LaylaBird

On this protection, we performed a radical evaluation to evaluate and distinction the efficiency of the healthcare gear trade. Particularly, we targeted on the highest 10 firms throughout the iShares U.S. Medical Gadgets ETF (NYSEARCA:IHI), which collectively signify 71% of the entire ETF holdings. Our evaluation was performed based mostly on full-year 2022 financials of all firms, and encompassed a number of key elements. Firstly, we gathered and scrutinized the efficiency information of those prime firms by way of income development, in addition to their development projections for the present 12 months, based mostly on administration steerage. We then in contrast these findings with our 3-year ahead common forecast derived from earlier analyses. Moreover, we examined the modifications available in the market share of those prime firms within the healthcare gear market to find out any notable tendencies. Lastly, we evaluated the profitability of those firms and in contrast them in opposition to the trade common to establish any aggressive benefits they could have.

Higher Outlook for Prime Firms however Nonetheless Going through Challenges

|

Firms |

This autumn 2022 TTM Development % (YoY) |

Analyst Consensus Development Distinction % |

Administration Steering (2023) |

Analyst Consensus (2023) |

Analyst Consensus 3-year Ahead Common |

Previous 5-year Common Development |

Our 3-year Ahead Common |

|

Thermo Fisher Scientific (TMO) |

14.5% |

2.41% |

0.8% |

0.87% |

5.6% |

16.51% |

4.1% |

|

Abbott Laboratories (ABT) |

1.3% |

0.98% |

-8.6% |

-8.53% |

1.1% |

9.77% |

7.9% |

|

Medtronic (MDT) |

-3.2% |

-0.32% |

– |

4.33% |

4.7% |

0.69% |

5.2% |

|

Stryker Corp (SYK) |

7.8% |

1.31% |

7.8% |

7.05% |

6.9% |

8.19% |

8.4% |

|

Intuitive Surgical Inc (ISRG) |

9.0% |

0.20% |

14.0% |

11.17% |

12.5% |

14.67% |

11.6% |

|

Boston Scientific Corp (BSX) |

6.7% |

0.02% |

7.0% |

6.66% |

7.3% |

6.99% |

8.5% |

|

Becton, Dickinson (BDX) |

1.1% |

0.96% |

6.3% |

1.38% |

4.3% |

8.87% |

5.6% |

|

Edwards Lifesciences Corp (EW) |

2.9% |

0.42% |

10.5% |

8.68% |

9.7% |

9.40% |

13.5% |

|

DexCom Inc (DXCM) |

18.8% |

-0.01% |

17.5% |

19.01% |

19.18% |

32.28% |

– |

|

Idexx Laboratories Inc (IDXX) |

4.7% |

0.22% |

10.0% |

8.54% |

9.56% |

11.33% |

– |

|

Common |

6.4% |

0.62% |

7.2% |

5.92% |

8.08% |

11.87% |

8.09% |

Supply: Firm Information, Looking for Alpha, Khaveen Investments

Within the desk above, we compiled the highest 10 firms by their weightage of IHI based mostly on their 2022 income development, development distinction to analyst consensus, administration steerage obtained from earnings briefings, analyst consensus for 2023, common 3-year ahead analyst consensus, previous 5-year common development and our 3-year ahead common from earlier analyses on firms which we coated beforehand.

First, beginning with the This autumn 2022 TTM YoY development, the highest 10 firms’ income in IHI grew by 6.4% in 2022, which is decrease in comparison with the common 5-year development of 11.9%. 5 firms had above-average development which incorporates Thermo Fisher Scientific (14.5%), Stryker Corp (7.8%), Intuitive Surgical Inc (9.0%), Boston Scientific Corp (6.7%) and DexCom Inc (18.8%). The precise revenues had been comparatively in keeping with analyst expectations, with the precise income development outperforming analyst consensus by solely 0.62% in 2022.

On common, the businesses (excluding Medtronic) have guided barely increased development in 2023 (7.2%) in comparison with the common development achieved in 2022 (6.4%). The businesses with above-average steerage are Intuitive Surgical Inc (14.0%), Edwards Lifesciences Corp (10.5%), DexCom Inc (17.5%) and Idexx Laboratories (10.0%).

Solely Abbott has guided damaging development as a result of decrease Covid income anticipated. The corporate guided its Covid income in 2023 to be solely $400 mln in comparison with $3.1 bln in 2023. Among the many firms, Abbott Laboratories has the bottom analyst consensus development of -8.53%. Its common analyst income consensus and the 3-year ahead common are each decrease than the corporate’s historic 5-year common development of 9.39%.

Moreover, Thermo Fisher additionally guided decrease revenues from vaccines and therapies income in 2023 of $500 mln in comparison with $1.7 bln within the earlier 12 months. Solely Boston Scientific and Edwards Lifesciences have a barely increased 3-year common analyst consensus development than their 5-year historic CAGR.

Moreover, we in contrast the highest firms in IHI by way of their income development consensus by analysts in 2023 and their 3-year ahead common with their historic 5-year income. From the desk, the common analysts’ consensus is 5.92% and is decrease than the 3-year common ahead development of 8.08%, which highlights a barely extra pessimistic outlook for the 12 months. The typical 5-year income development was 11.9%, with DexCom Inc having the best 5-year CAGR at 32.28% and Medtronic having the bottom 5-year CAGR at simply 0.69%.

As compared, based mostly on our earlier analyses of the highest 8 firms, we derived a median ahead 3-year development price of 8.09%. Our forecasts for all firms are increased than their 2023 analyst income consensus. Solely Thermo Fisher and Intuitive Surgical have increased 3-year ahead analyst consensus than our forecasts.

General, following a 12 months of slower development for the highest firms inside IHI which was beneath its 5-year historic common, the outlook of those firms is barely higher in 2023 with increased common development steerage from administration however nonetheless beneath the 5-year common as key holdings equivalent to Thermo Fisher and Abbott cited the poor outlook of Covid and vaccine revenues because the cumulative Covid instances seem to have plateaued in 2023 based mostly on Statista.

Optimistic Market Share Pattern of Prime Holdings

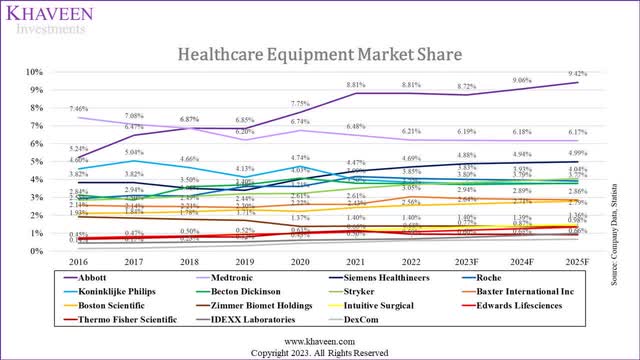

Firm Information, Looking for Alpha, Khaveen Investments

Moreover, we compiled the market share of the highest 15 healthcare gear firms by revenues within the chart above together with the highest 10 firms from IHI by weightage. For Thermo Fisher and Roche (OTCQX:RHHBY), we solely took their healthcare gear revenues.

Based mostly on the chart, Abbott remained the market chief of the healthcare gear market with a share of 8.8% in 2022 which was much like its share in 2021. Over the previous 7 years, Abbott has strengthened its market share and overtook the lead in 2019 as second-placed competitor Medtronic’s share has persistently been on a declining development besides in 2020. Siemens Healthineers (OTCPK:SEMHF) maintained its spot in third place with a 4.69% share has been on an rising development within the interval. That is adopted by Roche and Koninklijke Philips (PHG) which maintained their spots at fourth and fifth respectively however with a barely decrease share in comparison with 2021.

In relation to IHI particularly, 5 of the highest 10 firms are within the prime 10 holdings of IHI that are Abbott, Medtronic, Becton Dickinson, Stryker and Boston Scientific. Amongst these 5 firms, 3 out of the highest 5 firms gained share which was Abbott, Stryker and Boston Scientific. These 3 firms have been on a steadily rising development over the interval.

Moreover, the following 5 firms inside IHI which aren’t within the prime 10 are Intuitive Surgical, Edwards Lifesciences, Thermo Fisher Scientific, IDEXX Laboratories and DexCom. Aside from Thermo Fisher, these firms gained market share in 2022. Nevertheless, over your entire interval, all 5 firms have been gaining market share since 2016, highlighting the superior development of those firms.

In abstract, 7 of the highest 10 firms inside IHI gained market share within the healthcare gear market in 2022 which we consider signifies the constructive efficiency of those firms. Furthermore, the market shares of firms equivalent to Abbott, Stryker and Boston Scientific, Intuitive Surgical, Edwards Lifesciences, Thermo Fisher Scientific, IDEXX Laboratories and DexCom have been rising over the previous 7 years. We anticipate the highest firms in IHI to proceed sustaining their constructive share acquire development with each our common 3-year forecast (8.09%) and analyst consensus (8%) increased than the medical units market section CAGR of 5.5% by Statista.

Stronger Than Business Profitability Margins

|

Firm |

Gross Revenue Margin |

Internet Earnings Margin |

FCF Margin |

5-yr Gross Margin |

5-yr Internet Margin |

5-yr FCF Margin |

5-yr Ahead Gross Margin (Our Forecast) |

5-yr Ahead Internet Margin (Our Forecast) |

5-yr Ahead FCF Margin (Our Forecast) |

|

Thermo Fisher Scientific |

42.3% |

15.5% |

13.0% |

46.6% |

15.9% |

14.1% |

48.9% |

24.1% |

26.8% |

|

Abbott Laboratories |

56.3% |

15.9% |

16.5% |

57.8% |

11.7% |

15.8% |

59.3% |

18.6% |

17.4% |

|

Medtronic |

63.1% |

12.8% |

9.7% |

65.2% |

14.1% |

13.3% |

72.0% |

17.0% |

22.0% |

|

Stryker Corp |

66.7% |

13.2% |

10.5% |

68.2% |

13.9% |

17.2% |

68.1% |

20.0% |

19.8% |

|

Intuitive Surgical Inc |

67.4% |

21.3% |

18.0% |

68.6% |

27.0% |

22.2% |

72.8% |

41.4% |

38.7% |

|

Boston Scientific Corp |

68.4% |

5.5% |

9.1% |

69.9% |

14.7% |

13.3% |

73.0% |

15.4% |

23.7% |

|

Becton, Dickinson |

45.5% |

8.6% |

7.6% |

47.4% |

6.9% |

16.4% |

48.1% |

11.0% |

16.3% |

|

Edwards Lifesciences Corp |

80.0% |

28.3% |

17.3% |

75.6% |

22.5% |

14.1% |

78.5% |

31.9% |

26.6% |

|

DexCom Inc |

64.72% |

11.73% |

8.00% |

65.57% |

6.82% |

0.75% |

– |

– |

– |

|

Idexx Laboratories Inc |

59.52% |

20.17% |

9.75% |

57.59% |

19.42% |

13.39% |

– |

– |

– |

|

Common |

61.4% |

15.3% |

11.9% |

62.2% |

15.3% |

14.1% |

65.1% |

22.4% |

23.9% |

Supply: Firm Information, Khaveen Investments

Within the desk above, we compiled the profitability margins of the highest 10 holdings of IHI to investigate their profitability by way of gross, web and FCF margins based mostly on TTM and 5-year historic common as properly our 5-year ahead margins forecasts for the highest 8 firms.

As seen within the desk, the profitability of the highest firms is constructive for gross revenue, web revenue, and FCF margins. The typical TTM gross margin is 61.4% and web margin common is 15.3%. Extra importantly, its FCF margins had been constructive with a median of 11.9%. The corporate with the strongest gross margin in 2022 was Edwards Lifesciences at 80% and was additionally the corporate with the best web margin of 28.3%. When it comes to FCF margins, Intuitive Surgical has the best FCF margins of 18% adopted by Edward Lifesciences.

Compared to the 5-year averages, the common gross margins had been barely decrease than the 5-year common of 62.2% vs 60.9%. The typical FCF margins had been additionally decrease at 11.1% in comparison with the 5-year common of 14.1%. The typical web margins had been in keeping with the 5-year common at 15%

For our 5-year ahead averages compiled from earlier analyses, on common, we see the common gross margins improve to 62.4% as we anticipate these firms to have constructive development and broaden their scale. Based mostly on Abbott’s annual report, the corporate highlighted its improve in gross margins “displays the consequences of upper gross sales quantity, increased manufacturing utilization”. Moreover, we see the common web margins rising to 22.4% supported by gross margin enhancements and decrease working prices as a % of income and FCF margins rising to 23.9% as income development outpaced capex development. For instance, Abbott’s capex as a % of income had decreased from 9.4% to 4.4% up to now 10 years.

|

Image |

Gross Revenue Margin |

Internet Earnings Margin |

FCF Margin |

|

Prime 10 IHI Holdings |

61.4% |

15.3% |

11.9% |

|

Business Common |

63.5% |

4.0% |

7.9% |

Supply: Firm Information, Khaveen Investments

Moreover, we then in contrast the common revenue margins for the highest holdings of IHI with the common healthcare gear margins for firms bigger than a market cap of $2 bln. Based mostly on the desk, the common trade gross margins are barely increased in comparison with the highest firms in IHI. Nevertheless, the highest firms have a a lot stronger web margin of 15.3% in comparison with the trade common of 4% which highlights the larger scale of the highest firms in IHI as evidenced by its excessive mixed market share of 30% for the highest 10 holdings of IHI from the earlier level. Additionally, the common FCF margins of 11.9% for the highest firms are increased than the trade common of seven.9%.

To conclude, we decided that the profitability of the highest firms of IHI to be pretty steady with sturdy revenue margins up to now 5 years and we forecasted the common gross, web and FCF margins to proceed rising as we see their constructive income development outlook supporting their scale enlargement. Furthermore, we decided the highest firms have larger profitability in comparison with the trade common with increased web and FCF margins, which we consider is because of their bigger scale (30% mixed market share for prime 10 firms).

Danger: Decrease Development Outlook of Key Holdings

The highest healthcare gear firms guided a barely higher development outlook in 2023 however nonetheless decrease than their 5-year averages. For instance, Abbott guided damaging development because of decrease Covid income anticipated in 2023 to be solely $400 mln in comparison with $3.1 bln in 2023. Moreover, Thermo Fisher additionally guided decrease revenues from vaccines and therapies income in 2023 of $500 mln in comparison with $1.7 bln within the earlier 12 months as defined within the first level. That is vital as these two firms are the 2 largest holdings in IHI accounting for 30% of the entire ETF weighting.

Verdict

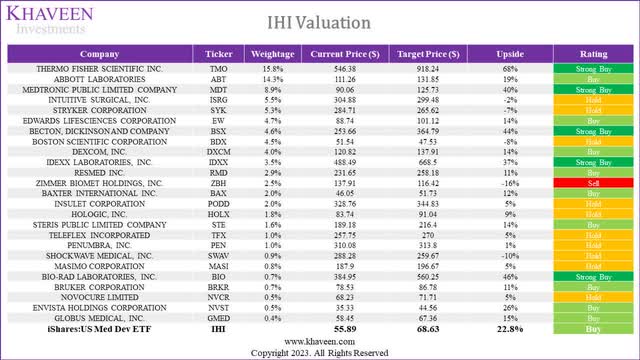

Looking for Alpha, Khaveen Investments

For the valuation of IHI, we compiled our value targets from earlier analyses for the businesses on which we had earlier protection. For all different firms, we based mostly their value targets on analyst consensus. The chart above exhibits the highest 25 firms in IHI. General, we derived a weighted common upside of twenty-two.8% for IHI. Out of a complete of 46 firms, the variety of firms with a minimum of a Purchase score is 32 or 68% of complete whereas the variety of firms with a Maintain is 14 or 30% of the entire.

In conclusion, the IHI ETF’s prime holdings are considerably concentrated, with solely 10 firms representing 71% of the entire breakdown, in distinction to different ETFs equivalent to XHE, the place the highest 10 account for less than 18% of the entire. After a 12 months of slower development for the highest firms inside IHI, which fell beneath its 5-year historic common, the outlook for these firms seems to be barely higher in 2023, with increased common development steerage from administration, albeit nonetheless beneath the 5-year common.

Additionally, we be aware that seven of the highest 10 firms inside IHI gained market share within the healthcare gear market in 2022, indicating constructive efficiency. We anticipate that the highest firms may proceed to take care of their constructive share acquire development, with each our common 3-year forecast (8.09%) and analyst consensus (8%) being increased than the medical units market section CAGR of 5.5%. Moreover, the profitability of the highest firms has been comparatively steady, with sturdy revenue margins over the previous 5 years and we forecasted that the common gross, web, and FCF margins to proceed to rise as we anticipate their constructive income development outlook to assist scale enlargement. Furthermore, we discovered that the highest firms exhibit larger profitability in comparison with the trade common, with increased web and FCF margins, which we consider is because of their giant scale as the highest 10 holdings have a mixed market share of 30%. Based mostly on our valuation, we price IHI as a Purchase with a weighted common value goal of $68.63.