USD/JPY TECHNICAL ANALYSIS

The U.S. greenback rallied initially of the week, bolstered by surging U.S. Treasury yields following the discharge of the U.S. ISM manufacturing report, which confirmed a bounce within the employment and costs paid parts of the survey. On this context, USD/JPY superior greater than 0.8% to ~137.40 in afternoon buying and selling, reaching its finest stage since early March.

USD/JPY’s technical outlook has turned extra constructive after the change fee breached confluence resistance positioned at 136.60 on Monday, an space the place the higher certain of a short-term rising channel aligns with the 200-day easy shifting common and the 38.2% Fibonacci retracement of the October 2022/January 2023 selloff.

If pair holds above 136.60, bulls might develop into emboldened to launch an assault on the 2023 highs only a contact beneath the psychological 138.00 stage. Efficiently piloting above this hurdle might put into play the 140.00 area. Within the occasion of a setback, preliminary assist rests at 136.60, but when costs dip beneath this ground, a retest of 135.00 can’t be dominated out.

Advisable by Diego Colman

Get Your Free JPY Forecast

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Utilizing TradingView

S&P 500 FUTURES TECHNICAL ANALYSIS

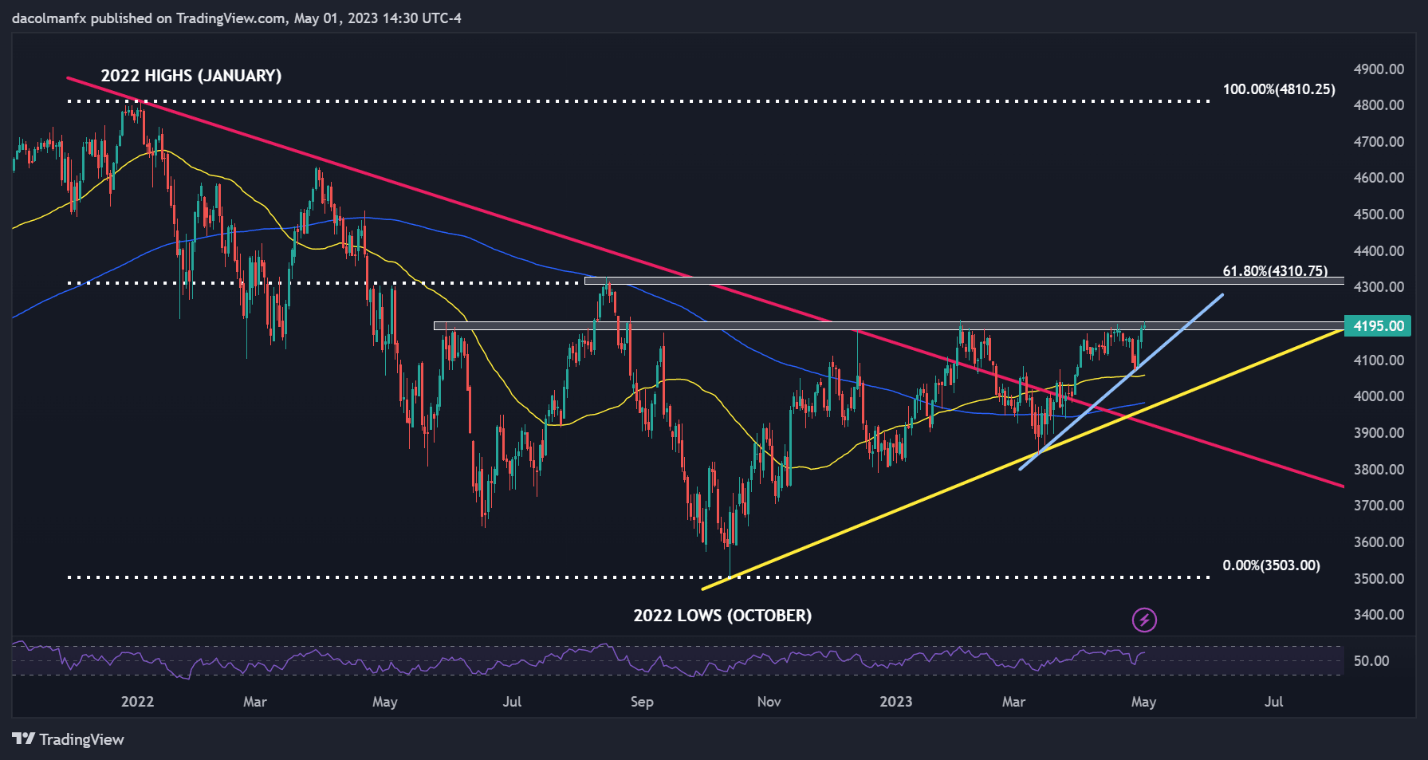

The S&P 500 fell early final week, however encountered assist at a rising trendline prolonged off the March lows. From these ranges, the index has made a strong comeback, with costs now testing main resistance close to 4,200, the place the bears have repeatedly overpowered the bulls since June of final yr, repelling the index decrease on practically each take a look at.

If historical past is a information, technical resistance at 4,200 might curb the tempo of latest beneficial properties and extinguish constructive impetus once more, paving the best way for a reasonable pullback within the coming days. If the bearish state of affairs performs out, we might see a retrenchment towards dynamic assist at 4,125 quickly forward of a attainable retest of the 50-day easy shifting common at 4,060.

Alternatively, if the bulls handle to get the S&P 500 decisively above the 4,200 barrier, upward momentum might collect tempo, attracting new consumers into the market and creating the fitting circumstances for a rally towards 4,310. This resistance corresponds to the 61.8% Fibonacci retracement of the 2022 selloff and final yr’s August excessive.

Advisable by Diego Colman

Get Your Free Equities Forecast

S&P 500 TECHNICAL CHART

S&P 500 Futures Chart Ready Utilizing TradingView