Dow Jones, S&P 500, Powell Testimony – Asia Pacific Market Open:

- Dow Jones, S&P 500 plunge after Jerome Powell testimony

- The chair of the Fed provided an more and more hawkish view

- Markets are beginning to favor 50-basis level hike this month

- Asia-Pacific markets are bracing for volatility on Wednesday

Really helpful by Daniel Dubrovsky

Get Your Free Equities Forecast

Asia-Pacific Market Briefing – Markets Bracing After Wall Avenue Volatility

Wall Avenue acquired a actuality test on Tuesday because the Dow Jones and S&P 500 sank 1.72% and 1.53%, respectively. The important thing wrongdoer was what merchants have been anxiously anticipating, testimony from Federal Reserve Chair Jerome Powell earlier than the Senate Banking Committee.

The important thing takeaway from Mr. Powell was that he famous that the central financial institution was ready to hurry up the tempo of hikes once more if warranted. In fact, this may proceed to be influenced by incoming financial information. Moreover, he famous that the Fed is probably going taking a look at a better fee peak than anticipated.

This testimony follows current indicators that inflation could be stickier than beforehand seen. The newest CPI and PCE report (the latter of which is the central financial institution’s most well-liked inflationary gauge) confirmed indicators that the tempo of disinflation slowed.

By the tip of the day, market pricing began to favor a 50-basis level fee hike this month versus 25. Treasury yields soared, sapping the attraction of shares, inducing traditional danger aversion. This leaves Asia-Pacific markets weak heading into Wednesday’s buying and selling session.

Dow Jones Technical Evaluation

The Dow Jones turned decrease after rejecting the 50-day Easy Shifting Common (SMA). This additionally adopted a breakout underneath a Symmetrical Triangle chart formation. That is putting the give attention to fast assist, which is the 38.2% Fibonacci retracement stage at 32709.

Really helpful by Daniel Dubrovsky

Get Your Free Prime Buying and selling Alternatives Forecast

Each day Chart

Chart Created in TradingView

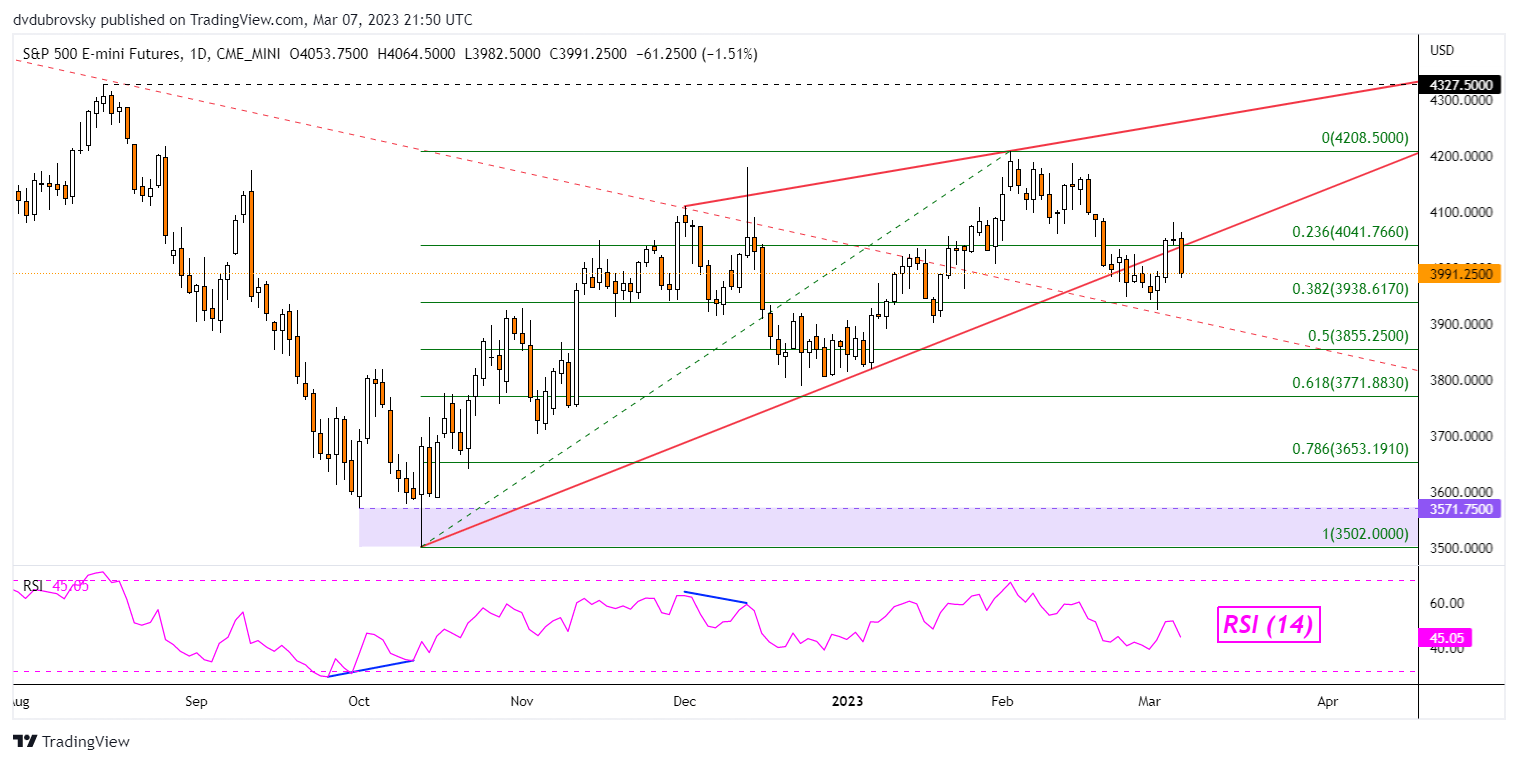

S&P 500 Technical Evaluation

In the meantime, the S&P 500 rejected the ceiling of a bearish Rising Wedge chart formation. That is leaving the index additionally dealing with the 38.2% Fibonacci retracement stage, which right here is sitting at 3938.61. Confirming a breakout underneath the latter would open the door to an more and more bearish technical bias.

Each day Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, observe him on Twitter:@ddubrovskyFX