On this piece, we’re going to run by way of a few of final week’s essential information releases.

Let’s dive proper in.

1. New York Fed World Provide China Pressures Index vs. U.S. CPI YoY%

One other month, one other vital drop in , as we’ve been anticipating.

Provide Chain Pressures additionally proceed to break down and lead CPI by 5 months, which means that CPI can be again under 2% ahead of most anticipate.

NY Fed World Provide Chain Stress Index

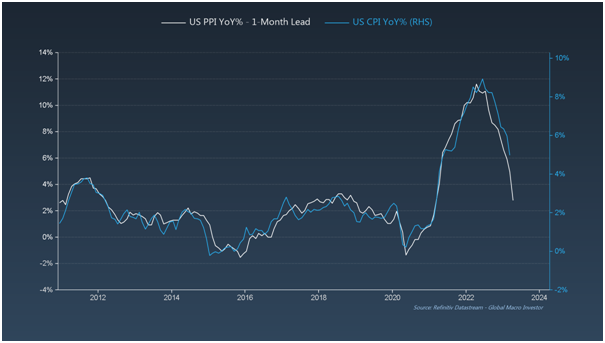

2. U.S. PPI YoY% vs. U.S. CPI YoY%

additionally got here in under consensus expectations in March (2.7% YoY vs. expectations for 3.0%) and indicated that CPI ought to already be nearer 3% over the subsequent one to 2 months.

US PPI YoY% vs. US CPI YoY%

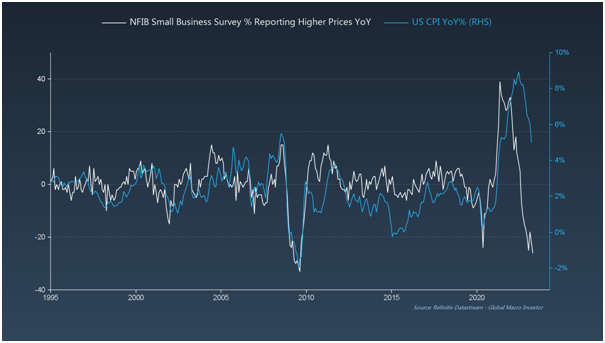

3. NFIB Small Enterprise Survey % Reporting Larger Costs YoY vs. U.S. CPI YoY%

Moreover, in response to the most recent information launched this week for March, U.S. small companies proceed to report a fast lower in costs – present YoY studying is the bottom since July 2009.

NFIB Small Enterprise Survey vs. US CPI YoY%

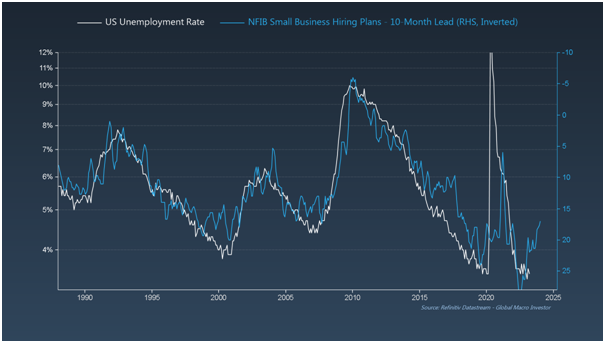

NFIB Hiring Plans additionally proceed to maneuver decrease (right here inverted) and counsel that unemployment will begin to rise very quickly, one thing we’ve been warning about based mostly on how lagging the unemployment information is – right here, NFIB Small Enterprise Hiring Plans are superior by ten months.

US Unemployment Charge

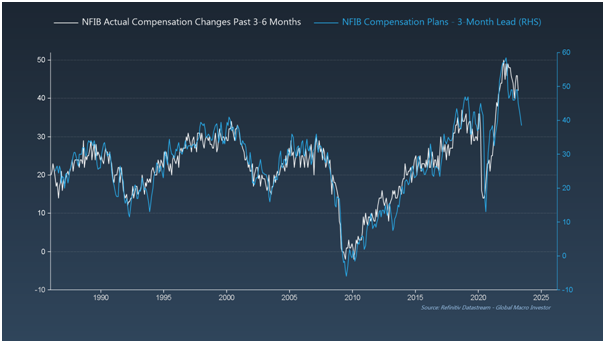

Lastly, NFIB Compensation Plans are nonetheless falling and point out that wage inflation is yesterday’s information.

NFIB Compensation Plans

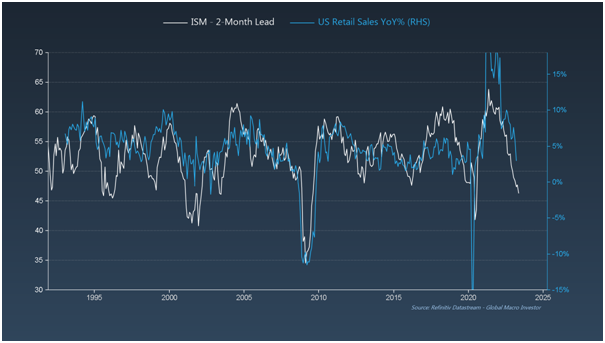

4. ISM vs. U.S. Retail Gross sales YoY%

March information (additionally launched this previous week) posted an enormous unfavourable shock and, based mostly on the conventional two-month lag versus the , ought to flip unfavourable over the subsequent couple of months.

ISM vs. US Retail Gross sales YoY%

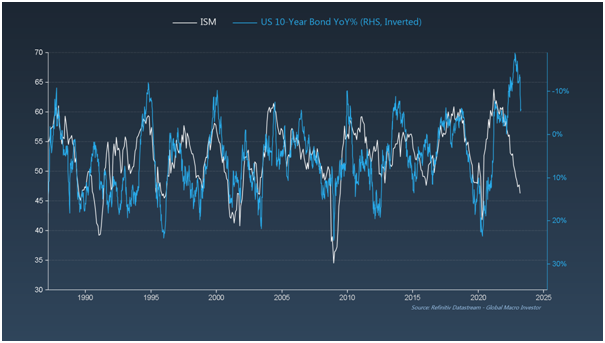

5. Bond Replace

Lastly, bonds proceed to shut the hole versus ISM after reaching probably the most excessive divergences from the enterprise cycle in historical past. We predict the chance/reward for bonds right here continues to be extraordinarily engaging and proceed to imagine that these alligator jaws will shut by way of bond costs rising.

ISM vs US 10-Yr Bond

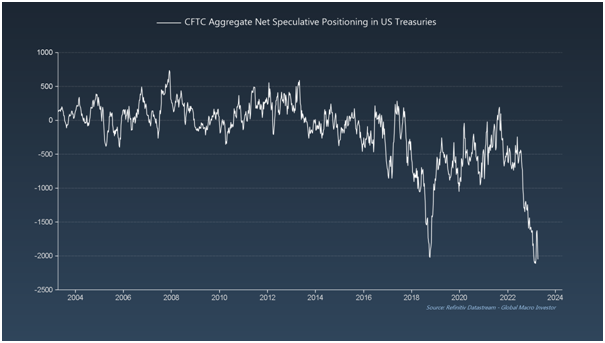

And everybody continues to be extraordinarily brief, which is offering gasoline for the fireplace.

CFTC Combination Internet Speculative Positioning

Conclusion

As we’ve been anticipating, inflation information continues to break down, and coincident information like retail gross sales and are nonetheless slowing – the proper atmosphere for bonds – and the massive brief place solely will increase our conviction across the commerce.

Discover All of the Information you Want on InvestingPro!

***

Wish to learn these the second they arrive out? Enroll solely free for my e-newsletter, Quick Excerpts From World Macro Investor right here. New articles are revealed each single Sunday.