Just_Super

Introduction

Cara Therapeutics (NASDAQ:CARA), a biopharmaceutical agency listed on the NASDAQ, primarily develops novel therapeutic options for sufferers affected by pruritus. Their product, Korsuva (difelikefalin) injection, obtained FDA approval in 2021, and it’s the solely permitted therapy for adults with persistent kidney illness present process hemodialysis who expertise moderate-to-severe pruritus. Moreover, the corporate is formulating a tablet model of difelikefalin and has begun Section 3 trials for its use in sufferers with superior non-dialysis dependent CKD and atopic dermatitis.

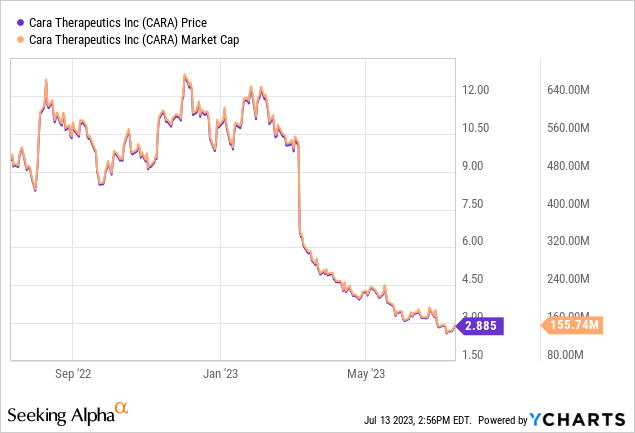

Up to now, I’ve had reservations about Cara Therapeutics attributable to its difficult monetary efficiency and unsure market outlook. The excessive bills and low revenues created doubt about their skill to ship a passable return on funding. Whereas they had been creating an oral model of difelikefalin and hoping to increase Korsuva’s market, the influence of those ventures on the corporate’s market share and monetary standing was ambiguous. The potential marketplace for Korsuva appeared restricted, because it was typically a later-line therapy for uremic pruritus, making substantial market share acquire a tough job. Consequently, my earlier advice for Cara Therapeutics was “Promote.” I urged buyers discover different choices within the biopharmaceutical sector, with stronger monetary efficiency and extra promising market prospects for higher long-term returns. Since my preliminary “Promote” advice in February, shares of Cara commerce 73% decrease.

Current developments: Jefferies states the US Medicare and Medicaid Providers proposes to increase Korsuva’s reimbursement to 2027, doubtlessly unlocking Cara Therapeutics’ inventory worth.

Q1 2023 Earnings

In Q1 2023, Cara Therapeutics reported a internet lack of $26.7 million, down from a lack of $27.7 million in Q1 2022. Its money, money equivalents, and marketable securities lowered to $123.4 million from $156.7 million on the finish of 2022 attributable to operational bills. Income elevated to $6.2 million from $4.8 million in Q1 2022, attributable to collaborative and royalty revenues, along with gross sales of Korsuva injection. Price of products bought rose barely, whereas R&D bills additionally elevated attributable to direct medical trial prices. Nevertheless, G&A bills decreased attributable to decrease stock-based compensation bills. Different revenue additionally elevated attributable to larger curiosity revenue. Primarily based on the present monetary place, Cara expects its funds to suffice to fund its deliberate operations until the second half of 2024.

Buyers additionally want to contemplate the inherent dangers related to investing in a “microcap” firm like Cara Therapeutics, which has a market capitalization round $150 million. Working within the unpredictable biotech sector, their success largely hinges on medical trial outcomes and regulatory approvals, each of which include important uncertainty. These smaller, ‘microcap’ corporations typically grapple with substantial operational bills and restricted revenues. Moreover, they are usually much less liquid and extra inclined to market volatility in comparison with their bigger counterparts, probably inflicting challenges in share buying and selling with out influencing the inventory worth. Potential buyers should brace for substantial worth fluctuations and the potential for losses. Prior thorough due diligence is crucial earlier than making any funding choices.

Firm Updates

Cara Therapeutics has made a number of strides not too long ago. The corporate has launched Kapruvia in France, Finland, the Netherlands, and Switzerland. It has additionally been progressing with enrollment for the Section 3 KIND program in atopic dermatitis, with preliminary findings anticipated in late 2023, and ultimate outcomes due in early 2025. The KICK Section 3 program for superior CKD can also be ongoing, with topline outcomes anticipated within the latter half of 2024. Cara has revealed its Section 2 trial outcomes of oral difelikefalin in NP and CKD sufferers in respected journals. Lastly, it has initiated the KOURAGE Section 2/3 program for NP-related pruritus therapy, anticipating preliminary and ultimate leads to 2024 and 2026 respectively.

Potential for Elevated Korsuva Reimbursement

Jefferies’ assertion factors to a possible extension of Cara Therapeutics’ drug Korsuva’s reimbursement interval by the US Facilities for Medicare and Medicaid Providers (CMS) as much as 2027. In essence, CMS is the federal company administering probably the most intensive healthcare packages within the US: Medicare, providing medical health insurance to people above 65 years, and Medicaid, offering medical price help to sure low-income people and households.

The idea of reimbursement is important to the industrial viability of any healthcare product. Ought to CMS prolong its reimbursement for Korsuva, it implies the remedy’s price might be compensated for these certified underneath Medicare and Medicaid. This might probably broaden the drug’s availability to those sufferers, doubtlessly resulting in enhanced utilization and gross sales—thus the reference to “sustaining quantity progress.”

The prolongation of the reimbursement interval might additionally sign positivity for the inventory’s potential efficiency. It’d render Cara Therapeutics extra interesting to buyers, because it hints at a constant income move for the corporate in the course of the prolonged reimbursement span. Therefore, Jefferies suggests this transfer might “enhance the inventory within the near-to-medium time period.”

Nevertheless, it is essential to acknowledge that this coverage is not ultimate but. The company will set up its ultimate stance on its reimbursement insurance policies after a 60-day public suggestions interval. Throughout this window, varied stakeholders, together with sufferers, healthcare suppliers, and different entities, can voice their views on the proposed coverage. The ultimate determination is likely to be formed by these inputs, including a level of unpredictability to the state of affairs. So, whereas the proposal is a bit of encouraging information, the final word outcome stays unsure.

My Evaluation & Suggestion

In conclusion, whereas latest developments such because the potential prolonged reimbursement for Korsuva and the continuing medical trials present promising alerts for Cara Therapeutics, it is important to contemplate the broader monetary image. The corporate nonetheless faces the enduring challenges of excessive operational bills, restricted income, and an unclear long-term market potential for its lead product, Korsuva.

Nevertheless, the projected reimbursement extension for Korsuva by the US Medicare and Medicaid Providers presents a possible short-term boon for the inventory. If the coverage comes into impact, it might enhance Cara’s near-to-medium time period monetary prospects, probably triggering a rebound within the inventory worth.

But, buyers should stay cautious. The reimbursement coverage is not ultimate but, and the end result of the continuing trials stays unsure. Cara’s inventory has considerably declined over the previous six months, and regardless of the potential for short-term share worth appreciation, I keep a “Promote” advice in the long run.

That stated, it is essential for buyers to keep watch over CMS’s ultimate determination on the reimbursement coverage, monitor the outcomes of Cara’s ongoing medical trials, and the corporate’s general monetary efficiency. These developments might present additional perception into Cara’s future and doubtlessly alter the funding thesis.

Dangers to Thesis

When the info change, I modify my thoughts.

As with every funding advice, there are potential dangers to my “Promote” steering on Cara Therapeutics. The most important threat could be a possible breakthrough of their ongoing medical trials, which might considerably improve the market potential of their therapies, resulting in a dramatic surge of their inventory worth. The proposed prolonged reimbursement coverage for Korsuva, if permitted, may result in elevated gross sales and income, enhancing Cara’s monetary prospects. Moreover, any sudden partnerships or acquisitions might alter the monetary outlook of the corporate positively. Lastly, there’s the chance inherent in market dynamics, the place optimistic general developments within the biotech sector might elevate Cara’s inventory regardless of its particular person challenges.