USD/CAD Information and Evaluation

- US jobs indicator alerts early indicators of stress, CAD rides constructive momentum after BoC hike

- Bearish momentum accelerates as CAD continues constructive momentum – ‘loss of life cross’ and main assist shall be examined

- Week forward: FOMC (abstract of financial projections) , ECB, US inflation

- The evaluation on this article makes use of chart patterns and key assist and resistance ranges. For extra data go to our complete schooling library

Really useful by Richard Snow

Discover out the #1 mistake merchants make and keep away from it

US Jobs Indicator Indicators Early Indicators of Stress, CAD Rides Constructive Momentum after BoC Hike

Preliminary jobless claims out of the US flashed one other early warning sign concerning the in any other case strong job market. 261 thousand individuals had been newly unemployed as of the week of three June and represented the second time in current prints that the information level exceeded estimates. In consequence, the greenback sold-off, seeing an prolonged transfer to the draw back for USD/CAD

The pair now exhibits renewed draw back momentum and has damaged beneath the longer-term channel that has contained nearly all of value motion. In actual fact, the transfer now assessments the long-term trendline assist that has witnessed a number of assessments, none of which had been profitable.

The ‘loss of life cross’ – circled in orange – offers additional indications of a bearish continuation from right here. A day by day and weekly candle shut under the trendline would naturally have bears taking a look at 1.3230 as the subsequent degree of assist with the extent coinciding with the November 2022 swing low. Breakouts usually retrace to retest assist/resistance and so a real check of a possible bearish breakdown could be a profitable check of the trendline which might successfully develop into resistance, and subsequent promoting thereafter.

Ought to CAD momentum wane and the US greenback look to claw again misplaced floor, a maintain of trendline assist shall be key. If the bearish momentum had been to falter, 1.3503 could be the subsequent degree of curiosity with an invalidation of the bearish viewpoint round 1.3600 and 1.3650.

USD/CAD Day by day Chart

Supply: TradingView, ready by Richard Snow

Really useful by Richard Snow

Study the fundamentals of breakout buying and selling & what to bear in mind

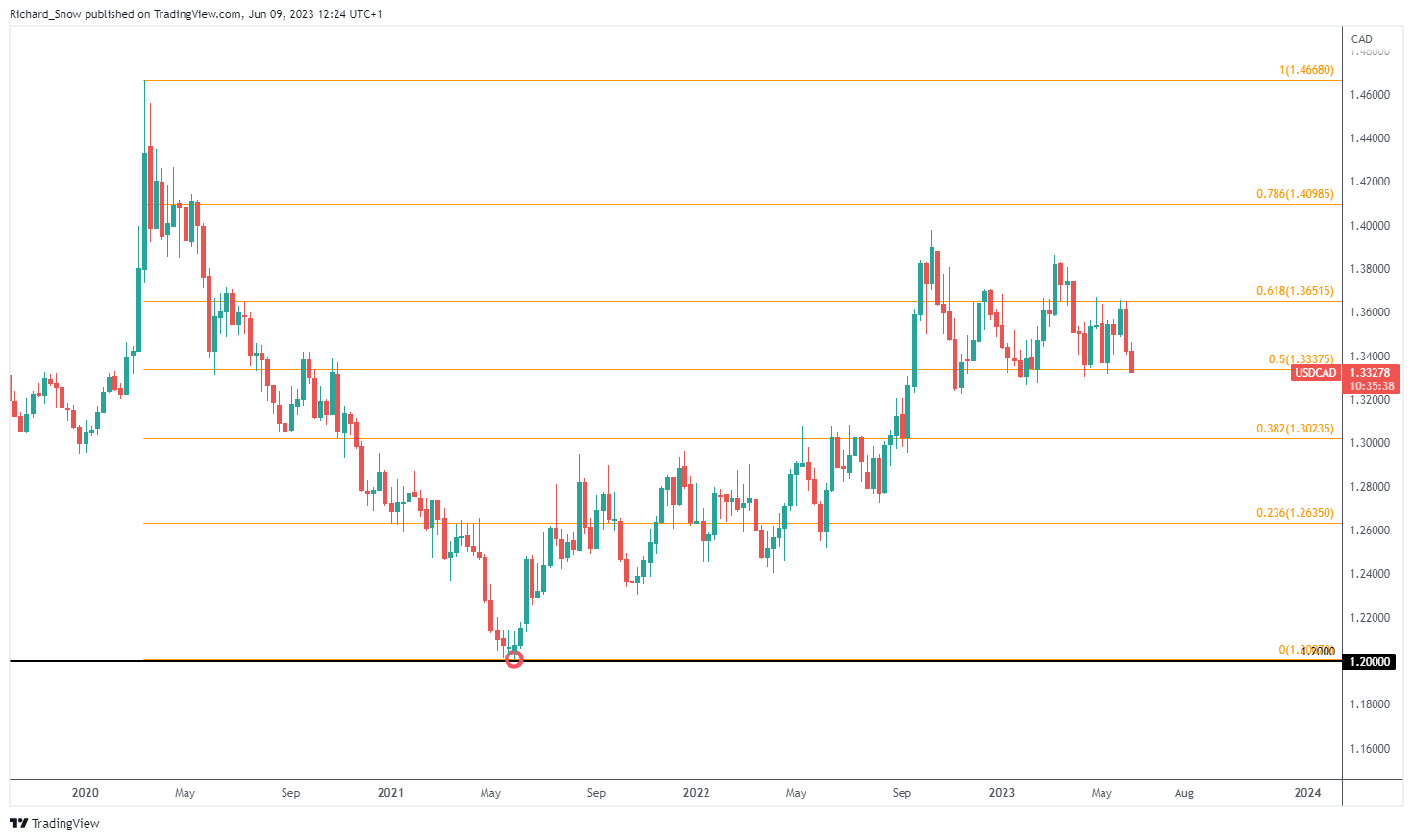

The weekly chart reveals the 61.8% and 50% Fibonacci retracements of the main 2020 to 2021 sell-off – roughly the zone that has been housing value motion for the final quarter of 2022 and 2023 this far.

USD/CAD Weekly Chart

Supply: TradingView, ready by Richard Snow

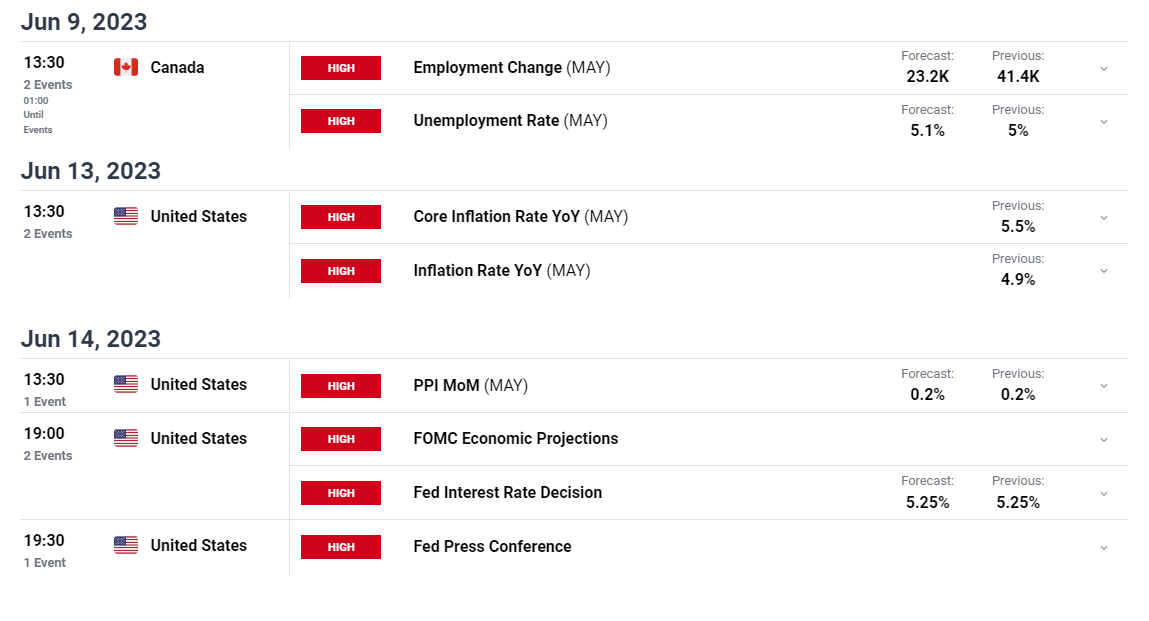

Main Threat Occasions Forward

Right now, Canadian employment knowledge might entice a number of extra eyes than regular given the uptick in US preliminary jobless claims yesterday – which induced a notable response within the greenback and highlights FX market’s sensitivity to incoming knowledge.

Subsequent week essential US inflation knowledge offers one other alternative for core inflation to lastly transfer under the current 5.5% – 5.7% multi-month vary. A softer inflation print might see downward revisions in future fee expectations and may even see the USD/CAD head even decrease from right here.

After the RBA and BoC shocked markets with hikes in June, might the Fed observe go well with? For my part I believe it will be a tricky ask, given how vocal outstanding members of the Fed have been about voting to forgo a hike subsequent week with the potential for a hike in July ought to the information necessitate one. The Fed will even launch its quarterly abstract of financial projections which ought to offer markets with a greater thought of the financial outlook. US PPI will even issue into the inflation dialog however any surprises there’ll must be factored into subsequent month’s FOMC assembly.

Customise and filter reside financial knowledge through our DailyFX financial calendar

— Written by Richard Snow for DailyFX.com

Contact and observe Richard on Twitter: @RichardSnowFX