zimmytws

Co-authored with “Hidden Alternatives.”

“Blue chip” is a time period used to explain well-established publicly traded corporations which can be nationally (or internationally) acknowledged, properly established, and financially sound. Retail traders usually really feel snug proudly owning these names as they’ve respected manufacturers constructed and maintained over a few years. A blue chip firm usually offers extensively recognized and high-quality items or companies.

Contemplating their established nature within the trade and secure operations, blue chips are a must have in your portfolio. As we speak, we are going to focus on Owl Rock Capital Company (ORCC), the 2nd largest public enterprise improvement firm, or BDC, that gives the twin advantages of security and excessive yields and represents an under-the-radar blue chip funding. Let’s dive in!

Background

ORCC offers direct lending options to U.S. higher middle-market corporations. The BDC’s typical buyer base generates a median EBITDA of $176 million. Center-market corporations represent ~40% of the GDP, make use of about 40% of the workforce, and characterize the heartbeat of the American financial system.

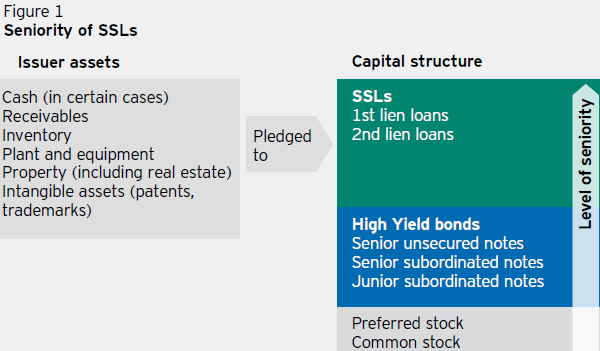

ORCC offers very important financing to those corporations by the problem of predominantly senior secured loans. 71% of ORCC’s funding portfolio is first lien, and 14% is second lien loans, offering important security in good and unhealthy instances. Supply.

Invesco web site

Senior loans are backed by the debtors’ very important belongings. information over the previous 30 years, we see that in situations of default, senior secured loans usually get well 80% of the principal on common (in comparison with 48% for top yield bonds). With such a excessive restoration price and a historic common annual default price of three%, the historic web credit score lack of senior secured loans is a meager 0.6%.

ORCC maintains a extremely conservative lending technique backed by its disciplined funding and underwriting course of, and has a small 15 bps annual loss price since its inception. This lending diligence and prudent portfolio composition makes ORCC extremely appropriate on your portfolio when financial uncertainties encompass us.

Rising Portfolio With Sturdy Credit score High quality

ORCC maintains an investment-grade steadiness sheet, rated BBB- by main companies. The corporate’s investments are diversified throughout 187 corporations and 98% of the borrowings are floating price.

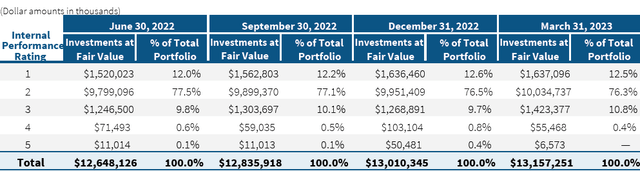

~90% of ORCC’s belongings are acting at or above preliminary expectations and <1% is performing beneath expectation or is at a default standing, portraying an image of fine well being and shiny prospects as we stare down the recession barrel. Supply.

ORCC Mar 2023 Investor Presentation

Throughout Q1, ORCC reported a file Web Funding Earnings (“NII”) of $0.45 and simply lined its $0.33 dividend. The BDC additionally issued a $0.04 supplemental dividend within the final quarter. For Q2, ORCC introduced a complement improve to $0.06 to be paid in June and the common $0.33 dividend to be paid in July. ORCC intends on persevering with to pay common dietary supplements primarily based on precise earnings so long as they proceed to exceed the common dividend.

ORCC is benefiting from the rising price atmosphere and is firing on all cylinders whereas sustaining its leverage at 1.21x. The BDC has $1.7 billion of liquidity in money and undrawn credit score, offering satisfactory flexibility with its money flows and the flexibility to climate declining credit score high quality.

Deeply Discounted Valuation – Insiders Are Loading Up!

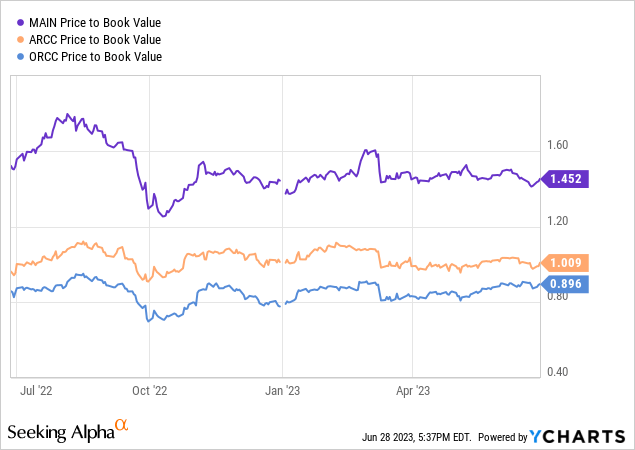

ORCC trades at a deep 10% low cost to NAV, a real discount in comparison with the present valuations of blue chip BDCs like Ares Capital Corp. (ARCC) and Foremost Avenue Capital Company (MAIN), which characterize stellar investments on their very own deserves.

It isn’t shocking to see ORCC aggressively pursuing share repurchases at this huge low cost. As of Could, $49 million price of frequent inventory was repurchased by the corporate from its beforehand introduced $150 million share repurchase plan.

ORCC insiders bought virtually $1.2 million of frequent inventory in Could, with CEO Craig Packer accountable for the majority ($1 million) of those purchases. As well as, ORCC’s exterior supervisor has been scooping up shares utilizing the worker funding car. Virtually $25 million price of inventory was bought as a part of this system, bringing the full buy to $74 million. Collectively, these repurchases characterize 1.4% of ORCC’s market cap, reflecting a big return to shareholders. There’s extra the place that got here from, as $100 million stays obtainable within the funds permitted by the board.

Insider shopping for exercise signifies a powerful alignment of administration intentions with shareholder curiosity, making it a giant plus for revenue traders.

Conclusion

Understanding what you personal, why you personal it, and the way it will assist obtain your funding objectives is vital. By understanding the basics of your investments and the execution, you’ll not really feel pressured to make poor selections simply primarily based on the inventory worth actions. At Excessive Dividend Alternatives, we offer detailed insights on the basics of the securities we suggest to our subscribers. Our “mannequin portfolio” has +45 dividend payers with an general yield of +9%, and ORCC represents one in every of many gems that contribute to our rising revenue stream.

ORCC is a blue chip BDC we’re shopping for with each palms on account of its:

-

Funding grade credit score scores and wholesome liquidity place

-

98% floating price belongings primarily in senior secured loans and file low annual loss charges since inception

-

Aggressive share repurchases and heavy insider shopping for in latest months

-

Large ~10% low cost to NAV

-

Nicely-covered 10% yield to lock in on the deeply discounted valuation.

We could also be dealing with a recession, however having ORCC in my portfolio at present worth ranges offers me quite a lot of consolation. That is due to the portfolio composition into senior secured loans, growing administration alignment with shareholders’ pursuits, and adequately lined dividends. ORCC’s low cost to NAV gained’t final lengthy; that is the chance to lock in huge yields from this blue-chip BDC. I’m shopping for up extra Owl Rock Capital Company inventory whereas insiders are, too!