Adobe is an American software program firm based in December 1982 and is finest recognized for its multimedia and inventive software program merchandise. It operates via three segments, Digital Media (a inventive cloud service that enables members to obtain and set up merchandise corresponding to Adobe Photoshop, Adobe Illustrator, Adobe InDesign, and many others.), Digital Expertise (offering options together with analytics, social advertising and marketing, focusing on, media optimisation, digital expertise administration, cross-channel marketing campaign administration, premium video supply and monetisation) and publishing and promoting (conventional services for e-learning options, technical doc publishing, internet software growth and high-end print).

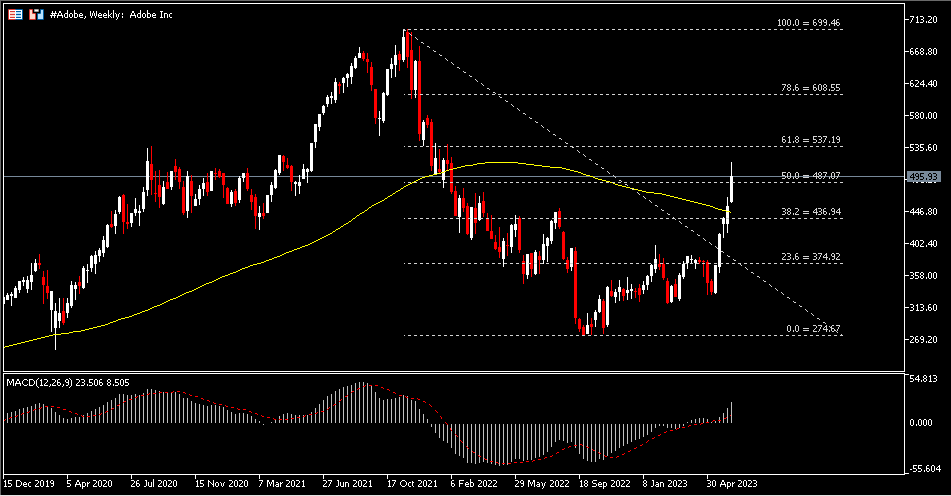

The corporate’s share value fell sharply from November 2021 to the third quarter of 2022 (from a excessive of $699.46 to a low of $274.67) because it was weighed down by a sell-off in main know-how shares, an antitrust evaluate of its deliberate buy of collaborative design platform Figma, and unfavourable macroeconomic drag. However, administration’s earlier optimistic forecast for 2023 didn’t disappoint traders. In truth, Adobe’s share value has soared by greater than 55% this 12 months with information of Adobe’s newest advances in synthetic intelligence (AI).

In late March 2023, Adobe.Inc launched Firefly, its generative AI device. normally, this device has quite a lot of options, corresponding to producing pictures from textual content content material (drawing straight what the person needs, or permitting the AI to execute instructions throughout the picture modifying course of), erasing backgrounds or including drawings to pictures by producing fills, producing inventive textual content (just like Microsoft Phrase artwork phrases), and many others. The principle use of its library, Adobe Inventory, is to open up coaching on licensed content material and content material whose copyright has expired, permitting customers to make use of it with confidence and with out worrying about copyright points.

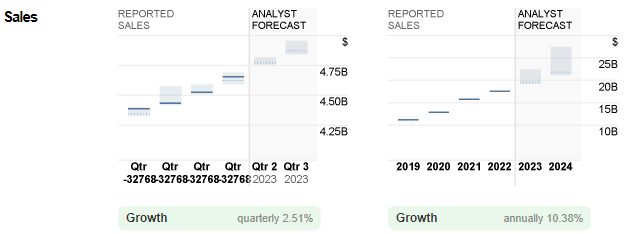

Gross sales reported by Adobe vs. analysts’ forecasts. Supply: CNN Enterprise

Final week, Adobe reported better-than-expected second quarter outcomes. Gross sales income elevated +10% (year-on-year) to $4.82 billion, exhibiting sturdy demand primarily from Inventive Cloud (+9% year-on-year), Doc Cloud (+11% year-on-year) and Expertise Cloud (+12% year-on-year). Its working earnings and web earnings had been US$1.62 billion and US$1.30 billion respectively. The subsequent earnings report is due on 19 September.

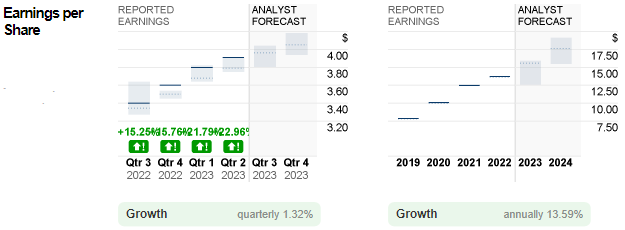

Adobe reported earnings per share vs. analysts’ forecasts. Supply: CNN Enterprise

Non-GAAP earnings per share for the quarter reached $3.91, up 17% from the identical quarter final 12 months. All in all, administration stays optimistic and has offered optimistic steerage for the third quarter of 2023. The corporate expects income of $4.83 billion to $4.87 billion and adjusted earnings per share within the $3.95 – $4.00 vary. Full 12 months earnings per share steerage was raised to $15.65 – $15.75, nicely above analyst forecasts ($15.57).

Technical Evaluation

Adobe (ADBE.s) shares have closed greater for 5 consecutive weeks and at the moment are above their 100-week SMA and FR 50.0% at $487. If the bullish momentum continues, the following resistance ranges to observe are $537 (FR 61.8%) after which $609 (FR 78.6%). In any other case, a retracement under 50.0% FR might point out a pause within the bullish rally, with the 100-week SMA and $437 (FR 38.2) being the closest help, adopted by $375 (FR 23.6%). The MACD remains to be pointing north at 23.506.

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is offered as a basic advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or needs to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.