The Japanese yen fell sharply towards the US greenback on Friday after the Financial institution of Japan left rates of interest unchanged and maintained its present bond-yield curve management coverage settings.

In his final assembly because the BOJ Governor Haruhiko Kuroda left coverage settings regular, consistent with expectations, given the Japanese central financial institution adjusted the yield band as not too long ago as December. Incoming BOJ Governor Kazuo Ueda has stated the central financial institution should keep its present ultra-easy coverage for now till there are indicators that inflation has sustained above BOJ’s 2% goal.

USD/JPY 5-minute Chart

Chart Created Utilizing TradingView

Ueda has tried to chill hypothesis of an earlier-than-expected normalization of coverage charges, however for monetary markets, coverage tweaks might are available sooner somewhat than later given the distortions brought on by the yield curve management coverage and inflation at a four-decade excessive. The main target now shifts to the subsequent BOJ assembly April 27-28, Ueda’s first assembly because the chair. Ueda has stated he has concepts on how the central financial institution might exit its large stimulus, however financial tightening is a chance provided that huge enhancements are made in Japan’s ‘development inflation’.

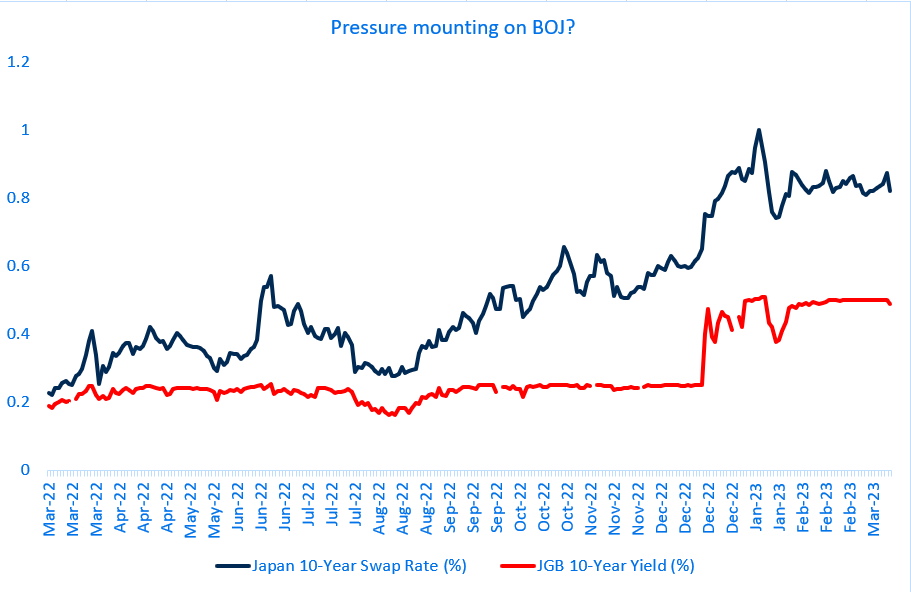

JGB 10-12 months Yield Vs Japan 10-12 months Swap Fee Chart

Supply: Bloomberg

The fast focus for markets shifts to US jobs information due later right now – development of the non-farm payroll possible slowed to 224,000 in February, slower from 443,000 in January, and unemployment is anticipated to carry close to the five-decade low of three.4%. In his semi-annual testimony to Congress,US Fed Chair Powell stepped up hawkishness, saying the final word charge peak is more likely to be greater than anticipated and the central financial institution is ready to extend the tempo of charge hikes, relying on incoming information.

On technical charts, USD/JPY has struggled to cross above a stable cap of round 137.00-138.20, together with the 200-day transferring common and the December excessive of 138.20. For extra dialogue, see “Japanese Yen Forecast: Excessive Bar for USD/JPY to Crack Resistance”, revealed February 26.

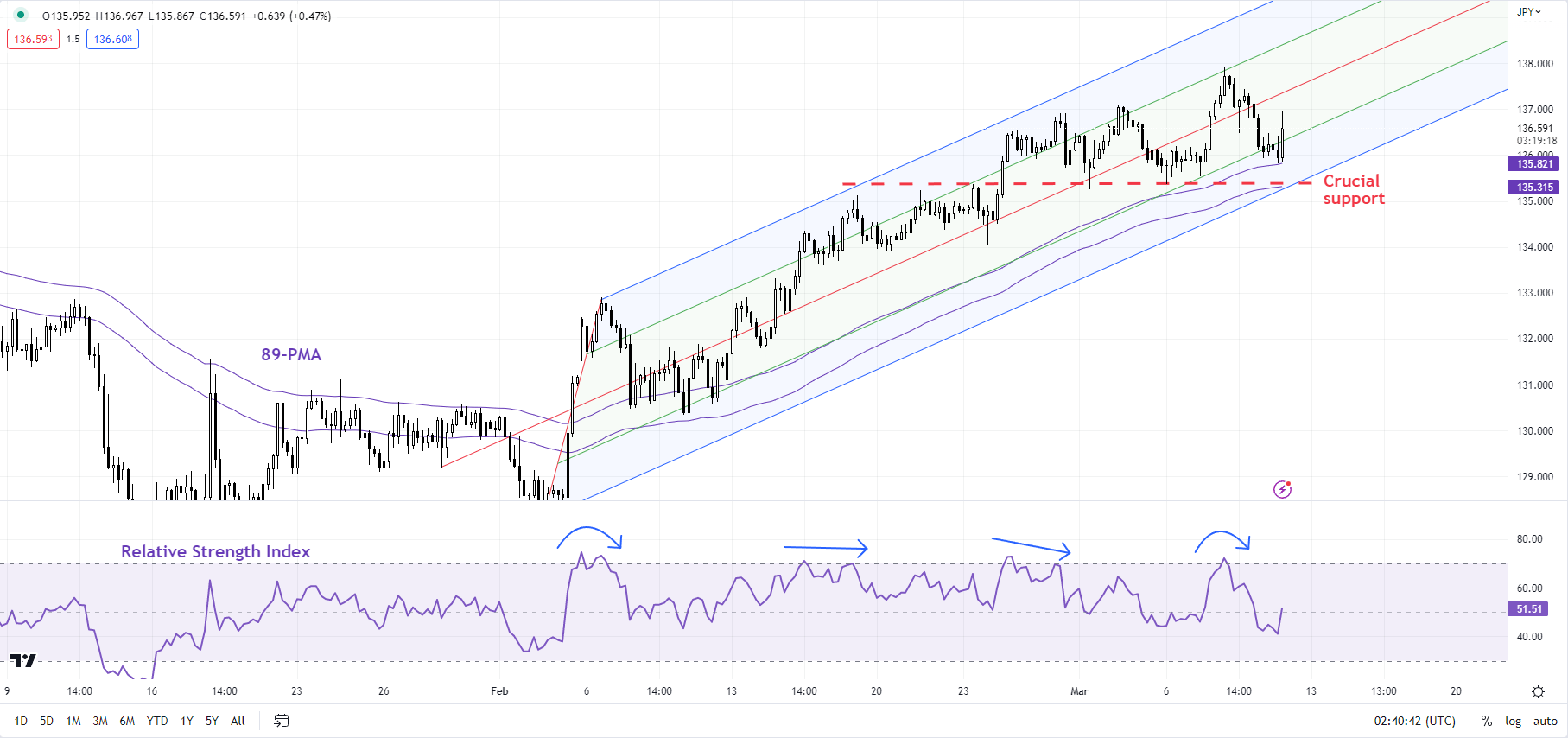

USD/JPY 240-minute Chart

Chart Created Utilizing TradingView

The failure to maintain good points this week above a quick break above resistance on the early-March excessive of 137.09 is an indication that USD/JPY’s six-week-long rally is dropping steam. Nonetheless, the pair would wish to interrupt beneath help on a horizontal trendline from mid-February at about 135.25 to verify that the upward strain is fading.

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX group

Subscribe to E-newsletter

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and comply with Jaradi on Twitter: @JaradiManish