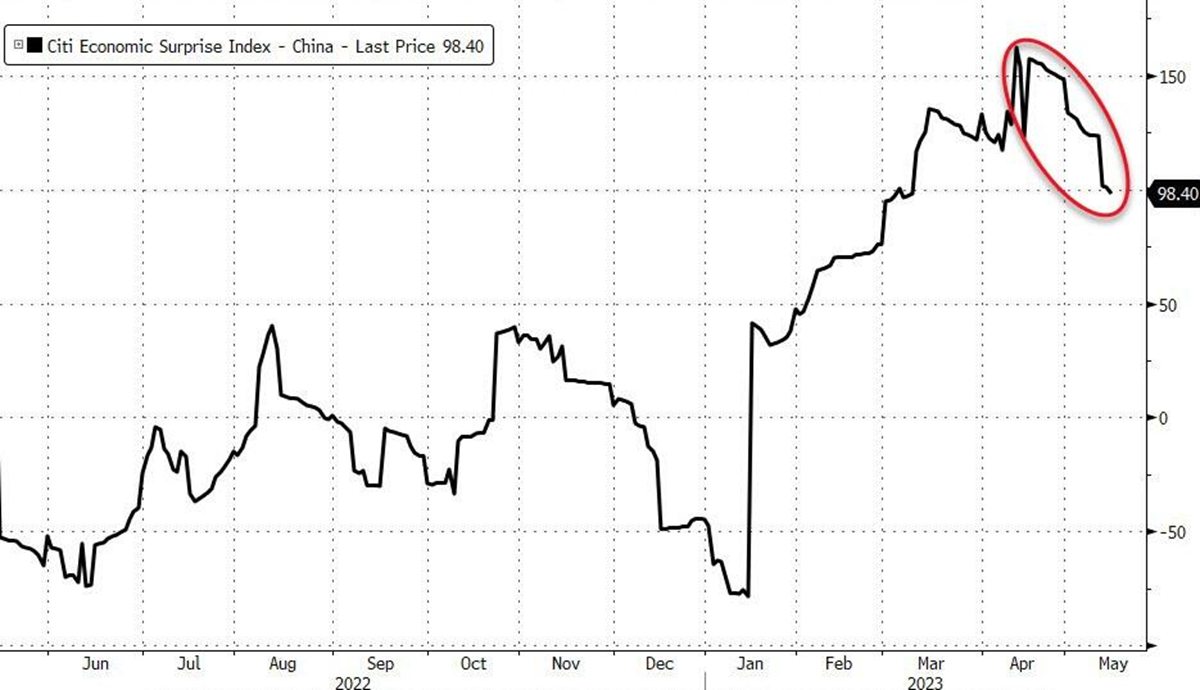

On January eighth, 2023, China formally ended its zero-COVID-19 coverage. That was enormous: the world’s second-largest financial system was about to return to full energy after many months, one of many final international locations to take action. There was lots of optimism worldwide: it can’t really be excluded that the robust danger rally originally of the yr was partly a consequence of such an encouraging outlook. However issues are cooling down quick: simply final evening, a set of destructive information, ALL under expectations, solid a brand new shadow on the financial outlook. Investments and industrial manufacturing fell m/m, and whereas retail gross sales rose, it was by lower than anticipated particularly compared to final yr, dictated by Covid restrictions. Youth unemployment reached 20.4%. Property Growth Funding fell in addition to combination financing information has been dramatically weaker than anticipated regardless of steady liquidity injections. GS is now anticipating a 25bp broad RRR reduce in June, down from 3.65%. The CITI Financial Shock Index summarizes the problem fairly effectively as does the USDCNH efficiency, again near the 7.00 degree (from 6.70 earlier this yr).

Citi Financial Shock Index – China

(opens in a brand new tab)

However why will we care about? In line with information lately revealed by the EIA, world demand for liquid fuels is predicted to face at 100.99 million barrels per day, with a development of 1.6 mm b/d, HALF of which is predicted to return from China. Additionally, you will do not forget that in early April OPEC+ selected an extra manufacturing reduce of 1.16 mm b/d on high of the 2 mm reduce beforehand, for a complete of 3.66 mm barrels faraway from world manufacturing every day. A number of analysts thought on the time that the cartel had gone too far with its cuts, UNLESS it anticipated demand to stagnate. So, the doable Chinese language slowdown is sort of an necessary concern and has primarily to do with the worldwide demand outlook, not solely within the oil market.

On this state of affairs, the US Authorities is lastly again within the crude-buying sport, making ready to purchase as much as 3 mm barrels of bitter crude oil to be delivered in August (after having offered greater than 200 mm barrels from its Strategic Petroleum Reserve, at its lowest degree since 1983). All this after, failing to purchase in December 2022 (having bid too low) and with a number of restrictions (purchases will likely be of ‘bitter crude oil produced in the US by United States producers’). As 3mm is roughly simply 3% of day by day manufacturing/demand, that is probably a reasonably irrelevant issue.

On this state of affairs, the US Authorities is lastly again within the crude-buying sport, making ready to purchase as much as 3 mm barrels of bitter crude oil to be delivered in August (after having offered greater than 200 mm barrels from its Strategic Petroleum Reserve, at its lowest degree since 1983). All this after, failing to purchase in December 2022 (having bid too low) and with a number of restrictions (purchases will likely be of ‘bitter crude oil produced in the US by United States producers’). As 3mm is roughly simply 3% of day by day manufacturing/demand, that is probably a reasonably irrelevant issue.

TECHNICAL ANALYSIS

Crude Oil was buying and selling within the $120 space nearly a yr in the past, in June 2022. Since then, the downward pattern has been extraordinarily clear and at present the value is at $71.07. On the draw back, the extent to observe is sort of apparent: the realm between $64 and $62. This can be a very robust degree that has served as resistance/help since not less than 2018. A break could lead on the value first to the $58 space after which probably even to the $51 space; in the intervening time nevertheless it’s a little untimely to take such ‘excessive’ behaviour into consideration.

Upwards the areas to observe are first $73.25 after which the $78.5 / $79 space. Solely Crude Oil buying and selling above these ranges once more may point out the start of a brand new value rise, to be confirmed within the $82.5 / $83 space. In the meanwhile the RSI marks 42 and the MACD is destructive.

US Crude Oil Spot – Each day

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a common advertising communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or must be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.