Jack Taylor/Getty Photos Information

Firm Overview

Marks and Spencer Group plc (OTCQX:MAKSF) (OTCQX:MAKSY) (“M&S”) is a number one British retailer bringing high quality, nice worth meals, clothes and homeware to hundreds of thousands of consumers all over the world.

- M&S was based in 1884 by Michael Marks and Thomas Spencer in Leeds. For now, M&S is headquartered in London, England.

- It focuses on a large spectrum of attire, house, furnishings, magnificence, meals, home goods and way more.

- M&S has a main itemizing on the London Inventory Change and is a constituent of the FTSE 250 Index.

- M&S consists of JV with Ocado and three main enterprise items that are introduced under.

Exhibit 1: Enterprise items.

Enterprise items. (Incomes report)

The income construction appears to us to be secure with the vast majority of future CF coming from Meals. Clothes & Dwelling (C&H), in flip, retains producing secure gross sales. The worldwide division supplies extra diversification of dangers.

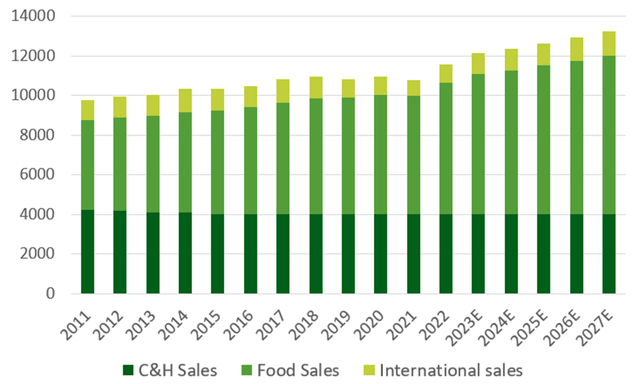

Exhibit 2: Income construction.

Income construction (GS estimates)

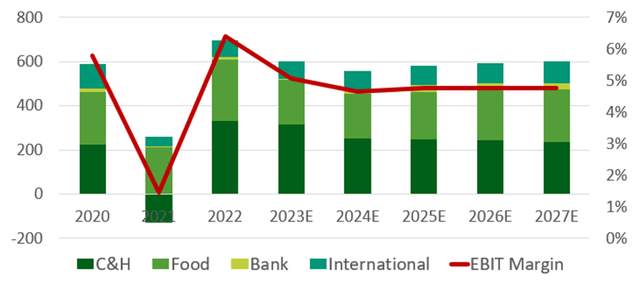

Now, as for EBIT, the state of affairs is totally completely different. C&H accounts for 52.5% of M&S’s EBIT. This share is predicted to additional lower with the projected improve in Meals and Worldwide contributions.

Exhibit 3: EBIT construction

EBIT construction (GS estimates)

Financials

Marks and Spencer has sturdy secure financials with constant income era and constructive FCF era. Efficiency in FY 2022 was sturdy as a result of each post-pandemic restoration and progress on its longstanding restructuring initiatives centered on value optimization, retailer property administration and digital functionality enhancement.

Moreover, M&S is on the way in which to gradual deleveraging. From 2019 FY whole debt was lowered by £627 mln or 15%.

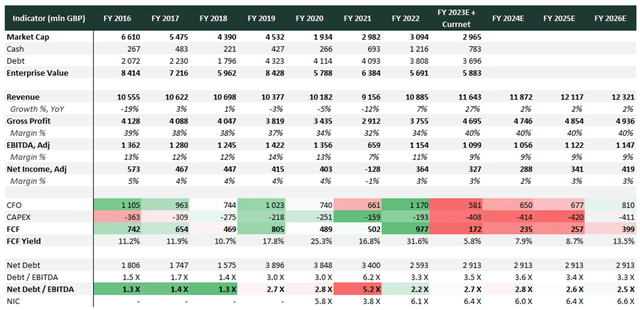

Exhibit 5: Firm historic financials and the consensus estimate

Firm historic financials and the consensus estimate (Bloomberg, Analyst analysis)

At present, M&S has an affordable leverage, lowering Web Debt / EBITDA to 2.7 X from 5.2 X within the pandemic yr. Sure, for the retail enterprise, it may be known as important, however it’s levelled by properties and high quality. Additionally, the extent of curiosity protection ratio doesn’t increase any questions.

M&S repurchased £150 mln of its medium-term notes in 1H22, lowering refinancing threat additional. The following main maturities are in 2025 – 2026 with whole quantity of £650 mln, that are absolutely coated by C&CE (£773 mln) and undrawn £850m Revolver credit score facility till June 2025.

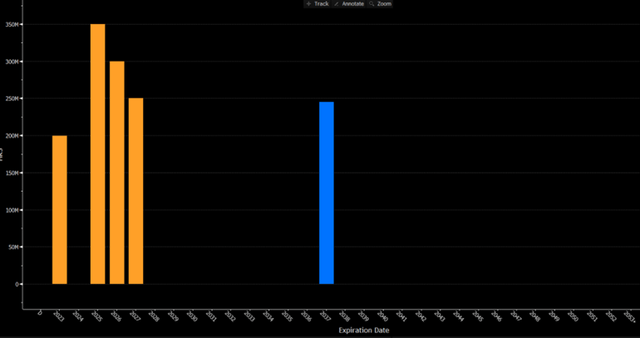

Exhibit 6: Debt distribution

Debt distribution (Bloomberg)

One other factor that we have now to say is that leases are the primary a part of the entire debt, contributing round 62%. Group web debt elevated by £229.9 mln since 1H 2023 pushed by web improve in lease liabilities, relating to 5 new UK leases, and the consolidation of Gist lease liabilities.

Talking about capital allocation technique, M&S has demonstrated good monetary self-discipline by suspending dividends throughout the pandemic and regardless of sturdy 2022 FY efficiency. Administration values sturdy liquidity in these unsure macroeconomic occasions. However we anticipate that potential renewed dividend funds and a giant CAPEX program are going to eat a tangible a part of CFO.

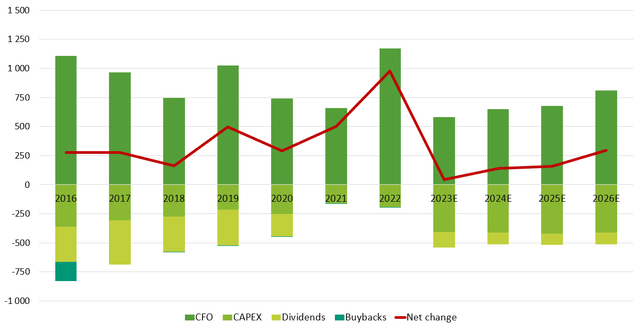

Exhibit 7: CF distribution

CF distribution (GS estimates)

Nonetheless, CEO stated on the final name that the precedence for M&S now’s enterprise enchancment and development. However sooner or later, M&S wants to begin capital returns to shareholders.

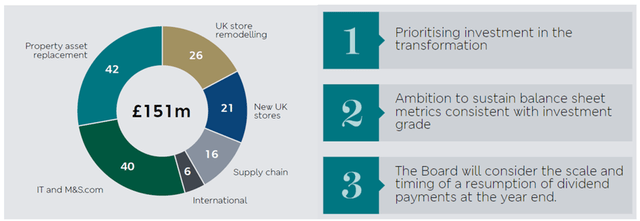

Exhibit 8: CAPEX construction

CAPEX construction (Earnings presentation)

Then again, Marks and Spencer expects to spend £400 mln in CAPEX in 2023, considerably increased than the roughly £200 mln in previous years. Excessive future CAPEX expectations are mirrored within the investments in new retailer codecs/retailer rotation program and enchancment of omnichannel capabilities.

Property made up accounts for over half of the CAPEX, important upkeep and asset substitute spending continued. Apart from, M&S proceed to develop new channels to speak with prospects, growing spending on software and IT growth. In different phrases, M&S reshapes for development, prioritizing funding within the transformation.

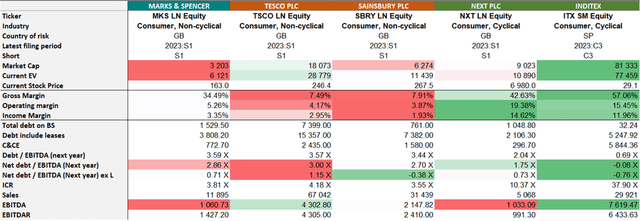

Apart from, M&S has a better NI margin evaluating with retail friends like Tesco and Sainsbury’s as a result of C&H enterprise. This permits M&S to develop its quick supply enterprise in JV with Ocado.

The extent and construction of debt will be known as comparable with rivals.

Exhibit 9: Peer’s evaluation

Peer’s evaluation (Bloomberg)

Moreover, CFO on the final earnings name confirmed that they’re satisfied to scale back leverage which signifies the corporate’s willpower to additional cut back the debt burden.

Sturdy market place

M&S advantages from being the second-largest UK clothes retailer, with a simplified product vary and a bigger full-price gross sales combine.

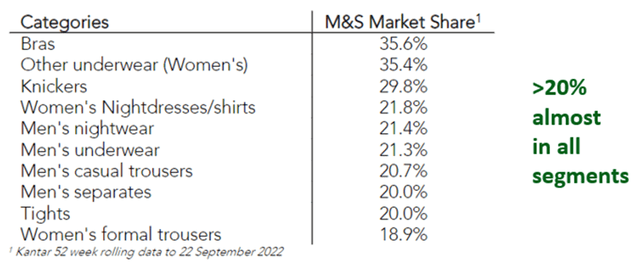

M&S’s share of the UK clothes market reached its highest degree in virtually 8 years and its meals division elevated its market share as a result of a powerful Christmas buying and selling interval. C&H has market share positions of greater than 15% in classes that are much less acutely uncovered to discretionary spending, similar to underwear and college uniforms.

Exhibit 10: Market share by classes

Market share by classes (Presentation for buyers)

Actual Property property & Shops

One other factor that makes you consider is a convincing portfolio of various actual property. U.S. personal fairness agency Apollo World Administration is contemplating a takeover bid for retailer Marks and Spencer due to important actual property property. The latter could possibly be price round £2 bln, which probably covers a tangible a part of whole debt.

Then again, Marks and Spencer has been making property enchancment to revive its fortunes. M&S is about to open 104 meals outlets and shut sixty-seven full-line outfitters within the subsequent 3 years. Total, it plans to scale back the variety of full shops providing meals, clothes and residential gross sales from 247 to 180 by 2026 and improve its Merely Meals retailers by 104 to 420.

That is the place a lot of the CFO might be distributed. And thus, it additionally raised questions concerning whether or not the implementation of this technique might be profitable or not.

M&S’s sturdy worth model notion

Marks and Spencer high for buyer loyalty and satisfaction. The corporate advantages from sturdy model recognition in meals and a well-established market place in clothes.

Marks and Spencer has gained a ballot to determine to which clothes model or retailer UK consumers are most loyal.

Aside from this, M&S has been ranked because the UK’s finest model primarily based on general model well being, impression, high quality, worth, satisfaction, and repute.

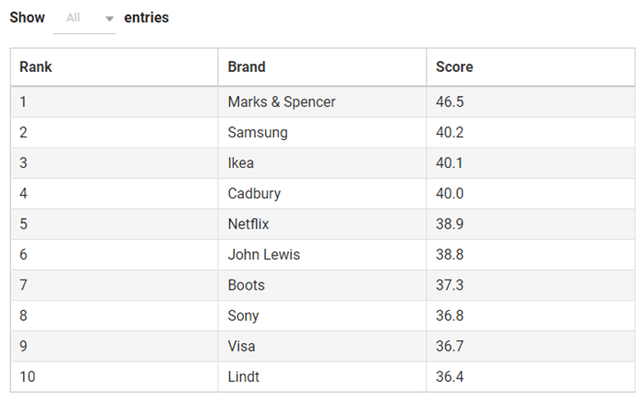

Exhibit 11: The UK’s high manufacturers

The UK’s high manufacturers (Retail gazette)

Sturdy business experience with large challenges forward

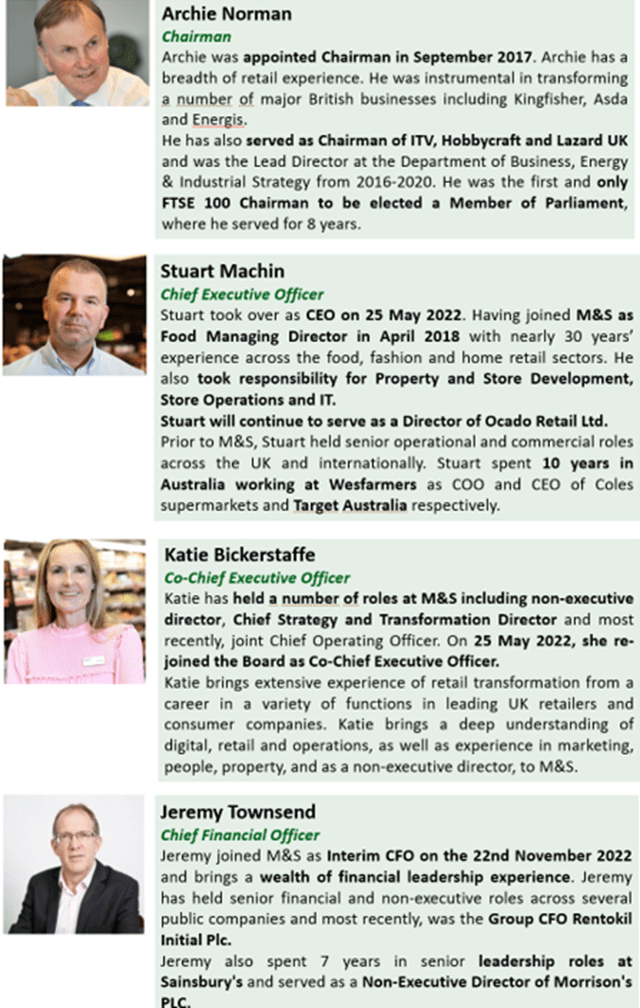

As well as, it ought to be famous that M&S’s new CEO created an all new workforce within the 1Q of 2022, which brings just a little uncertainty. Nonetheless, administration consists of pros who’ve been in enterprise for greater than a decade with broad expertise in different business giants similar to Goal.

Exhibit 12: Administration workforce

Administration workforce (Annual report)

Bonds choice

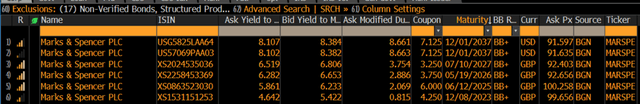

M&S’ BB-rated USD bonds provide a substantial upside to BBB retailers like Subsequent and Tesco, whose spreads mirror increased rankings. Regardless of 10Y UST rally in current months, the choice to lock in yields now nonetheless exists.

Exhibit 13: Bond points

Bond’s points (Bloomberg)

As we write earlier than, it is overly difficult to search out the underside of the bond market on this quickly altering financial setting. Thus, it’s vitally essential to begin forming bonds portfolio with prolonged durations. This M&S’s bond difficulty definitely belongs to the latter.

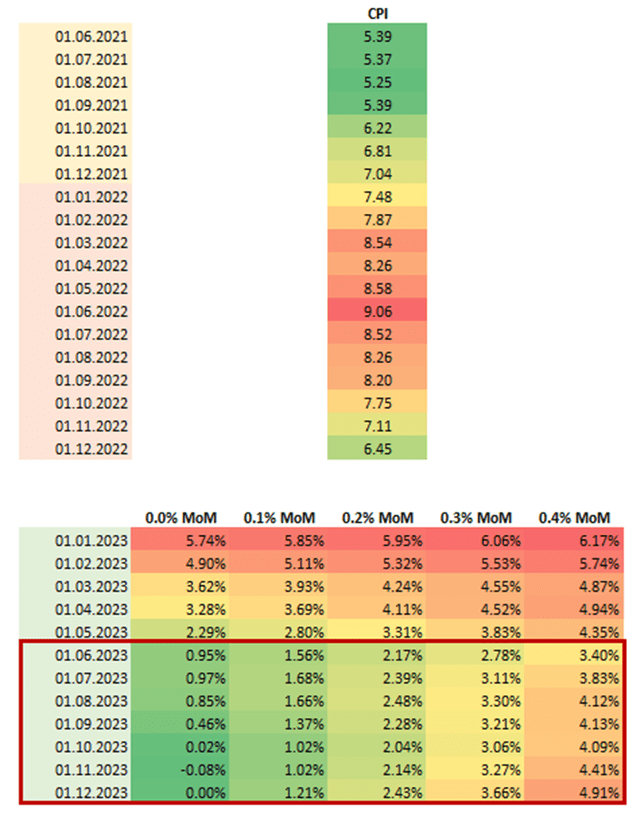

Furthermore, plainly we have now already handed the height of inflation in US. CPI has already decreased by 3% from the utmost.

Under are a possible 5 paths for US CPI primarily based on mounted MoM adjustments.

Exhibit 14: Attainable CPI dynamics

Attainable CPI dynamics (Analyst analysis)

It could possibly be talked about that US CPI YoY might be under the projected Fed inflation goal as early as June 2023 and actual yield will grow to be constructive in March. The primary decline in CPI might be within the subsequent two months as a result of in February and March final yr, inflation was greater than 2%.

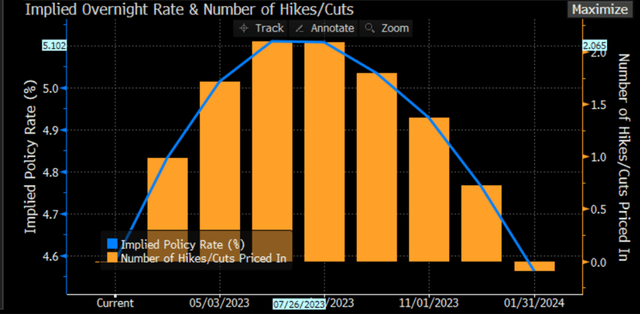

Exhibit 15: Implied in a single day Charge & variety of Hikes

Implied in a single day Charge & variety of Hikes (Bloomberg)

As well as, the swap market costs the beginning of charge cuts as early as July this yr. Due to this fact, it’s price taking note of bonds with an extended length.

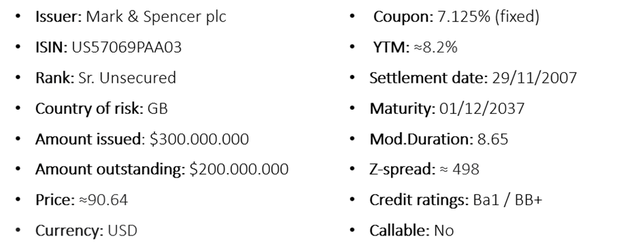

Exhibit 15: Bond description

Bond description (Bloomberg)

Investor takeaways

In our view, M&S stays the most suitable choice to purchase within the bond universe within the retail phase to lock excessive charges on scrunching inflation expectations. We’re overweighting M&S’s bond difficulty with 9-years length as a result of excessive publicity to curiosity change.

Key dangers

- Client weak spot and inflationary pressures are being confronted throughout the business.

- Restart of dividend funds

- Execution dangers associated to implementing a excessive diploma of change within the enterprise and new administration workforce

- Multi-year pre-pandemic development of weak underlying gross sales and declining profitability, however the firm is on the lookout for new development factors

- Weak shopper confidence

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.