OlekStock/iStock through Getty Pictures

Thesis

Blackstone Mortgage Belief, Inc. (NYSE:BXMT) continues to draw buyers with its eye watering dividend payout, 11.8% on the time of this text. Administration continues to iterate their perception in sustaining that dividend, drawing consideration to the 125% dividend protection in the course of the first quarter. Even lots of the evaluation items right here on Looking for Alpha assist shopping for BXMT. However has administration been prudent sufficient? Is that dividend actually protected? These are the questions we are going to search to reply.

Overview

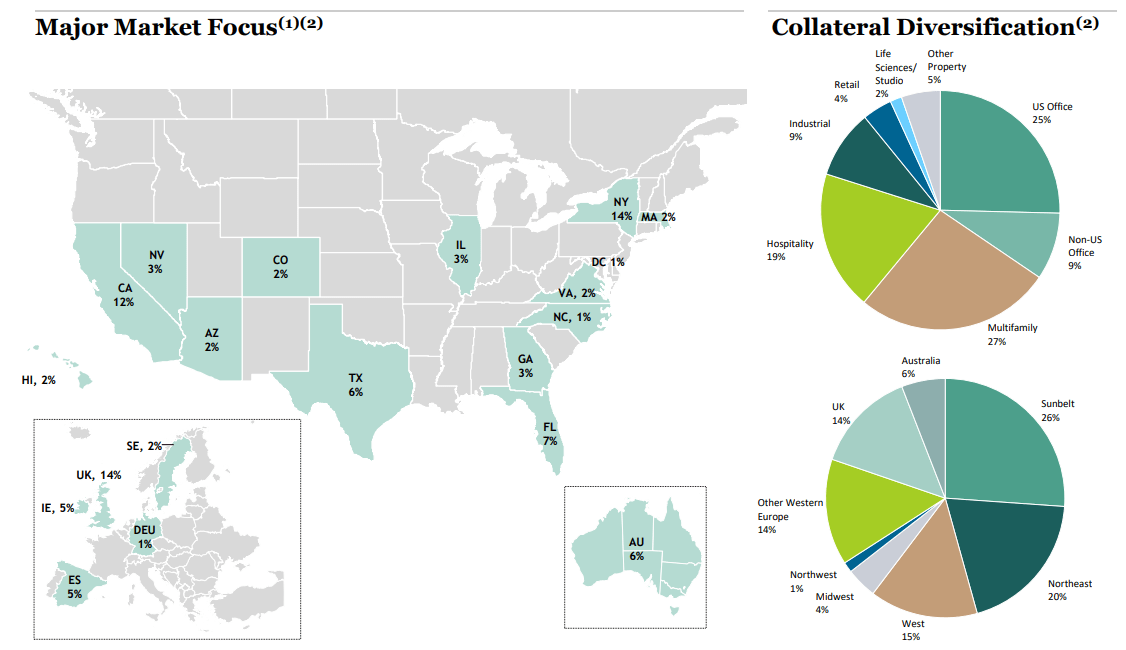

For these taking a look at BXMT for the primary time, BXMT is an actual property firm, originating collateralized loans in North America, Europe, and Australia. They handle roughly 25 billion in loans globally unfold throughout numerous property sorts.

BXMT Presentation

BXMT pays out a quarterly 62 cent dividend that has been flat since 2014. These in search of dividend progress ought to already look elsewhere. And sadly for current BXMT the market of rising rates of interest has not been sort to buyers. BXMT buyers have suffered a 25% loss within the final yr, regardless of the excessive distributions. It continues to commerce at a big low cost to guide worth, 0.8 P/BV which has added additional justification for buyers so as to add to their positions.

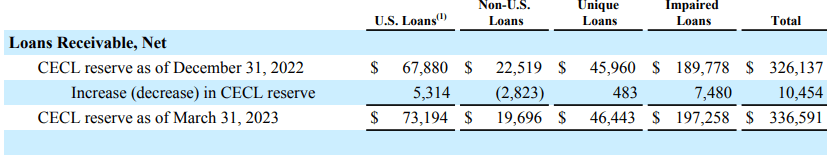

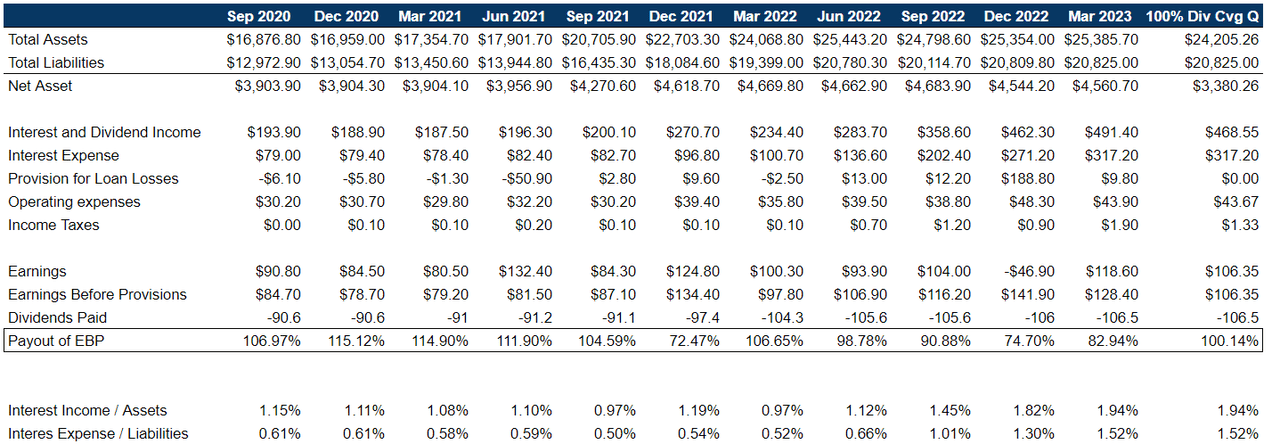

In This fall 22, BXMT administration began down the correct path and accrued a 189M provision for mortgage losses, however solely 10M in Q1 2023.

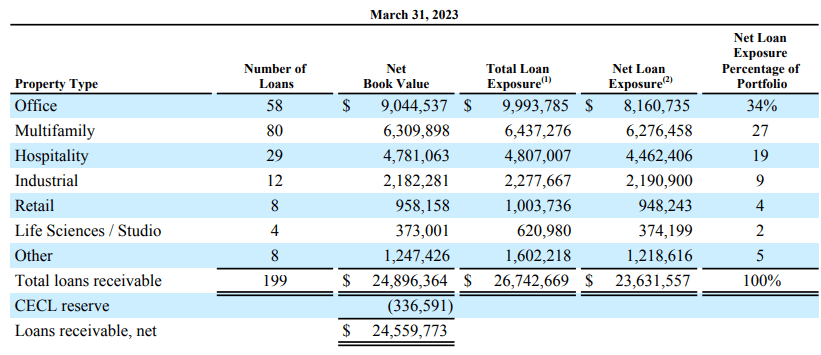

Clearly the market and administration are trying by very completely different lenses as buyers as an entire low cost the guide worth of BXMT by 20%. Administration attributes the low cost to the market not doing their analysis and simply treating all business actual property the identical.

Katie Keenan – CEO – BXMT Q1’23 Transcript

Portfolio

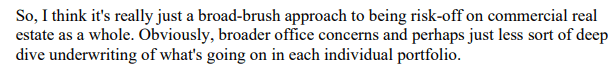

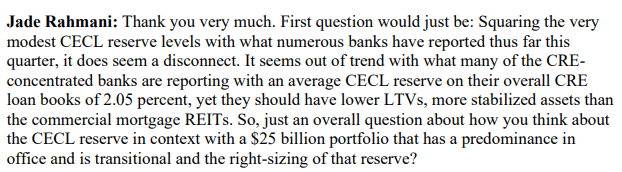

Under is the breakdown of BXMT’s portfolio on the finish of Q1. Though they’re diversified, the most important publicity stays with arguably probably the most regarding sub-sector, workplace.

BXMT

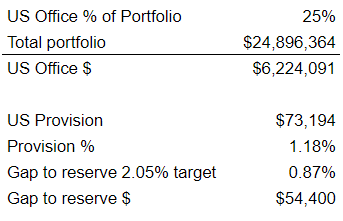

We will outline this publicity a bit additional by combining the desk with different printed supplies. US Workplace actual property, based on the Q1 presentation, makes up 25% of their portfolio. It is a vital publicity to an space of actual property that could be a fixed information headline bait. We must also word the 336M of reserve BXMT has accrued for. This reserve represents 1.35% of their whole mortgage receivable. Is This sufficient? In keeping with Jade Rahmani of KBW, in all probability not as they ask administration that exact same query.

BXMT

Digging additional of their Q1 outcomes, we discover the breakdown of the provisions. US loans, make up lower than 1 / 4 of reserves however as we’ve already proven that the US Workplace alone represents 25% of their portfolio.

BXMT

Taking Jade’s query one step additional and making use of it solely to the US workplace publicity, we are able to level out there may be possible a 54.4M hole of their reserve. This isn’t considering every other components of BXMT’s portfolio, the truth that US workplace in all probability deserves a fair increased reserve than the common CECL ratio or that the two.05% is a mean for banks with a decrease LTV. This hole might possible be a lot increased, even multiples of the present reserve.

Writer’s Evaluation

Business Actual Property

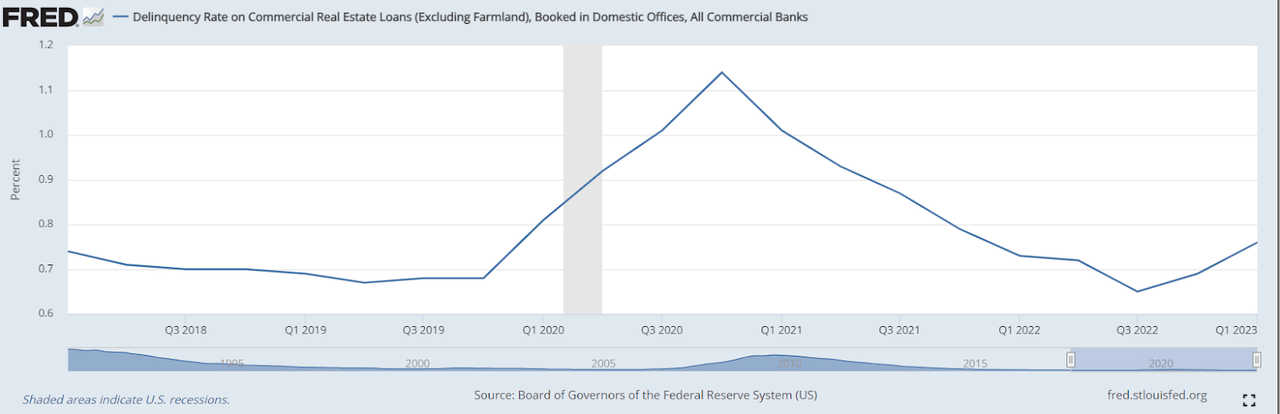

Delinquencies on US business loans, as proven within the chart under from FRED, stay comparatively muted. Even accounting for the tick up in Q1, they’re nicely under the preliminary covid ranges and tiny when in comparison with the worldwide monetary disaster. Q2 will definitely be a telling information level, however sadly for buyers it can possible be too late of a warning to react and save portfolios.

FRED

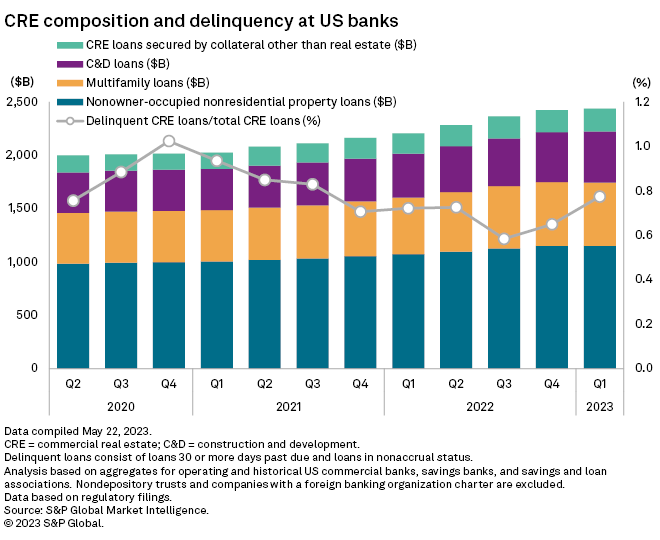

Additional information from S&P spotlight the rise in delinquencies for CRE.

S&P International

The information right here in each examples is backwards going through, however buyers ought to settle for that they’re exposing themselves to increased danger even when they disagree with the end result. Within the case of BXMT, it warrants the additional query on whether or not buyers are being compensated for this elevated danger. Anticipated returns should greater than compensate to make it a worthwhile funding.

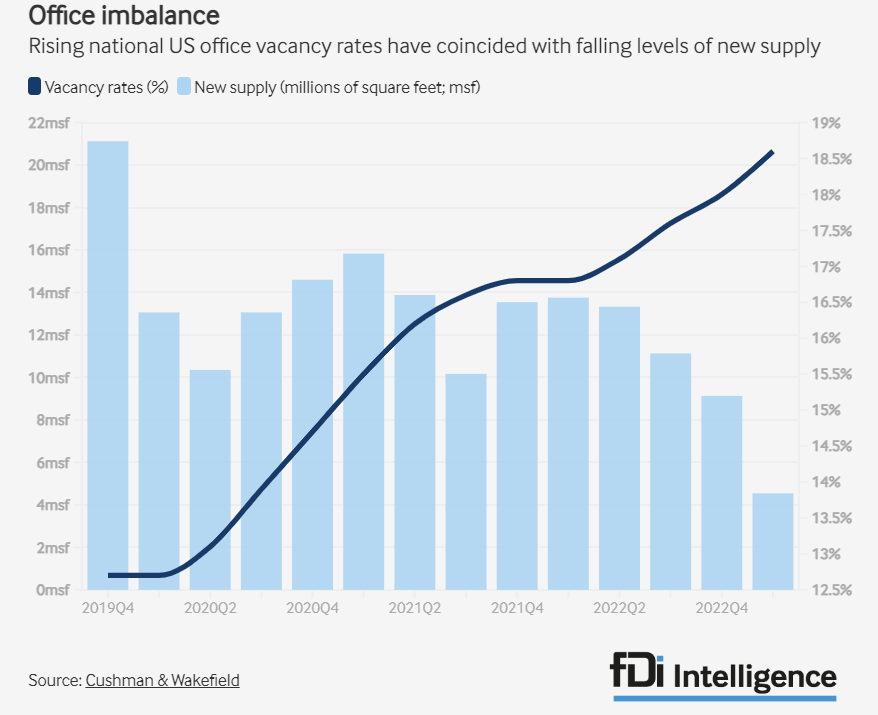

A 3rd information level that precedes delinquencies is the emptiness price of workplace actual property. In keeping with Cushman & Wakefield the emptiness price is hitting latest highs within the US with nonetheless extra provide coming on-line. Provided that covid is now 3 years deep, we view this as a very regarding danger because the time it can take to eat extra provide and scale back the emptiness price could also be longer than lenders can stand up to.

Cushman & Wakefield

Though we can not conclude the BXMT is ready to have vital defaults in its portfolio, we are able to actually conclude that the portfolio accommodates a number of inherent dangers. Moreover, we are able to join this again to their present reserve steadiness and conclude that could be very possible inadequate given the extent of danger and future reserves are prudent.

Stress Take a look at

Finally buyers in BXMT are possible chasing a dividend yield or at the least anticipate its continued distribution as a part of their return. It’s subsequently vital to know below what situations a reduce could be possible. We are going to outline this situation as when the distribution is now not supported by earnings earlier than provisions (basically distributable money). BXMT doesn’t have any debt maturing till 2026 so we are able to additional simplify the mannequin by assuming no debt compensation.

Strategy

-

Assume Q1’23 as start line

-

Curiosity expense and revenue as a % of property and liabilities proceed ahead on the identical price of Q1’23. In actuality the unfold between these two has shrunk over the previous couple of years

-

Working bills and taxes are equal to the common of the final 3 quarters.

-

Calculate what stage of asset discount would scale back the payout to 100%, our set off for the dividend to being now not sustainable

Writer’s Evaluation

The extent of asset write down is 4.65% or 1.1B, that’s the stage of asset discount that gives a protection ratio of 100%. Not that this isn’t the identical as a 1.1B reserve, as reserved property can proceed to supply revenue. 1.1B is loads and in our opinion most unlikely for Q2, nevertheless it turns into much more potential as that point horizon is prolonged. As some extent of reference, in the course of the peak of the monetary disaster delinquencies on CRE loans hit 8.93%.

Moreover it must be famous that within the occasion of upper defaults, the price of resolving and supporting recoveries will possible enhance as nicely resulting in decrease restoration and/or increased working bills to assist resolutions.

This mannequin, though easy in strategy, highlights that very excessive danger of an prolonged disaster in CRE. Within the occasion that this case unfolds, BXMT would possible reduce its dividend, have materials impairment to its steadiness sheet and the inventory worth would react accordingly.

Conclusion

Business actual property stands on a precipice in as we speak’s monetary markets. On one facet there are looming rate of interest hikes, climbing vacancies and delinquencies that may very well be beginning to pattern upwards. On the opposite facet is the belief that each one of these elementary points resolve themselves and we’re again to pleased occasions. The skewed distribution of this danger/reward payoff has us recommending buyers avoid BXMT inventory. There is no such thing as a motive to suppose we’re on the backside of the CRE trough and buyers ought to pursue increased high quality names.