Foreword

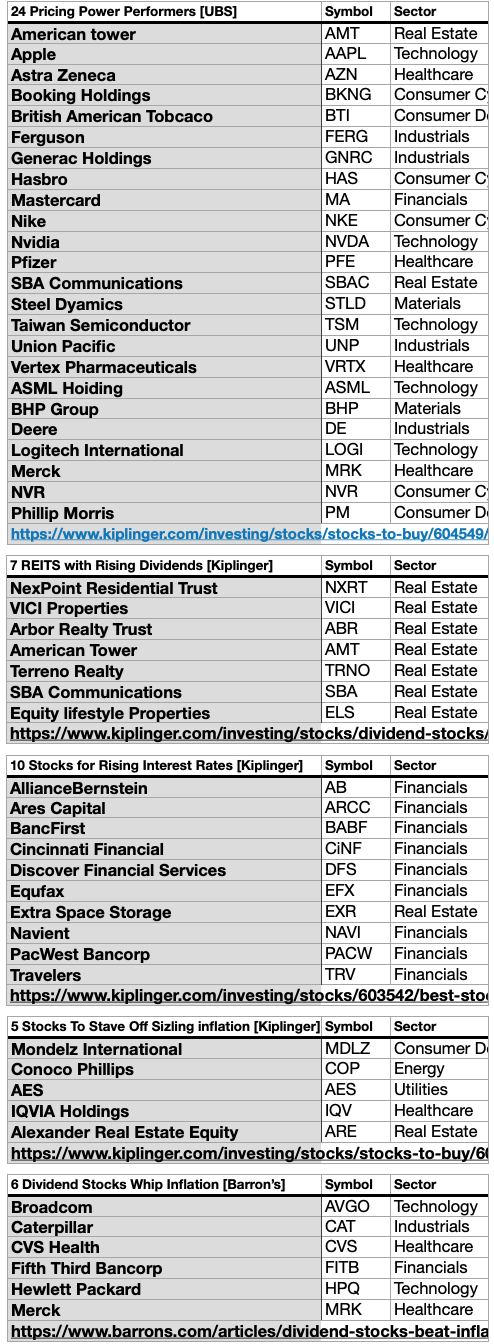

This text is predicated on 5 UBS, Kiplinger, and Barron’s articles, aimed toward discovering “Inflation-Busting,” shares since 2022. The writer believes these inventory solutions are prescient into the brand new 12 months 2023. The title and hyperlinks to the articles observe:

24 Pricing Energy Performers

“With inflation pressures surging, pricing energy relative to value exposures will likely be a key theme and supply of [absolute outperformance] for world fairness markets,” writes the UBS Fairness Technique workforce.—by: Dan Burrows April 14, 2022

7 REITS with Rising Dividends

REIT dividends are anticipated to submit double-digit share progress this 12 months, making the yield-friendly sector all of the extra engaging.—by: Lisa Springer April 13, 2022

10 Shares for Rising Curiosity Charges

The Federal Reserve has signaled in no unsure phrases that rates of interest will head increased in 2022. Listed below are 10 of one of the best shares for this setting. —by: Jeff Reeves April 4, 2022

5 Shares To Stave Off Scorching inflation

Earnings buyers like utility shares for his or her stability and beneficiant dividends. Listed below are 12 top-rated ones to observe within the new 12 months. —by: Dan Burrows February 10, 2022

6 Dividend Shares Whip Inflation

The new new funding theme isn’t socially nuanced crypto area finance or metaverse charging networks for digital automobiles. It’s dividends—money funds to shareholders.

To seek out extra dividend growers, Barron’s used an strategy impressed by the Federal Reserve’s so-called dot plot, or path of anticipated rate of interest hikes. They screened the S&P 500 for firms that analysts predict will enhance funds properly within the years forward. They got here up with six. —By Jack Hough Up to date April 24, 2022 / Authentic April 22, 2022

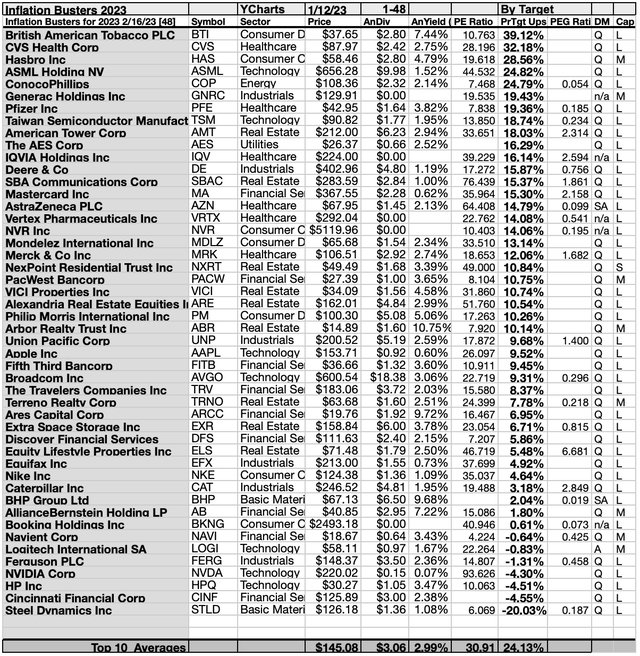

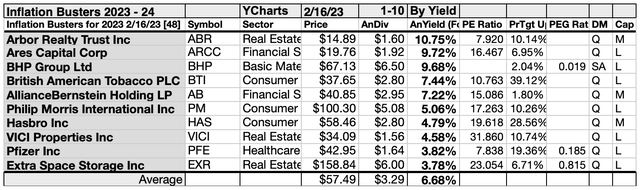

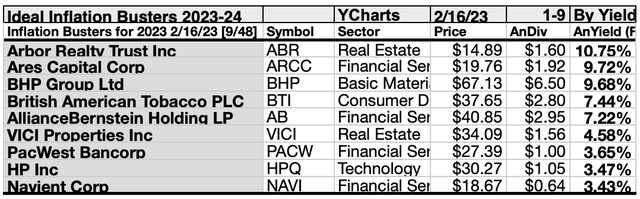

Any assortment of shares is extra clearly understood when subjected to yield-based (canine catcher) evaluation, this assortment of UBS, Kiplinger, and Barron’s articles, aimed toward discovering the “Inflation Busting,” shares is ideal for the dogcatcher course of. Under are the February 16, 2023 “Inflation-Busters” as parsed by YCharts.

The costs of 9 of those 48 UBS, Kiplinger, and Barron’s dividend picks, made the potential of proudly owning productive dividend shares from this assortment extra viable for first-time buyers.

These 9 Dogcatcher Perfect “Inflation Busting” shares for February are: Arbor Realty Belief Inc (ABR); Ares Capital Corp. (ARCC); BHP Group Ltd. (BHP); British American Tobacco PLC (BTI); AllianceBernstein Holding (AB); VICI Properties Inc (VICI); PacWest Bancorp (PACW); HP Inc. (HPQ); and Navient Corp. (NAVI).

These 9 all dwell as much as the perfect of getting their annual dividends from a $1K funding exceed their single share costs. Many buyers see this situation as “look nearer to perhaps purchase” alternative.

Which of the 9 are “safer” dividend canines? To seek out the reply discover my “Safer” February Dividend Dogcatcher follow-up detailing these UBS, Kiplinger, and Barron’s “Inflation Busting,” shares in Looking for Alpha’s Market showing on or about February 23. Merely click on on the hyperlink within the final Abstract bullet level above.

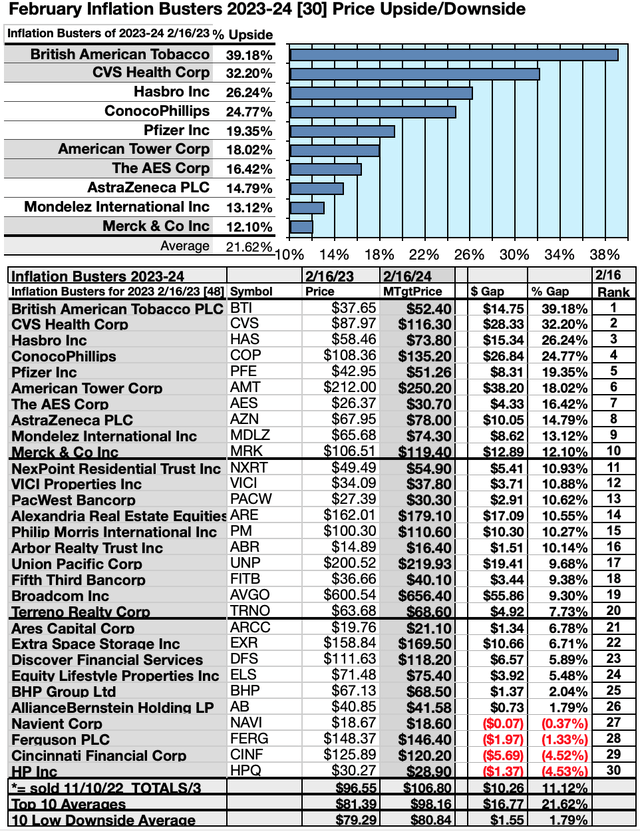

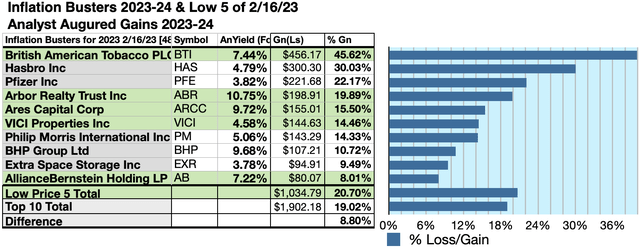

Actionable Conclusions (1-10): Analysts Estimated 14.46% To 45.62% Internet Positive factors For Ten High “Inflation-Busting” Dividend Shares To February 2024

4 of ten high “Inflation Buster” dividend shares by yield had been additionally among the many top-ten gainers for the approaching 12 months based mostly on analyst 1-year goal costs. (They’re tinted grey within the chart under.) Thus, the yield-based forecast for these January canines was graded by Wall St. Wizards as 40% correct.

Supply: YCharts.com

Estimated dividends from $1000 invested in every of the very best yielding ”Inflation Buster” shares, added to the median of combination one-year goal costs from analysts (as reported by YCharts), generated the next outcomes. Observe: one-year goal costs by lone analysts weren’t included. Ten possible profit-generating trades projected to February, 2024 had been:

British American Tobacco was projected to internet $456.17 based mostly on dividends, plus the median of goal estimates from 3 brokers, much less transaction charges. The Beta quantity confirmed this estimate topic to threat/volatility 41% lower than the market as an entire.

CVS Well being Corp. (CVS) was projected to internet $339.72 based mostly on the median of goal value estimates from 22 analysts, plus annual dividend, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 33% lower than the market as an entire.

Hasbro Inc. (HAS) was projected to internet $300.30, based mostly on dividends, plus the median of goal value estimates from 13 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 30% lower than the market as an entire.

ConocoPhillips (COP) was projected to internet $259.09, based mostly on dividends, plus the median of goal value estimates from 26 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 28% over the market as an entire.

Pfizer Inc. (PFE) was projected to internet $221.68, based mostly on dividends, plus the median of goal value estimates from 22 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 37% lower than the market as an entire.

American Tower Corp. (AMT) was projected to internet $199.94, based mostly on the median of estimates from 18 analysts, plus dividends, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 45% lower than the market as an entire.

Arbor Realty Belief Inc was projected to internet $198.91, based mostly on the median of goal value estimates from 5 analysts, plus dividends, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 95% better than the market as an entire.

The AES Corp. (AES) was projected to internet $179.40, based mostly on the median of goal estimates from 12 analysts, plus dividends, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 7% lower than the market as an entire.

AstraZeneca PLC (AZN) was projected to internet $159.20, based mostly on dividends, plus the median of goal value estimates from 8 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 49% beneath the market as an entire.

Mondelez Worldwide Inc. (MDLZ) was projected to internet $144.64, based mostly on dividends, plus median goal value estimates from 24 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 35% beneath the market as an entire.

The common internet achieve in dividend and value was estimated at 24.59% on $10k invested as $1k in every of those ten shares. These achieve estimates had been topic to common threat/volatility 15% beneath the market as an entire.

Supply: Open supply canine artwork from dividenddogcatcher.com

The Dividend Canine Rule

Shares earned the “canine” moniker by exhibiting three traits: (1) paying dependable, repeating dividends, (2) their costs fell to the place (3) yield (dividend/value) grew increased than their friends. Thus, the very best yielding shares in any assortment turned often known as “canines.” Extra exactly, these are, in truth, finest known as, “underdogs.”

48 Inflation Busters For 2023-24 Per February Analyst Goal Knowledge

Supply: YCharts.com

48 Inflation Busters 2023-24 Dividends By February Yields

Supply: YCharts.com

Actionable Conclusions (11-20): Ten High Inflation Busters By Yield For 2023-24

High ten 2023-24 “Inflation Busting” shares by yield in February represented six of 11 Morningstar sectors. First place went to the primary of three actual property sector representatives, Arbor Realty Belief Inc [1]. The others positioned eighth, and tenth, VICI Properties Inc. [8], and Further Area Storage Inc. (EXR) [10].

Positions two, and 5 had been claimed by monetary companies sector members: Ares Capital Corp. [2]; AllianceBernstein Holding LP [5].

Third place was claimed by the one fundamental supplies rep within the high ten, BHP Group Ltd. [3].

Two client defensive shares took the fourth and sixth slots on this listing, British America Tobacco PLC [4], and Philip Morris Worldwide Inc (PM) [6].

Then. a lone client cyclical member positioned seventh, Hasbro Inc [7]. Lastly, a lone healthcare member positioned ninth, Pfizer Inc. [9], to finish the highest ten “Inflation Busters” for 2023-24 dividend pack as of February 16.

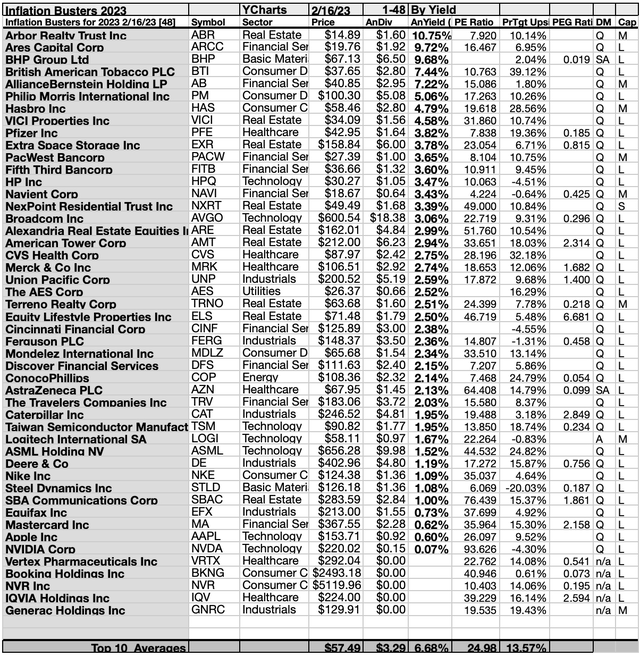

Actionable Conclusions: (21-30) Ten High “Inflation-Buster” Dividend Payers For 2023-24 Confirmed 12.10%-39.18% Upsides Whereas (31) 4 Down-siders Tumbled In February

Supply: YCharts.com

To quantify high canine rankings, analyst median value goal estimates supplied a “market sentiment” gauge of upside potential. Added to the easy high-yield metrics, median analyst goal value estimates turned one other software to dig out bargains.

Analysts Forecast An 8.8% Benefit For five Highest Yield, Lowest Priced, of 10 Inflation-Busting Shares for February 2023-24

Ten high UBS, Kiplinger, and Barron’s dividend picks, aimed toward discovering the “Inflation Busters” for 2023-24 had been culled by yield for this replace. Yield (dividend / value) outcomes supplied by YCharts did the rating.

Supply: YCharts.com

As famous above, high ten UBS, Kiplinger, and Barron’s dividend picks, aimed toward discovering one of the best Inflation Buster shares, as screened 2/16/23, displaying the very best dividend yields, represented six of 11 within the Morningstar sector scheme.

Actionable Conclusions: Analysts Predicted 5 Lowest-Priced Of The High Ten Highest-Yield Inflation-Buster Dividend Shares for 2023-24 (32) Delivering 20.7% Vs. (33) 19.02% Internet Positive factors by All Ten Come February 2024

Supply: YCharts.com

$5000 invested as $1k in every of the 5 lowest-priced shares within the high ten UBS, Kiplinger, and Barron’s dividend picks, aimed toward discovering the “Inflation Busters” for 2022-23 by yield, had been predicted, by analyst 1-year targets, to ship 28.71% extra achieve than $5,000 invested as $.5k in all ten. The fourth lowest-priced choice, British American Tobacco PLC, was projected to ship one of the best internet achieve of 45.62%.

Supply: YCharts.com

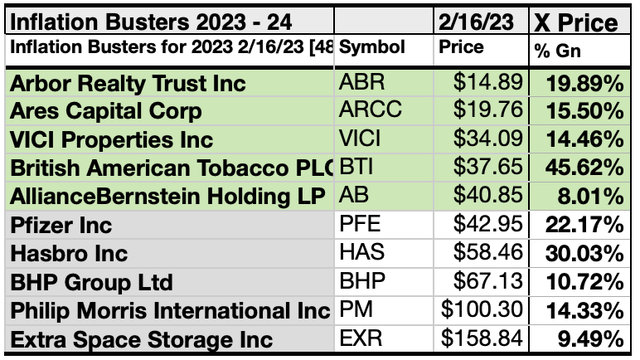

The 5 lowest-priced top-yield UBS, Kiplinger, and Barron’s dividend picks, aimed toward discovering the “Inflation Busters” as of February 16 had been: Arbor Realty Belief Inc; Ares Capital Corp; VICI Properties Inc; British American Tobacco PLC; AllianceBernstein Holding LP, with costs starting from $14.89 to $40.85.

5 higher-priced UBS, Kiplinger, and Barron’s dividend picks, aimed toward discovering “Inflation Busters” as of December 12 had been: Pfizer Inc; Hasbro Inc; BHP Group Ltd; Phillip Morris Worldwide Inc; Further Area Storage Inc, whose costs ranged from $42.95 to $158.84.

The excellence between 5 low-priced dividend canines and the final subject of ten mirrored Michael B. O’Higgins’ “fundamental technique” for beating the Dow. The size of projected beneficial properties based mostly on analyst targets added a singular factor of “market sentiment” gauging upside potential. It supplied a here-and-now equal of ready a 12 months to seek out out what may occur out there. Warning is suggested, since analysts are traditionally solely 20% to 85% correct on the route of change and simply 0% to fifteen% correct on the diploma of change.

The online achieve/loss estimates above didn’t consider any overseas or home tax issues ensuing from distributions. Seek the advice of your tax advisor relating to the supply and penalties of “dividends” from any funding.

Afterword

This text options 48 UBS, Kiplinger, and Barron’s “Inflation Buster“ picks for 2022-23. The article focuses on the highest 30, or so, dividend payers. Thus, almost one-third of the unique listing of firms is uncared for. Due to this fact, under is the entire listing of 48 shares grouped by supply.

Sources: Kiplinger.com, Barrons.com, YCharts.com

If someway you missed the suggestion of which shares are ripe for selecting initially of this text, here’s a reprise of the listing on the finish:

The costs of 9 of those 48 Kiplinger, and Barron’s dividend picks, as “Inflation Buster,” shares for 2023-24 made the potential of proudly owning productive dividend shares from this assortment extra viable for first-time buyers.

These 10 Dogcatcher best “inflation Busting” dividend shares for February are:

Supply: YCharts.com

These 9 all dwell as much as the perfect of getting their annual dividends from a $1K funding exceed their single share costs. Many buyers see this situation as “look nearer to perhaps purchase” alternative.

Which of the 9 are ‘safer’ dividend canines? To seek out the reply discover my ‘Safer’ December Dividend Dogcatcher follow-up detailing these Kiplinger, and Barron’s Inflation Busting, shares for 2023 within the Looking for Alpha Market showing on or about February 26. Merely click on on the hyperlink in final Abstract bullet level on the high of this text.

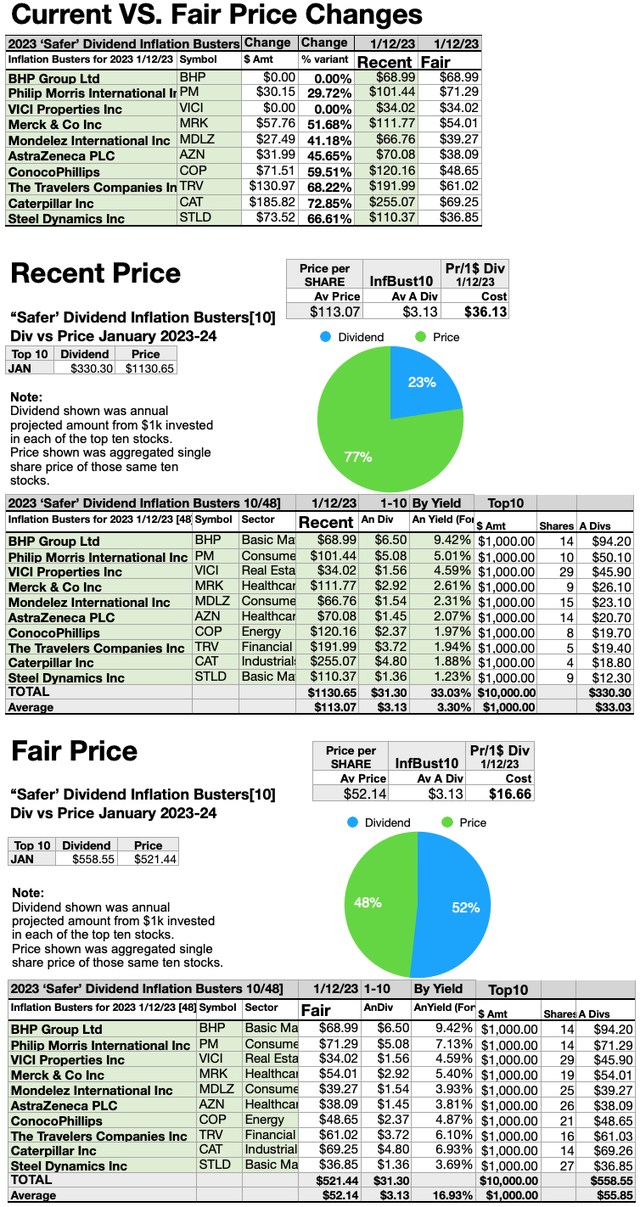

How All Ten High “Inflation Buster” 2023-24 Shares May Change into Perfect Truthful Priced Canine

Supply: YCharts.com

Since six of the highest ten Kiplinger, and Barron’s “Inflation Buster”, shares for 2023 shares at the moment are priced lower than the annual dividends paid out from a $1K funding, the above charts evaluate these six plus 4 at current costs.

The greenback and share variations between current and honest costs are detailed within the high chart. The current costs are proven within the center chart with the honest pricing of all ten high canines conforming to the dogcatcher best are detailed within the backside chart.

With renewed draw back market stress to 51.22%, it’s potential for all ten highest-yield UBS, Kiplinger & Barron’s Inflation-Busting Dividend shares to grow to be honest priced with their annual yield (from $1K invested) assembly or exceeding their single share costs. This pack acquired a pleasant head-start with six of ten already pretty priced.

Shares listed above had been recommended solely as potential reference factors in your buy or sale analysis course of. These weren’t suggestions.

ThomasVogel