On the time of writing, we’re simply few hours away from the subsequent launch of the US Client Worth Index, anticipated to stay anchored at a 5% YoY development charge because it was final month.

Just below two months in the past, merchants had been cautiously optimistic in regards to the path of costs and, consequently, the way forward for financial coverage. Worth development had peaked in June 2022 (-9.1%) and has since ”nearly halved”, led by vitality. Different once-hot parts reminiscent of used automobiles confirmed a constant decline (-11.2% y/y in March), searches for ”Provide Chain Disruption” had been down sharply amongst Google Tendencies (actually the World Container Freight Fee index is at its lowest since September 2020) and a few Central Banks such because the RBA and BOC had stopped elevating charges, the FED being the subsequent suspect. Probably the most aggressive forecasters had gone as far as to foretell a reduce of as much as 100 foundation factors by the tip of 2023.

By no means thoughts that the much less unstable and extra significant CORE CPI continued to print 5.6% development – a great distance from the ‘near 2%’ goal -, by no means thoughts that the job market was nonetheless tight, by no means thoughts that even Powell was insisting that his work on charges was removed from over. The Shelter element (which weighs 30% within the CPI basket) was additionally nonetheless rising at double-digit charges.

Then the MAR23 knowledge was revealed and, though displaying a really modest improve, out of the blue the markets began to think about the choice of a persistent phenomenon. At one level, some even began to recall earlier episodes of excessive inflation, reminiscent of within the Seventies, when costs moderated not less than twice earlier than rising additional.

Proper now, there’s quite a lot of uncertainty amongst cash managers and the FED’s charge cuts bets in 2023 have began to be trimmed. And that is one thing that affects the USD.

Checking the each day chart of the EURUSD we are able to simply see that the worth has been trapped in a sideways consolidation motion, buying and selling principally between 1.0940 and 1.1060 over the past month. The bullish development remains to be holding, however the 1.11 space appears like sturdy resistance for now.

A softer or in-line determine may push EURUSD again into the rectangle (presumably as much as 1.1060) and hold it buying and selling sideways, whereas an upside shock may make it break 1.0940.

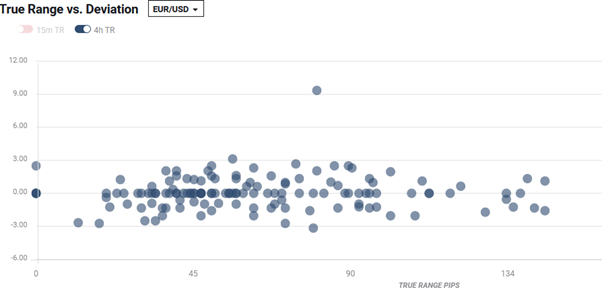

What is for certain is that the info will most definitely set off some volatility, as will also be seen on this graph displaying the pair’s common Common True Vary over the 4 hours following the info (the densest space is between 40 and 75 pips).

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a normal advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or needs to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.