- Uber’s effectivity surge boosts inventory costs, however long-term sustainability questioned.

- Optimistic outlook for Uber’s future earnings, projecting vital EPS progress by 2024.

- Concentrate on self-driving automobiles and AI investments as potential game-changers for Uber’s profitability.

Few corporations on Wall Avenue have been in a position to grasp this 12 months’s moat higher than the ride-hailing big Uber Applied sciences (NYSE:).

On the one aspect, the San Francisco-based firm has tremendously benefited from the resurgence of high-flying tech shares as buyers anticipate extra dovish monetary circumstances within the close to flip, favoring corporations which are but to show a full-year revenue.

Alternatively — and maybe most significantly — Uber has been completely killing it in what Zuckerberg named the ‘12 months of effectivity.’

Not solely has the corporate posted its two finest earnings studies since going public, beating analysts’ earnings per share estimates by a lofty 1.570% in This fall 2022 and 100% in Q1 2023, however it additionally did so by slicing bills, rising revenues, and bettering EBITDA margins at a time when labor prices rose sharply and the specter of regulation for drivers around the globe weighed on authorized spending.

After a troublesome pandemic — which led the corporate to postpone its plans for a completely worthwhile 12 months — this 12 months’s mixture of things has propelled the ride-hailing big to its 52-week excessive with an almost 100% rise in costs. Long run, nevertheless, the corporate nonetheless sits practically 25% beneath its ATH of $64.05.

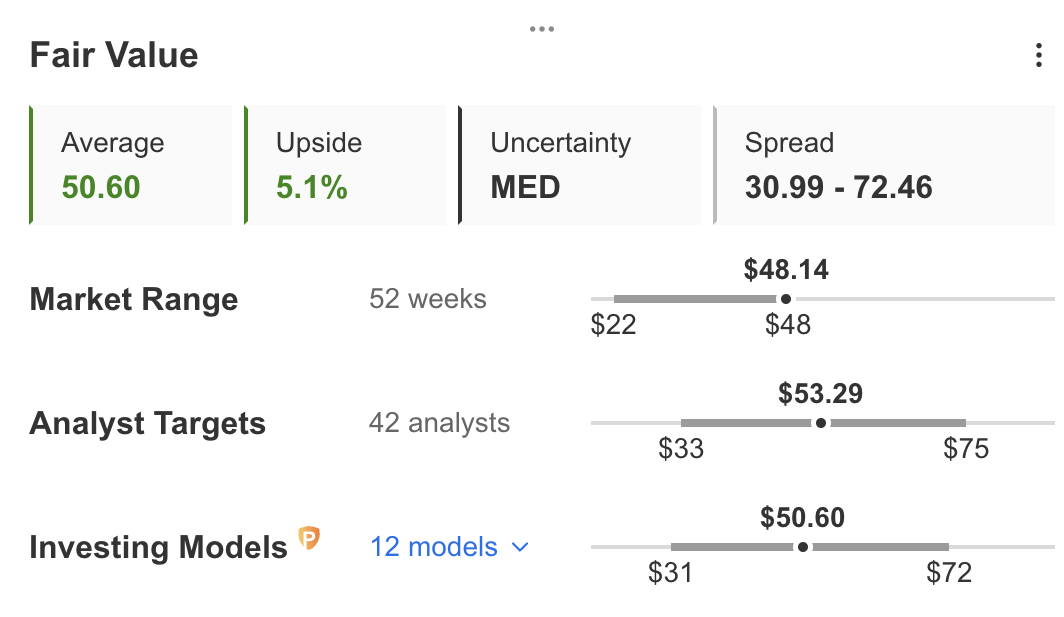

InvestingPro’s truthful worth estimate signifies that Uber nonetheless has a 5.1% upside potential within the subsequent 12 months with medium uncertainty.

Supply: InvestingPro

On the macro aspect, the market has broadened its YTD rally towards extra sectors, suggesting a broader correction could also be nearing from seemingly overbought shares.

With valuation trying stretched from a short-term perspective however with earnings trending increased, the bull vs. bear dialogue for Uber inventory grows more and more disputed.

Let’s take a deeper dive into the corporate’s fundamentals to know the place we stand proper now.

Profitability Progress and Margins

After the corporate’s IPO in 2019, Uber hasn’t but managed to show a full 12 months of profitability and, therefore, nonetheless holds a unfavorable PE ratio of -28.9%. Nonetheless, since turning the tables in This fall 2022 with a large earnings beat, Uber’s unprofitable days have been counted.

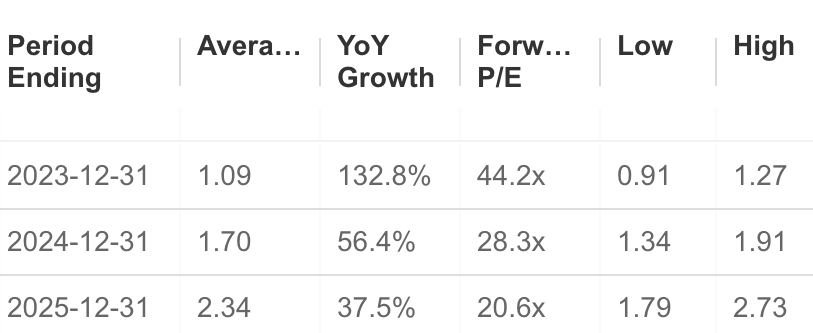

Supply: InvestingPro

Wall Avenue has excessive expectations for Uber’s future earnings, with EPS projected to achieve $1.09 per share this 12 months, $1.70 in 2024, and $2.34 in 2025. This is able to suggest a formidable improve of 37%, 56.4%, and 132.8%, respectively, bringing PE to as little as 20x in 2025.

Supply: InvestingPro

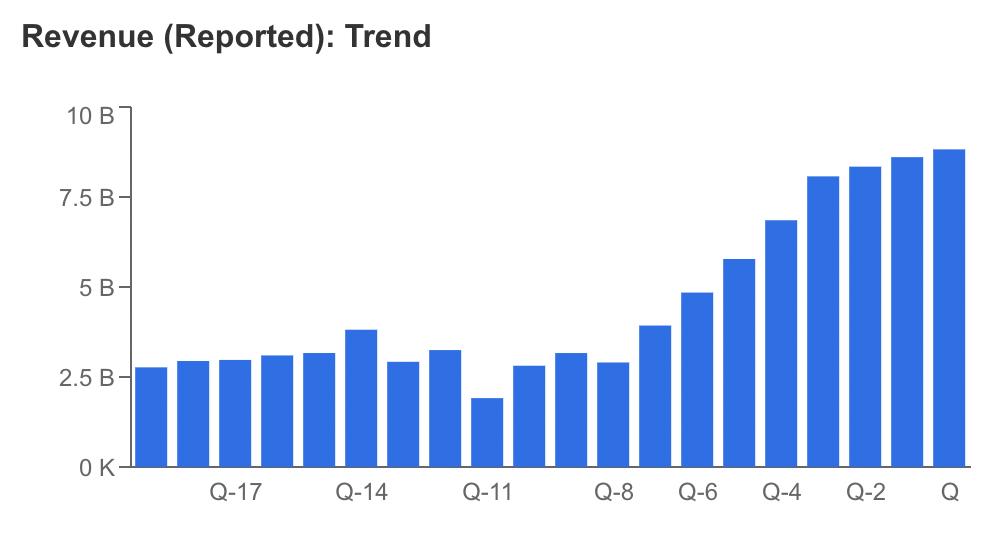

Revenues are additionally trending a lot increased and are anticipated to achieve compelling ranges in 2024. In response to projections, Uber’s income is predicted to extend by 18% in 2023 and an additional 19% in 2024, reaching $44.51 billion in comparison with $31.88 billion within the full 12 months of 2022.

Supply: InvestingPro

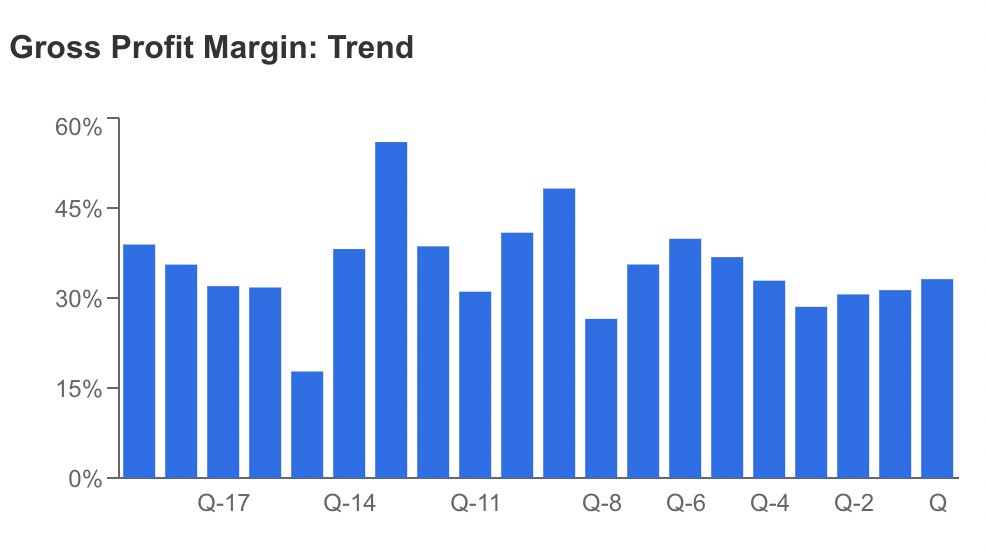

Extra impressively, these numbers come on the again of bettering gross margins regardless of the troublesome macro atmosphere, particularly for corporations that rely upon highly-skilled labor.

Supply: InvestingPro

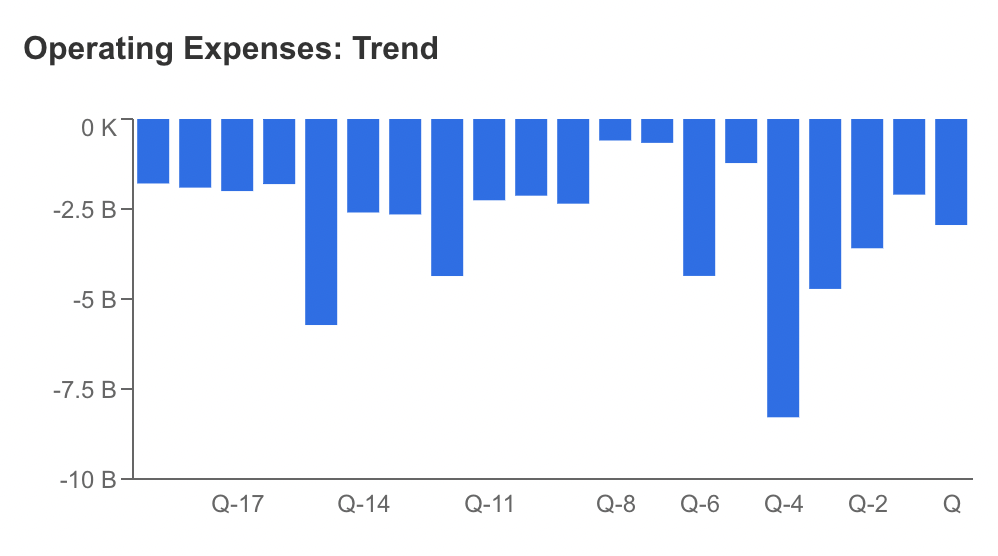

Uber has additionally reported decrease working bills, indicating the corporate has managed to remain financially resilient as it really works patiently towards a extremely worthwhile 2024.

Supply: InvestingPro

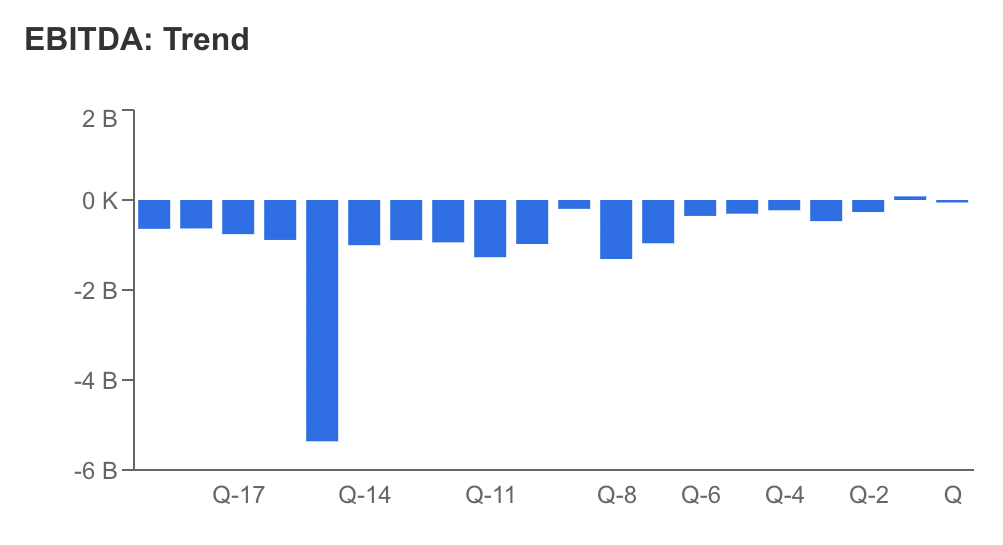

However the primary metric buyers ought to take note of in tomorrow’s earnings is Uber’s EBITDA margins. After turning a optimistic studying for the primary time in This fall 2022, the corporate has been preventing to keep up a impartial studying.

Supply: InvestingPro

A impartial to optimistic studying tomorrow would suggest Uber has been doing a significantly better job than the competitors when it comes to securing funds for future investments, which ought to be key in 2024 onward as a mix of AI and EV developments is predicted to overhaul the sector.

Self-Driving Automobiles, AI

Uber envisions a future wherein fleets of autonomous automobiles seamlessly navigate by means of bustling cities, revolutionizing city transportation, meals supply, and logistics companies.

Lately, in late Could, the corporate made a noteworthy stride in direction of realizing this imaginative and prescient by unveiling a groundbreaking multi-year strategic partnership with Waymo, a famend chief in autonomous driving know-how.

CEO Dara Khosrowshahi mentioned on the time he envisions that the combination of autonomous automobiles will create a self-reinforcing cycle. In response to his imaginative and prescient, as extra autonomous automobiles are deployed on the roads, there will likely be a rise in transportation choices, which, in flip, will drive down costs step by step. This affordability ought to stimulate a surge in demand for these companies, thus fueling additional growth and adoption of autonomous automobiles available in the market.

″We’re completely dedicated to self-driving automobiles,” Khosrowshahi informed NBC on the time.

Enterprise-wise, if Uber manages to totally deploy such a technique within the subsequent few years, margins would development a lot decrease, bettering revenues and, thus, making the inventory value very low cost from a basic perspective.

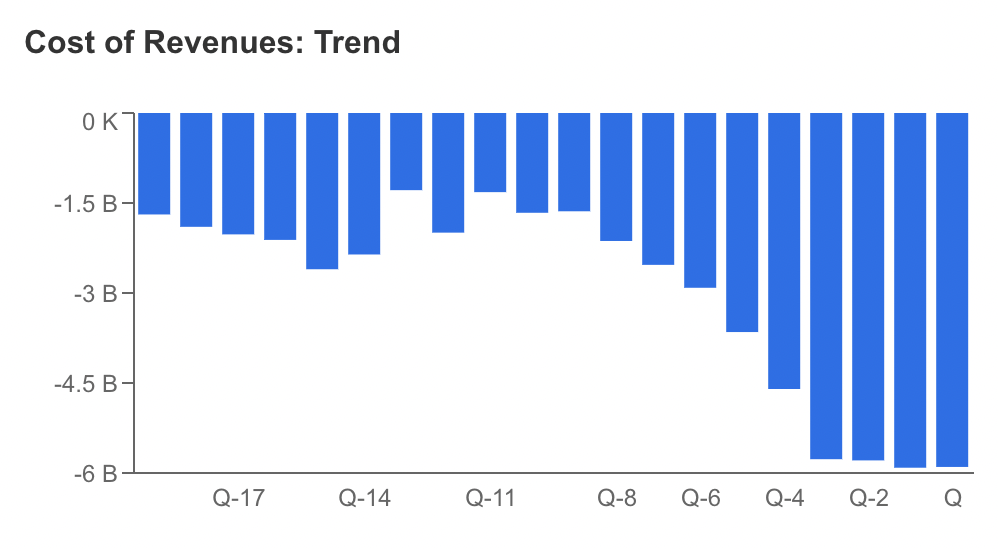

Once more, to wit, Uber’s principal profitability drag stays its excessive price of revenues because of the percentages paid to its drivers amid an inflationary atmosphere.

Supply: InvestingPro

To make CEO Khosrowshahi’s imaginative and prescient work, Uber has been investing arduous in AI and the development of its knowledge facilities.

Uber already incorporates AI in numerous features of its operations, akin to route planning, demand forecasting, and buyer communication. Nonetheless, the subsequent step – integrating AI and self-driving – is a serious step leap that can rely upon wholesome margins from the large. Furthermore, the authorized implications of such an endeavor may very effectively weigh on the corporate’s financials all through the method.

One other authorized difficulty is the fixed breach of consumer knowledge in Uber apps, which has been consuming massive sums of funding from the corporate. As CEO Khosrowshahi pledges to maintain investing within the subject, it’s doable that Uber’s working prices will stay elevated going ahead.

Backside Line

Margins, margins, margins.

Uber’s future prospects maintain an fascinating promise from each macro and micro views. Nonetheless, the attractiveness of funding will hinge upon the corporate’s capability to safe substantial funding amid excessive working bills.

Because the race for self-driving automobiles and the widespread implementation of AI in on a regular basis life intensifies, solely probably the most environment friendly corporations will be capable to thrive. Notably, Uber has demonstrated an edge over its rivals and is predicted to keep up this aggressive benefit within the subsequent few years.

For buyers looking for long-term positive factors, Uber’s inventory seems promising. However, warning is warranted as present ranges might point out an overbought scenario, and a broader market pullback may current a compelling alternative for these looking for an advantageous entry level.

***

Hurry up and benefit from the closing day of our InvestingPro summer time sale!

Disclosure: The writer doesn’t personal Uber inventory.