- Tech corporations on Nasdaq 100 have seen their weightage scale back put up rebalancing

- Apple, Microsoft, and Alphabet are all buying and selling in overvalued territory

- Can these 3 corporations proceed their uptrend put up rebalancing?

It is no secret that enormous U.S. tech corporations have skilled a discount of their weighting on the after the ‘particular’ rebalancing. The weightage of the 7 largest corporations within the index has decreased from 56% to 44%.

As we make our approach via earnings season, with some corporations having already reported and others but to take action, there is a lingering query on many minds. Individuals are considering whether or not these influential corporations, which performed a pivotal function out there’s restoration from the October 2022 lows, nonetheless have room for development or if a downturn awaits them.

Whereas we won’t declare to foresee the long run with absolute certainty, we’ll delve into an intensive evaluation of the highest 3 corporations utilizing InvestingPro.

1. Apple

Let’s start with Apple (NASDAQ:), the biggest holding in Warren Buffett’s portfolio. The corporate has surged to all-time highs because the starting of the yr, and its upward trajectory suggests the potential for reaching even increased ranges within the close to future.

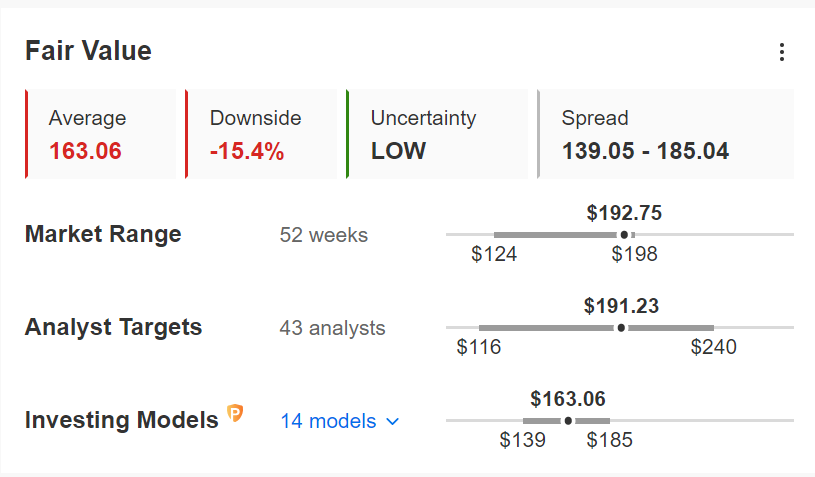

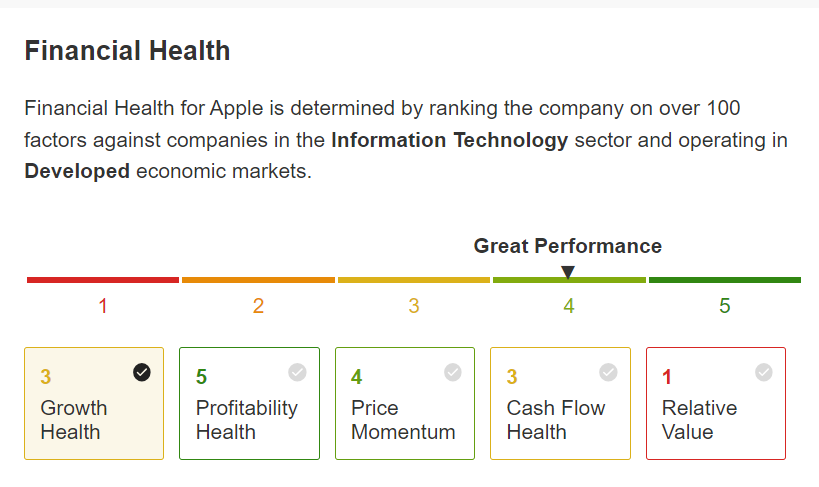

Valuation-wise, the inventory seems to be on the costly aspect, with a 14.5% premium (with out the well-known “margin of security”). Nonetheless, its monetary well being rating is 4 out of 5, taking all parts under consideration, the place the one concern lies in its comparatively excessive valuation.

Supply: InvestingPro

Supply: InvestingPro

2. Microsoft

As for Microsoft Company (NASDAQ:), chart-wise, we’re at the moment retesting the highs at $345. Nonetheless, a decisive breakthrough has not occurred but. As we speak’s quarterly earnings name may play an important function, both offering the enhance wanted for additional upward motion or probably resulting in a double-high situation if the inventory retraces.

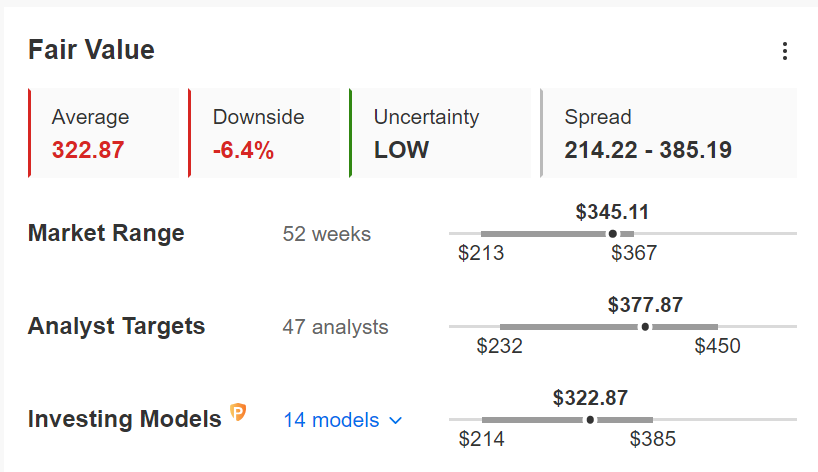

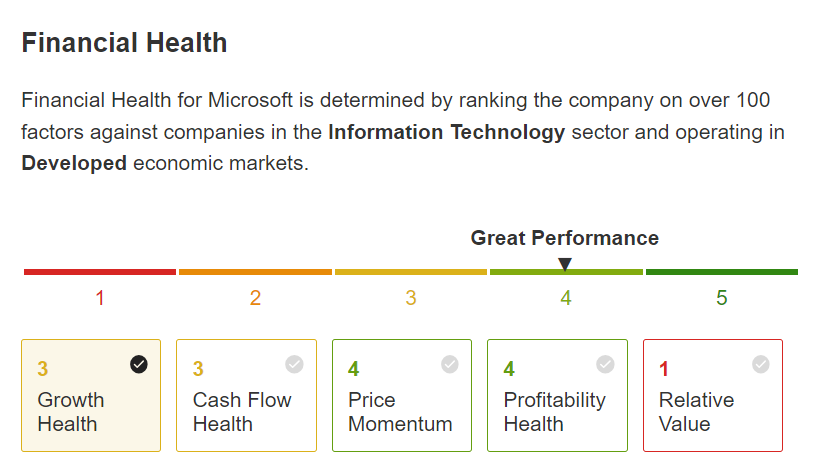

Each Apple and Microsoft discover themselves within the overvalued territory right now, although Microsoft is barely much less affected in comparison with Apple. Regardless of this, their monetary well being scores stand at a commendable 4 out of 5. Nonetheless, the primary issue affecting their monetary well being is, as soon as once more, the priority over valuations.

Supply: InvestingPro

Supply: InvestingPro

3. Alphabet

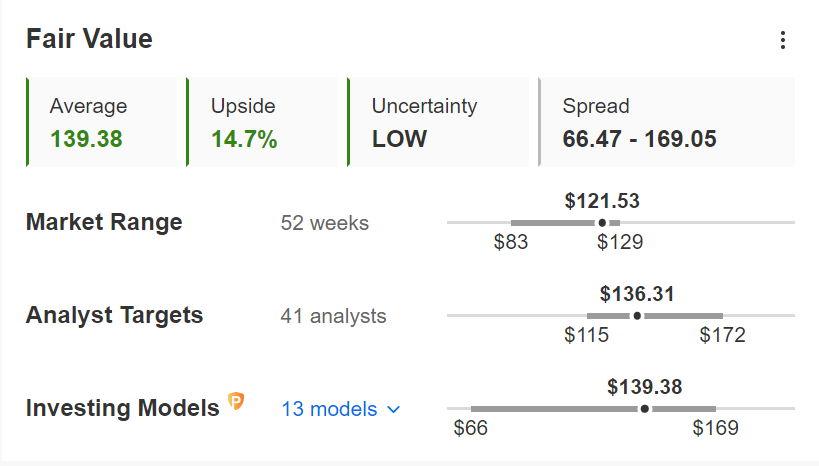

Lastly, let’s talk about Alphabet Inc Class A (NASDAQ:). Among the many three corporations, Alphabet retraced greater than the others. Nonetheless, it seems to be making an effort to regain floor just lately, though it is nonetheless about 25% away from reaching its earlier highs.

Notably, the correction halted across the $86.60 mark, and since then, the inventory has managed to get well greater than half of its losses.

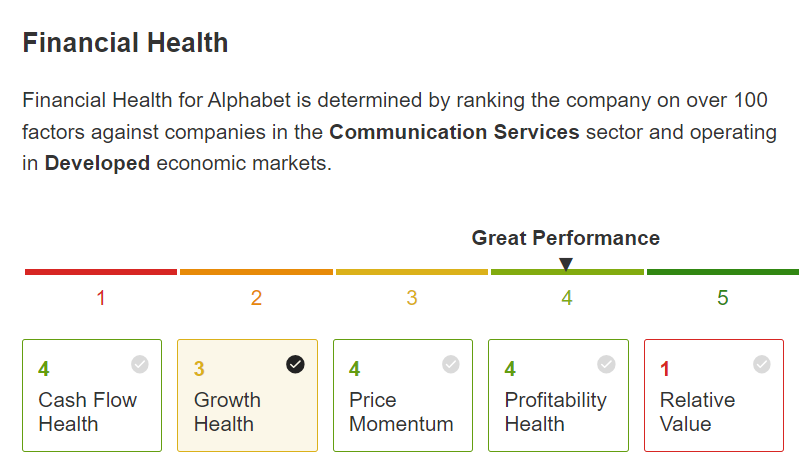

As a result of this substantial drop, Alphabet’s inventory now seems to be essentially the most discounted by way of valuation (although not by a major margin). Its monetary well being is just like the opposite two shares, with a confirmed rating of 4 out of 5, primarily impacted by the inventory’s values.

Supply: InvestingPro

As we speak’s quarterly earnings report holds important significance because it may probably give Alphabet the mandatory enhance to make a contemporary try at reaching new highs. Traders will intently scrutinize Google’s revenues and developments in synthetic intelligence, as these components are anticipated to have a considerable affect on the corporate’s efficiency.

Discover All of the Data you Want on InvestingPro!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, counsel or suggestion to speculate as such it’s not supposed to incentivize the acquisition of belongings in any approach. As a reminder, any kind of belongings, is evaluated from a number of factors of view and is very dangerous and due to this fact, any funding choice and the related threat stay with the investor. The creator owns the shares talked about within the evaluation.