgages. PBOC and regulators met with financial institution executives and advised lenders to spice up loans to help the financial restoration as an alternative. In the meantime Nation Backyard has been delisted from the Hold Seng as the actual property sector in China crumbles earlier than our eyes.

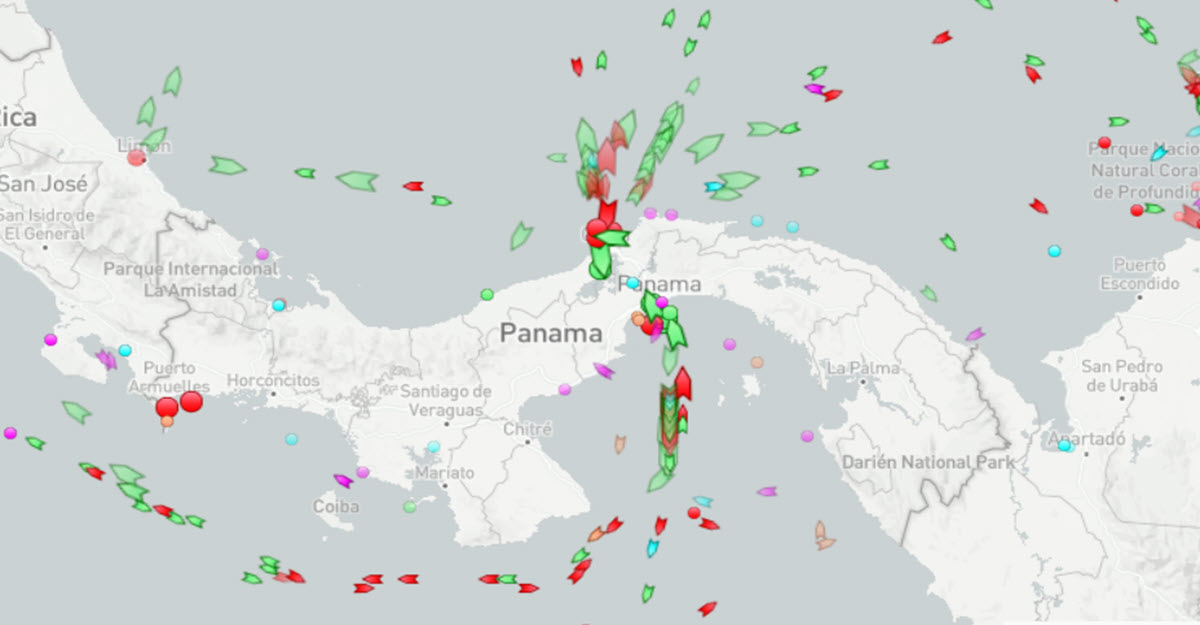

US500 futures have been little modified on Sunday night time after one other dropping week for the most important averages: US100 closed the week decrease about 2.6%, down for a 3rd straight week for the primary time since December. In the meantime, the Dow closed the week decrease by 2.2%, its worst streak since March. And the S&P 500 dropped 2.1% and posted its third consecutive dropping week, which hadn’t occurred since February. German PPI are simply out, exhibiting one other constant decline, however Unions at Woodside Vitality’s North West Shelf offshore gasoline platforms on Sunday introduced plans to strike as early as September 2nd, sending EU Pure Gasoline +18% this morning. On the inflation aspect we even have Japan, which is ready to extend minimal pay by a file quantity as inflation takes maintain and 200 cargo ships are caught ready to cross the Panama Canal Water as shortages attributable to the worst drought in 100 years have compelled the canal operators to scale back the movement of site visitors, which might have penalties for the worldwide provide chain additionally on account of what seems to be a nonetheless robust American shopper market.

Panama channel congestion actual time

- FX – USDIndex is regular above 103 (103.32 now) and nicely above its 50-200 MAs; USDJPY discovered help above 145 (145.45 now), USDCNH heading north (7.33). NZDUSD retains drifting decrease (as does AUDUSD) after the Commerce Stability information. Cable flat and lateral (1.2690 – 1.2765).

- Shares – US and EU Futures are flat, Hong Kong slides once more (-1.60% at 17631) regardless of Nation Backyard delisting.

- Commodities – USOil retains recovering some floor, at present +0.61% at $81.88, the identical for Copper regular at $371.20 after rebounding from the trendline final week.

- Gold – flat at $1,889 as is Silver ($22.75).

Right now: No extra related information after PBOC price resolution and German PPI earlier this morning.

Fascinating Mover: VIX (-0.27%) @ 18.45, is pulling again after having examined its 200MA on Friday (Opex day); It’s lastly again above the world that has been help after 2020 and will consolidate right here. A transfer to the upside would have the 20.50-22 space as the subsequent goal.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a basic advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or must be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.