GBP/USD Costs, Charts, and Evaluation

- Sterling bolstered by price hike expectations.

- Key financial information and occasions subsequent week will drive GBP/USD and EUR/GBP.

Really helpful by Nick Cawley

Find out how to Commerce GBP/USD

The British Pound is closing a optimistic week on the entrance foot, exhibiting respectable beneficial properties in opposition to a spread of different G7 currencies. On a weekly low-to-high foundation, cable is roughly 2 cents larger, GBP/JPY is round 2.5 Yen larger, whereas EUR/GBP has fallen one of the best a part of one Euro. Whereas all these currencies are barely weak, Sterling has been higher bid all week as expectations proceed to construct that the Financial institution of England could need to hike extra aggressively within the coming months to mood inflation. UK inflation is seen falling over the approaching months and will make present market predictions of an additional 100 bps of UK rate of interest hikes look slightly hawkish.

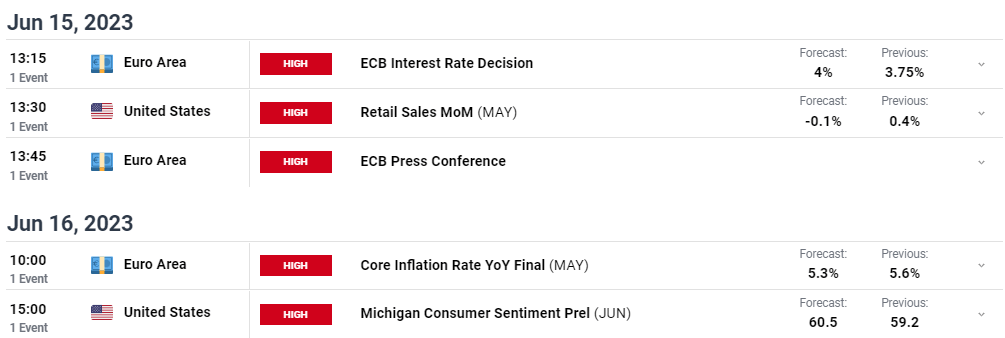

Subsequent week’s financial information and occasions calendar is stuffed with market-moving potential. Simply wanting on the UK, US, and Euro releases highlights that GBP/USD and EUR/GBP could get a shot of volatility, particularly with the US Fed and ECB coverage choices mid-week.

For all market-moving occasions and information releases see the real-time DailyFX Calendar

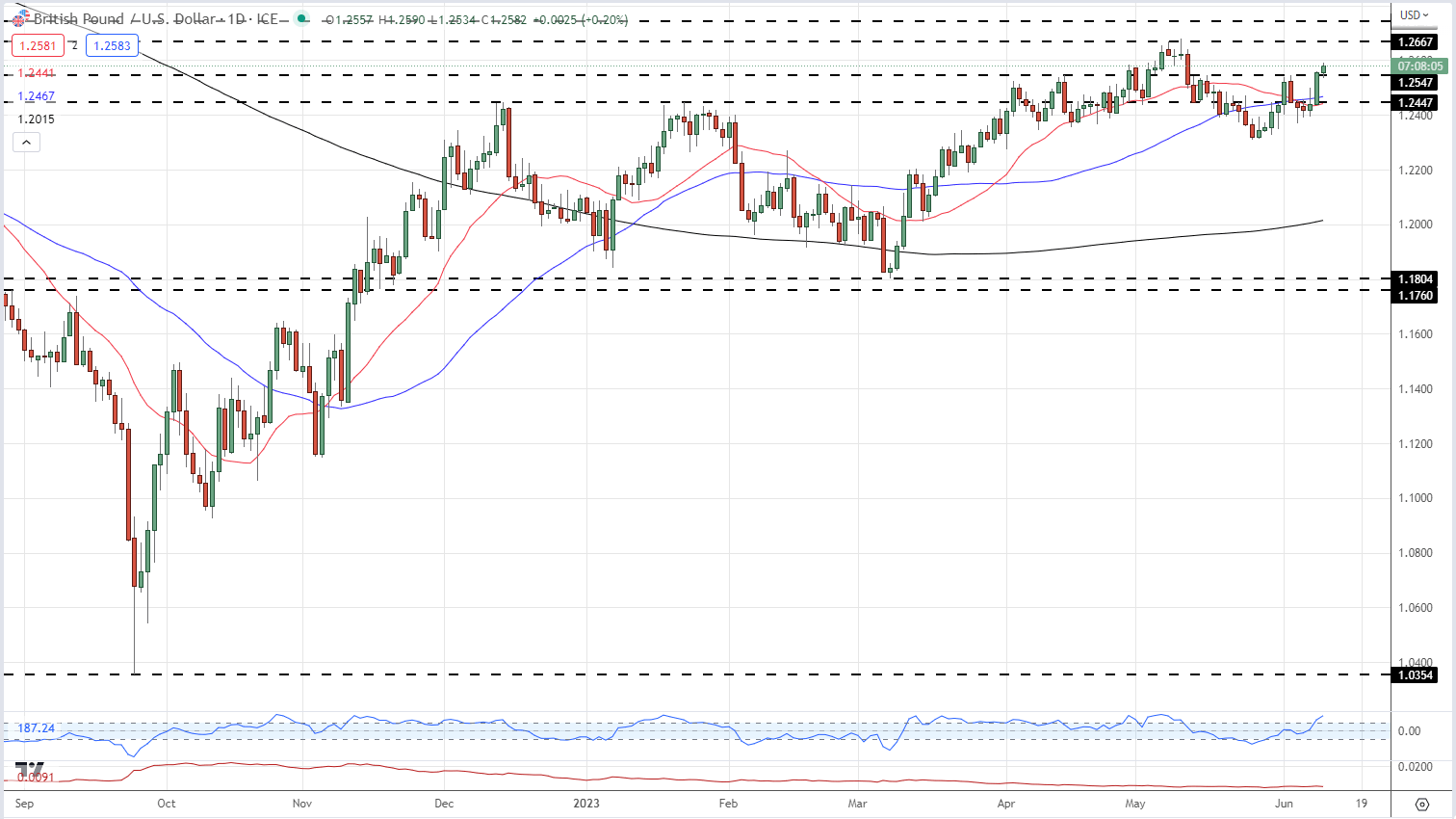

GBP/USD is again above prior resistance seen round 1.2550 and continues to push larger. Thursday’s bullish candle took out each the 20- and 50-day easy transferring averages, and if the pair can stay above these two technical indicators then GBP/USD could have sufficient energy to check the current multi-month excessive round 1.2680.

GBP/USD Each day Value Chart – June 9, 2023

| Change in | Longs | Shorts | OI |

| Each day | -3% | 7% | 3% |

| Weekly | -15% | 34% | 10% |

GBP/USD Retail Merchants are Internet-Brief Cable

Retail dealer information present 36.30% of merchants are net-long with the ratio of merchants quick to lengthy at 1.75 to 1.The variety of merchants net-long is 23.70% decrease than yesterday and 9.07% decrease from final week, whereas the variety of merchants net-short is 43.64% larger than yesterday and 12.00% larger from final week.

We sometimes take a contrarian view to crowd sentiment, and the actual fact merchants are net-short suggests GBP/USD costs could proceed to rise. Merchants are additional net-short than yesterday and final week, and the mix of present sentiment and up to date modifications offers us a stronger GBP/USD-bullish contrarian buying and selling bias.

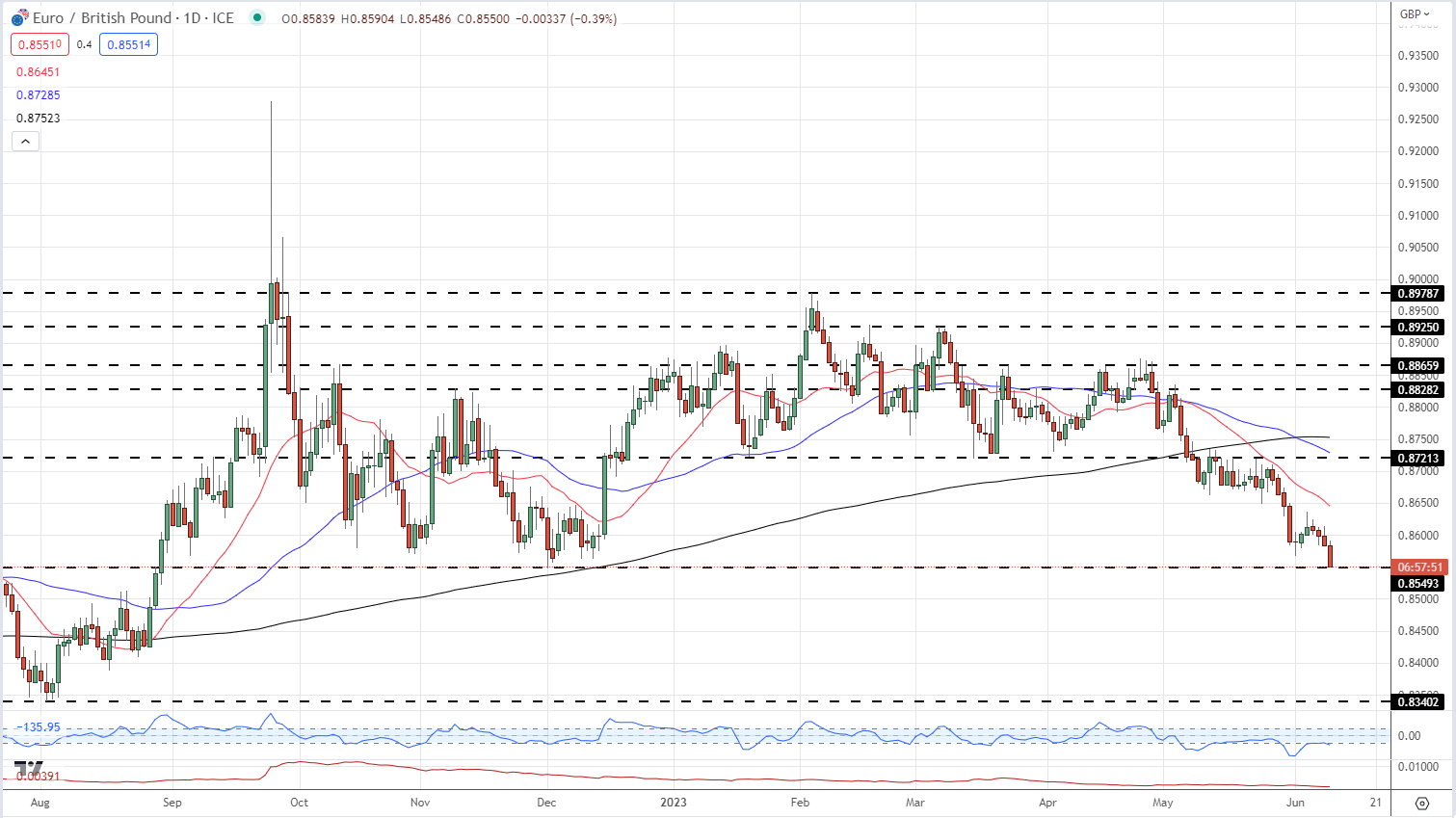

EUR/GBP merchants will probably be focussed on the newest ECB rate of interest determination with the market strongly forecasting an additional 25 foundation level price hike. Current weak development numbers for This fall 2022 and Q1 2023 present the single-block is in a technical recession and the ECB must tread fastidiously within the coming months to not overdo price hikes in case this financial slowdown turns into entrenched.

EUR/GBP is at the moment making a contemporary nine-month low and will transfer nonetheless. All three transferring averages are lined up in a bearish formation, leaving the pair prone to additional losses. EUR/GBP is in oversold territory however not by a lot and whereas this may increasingly have to be corrected, because it stands the trail of least resistance for EUR/GBP is decrease. Thursday’s ECB assembly will probably be essential for the pair.

EUR/GBP Each day Value Chart – June 9, 2023

What’s your view on the British Pound – bullish or bearish?? You possibly can tell us by way of the shape on the finish of this piece or you may contact the writer by way of Twitter @nickcawley1.