LilliDay

A number of months in the past, I warned {that a} recession was imminent for the U.S. economic system, and holding a levered credit score fund just like the PIMCO Dynamic Revenue Fund (NYSE:PDI) was not the best funding technique.

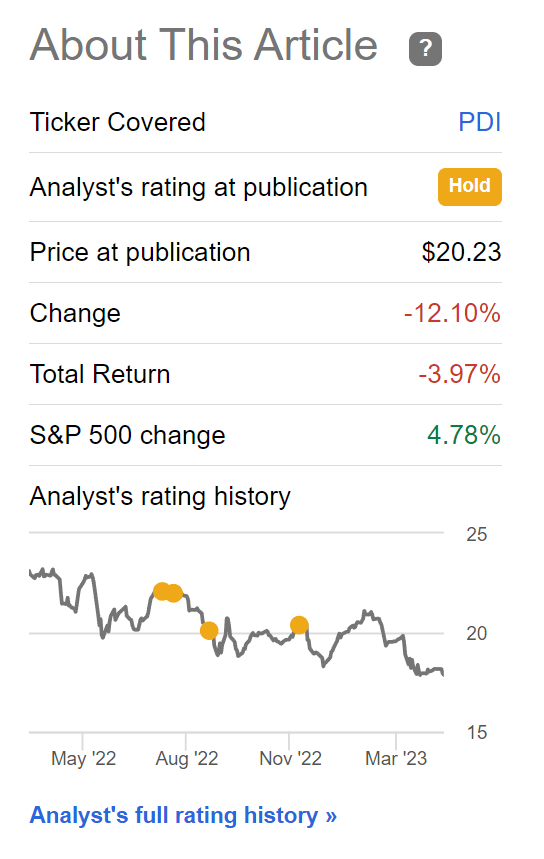

Whereas we patiently await the inevitable, the PDI fund has continued to battle with a 12% drop in worth and delivering complete returns of -4.0% (Determine 1).

Determine 1 – PDI efficiency since final article (Looking for Alpha)

With the primary quarter of 2023 within the historical past books, has my views on an impending recession modified? Ought to traders go and purchase the PDI fund now, with it yielding nearly 15%?

PDI Muddled By way of Q1

In my prior article, I laid out two doable eventualities for the PDI fund. First, in a ‘muddle-through’ situation, I anticipated the PDI’s portfolio to earn revenue, whereas affected by period induced MTM losses.

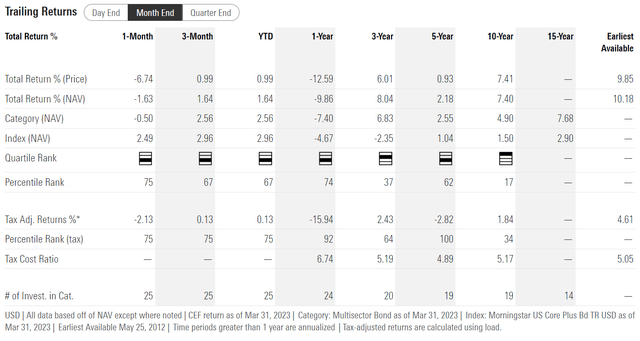

That is mainly what occurred to the PDI fund within the first quarter, because the Federal Reserve continued to lift rates of interest to combat inflation. Though the PDI fund paid unitholders $0.6615 in distributions to March thirty first (3.6% yield on 2022 year-end worth of $18.48), precise complete returns in Q1 had been just one.6% (Determine 2).

Determine 2 – PDI historic efficiency (morningstar.com)

Financial Clouds Darkening

Nevertheless, as we transition into Q2, financial clouds are darkening and I concern my second situation, a ‘hard-landing’ recession, will play out within the coming quarters. In current months, we’ve seen continued deterioration in lots of financial indicators.

Declines In Retail Gross sales Level To Struggling Client

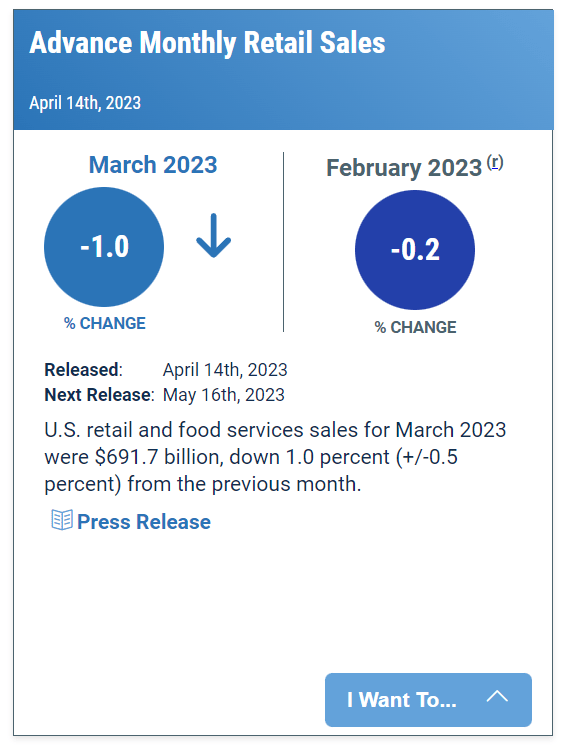

For instance, U.S. retail gross sales that had been launched on April 14th confirmed retail gross sales fell 1.0% in March, following a 0.2% decline in February (Determine 3).

Determine 3 – Decline in March retail gross sales (Census.gov)

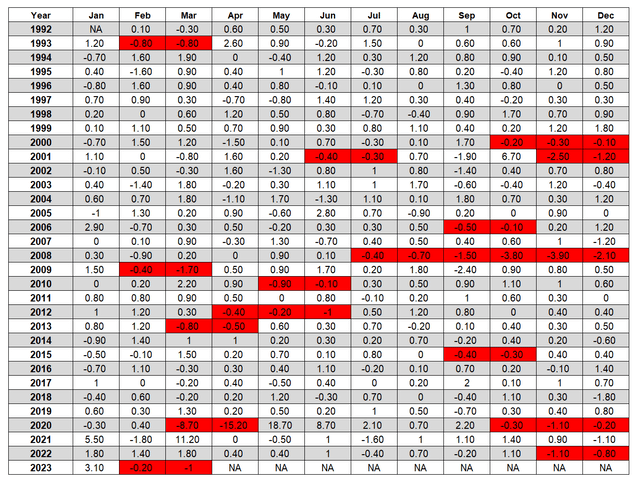

Traditionally, for a client nation just like the U.S., back-to-back declines in retail gross sales are uncommon and usually related recessions (2000/2001,2008/2009, 2020). Subsequently, March’s back-to-back decline is regarding. In actual fact, the U.S. economic system has seen a month-to-month decline in retail gross sales in 4 of the previous 5 months and 6 of the previous 9 (Determine 4).

Determine 4 – Again-to-back decline in retail gross sales are uncommon (Census.gov)

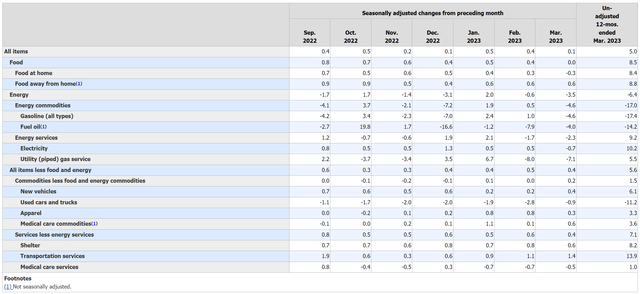

Declining retail gross sales are particularly regarding given the truth that retail gross sales are measured in nominal {dollars} that aren’t adjusted for inflation. With inflation working sizzling, retail gross sales shouldn’t be declining MoM if quantity of products offered had been secure (Determine 5).

Determine 5 – CPI inflation has been working sizzling (BLS)

Manufacturing In Contraction Since Late 2022

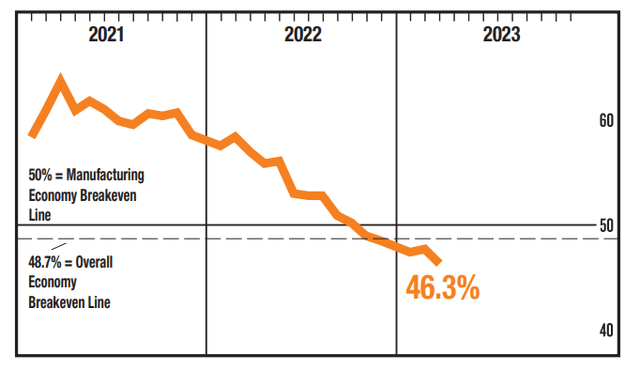

Financial exercise in manufacturing has not fared a lot better, with the newest ISM Manufacturing PMI survey coming in at 46.3, having been in contraction territory since late 2022 (Determine 6).

Determine 6 – ISM Manufacturing PMI has been contracting since late 2022 (ismworld.org)

Providers See Orders Plunge

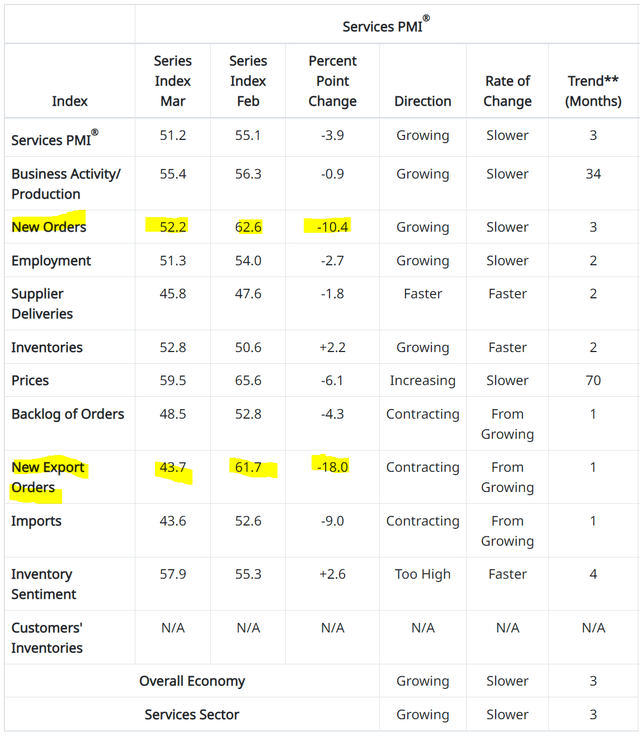

Though the ISM Providers PMI continued to see growth in March, registering 51.2, the survey declined markedly from 55.1 in February. Importantly, the New Orders sub-component plunged in March, suggesting a pointy slowdown in future companies exercise (Determine 7).

Determine 7 – ISM Providers PMI New Orders plunged (ismworld.org)

Regional Banking Disaster Tightens Credit score Situations

Lastly, in current weeks, the impression of the Fed’s speedy rate of interest will increase is lastly flowing by to the actual economic system, as a number of regional banks failed in spectacular style from a mix of deposit flight (financial institution deposits paying 0.37% are unattractive in comparison with cash market funds paying over 4%) and funding securities losses (many regional banks held portfolios of bonds that misplaced worth resulting from greater rates of interest).

As regional banks combat to retain deposits, their funding prices are anticipated to rise which can additional tighten lending requirements for shoppers and companies. In accordance with the Fed, this might be equal to a number of rate of interest hikes. Industrial actual property is a sector that is significantly laborious hit, as regional banks had been giant lenders within the area.

Recession Appears All However Sure

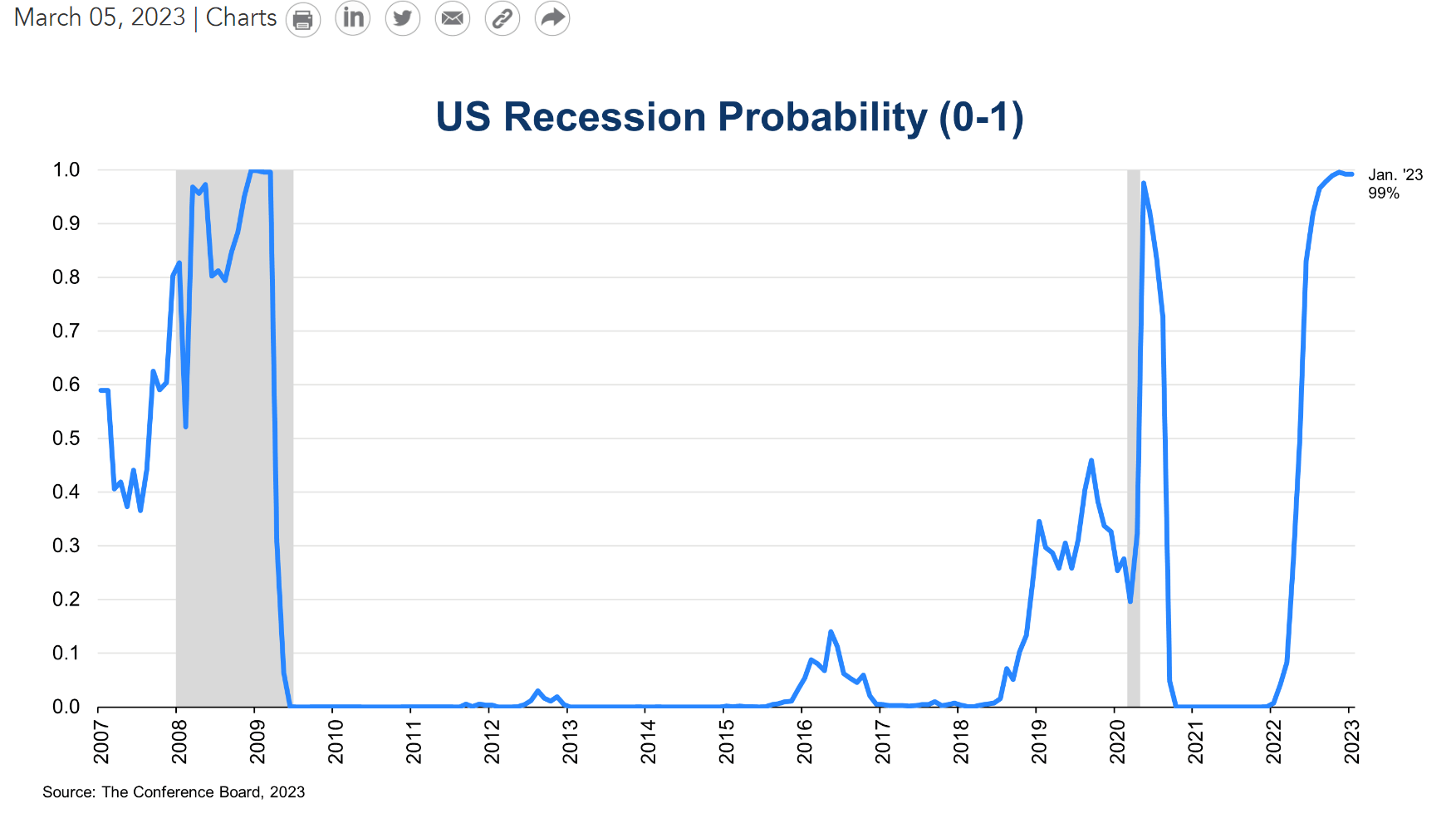

Placing all of it collectively, it’s no surprise {that a} many economists consider a U.S. recession is all however sure within the coming quarters (Determine 8).

Determine 8 – U.S. recession chance at 99% (Convention Board)

In actual fact, even the Fed’s personal workers economists are projecting “a gentle recession beginning later this 12 months, with a restoration over the next two years,” as we just lately realized from the Fed’s FOMC Minutes.

Levered Credit score Funds Endure Throughout Recessions

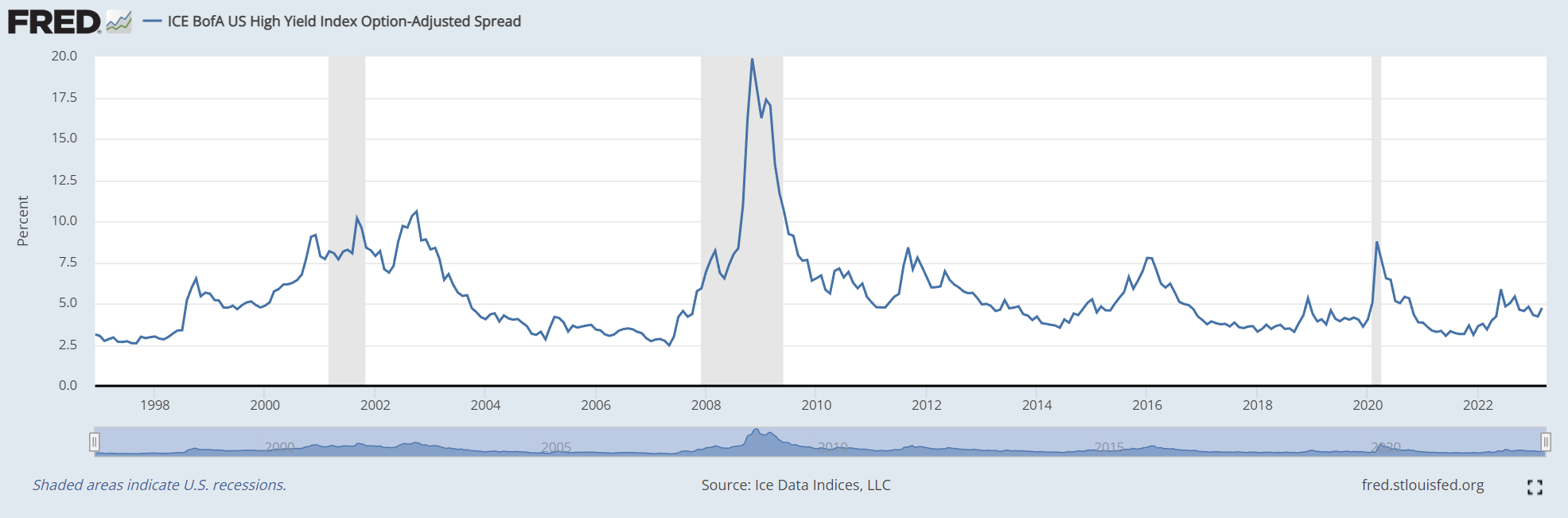

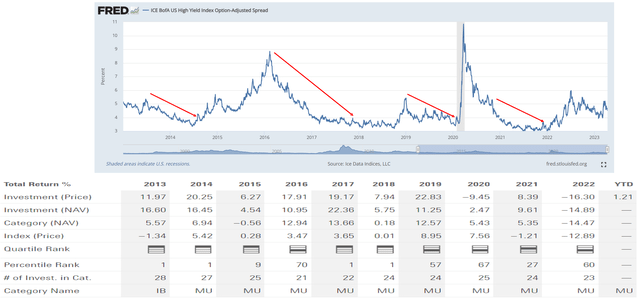

As I wrote in my prior article, “if the economic system does enter a recession, then I count on credit score spreads and bond defaults to spike, as corporations will battle to service their money owed. A recession has by no means occurred with no rise in excessive yield credit score spreads (as measured by the ICE BofA Excessive Yield OAS) to 8-10%” (Determine 9).

Determine 9 – Recessions are accompanied by spikes in excessive yield credit score spreads (St. Louis Fed)

Given excessive yield credit score spreads are at the moment buying and selling at solely ~4.50%, there’s a variety of worth draw back to the credit score investments held inside PDI’s portfolio.

A 1% improve in credit score spreads has as a lot impression to a bond as a 1% improve in rates of interest. Given the PDI fund’s 3.9 Yr period, a primary order approximation is {that a} 1% widening in credit score spreads will trigger ~4% decline in costs. Subsequently, if excessive yield credit score spreads do widen to 8-10% in a recession situation, PDI’s 2023 returns might be as dangerous as 2022’s, when the fund misplaced 14.9% total.

Will PDI’s Distribution Be At Danger?

Many traders rely upon excessive yielding closed-end funds just like the PDI to fund their retirements or complement their revenue. A key query for these traders is whether or not a recession can have any impression to PDI’s distribution?

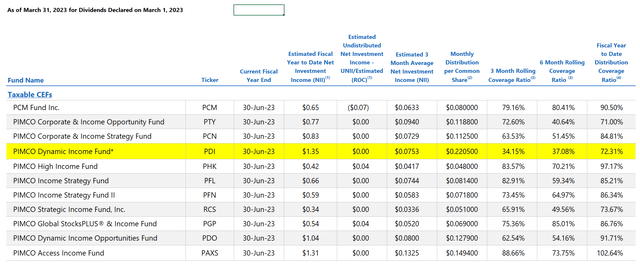

First, primarily based on the fund’s newest UNII report, the PDI fund is just not at the moment incomes its distribution with 3 month distribution protection ratio of solely 34% (Determine 10).

Determine 10 – PDI UNII report (PIMCO)

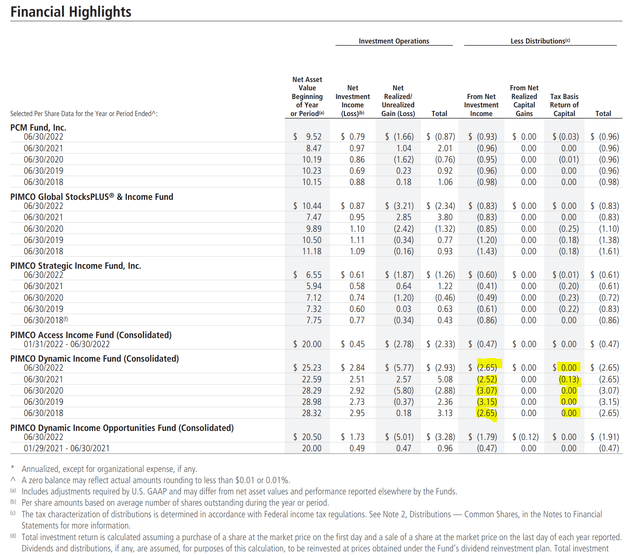

Nevertheless, this protection determine can fluctuate and as many commentators prefer to argue that traditionally, the PDI fund has been capable of fund its distributions principally out of internet funding revenue (“NII”) (Determine 11).

Determine 11 – Traditionally, PDI has funded distribution out of NII (PDI 2022 annual report)

Nevertheless, one other means to consider the sustainability of a fund’s distribution is to match the distribution fee to the fund’s long-term common annual returns. In PDI’s case, the PDI fund has solely earned 3/5/10Yr common annual returns of 8.0%/2.2%/7.4% respectively to March 31, 2023, in comparison with the fund’s 15.3% of NAV distribution fee (see determine 2 above).

Even when we examine PDI’s distribution fee to the beneficiant 3Yr common annual return of 8.0% (which is flattered by the beginning interval of March 2020, the depths of the COVID lows), the PDI fund is paying way over it earns.

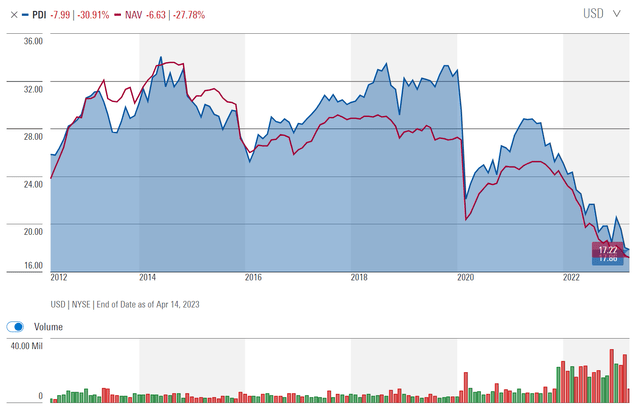

Funds that don’t earn their distributions are referred to as ‘return of principal’ funds by Eaton Vance and are characterised by an amortizing NAV. PDI, we are able to see the that the fund’s NAV has certainly shrunk, from over $32 in 2014 to $17 just lately (Determine 12).

Determine 12 – PDI’s NAV has shrunk over time (morningstar.com)

Whereas PDI’s distributions might certainly be ‘absolutely funded’, traders might be dropping by ‘realized and unrealized funding losses’. For instance, from determine 11 above, we are able to see that the fund amassed $9.19 / share in realized and unrealized losses up to now 5 fiscal years.

Some readers might argue, aren’t these simply unrealized losses that may normalize as soon as rates of interest decline? Sadly, I do not consider that would be the case.

Much like my argument in opposition to the Blackstone Strategic Credit score Fund (BGB), I consider the rationale PDI suffers from funding losses is as a result of the fund might have been ‘reaching for yield’ and invested in dangerous loans and bonds which have led to everlasting losses of principal. So though the fund generates ample NII to fund its distribution, it additionally suffers from principal losses from heightened credit score occasions all through its portfolio.

Credit score occasions would not have to be full on bankruptcies. They might be so simple as credit score downgrades that trigger credit score spreads to widen and costs to say no. By way of portfolio turnover, the PDI fund would flip these unrealized MTM losses into everlasting losses of principal.

For instance, throughout the COVID pandemic, PDI’s NAV plunged from over $27 / share to $22 / share. Since credit score is a imply reverting asset class, if the PDI fund had held onto its investments, the next restoration in 2020 and 2021 ought to have recovered many of the NAV declines because the Fed lowered rates of interest to zero and backstopped all credit score markets. Nevertheless, we are able to see that PDI’s NAV solely recovered to $25, which counsel everlasting losses had been taken.

PIMCO Precedents For Distribution Cuts

My largest fear is that distribution cuts normally occur on the worst doable time for traders. For instance, throughout the 2008/2009 Nice Monetary Disaster, many closed-end funds needed to minimize their distributions simply because the recession took their portfolio values to the woodshed. Numerous unitholders had been left actually holding the bag, by no means to recuperate their losses in principal and revenue.

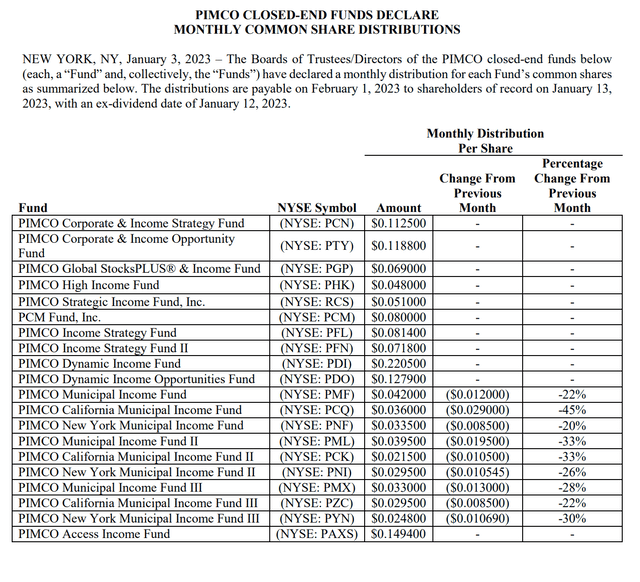

Lately in January, PIMCO chopped the distributions on a lot of its municipal CEFs (Determine 13). Thankfully, the broad revenue funds like PDI had been spared, however for a way lengthy?

Determine 13 – PIMCO minimize its municipal CEF distributions (PIMCO)

A Recession May Be An Alternative

On the intense aspect, a U.S. recession might be a blessing in disguise for traders seeking to purchase bargains.

As we talked about above in determine 9, recessions are typically accompanied by spikes in credit score spreads. For credit score funds like PDI, this may result in large declines within the MTM values of its portfolio.

The imply reverting nature of credit score spreads imply that ultimately, credit score spreads will normalize and traders who’ve the braveness to purchase when markets look bleak will earn above common ahead returns. Empirically, the PDI fund and different related credit score funds usually earn sturdy ahead returns after credit score spreads spike. The problem for traders is to have the endurance to attend for such an occasion to happen (Determine 14).

Determine 14 – Credit score spikes result in sturdy ahead returns (Creator created with information from Morningstar and St. Louis Fed)

Conclusion

In abstract, since my final article, the U.S. financial fundamentals have deteriorated additional, with even Fed officers now projecting a recession to start shortly. My major fear is that heading right into a recession, credit score spreads will spike, which can flip into MTM losses for credit score funds just like the PDI. Moreover, with a ~15% distribution yield, I concern PIMCO might have to chop its distribution if asset values had been to fall considerably throughout the coming recession.

Nevertheless, not all is gloom and doom. Recessions are additionally terrific alternatives for affected person traders to snap up cut price credit score funds just like the PDI. It is because credit score is a mean-reverting asset class, and ultimately, credit score spreads will normalize. Buyers who can sit on their arms within the meantime could possibly take pleasure in above common ahead returns when shopping for from panicked sellers.

Editor’s Observe: This text was submitted as a part of Looking for Alpha’s Finest Funding Thought For A Potential Recession competitors, which runs by April 28. This competitors is open to all customers and contributors; click on right here to search out out extra and submit your article right now!