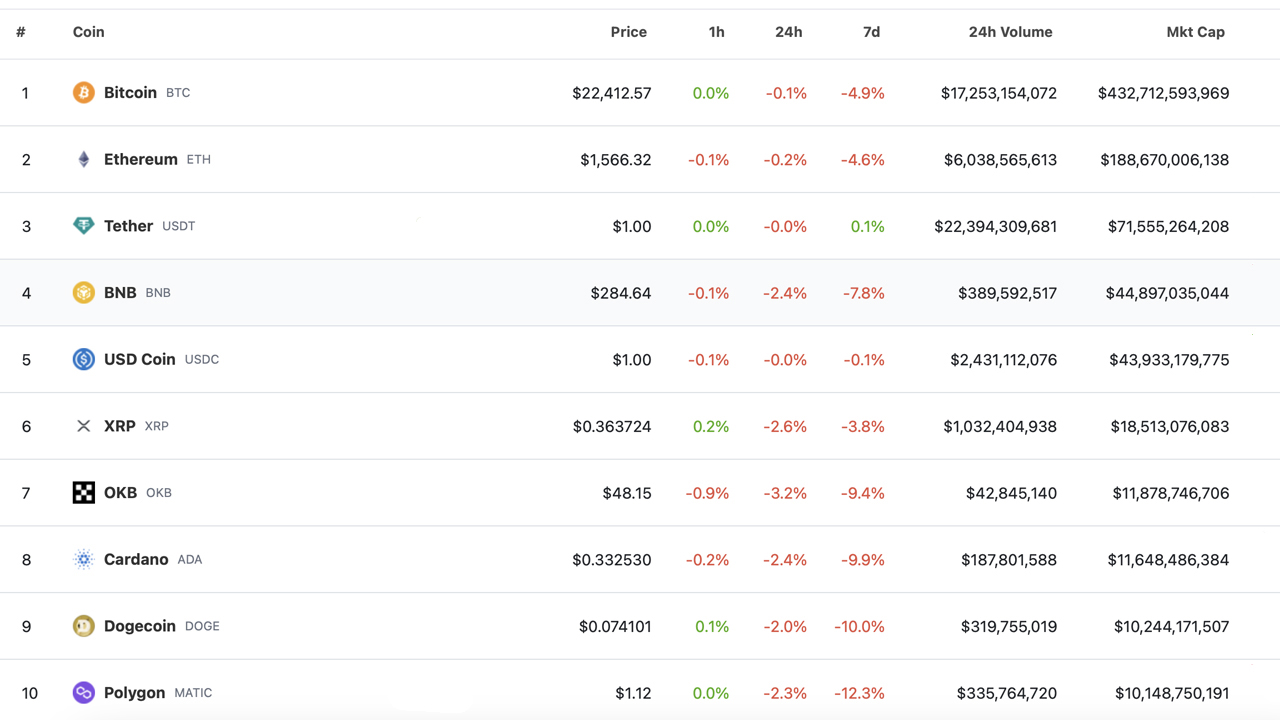

It has been 21 days since Paxos revealed that it could not mint the stablecoin BUSD. Since then, over 7 billion BUSD stablecoins have been redeemed. Previous to the announcement, BUSD was as soon as a top-ten crypto asset. Nevertheless, the highest ten cryptocurrencies by market valuation have modified because the redemptions. Presently, there are solely two stablecoins within the prime ten standings, and the Okx alternate token, OKB, has joined the pack.

2023 Information Adjustments within the High 10 Cryptocurrencies by Market Capitalization

Yearly, the highest ten cryptocurrencies by market capitalization change considerably, resembling final 12 months when three stablecoins entered the highest ten for the primary time. Moreover, the variety of proof-of-work (PoW) cryptocurrencies within the prime ten fell to 2 tokens final 12 months (BTC, DOGE), and that is still the case at the moment.

Within the 21 days since BUSD was faraway from the highest ten standings, the highest ten cryptocurrency opponents have modified. For instance, there at the moment are solely two stablecoins within the group, together with tether (USDT), the third-largest cryptocurrency by market capitalization, and usd coin (USDC), the fifth-largest crypto when it comes to market valuation.

A comparatively new entrant into the highest ten cryptocurrencies by market capitalization is polygon (MATIC), presently the tenth largest digital token by valuation. The day earlier than Paxos introduced it could not mint BUSD, MATIC was the tenth largest cryptocurrency by market capitalization, with an $11.55 billion market cap.

On Feb. 12, 2023, Okx’s alternate token OKB was not among the many prime ten cryptocurrencies by market capitalization, in keeping with an archive.org snapshot. Nevertheless, the utility token OKB has since moved up a number of spots and is now the seventh largest by market valuation.

OKB has risen greater than 25% towards the U.S. greenback over the previous month. 12 months-to-date, the alternate/utility token is up 176.3%. Nevertheless, two-week statistics present a 4% loss towards the dollar. With OKB, there at the moment are two alternate/utility tokens within the prime ten cryptocurrencies, and the fourth-largest cryptocurrency by market capitalization, BNB, is the second.

There at the moment are two stablecoins, two alternate/utility tokens, 4 sensible contract tokens, and two proof-of-work fee crypto property within the prime ten. Two cryptocurrencies which are near the highest ten by market capitalization embody solana (SOL) and Lido’s staked ether (STETH).

What do you suppose the longer term holds for the composition of the highest ten cryptocurrencies by market capitalization? Share your ideas within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any harm or loss prompted or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.