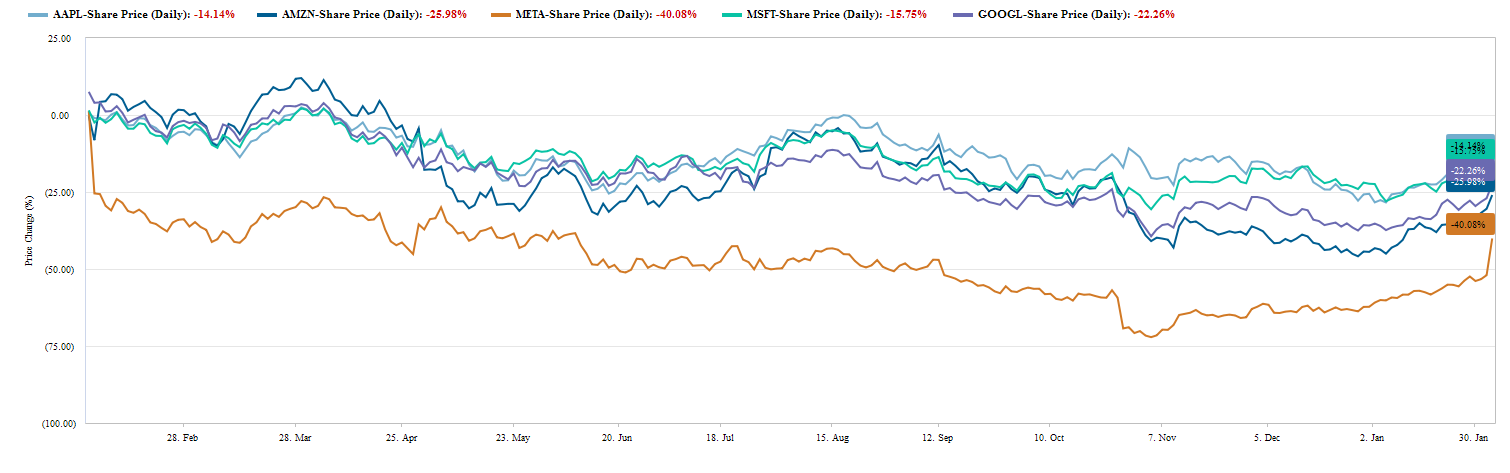

The pandemic revealed a really distinctive dynamic: tech-centric corporations captured important good points out there whereas different kinds of corporations needed to react to the draw back of drastic shifts in shopper conduct. Valuations throughout the tech trade ballooned by way of the pandemic as tech corporations’ income power outstripped the larger market. At one level, Apple, Amazon, Meta, Google, and Microsoft every topped one trillion {dollars} in market capitalization.

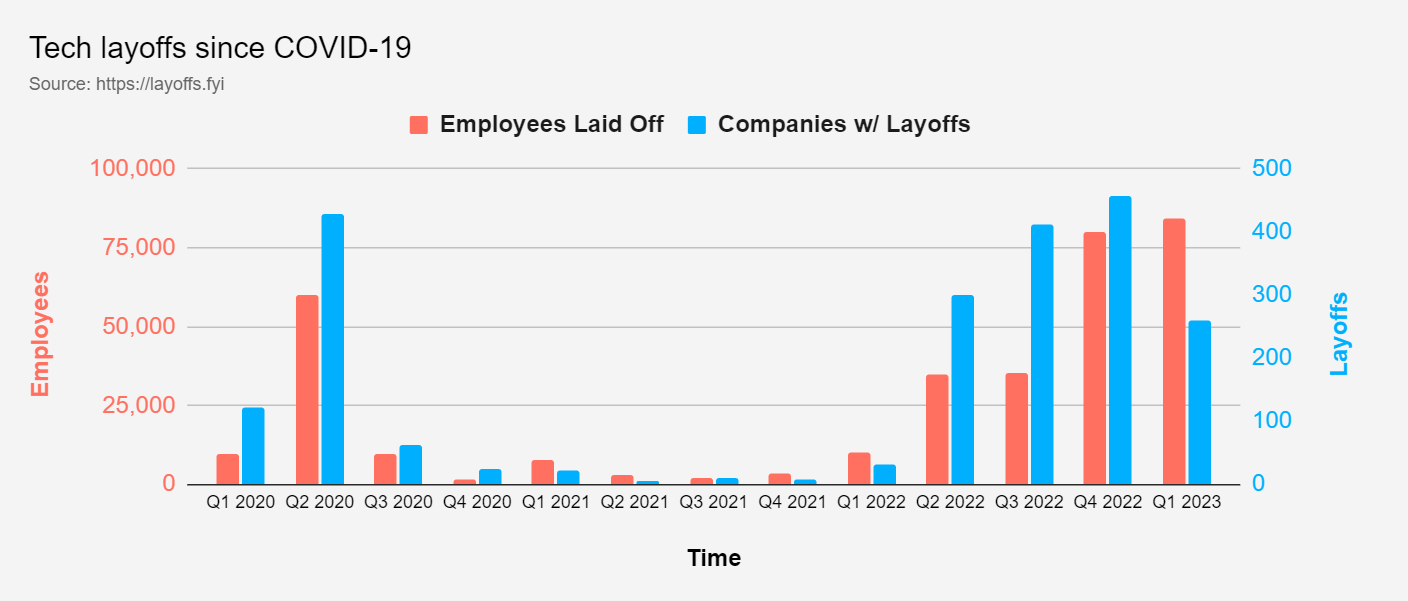

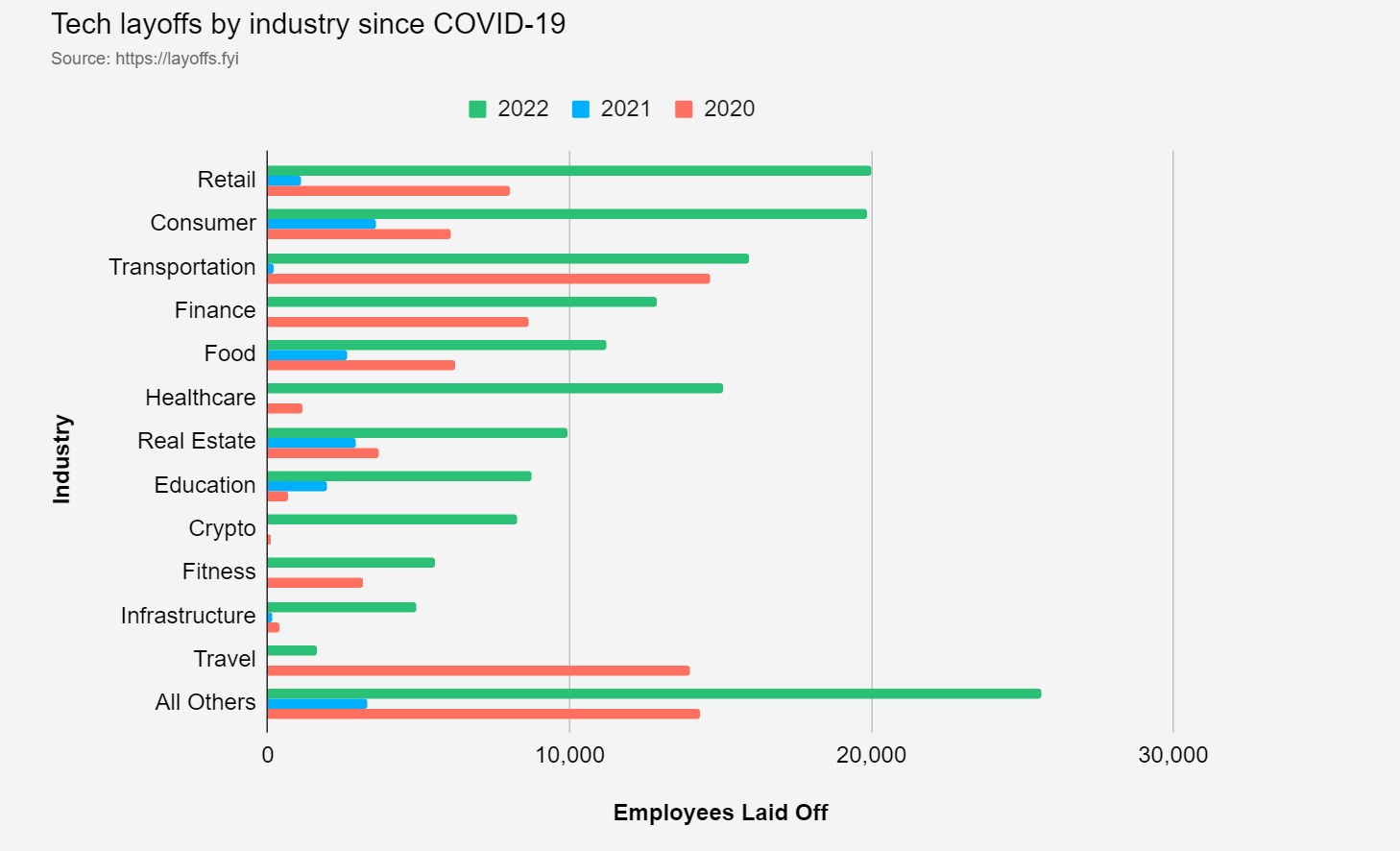

Oh, how the mighty have fallen. As we speak these corporations are 10%–50% under their peak valuations. These market corrections are resulting in adjustments in employment. For example, Amazon is pulling again on the a million hires they’ve made prior to now three years; equally, Paypal simply introduced round a 7% discount of their workforce attributable to margin pressures. For Large Tech, the layoffs are a results of elevated trade maturity: corporations that when targeted single-mindedly on progress (even by way of the monetary disaster) now should search profitability for the primary time attributable to shareholder pressures.

Margins are the main indicator for Large Tech, not earnings, as evidenced by the higher-profile layoffs over the past 12 months. For Large Tech, the surplus constructed by way of the pandemic was protected by excessive valuations. Now that the market is extra precisely pricing danger amid the downturn and Large Tech is being priced like different industries, they need to reply like their extra conventional friends. For example, Salesforce hit file earnings, however they introduced layoffs as their inventory value continued to fall.

Extra importantly, these layoffs seem like a number one indicator for different industries. Quantitative tightening has begun to reveal short-term margins within the monetary sector. Because of this, corporations like Goldman Sachs and Capital One have began making labor adjustments. As Fed-driven demand destruction picks up tempo, weaker earnings will start to spill over into extra sectors, precipitating extra cutbacks. Extra layoffs are seemingly, however we should always know by summer time if the market can have a gentle touchdown.

For tech leaders, don’t be too aggressive with short-term cuts that inevitably will pressure you to play catch-up in the long term. As a substitute, be aggressive with repositioning your workforce to develop core enterprise progress and strengthen the sturdiness of your benefit out there.

This analysis falls below Forrester’s tech insights and econometric analysis (TIER).