GBP/USD, BRITISH POUND – Elementary & Technical Outlook:

- GBP/USD appears to be like overbought from a multi-month perspective, simply because it checks very important resistance.

- GBP/USD’s rally is displaying indicators of fatigue whilst UK inflation fell lower than anticipated final month.

- Which manner for GBP/USD within the close to time period?

Beneficial by Manish Jaradi

Methods to Commerce GBP/USD

The British pound’s rally in opposition to the US greenback has stalled lately, and likelihood is that the consolidation may proceed some time longer earlier than it embarks on a brand new leg larger.

That’s as a result of despite the fact that UK inflation earlier within the week confirmed value pressures stay stubbornly excessive, the near-term financial coverage dynamics for GBP and USD are broadly related, the pound is overbought from a multi-month perspective, and there are indicators of fatigue on technical charts. For additional dialogue see “British Pound Worth Setup: GBP/USD Rally Due for a Minor Pause?”, revealed April 17.

GBP/USD 6-Month Change

Chart Created by Manish Jaradi Utilizing Excel; Supply Knowledge: Bloomberg

UK core inflation didn’t fall as anticipated final month, holding regular at 6.2% on-year, and surpassing estimates of 6.0%, whereas UK wage development stunned on the upside in February. Headline inflation rose quicker than anticipated at 10.1% on-year in February Vs the 9.8% anticipated, and never too removed from the four-decade excessive of 11.1% hit in October. Traders at the moment are absolutely pricing in a 25-basis level charge hike to 4.25% on Might 11 and count on charges to peak at 5% by September.

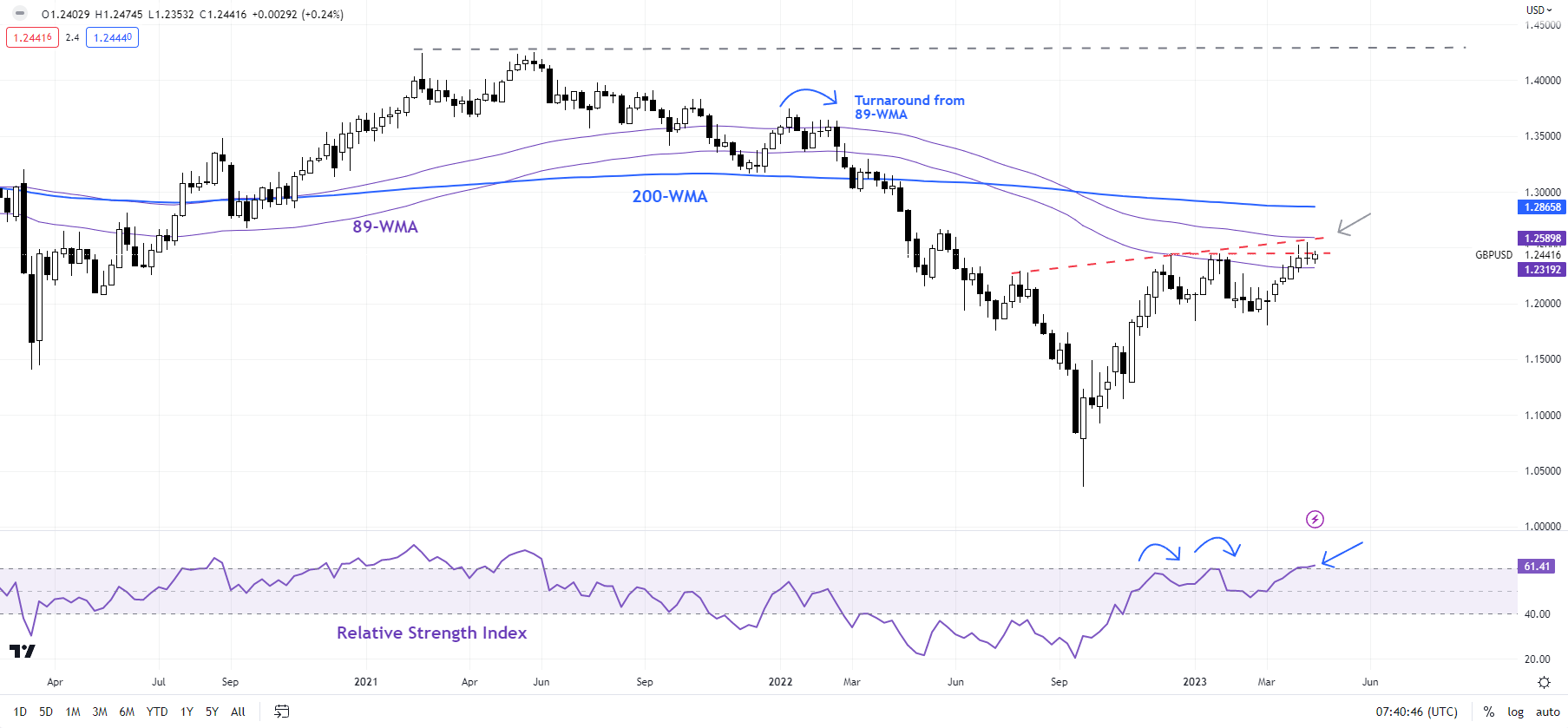

GBP/USD Weekly Chart

Chart Created by Manish Jaradi Utilizing TradingView

In the meantime, the market is pricing in round a 90% probability of yet another quarter-point rate of interest hike by the US Federal Reserve at its Might 2-3 assembly earlier than pausing. Nevertheless, Fed officers proceed to strike a hawkish tone – Cleveland Federal Reserve President Loretta Mester mentioned on Thursday the Fed nonetheless has extra rate of interest will increase forward of it – suggesting that the bar for Fed charge cuts later this yr is excessive whereas inflation stays above the US central financial institution’s 2% goal.

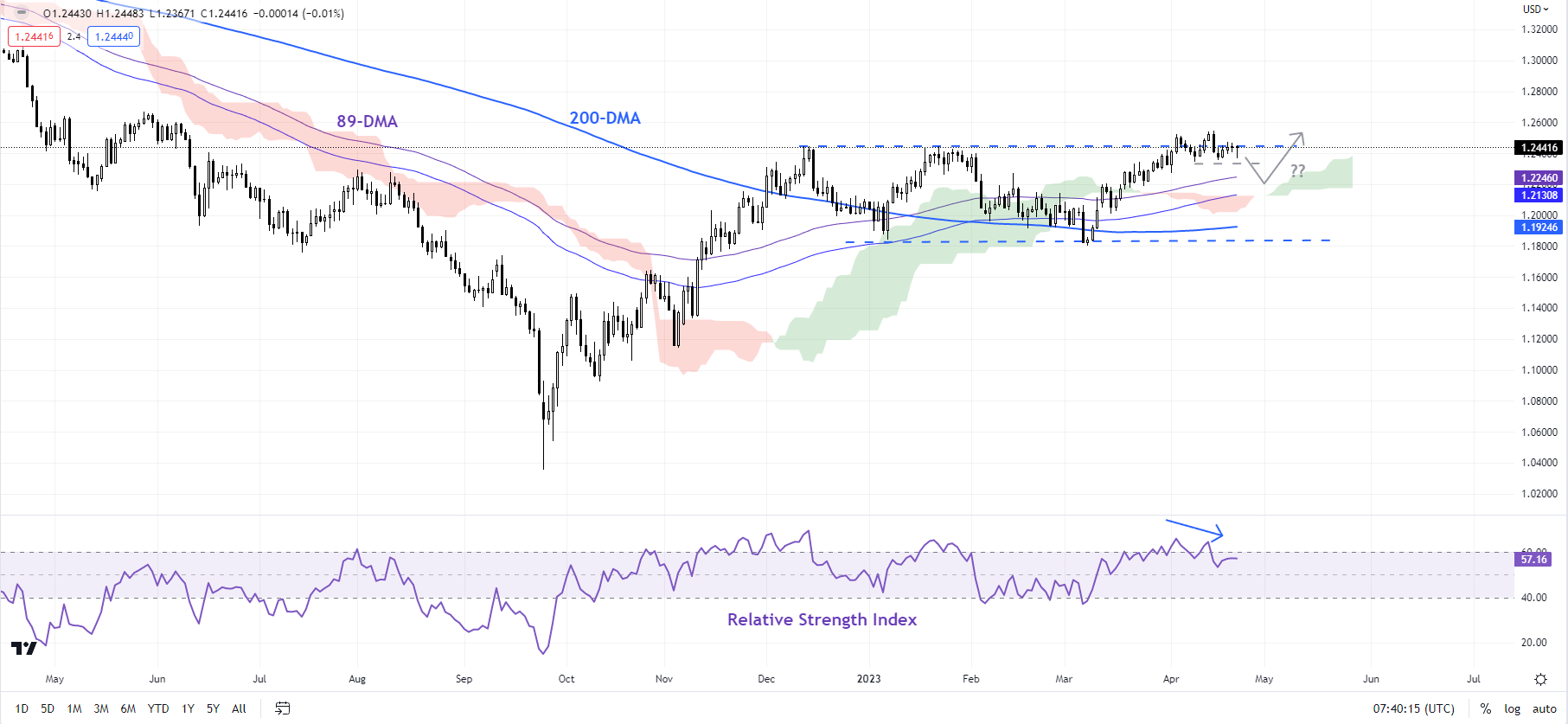

GBP/USD Day by day Chart

Chart Created by Manish Jaradi Utilizing TradingView

The tempo of GBP/USD features in latest months has been fairly sharp – the six-month change is the best at the least since 2014. Whereas the surge in momentum bodes effectively for the medium-term outlook, within the near-term likelihood is that the features may sluggish and even reverse a bit, given the mean-reverting nature of the sequence (see the chart).

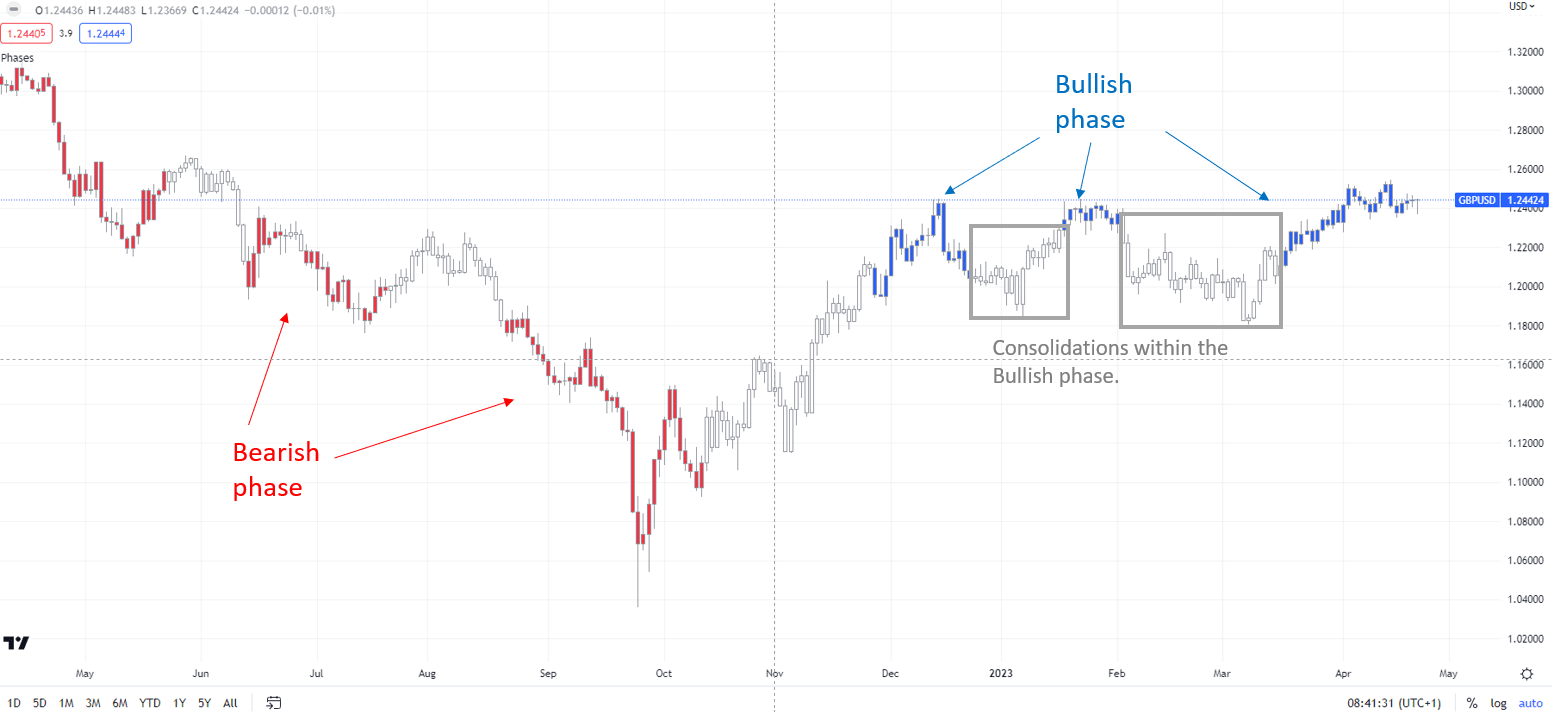

GBP/USD Day by day Chart

Chart Created by Manish Jaradi Utilizing TradingView

Word: Within the above colour-coded chart, Blue candles symbolize a Bullish section. Purple candles symbolize a Bearish section. Gray candles function Consolidation phases (inside a Bullish or a Bearish section), however typically they have a tendency to kind on the finish of a development. Word: Candle colours should not predictive – they merely state what the present development is. Certainly, the candle shade can change within the subsequent bar. False patterns can happen across the 200-period shifting common, or round a assist/resistance and/or in sideways/uneven market. The creator doesn’t assure the accuracy of the data. Previous efficiency just isn’t indicative of future efficiency. Customers of the data accomplish that at their very own danger.

On technical charts, the broader development is up. The color-coded candlestick charts based mostly on development/momentum indicators present GBP/USD stays in a bullish section on the day by day charts. Nevertheless, GBP/USD has been struggling to interrupt above the highest finish of a sideways channel for the reason that finish of 2022 at about 1.2450.

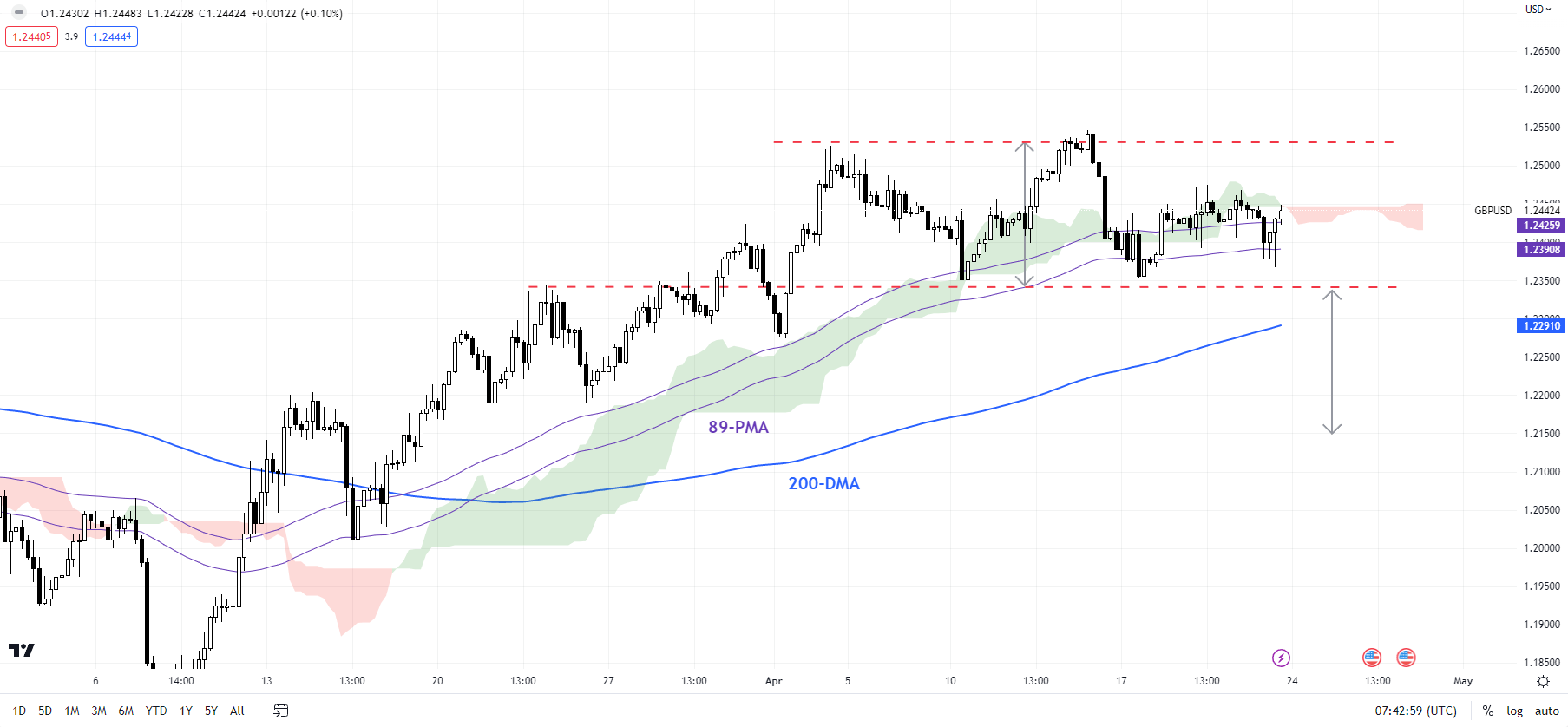

GBP/USD 240-minute Chart

Chart Created by Manish Jaradi Utilizing TradingView

Most lately, a adverse divergence (rising value related to falling momentum) on the day by day charts suggests GBP/USD’s rally is shedding steam. The pair may consolidate sideways or retreat a bit within the close to time period. On the 4-hourly charts, there may be rapid assist on the April 10 low of 1.2345. Any break under would set off a minor double high (this month’s highs), opening the best way towards 1.2200.

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to E-newsletter

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and observe Jaradi on Twitter: @JaradiManish