US DOLLAR OUTLOOK: BULLISH

- The U.S. greenback, as measured by the DXY index, rallies and closes the week at its greatest stage since early January

- The buck’s beneficial properties are pushed by surging U.S. Treasury yields following hotter-than-expected PCE outcomes

- ISM information can be in focus within the coming days, however the DXY heads into the brand new week with robust upside momentum.

Really useful by Diego Colman

Get Your Free USD Forecast

Most Learn: EUR/USD Subdued as US Greenback Retains Higher Hand, Gold Can’t Shake Off the Blues

The U.S. greenback, as measured by the DXY index, rose this previous week for the fourth consecutive week, notching to its greatest shut since January (~105.2), supported by the surge in U.S. bond yields. The latest transfer within the mounted revenue house has been pushed by a hawkish repricing of the Fed’s tightening path in response to a string of hotter-than-expected financial reviews.

Sturdy labor market information, in live performance with persistently elevated worth pressures, have boosted expectations for the Fed’s terminal charge, lifting it to five.39% on the time of this writing, a determine that suggests about three extra 25 foundation level hikes by the summer time.

The upper peak for borrowing prices envisioned by Wall Avenue has bolstered Treasury yields throughout the curve, particularly these on the entrance finish, catapulting the 2-year word to contemporary cycle highs above 4.82%, a stage not seen since 2007. This has been an upside catalyst for the U.S. greenback.

2023 FED FUNDS FUTURES IMPLIED YIELD CHART

Supply: TradingView

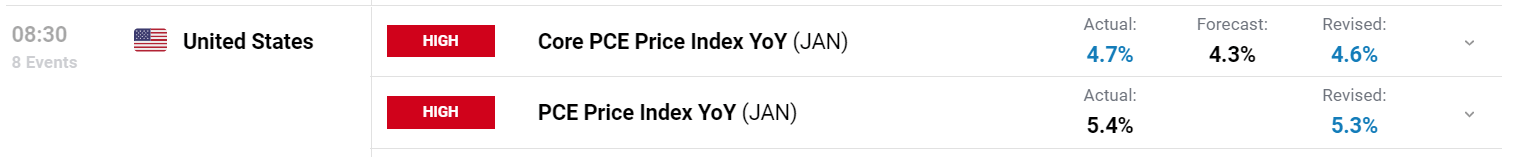

The present dynamic isn’t prone to change any time quickly. In actual fact, the January PCE numbers launched on Friday, which confirmed an surprising acceleration within the Fed’s favourite inflation gauge, recommend that policymakers may have no selection however to take care of an aggressive stance for longer, indefinitely delaying a financial coverage pivot (Core PCE clocked in at 4.7% y-o-y versus 4.3% y-o-y anticipated).

Supply: DailyFX Calendar

Total, the celebrities look like aligning for a continuation of the bullish U.S. greenback impetus noticed because the starting of the month, particularly if incoming information proceed to level to excessive financial resilience.

We’ll have extra perception into how enterprise exercise advanced in February subsequent week when the Institute for Provide Administration publishes its manufacturing PMI and companies PMI reviews, so merchants ought to carefully watch each surveys. That mentioned, any financial power in macro statistics can be constructive for the U.S. greenback, whereas weak spot ought to gradual its advance, capping future beneficial properties.

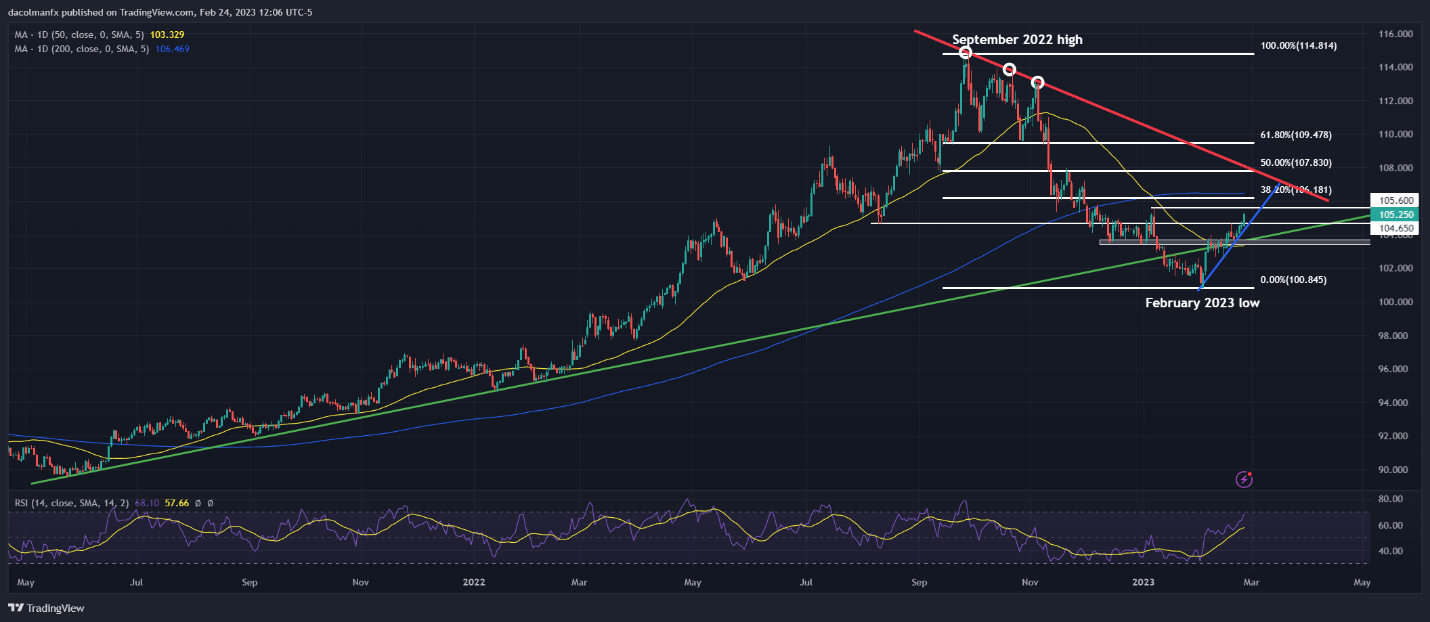

By way of technical evaluation, the DXY index cleared a key resistance close to 104.70 heading into the weekend, reinforcing its constructive near-term outlook.

In any case, with upward momentum on its aspect, the U.S. greenback could possibly be on observe to retest the 2023 excessive within the coming periods. Round that peak, market response can be key, however a topside breakout may set the stage for a dash in the direction of 106.18, the 38.2% Fib retracement of the September 2022/February 2023 correction. Conversely, a bearish rejection may result in worth motion consolidation and a doable retrenchment in the direction of 104.70.

Really useful by Diego Colman

Introduction to Foreign exchange Information Buying and selling

US DOLLAR INDEX (DXY) TECHNICAL CHART

US Greenback Index Chart Ready Utilizing TradingView

Written by Diego Colman, Contributing Strategist