Editor’s be aware: Searching for Alpha is proud to welcome Mandela Amoussou as a brand new contributor. It is simple to turn out to be a Searching for Alpha contributor and earn cash on your greatest funding concepts. Energetic contributors additionally get free entry to SA Premium. Click on right here to search out out extra »

Oleksandr Shatyrov/iStock Editorial through Getty Pictures

Thesis

Liquid staking, a sophisticated type of crypto staking, presents a compelling alternative for crypto traders. With its means to supply liquidity, flexibility, and potential for development, liquid staking has turn out to be a big development within the decentralized finance (DeFi) area. As Ethereum (ETH-USD) leads the way in which in liquid staking and the rising LSDfi market phase good points momentum, traders stand to learn from taking part on this evolving ecosystem, whereas maintaining a tally of regulatory developments to mitigate potential dangers.

Overview

Crypto staking is a core characteristic of proof-of-stake (PoS) cryptocurrency networks; it’s wanted to safe and validate transactions on a PoS community. PoS crypto networks have turn out to be well-liked through the years as a number of issues in regards to the carbon footprint created by energy-intensive proof-of-work (PoW) blockchain networks, like Bitcoin (BTC-USD), have been raised.

In a PoW community, miners who make use of resource-intensive computing energy to validate transactions and safe the community are rewarded with a crypto coin. In a PoS community, customers, generally known as validator nodes, safe the community and validate transactions by locking up among the native crypto belongings of the blockchain—a course of generally known as staking.

Crypto staking has gained reputation amongst crypto traders—particularly traders with a buy-and-hold portfolio technique—and has turn out to be a manner for crypto traders to earn common passive earnings. The full worth locked (TVL) of staked crypto belongings has turn out to be one of many vital metrics in measuring the state of the crypto market and the worth of belongings.

TVL in crypto staking jumped from round $400 million in 2020 to ~$2 billion in 2022. With the introduction of liquid staking (which this text is targeted on), TVL continues to develop on main blockchains. In Q1 2023, TVL on Ethereum elevated by 33.6%, whereas Arbitrum (ARB-USD) had a whopping TVL enhance of 83.4%.

The Evolution of Crypto Staking

The crypto area is fast-paced and ever-evolving. Like different crypto traits, crypto staking has certainly developed considerably through the years; varied staking mechanisms resembling DeFi staking and liquid staking have been launched, every with distinct ideas that provide completely different approaches to staking crypto belongings.

PoS Staking

PoS staking is usually known as conventional staking. It’s the earliest type of crypto staking. PoS staking refers back to the technique of taking part within the consensus of a PoS blockchain community by locking up a certain quantity of cryptocurrency to help community operations. By staking or “locking up” cash, individuals contribute to the community’s safety and transaction validation course of, incomes rewards in return. Conventional staking sometimes entails locking up funds for a predetermined interval, throughout which the staked belongings are illiquid and can’t be freely used or traded.

Relying on the particular PoS blockchain, staking individuals might not have the power to unstake and withdraw belongings at any time, whereas some PoS blockchains have lock-up intervals or require a discover interval for the unstaking of belongings.

DeFi Staking

DeFi staking refers to staking actions carried out inside DeFi ecosystems. It entails locking up crypto belongings in sensible contracts inside DeFi protocols. DeFi staking affords further advantages like liquidity, yield farming, and participation in governance. Not like PoS staking, which is taken into account inflexible and illiquid, DeFi staking gives larger flexibility. Customers can sometimes stake and unstake their belongings at any time, permitting for liquidity and rapid entry to funds.

Liquid Staking

Liquid staking is the newest development in crypto staking. It’s a sophisticated type of PoS staking that eliminates the rigidness and illiquidity that comes with conventional staking. Liquid staking gives a tokenized illustration of a staked crypto asset. When a crypto asset is staked, a “receipt” that represents the underlying asset’s worth is issued. This “receipt,” which is within the type of a monetary instrument generally known as a liquid staking by-product (LSD), might be traded or used throughout DeFi protocols with no need to first unstake the underlying asset. LSD gives on-the-go liquidity for staked crypto belongings.

One other perk of liquid staking is the low barrier to entry it provides customers. Operating a solo PoS node could possibly be costly for the common person, costing 1000’s of {dollars} usually. With liquid staking, customers can take part within the staking course of with just some {dollars}. For instance, operating a solo Ethereum node requires staking 32 ETH, however with liquid staking, a person can stake a fraction of ETH.

Liquid Staking on Ethereum

Ethereum started its transition from PoW to PoS consensus in December 2021, when it launched the Beacon Chain and allowed the staking of ETH. The transfer to PoS was accomplished on April 12 in a blockchain improve referred to as the Shanghai or Shapella improve. Liquid staking has gained large momentum following the Shanghai improve on the Ethereum blockchain.

The thought of customers staking their ETH and on the similar time getting a by-product token that’s usable on DeFi platforms, for functions like lending and yield farming, was far-reaching. A number of analysts have referred to as liquid staking “the most important crypto development of 2023,” and the fastest-growing DeFi class when it comes to whole worth locked. The TVL on some liquid staking protocols has surpassed the TVL on decentralized exchanges (DEXs). Although the Ethereum community has an enormous share of whole LSD quantity, the liquid staking development has unfold to different blockchain networks.

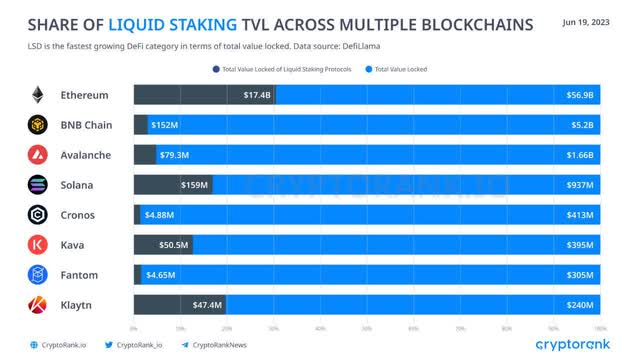

Liquid Staking TVL Throughout A number of Blockchains (twitter.com/CryptoRank_io)

Current information reveal that of the ~$57 billion TVL recorded on the Ethereum community, ~$17 billion are locked in liquid staking—a powerful 30% of Ethereum’s TVL. Different blockchains like Avalanche (AVAX-USD), Solana (SOL-USD), and Kava (KAVA-USD) have seen some uptick in liquid staking actions; nevertheless, Ethereum stays the blockchain with the best liquid staking TVL. Ethereum takes the lead in liquid staking, with Lido Finance (LDO-USD) having an enormous market share of staked ETH deposits. On the BNB chain, Ankr Community (ANKR-USD) is the biggest liquid staking supplier.

LSDfi: The Intersection of Liquid Staking and DeFi

A latest report revealed by Binance Analysis, on June 16, 2023, highlights the state of LSDs and the regular enhance of the liquid staking market. The report explores newer DeFi protocols constructed on LSD and older DeFi protocols which have lately built-in LSD. These protocols have created a fusion of DeFi and liquid staking and have created a brand new market phase fondly referred to as LSDfi.

LSDfi protocols have skilled a fast enhance in whole worth locked ((“TVL”)) over the previous few months, benefiting from the adoption of liquid staking. Because the narrative gained steam, cumulative TVL in prime LSDfi protocols crossed the US$400M mark and has greater than doubled since a month in the past.

Supply: Binance Analysis

LSDfi is the most recent crypto-staking narrative; it’s rising quickly and has the potential to meet up with the TVL of LSDs. The present TVL in LSDFi protocols is simply ~3% of the full addressable LSD market, creating a lot headroom for development. Based on the Binance Analysis report, the TVL in LSDfi protocols throughout all chains is ~$400 million. This determine compared with the liquid staking TVL on Ethereum alone (~$17 billion) exhibits that the LSDFi phase is pretty nascent and the untapped quantity is large.

Potential Positive aspects and Dangers

As talked about earlier, liquid staking is now obtainable in just about each main PoS blockchain. However for the scope of this text, I’d persist with LSDs on the Ethereum blockchain, the highest liquid staking protocols on Ethereum, and the way Ethereum has been the principle beneficiary of the LSD narrative development.

Simply when Ethereum was dropping important NFT and DeFi market share to competing smart-contract blockchains after the 2021 crypto bull run, the transition to PoS and the introduction of liquid staking has given Ethereum the wanted comeback to dominate the DeFi and NFT area. A latest report exhibits that Ethereum’s market cap dominance is on the rise. I imagine that because the LSDfi narrative good points extra momentum, Ethereum may simply keep this dominance within the coming months and even years.

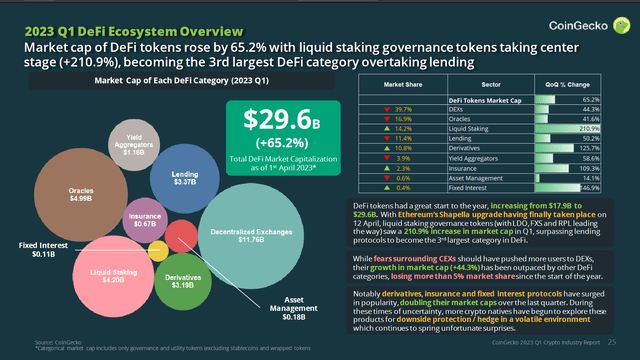

2023 Q1 DeFi Ecosystem Overview (CoinGecko)

Liquid staking protocols on the Ethereum community and their governance tokens have additionally performed properly in Q1 2023. Lido Finance takes the lead because the protocol with probably the most staked ETH deposits. The governance tokens of those ETH-based staking protocols have seen spectacular returns post-Shapella. Lido Finance’s governance token LDO and RocketPool’s token (RPL-USD) led the crypto market good points in mid-Might, defying the downward value development of the broader crypto market in that interval. Information from the CoinGecko Crypto Trade Report for Q1 2023 reveal that liquid staking governance tokens had a powerful 210.9% quarter-on-quarter change in Q1, with LDO and RPL taking the lead.

With the latest SEC clampdown on centralized exchanges’ staking-as-a-service choices, the amount of staking on decentralized protocols like Lido and Rocket Pool will most definitely see a gradual enhance over time. Although the SEC hasn’t issued any set-in-stone guidelines associated to crypto staking, no on-chain permissionless staking protocols have been sanctioned by the SEC but. The shortage of regulatory readability, nevertheless, nonetheless poses some risk to the booming crypto-staking sector. This similar sentiment was shared by Jacob Blish, head of enterprise improvement at Lido Finance, earlier this 12 months.

Remaining Ideas

In conclusion, crypto staking has emerged as a big drive within the cryptocurrency trade, providing traders a manner to participate in consensus, earn passive earnings, and take part within the evolving world of DeFi. The introduction of liquid staking has revolutionized the crypto staking panorama, offering higher liquidity and adaptability to staked belongings. Because the liquid staking market continues to develop, significantly inside the rising LSDfi phase, there’s immense potential for additional growth and adoption. Regulatory readability, nevertheless, stays essential to make sure the sustained development and stability of the crypto-staking sector. With Ethereum’s dominance reaffirmed by liquid staking, we are able to anticipate continued developments and alternatives within the liquid staking area and the solidification of Ethereum’s place on the forefront of the crypto trade.