Prime brokerages present a mess of bundled companies to different monetary establishments, sometimes hedge funds to facilitate their operational wants like securities lending/borrowing, money loans, and danger administration. Giant hedge funds ($1B+ AUM) can work with as many as ten prime brokers whereas smaller funds might depend on just one. Sometimes, the constraint that forestalls these funds from using extra prime brokers is expertise implementation and integration. Clear Avenue is a tech-enabled prime brokerage that takes an API-first method to supply a full suite of companies which might be cloud-native. 70% of the prime brokerage enterprise has been dominated by a handful of establishments and by taking a technology-first method, Clear Avenue is ready to provide real-time processing and unprecedented information scalability that simply isn’t doable in legacy techniques utilized by the incumbents. Presently, the corporate gives clearing and custodial companies, execution, and financing for US equities and choices for over 200 funds however plans to broaden to cowl any asset class, anyplace on the globe.

AlleyWatch caught up with Clear Avenue Cofounder and CEO Chris Pento to study extra concerning the enterprise, the corporate’s strategic plans, newest spherical of funding, and far, way more…

Who have been your buyers and the way a lot did you elevate?

The second tranche of our Collection B capital elevate values Clear Avenue at $2.0B. This $270M funding spherical follows an preliminary Collection B funding of $165M in Might 2022, which was additionally led by Prysm Capital and valued Clear Avenue at $1.7B at the moment. Extra buyers included NextGen Enterprise Companions, IMC Investments, Walleye Capital, Belvedere, NEAR Basis, McLaren Strategic Ventures, and Validus Progress Buyers.

Inform us concerning the services or products that Clear Avenue gives.

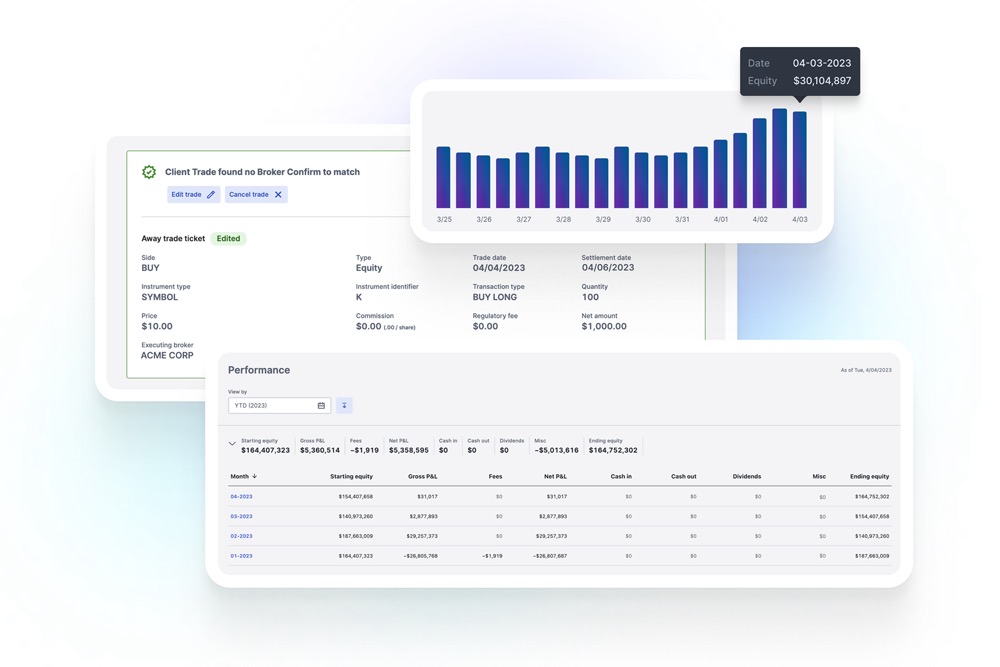

Clear Avenue is a tech-enabled unbiased prime dealer. We’ve constructed an inner platform to be API-first, which incorporates clearing, custody, prime financing and execution, that we’re dogfooding to construct a multi-asset prime dealer enterprise. At the moment our platform helps U.S. equities and choices, however the purpose is to be a single supply of reality that helps any asset class, any geography, for anybody.

Our tech stack makes use of fashionable cloud-native infrastructure, together with resilient service orchestration, event-driven real-time processing, and scalable information warehousing, which is a pointy distinction to the batch processing provided by mainframes that run many back-office techniques. Clear Avenue’s whole suite of software program techniques is constructed upon this constant and cohesive expertise stack, enabling the elements to speak seamlessly.

What impressed the beginning of Clear Avenue?

In 2018, Clear Avenue set out with the daring mission to exchange the outdated infrastructure getting used throughout capital markets. The general public U.S. securities business, which strikes trillions of {dollars} a day, nonetheless depends on mainframe expertise from the Eighties. These legacy techniques are entrenched in guide processes and siloed information, leading to expensive errors and costly technical debt. For a lot of companies, changing these antiquated techniques could be like eradicating the engine from a airplane in mid-air. It’s time-consuming and tough to execute with fragmented expertise.

Clear Avenue is dealing with the problem of outdated capital markets infrastructure head-on. We began from scratch and constructed a totally cloud-native prime brokerage and clearing system designed for a posh, fashionable world market. Our proprietary expertise platform provides important effectivity to the market, whereas specializing in maximizing returns and minimizing danger and value for purchasers.

At the moment, we offer purchasers, from rising managers to giant establishments, with every little thing they should clear, custody, and finance U.S. equities and choices. Within the final yr, we launched capital introduction and repo companies, enhanced our securities lending capabilities, and up to date and refined our client-facing place, danger, operations, and reporting portals.

Sooner or later, our single-source platform will serve quite a lot of investor sorts, throughout a number of asset courses, on a worldwide scale. It’s by no means been extra obvious that the forces of volatility, regulatory change, and pace are demanding instruments that enable companies to make sense of the markets in real-time.

What market does Clear Avenue goal and the way massive is it?

Our prime brokerage purchasers vary from rising managers to giant establishments. Over the previous yr, the variety of institutional purchasers on our platform elevated by 500%, our each day transactional quantity elevated by greater than 300%, and our financing balances elevated by practically 150%.

Our prime clearing platform processes 2.5% of the gross notional U.S. equities quantity, which is about $10 billion in each day notional buying and selling worth of U.S. equities.

What’s your enterprise mannequin?

At the moment, we’re servicing roughly 200 institutional-sized buyers and tons of of smaller lively buying and selling entities. Our purchasers choose anonymity so we don’t publicly title them. We earn charges from our clients for transactions and financing of public market securities. We really feel this construction is best aligned than different choices within the present markets.

What components about your enterprise led your buyers to put in writing the test?

“A good portion of the monetary system’s spine is made on decades-old legacy expertise. With what we consider to be the strongest management workforce within the capital markets business, Clear Avenue has rethought and rebuilt the core underlying infrastructure for capital markets to really modernize an antiquated business.” – Matt Roberts, Cofounder & Accomplice at Prysm Capital

The place do you see the corporate going now over the close to time period?

This funding will help the launch of recent merchandise and our enlargement into new markets and asset courses. Within the final yr, we’ve made key hires in Europe and within the Derivatives house. We’re additionally increasing our product providing to help the clearing wants of Market Makers, which we see as a significant development space for Clear Avenue.