- Many corporations resumed dividend payouts for the primary time because the pandemic

- A few of them pay a excessive dividend and have good upside potential

- Let’s check out these corporations utilizing InvestingPro

- InvestingPro Summer time Sale is on: Take a look at our large reductions on subscription plans!

After a difficult interval as a result of broad market route and decrease earnings progress final yr, many corporations have now begun to renew their dividend payouts, presenting an ideal alternative for traders searching for earnings and progress.

And that is not all. A few of these corporations not solely supply excessive dividend yields but additionally boast important upside potential.

With that in thoughts, let’s dive into the world of dividend investing and discover 4 shares that match this description, utilizing the highly effective insights offered by InvestingPro.

By the way in which, InvestingPro is at present internet hosting its Summer time Sale, providing large reductions on subscription plans. That is your likelihood to entry cutting-edge instruments, real-time market evaluation, and professional opinions at a fraction of the worth.

1. Coca-Cola

Because the world’s most generally bought beverage model and the flagship product of the Coca-Cola Firm (NYSE:), Coca-Cola has an intriguing historical past. Initially formulated by pharmacist John Pemberton as a patented medicinal drink, it was later acquired by entrepreneur Asa Griggs Candler, who efficiently reworked it into probably the most consumed beverage worldwide.

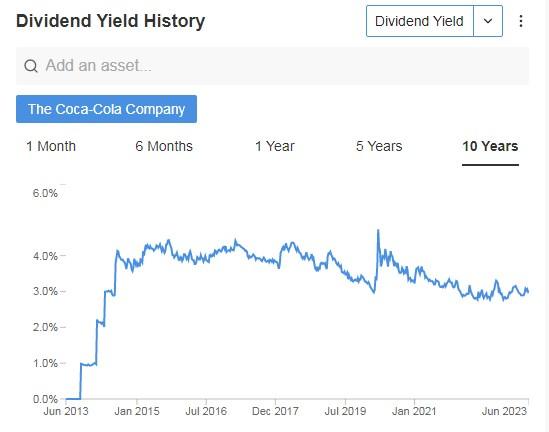

Coca-Cola has constantly elevated its dividend for a powerful 61 consecutive years. In 2022, the corporate paid out $1.76 per share in dividends, and indications counsel that this determine is prone to rise in 2023. Notably, in March, the quarterly dividend was raised from $0.44 to $0.46 per share. Presently, the dividend yield stands at over 3%.

Coca-Cola Dividend Yield Historical past

Supply: InvestingPro

On April 24, the newest had been unveiled, surpassing market expectations.

Coca-Cola Earnings

Supply: InvestingPro

The following earnings are due on July 25.

Coca-Cola Upcoming Earnings

Supply: InvestingPro

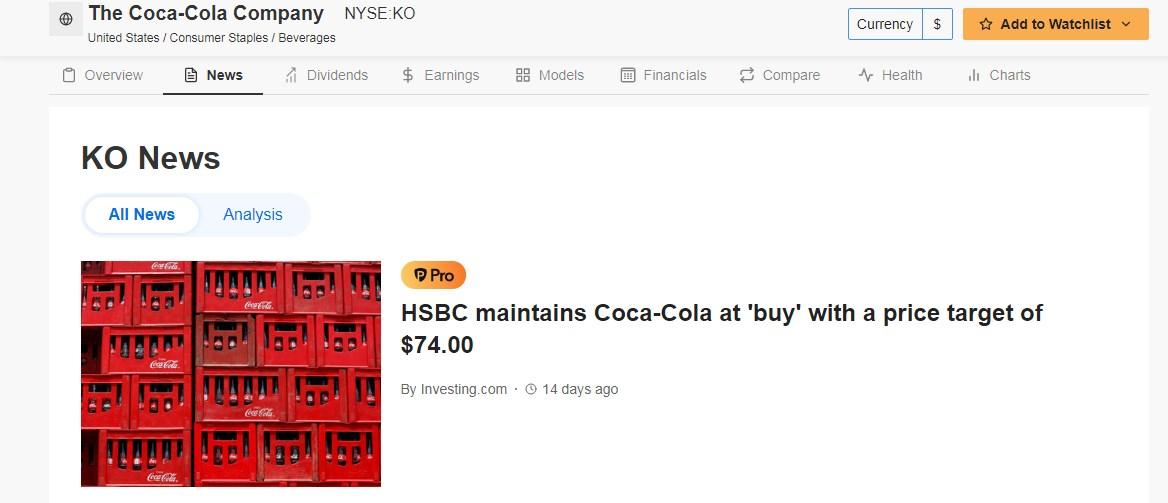

Coca-Cola receives robust help from analysts, with 17 purchase scores and eight maintain scores, whereas no promote scores have been assigned. HSBC tasks a possible goal value of $74 for the inventory, whereas the market’s outlook downgrades it to round $70.

Coca-Cola Analyst Targets

Supply: InvestingPro

The InvestingPro information part gives useful insights into the valuations and goal costs assigned to Coca-Cola shares by Wall Avenue analysts.

Supply: InvestingPro

Technical View:

After reaching a resistance level in April (which was shaped in December), Coca-Cola’s inventory began to say no. What’s attention-grabbing is that there’s a help stage of $59.51-$59.66, which coincides with a Fibonacci stage. This help stage may act as a set off for a possible upward rebound.

2. Kraft Heinz

Kraft Heinz (NASDAQ:) has solidified its place because the fifth-largest meals and beverage firm globally and the third-largest in america.

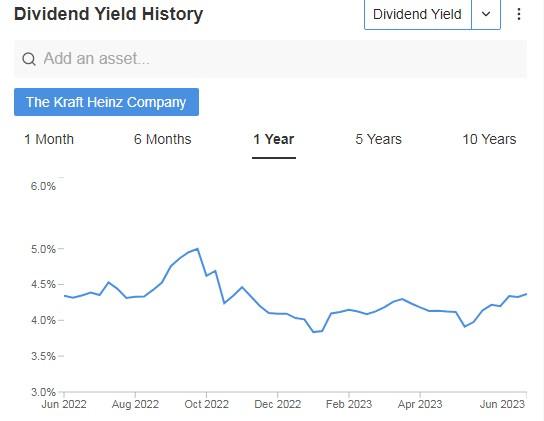

Within the earlier yr, Kraft Heinz distributed dividends amounting to $1.60 per share to its shareholders. With a dividend yield of roughly 3.94%, the corporate has maintained a constant quarterly dividend payout of $0.40 per share since March 2019.

Kraft Dividend Yield Historical past

Supply: InvestingPro

In Q1, Kraft Heinz gross sales of $6.489 billion, reflecting a notable enhance of seven.3% in comparison with Q1 2022. Waiting for everything of 2023, the corporate anticipates a internet gross sales progress vary of 4-6%.

On Might 3, Kraft Heinz unveiled its newest outcomes, which exceeded market expectations, demonstrating robust efficiency.

Kraft Newest Earnings

Supply: InvestingPro

It presents outcomes on August 3.

Kraft Upcoming Earnings

Supply: InvestingPro

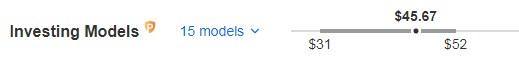

InvestingPro fashions point out a possible worth of $45.67 for Kraft Heinz.

Kraft InvestingPro Fashions

Supply: InvestingPro

Technical View:

It’s immersed inside a large rectangular vary. A drop to $32.88 could be an attention-grabbing shopping for alternative. Though it’s a distant stage, as it’s about 10% away.

3. British American Tobacco

British American Tobacco (NYSE:) is a outstanding tobacco firm that holds possession of a number of famend cigarette manufacturers, together with Dunhill, Fortunate Strike, and Pall Mall.

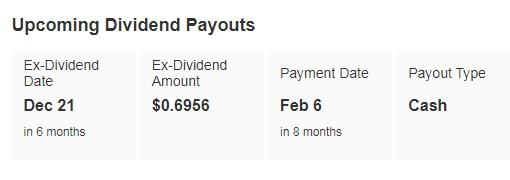

Whereas the corporate continues to thrive, it’s value noting that it’s going to distribute a dividend on February 8. Trying forward, the anticipated dividend yield for 2024 stands impressively at +9.90%.

British American Tobacco Dividend Payouts

Supply: InvestingPro

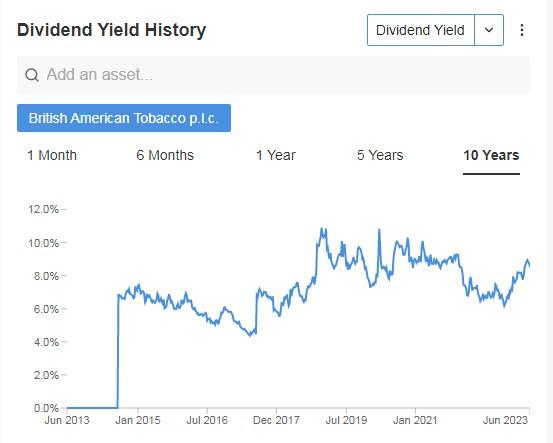

Its dividend historical past over the past 10 years may be very attention-grabbing.

British American Tobacco Dividend Yield Historical past

Supply: InvestingPro

British American Tobacco has reaffirmed its annual income and earnings forecast for 2023, citing robust demand and constant buyer numbers. The corporate expects natural income progress of three% to five% this yr.

The upcoming monetary outcomes are scheduled to be introduced on July 26, offering additional insights into the corporate’s efficiency.

Beneath are the income and earnings per share (EPS) forecasts for the present yr and the next yr:

British American Tobacco Analyst Income and EPS Forecasts

Supply: InvestingPro

The information part gives complete protection of the various estimates and valuations assigned to British American Tobacco shares by Wall Avenue analysts.

Supply: InvestingPro

The market consensus provides it a possible of $48.15.

British American Tobacco Analyst Targets

Supply: InvestingPro

Technical View:

After reaching a resistance stage in February and failing to interrupt via it, British American Tobacco’s inventory started a downward development. Nonetheless, it has lately reached its help stage and began to rebound. Notably, the inventory will not be solely discovering help but additionally exhibiting indicators of being oversold.

Analyzing the chart, we are able to observe a sample the place every time the shares had been in an overbought situation, they skilled a decline, whereas every time they had been oversold, they witnessed an increase in worth. This implies a possible reversal and upward motion within the inventory’s value.

4. Chevron

Chevron (NYSE:) is an American oil firm that was integrated in 1911 in California following the dissolution of the Normal Oil Belief.

With a dividend yield of roughly 4%, Chevron has constantly elevated its dividend funds to shareholders for over 36 years. In actual fact, the latest dividend enhance occurred in February, elevating the quarterly dividend from $1.42 to $1.51 per share.

In 2022, Chevron reported earnings of $35.465 billion, marking a powerful 127% enhance in comparison with the earlier yr. This strong efficiency contributed to a big rise of 58% in its share value.

On April 28, Chevron introduced its newest monetary , which exceeded market expectations, showcasing a powerful efficiency.

Chevron Final Reported Earnings

Supply: InvestingPro

It can current earnings on July 28.

Chevron Upcoming Earnings

Supply: InvestingPro

InvestingPro fashions give it a possible of $183.75.

Chevron

Supply: InvestingPro

After encountering resistance in late January, Chevron’s inventory began a downward development. Nonetheless, in March, it discovered help on the $150.16 stage. Notably, when the inventory touched this help stage once more in June, it successfully halted additional declines and triggered a subsequent upward bounce. Now, a return to that stage is a chance for one more upward rebound, making it a pretty entry level.

***

Prepare to spice up your funding technique with our unique summer time reductions.

As of 06/20/2023, InvestingPro is on sale!

Get pleasure from unbelievable reductions on our subscription plans:

- Month-to-month: Save 20% and get the pliability of a month-to-month subscription.

- Annual: Save an incredible 50% and safe your monetary future with a full yr of InvestingPro at an unbeatable value.

- Bi-Annual (Net Particular): Save an incredible 52% and maximize your income with our unique net supply.

Do not miss this limited-time alternative to entry cutting-edge instruments, real-time market evaluation, and one of the best professional opinions.

Be part of InvestingPro at this time and unleash your funding potential. Hurry, the Summer time Sale will not final perpetually!

Disclaimer: This text was written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counsel, or advice to take a position, neither is it meant to encourage the acquisition of property in any means.