John Kevin

Introduction

Probably the most annoying a part of an funding analyst’s job is not a lot making errors, however getting forward of predicted occasions. Clearly, my current bearish calls on the S&P 500 Index (SPX) (NYSEARCA:SPY) (SP500) proved mistaken in follow – the upside dangers such because the continuation of AI mania, the greed of the lots, and a bit stronger-than-expected financial indicators despatched the market even larger into the overbought territory.

TME [proprietary data], Refinitiv![TME [proprietary data], Refinitiv](https://static.seekingalpha.com/uploads/2023/6/15/49513514-16868061186803544.png)

From as we speak’s perspective, nonetheless, my primary argument for the draw back remains to be legitimate and hasn’t aged – Wall Road’s expectations appear too excessive in opposition to the backdrop of the approaching peak in financial exercise. Maybe the recession is delayed, however the market is not as protected because the Road believes, in my view.

Why Do I Assume So?

One among my bearish arguments from late Might 2023 was associated to EPS projections, which appeared to me on the time to be completely unrealistically optimistic, primarily based on Morgan Stanley’s macro mannequin, which proved profitable in predicting the decline in 2022. A current word from the financial institution’s chief strategist, Mike Wilson [June 12, 2023 – proprietary source], signifies that the mannequin nonetheless predicts a pointy decline in earnings per share this 12 months:

Mike Wilson [June 12, 2023 – proprietary source]![Mike Wilson [June 12, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/15/49513514-16868100663549185.png)

Morgan Stanley’s report from 2 years in the past predicted that the present financial cycle can be characterised by larger depth however shorter length in comparison with earlier cycles. This evaluation was primarily based on similarities noticed with the post-World Warfare II interval. In each circumstances, there was a launch of collected financial savings throughout occasions of provide constraints, resulting in a surge in inflation. The rebound in fundamentals and asset costs occurred quickly, reaching earlier cycle highs in a traditionally fast method. The surprising increase in inflation and earnings in 2021 ultimately prompted the Federal Reserve to tighten coverage on the quickest price seen in 4 many years, stunning many. Now, it is anticipated that there will probably be one other shock as earnings decline considerably in 2023, adopted by a rebound in 2024-25, making a “increase/bust” state of affairs.

Mike Wilson [June 12, 2023 – proprietary source]![Mike Wilson [June 12, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/15/49513514-16868103743591263.png)

So it seems like we’re at present within the earnings decline stage of the increase/bust cycle described above. Earnings ought to decline as inflation falls, significantly for the S&P on account of its publicity to items, MS notes. Labor inflation stays persistent, including to margin stress. The return of inflation limits the effectiveness of proactive accommodative financial coverage. Fiscal coverage assist could also be restricted as a result of suspension of the debt ceiling and the potential finish of sure fiscal applications, dragging on progress within the latter half of 2023.

And since I am speaking about fiscal applications, I am unable to get previous the upcoming resumption of funds by 40 million Individuals on their pupil loans – that is doubtlessly a $15.8 billion [monthly] headwind to the U.S. spending funds, as the typical pupil debt holder must make an incremental month-to-month fee of ~$390 beginning this fall. In accordance with Barclays [proprietary source], this represents a headwind of ~8% of month-to-month revenue, affecting 16% of the U.S. inhabitants.

Barclays [June 13, 2023 – proprietary source] Barclays [June 13, 2023 – proprietary source]![Barclays [June 13, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/15/49513514-16868113056441433.png)

![Barclays [June 13, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/15/49513514-1686811671214757.png)

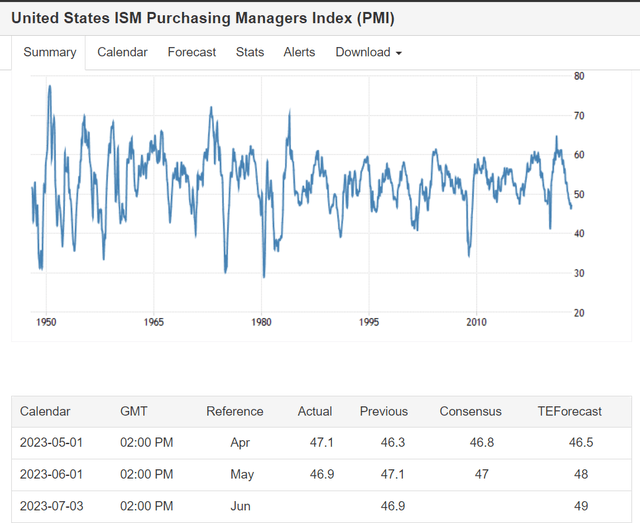

That falling private revenue [as a result of rising interest expenditures] ought to result in decrease consumption – that is a fundamental macroeconomic idea that’s laborious to disagree with. From the identical principle, we all know that company income play an essential position within the financial cycle. The query now’s: How will firms behave after they see demand weakening? I feel the reply is clear: they will have to chop again on manufacturing. If you concentrate on it, that is most likely why ISM PMI hasn’t hit backside as everybody anticipated – a transfer down or a freeze on the present low degree appears very more likely to me.

Tradingeconomics.com

In current months, the market has centered on falling inflation as the primary optimistic second, fully ignoring that if inflation falls and demand cools concurrently, revenue margins ought to shrink. That is why the ISM manufacturing value sequence remains to be declining, and I do not assume that can bode properly for S&P 500 EPS revisions.

Mike Wilson [June 12, 2023 – proprietary source]![Mike Wilson [June 12, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/15/49513514-16868134990144002.png)

The BEA US nationwide income sequence aligns carefully with reported inventory market revenue measures. The beneath chart shared by Societe Generale’s Albert Edwards in his current word [June 14, 2023 – proprietary source] reveals that revenue margins will not be solely elevated relative to historic ranges but in addition spotlight the diminishing relevance of company taxes over the previous 50 years. The pre-tax sequence, indicated by the purple line, is taken into account a greater indicator of underlying company profitability. On this pre-tax measure, home non-financial revenue margins have just lately surpassed the height noticed in 1950:

Societe Generale’s Albert Edwards [June 14, 2023 – proprietary source]![Societe Generale's Albert Edwards [June 14, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/15/49513514-16868138413303041.png)

Albert Edwards believes that the current enhance in unit income after the pandemic, regardless of vital rises in unit prices, is unprecedented. He argues that this phenomenon, which he refers to as “profit-led inflation” or “Greedflation,” performs a major position in shaping the present financial panorama.

In accordance with Edwards, no matter whether or not we analyze unit revenue information or income as a share of nominal GDP or Gross Worth Added, the margins of firms as we speak stay near peak ranges. This implies that “Greedflation,” which retains income elevated for an prolonged interval, has delayed the onset of a recession. That very same “Greedflation” has apparently slowed the decline in home income and consequently diminished the severity of the present funding downturn.

Societe Generale’s Albert Edwards [June 14, 2023 – proprietary source]![Societe Generale's Albert Edwards [June 14, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/15/49513514-1686814176487434.png)

However this impact is just not everlasting. Please word that inventories within the chart above are a part of enterprise investments, so their future dynamics are essential in predicting GDP motion [in this particular model]. And the dynamics of inventories, in flip, are inclined to lag considerably behind enterprise gross sales and EPS, each of which are actually predicting a decline for this metric:

Societe Generale’s Albert Edwards [June 14, 2023 – proprietary source]![Societe Generale's Albert Edwards [June 14, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/15/49513514-16868148743811157.png)

Surprisingly, in opposition to the backdrop of the above, analysts paint a rosy future for the S&P 500’s EPS forwarding figures:

Societe Generale’s Albert Edwards [June 14, 2023 – proprietary source]![Societe Generale's Albert Edwards [June 14, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/15/49513514-16868154620405667.png)

Edwards argues that analysts, who’re celebrating firms’ larger margins on the micro degree, have failed to acknowledge the macroeconomic implications of Greedflation. This contains the truth that extended excessive income and inflation end in larger and longer-lasting rates of interest, resulting in a deeper and longer recession. Moreover, on account of labor shortages and elevated operational gearing of the company sector, income might doubtlessly plummet within the coming quarters.

However how low could EPS fall? I have not developed my econometric mannequin but – however Morgan Stanley already has one. In accordance with it, earnings are anticipated to fall by 16% [compared to sell-side analysts’ forecasts of a 2.4% increase in their 2023 earnings expectations].

Mike Wilson [June 12, 2023 – proprietary source]![Mike Wilson [June 12, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/15/49513514-16868156952342448.png)

The Backside Line

I do not presume to evaluate precisely when the S&P 500 Index and the broad market would possibly fall – I simply provide you with meals for thought sometimes primarily based on frequent sense and macroeconomics. Generally greed overrides each of these items and drives the markets larger – a attribute of all bubbles that it is best to get used to. The shifting common of the put name ratio hasn’t but turned upward, which may solely imply one factor – the danger urge for food of market members may be very, very excessive.

Richard Excell’s publication [June 11, 2023]![Richard Excell's newsletter [June 11, 2023]](https://static.seekingalpha.com/uploads/2023/6/15/49513514-1686816295324731.png)

Nonetheless, when it does flip up, which appears more and more possible within the close to future, it could be sensible to train warning and contemplate taking a step again, making an allowance for the overly optimistic stance of fairness buyers, Richard Excell notes in his current publication.

I may very well be mistaken and the markets will proceed to go up – the upside dangers stay the identical and anybody brief the market lately ought to know the way to take care of that.

Regardless of the upside dangers, nonetheless, I stay bearish on SPY/SPX and the broad market. My earlier calls have been too early, in my view, however have not misplaced their basic significance.

Thanks for studying! Please, let me know what you assume within the remark part beneath!