Welcome to Startups Weekly, a nuanced tackle this week’s startup information and traits by Senior Reporter and Fairness co-host Natasha Mascarenhas. To get this in your inbox, subscribe right here.

Towards the top of 2022, various entrepreneurs, some citing Elon Musk, instructed me that they’re bringing again an in-person work tradition within the following yr to assist promote productiveness and, in some circumstances, loyalty. One founder even instructed me over drinks and fancy snacks that they weren’t nervous about dropping expertise — as a result of those that go away simply because there’s an in-person mandate weren’t actually mission-driven to start with.

Whereas some founders are clearly set on a return, others are confused. There’s the argument — typically coming from enterprise capitalists determined to see portfolio firms succeed — that being in-person will assist develop productiveness, and ultimately the underside line. And there’s additionally the counterargument that distant work permits for extra inclusive and expansive hiring, which may additionally assist, properly, the underside line.

And if 2023 isn’t the yr of the underside line, I don’t know what else it could possibly be. Kruze Consulting, an accounting agency for startups, mined by way of over 750 firms’ funds, which incorporates upward of $300 million in quarterly income and over $750 million in quarterly spend. I spoke to Healy Jones, who runs monetary planning and evaluation for Kruze Consulting, about his findings — and the outcomes, he thinks, provide some steadiness to the talk.

To learn extra about his findings, learn my TC+ column “Knowledge hints on the worth of startup places of work.” In the remainder of this text, we’ll speak about noisy enterprise corporations, Salesforce spinouts and Artifact. As at all times, you’ll be able to observe me on Twitter or Instagram.

The wrinkle

On paper, enterprise funding seems to be again. The flurry of recent funds provides me and, extra importantly, founders the vibe that VCs are again in enterprise and able to write heaps and plenty of checks. However one may argue that new VC fund announcement dates, very similar to the phrase “oversubscribed,” don’t imply a lot in observe.

Right here’s why that is vital: There are lots of the explanation why all of the dry powder isn’t as jumpy as we might hope. Whereas new fund bulletins are definitely thrilling, the fund might already be partially invested by way of and buyers have to make capital calls earlier than writing these checks. The sign to observe is much less round new cash getting into the enterprise area and extra round, Why is that this VC agency saying their fund now, versus earlier than, versus later? What’s the argument to point out that you just’re taking part in offense proper now? I think about it’s extra sophisticated than “enterprise as traditional.”

Picture Credit: Getty Pictures/dane_mark/DigitalVision

Salesforce, salesfund

Firsthand Alliance, led by solo investor Simon Chan, is a enterprise agency looking for to capitalize on Salesforce. Right here’s how: The agency, which closed a $25 million debut funding car, landed investments from 21 Salesforce-acquired founders, whereas Chan himself constructed the corporate that he says is the muse of Einstein, the AI initiative throughout all of Salesforce companies.

With the backing of alumni and advisors, the agency hopes it will probably assist early-stage enterprise startups land additional assist and, after all, recent capital.

Right here’s why it’s vital: Mafia funds might be unique, each through which LPs are invited to the desk and which firms land funding. In a press release to TechCrunch, Chan mentioned that the agency’s funding scope is “manner past the Salesforce app ecosystem” and that founders don’t have to be Salesforce alumni to be thought of. Proper now, 35% of Firsthand Alliance’s portfolio is based or co-founded by females, and 50% of the portfolio is co-founded or based by folks of coloration.

Spectacular. And, properly, apparently timed contemplating each the layoffs and the tensions seeping out from the mothership as we converse. Perhaps now could be the time to capitalize on adjustments occurring on the outdated stomping grounds?

Picture Credit: Bryce Durbin/TechCrunch

The follow-up

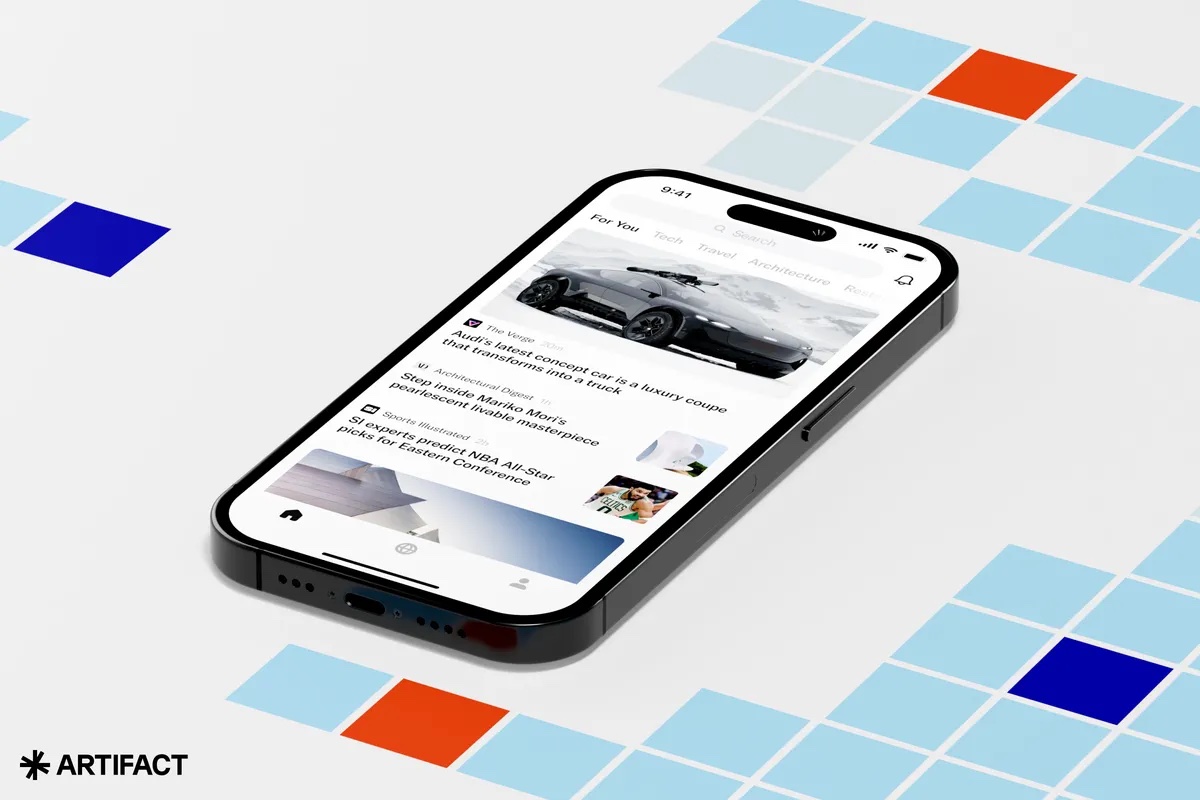

There’s nothing like a superb comeback story to observe up on, am I proper? Instagram’s co-founders are again with a brand new social app, trying to make information consumption simpler and smarter. The startup, Artifact, is accepting folks on its waitlist as we converse.

Right here’s why it’s vital: Artifact is eyeing a controversial enterprise as a result of it has to do with information consumption, management, algorithms and, no offense, simply persuaded customers. For those who’re elevating your eyebrows in any respect the potential points that will come up from this firm, you’re not alone. We speak in regards to the information and why we’re hopeful anyway on Fairness.

Picture Credit: Artifact screenshot by way of The Verge (opens in a brand new window)

And so on., and so forth.

Seen on TechCrunch

Automotive-sharing SPAC Getaround lays off 10% of employees

Automotive-sharing platform Getaround will get delisting warning from NYSE

There are nonetheless robotics jobs to be discovered (if you realize the place to look)

Apple inventory drops on uncommon earnings miss

Coinbase’s asset restoration instrument simply saved my bacon

Seen on TechCrunch+

Pitch Deck Teardown: Laoshi’s $570K angel deck

Pricey Sophie: What H-1B and different immigration adjustments can we count on this yr?

Which open supply startups rocketed in 2022?

What do current adjustments to state taxes imply for US SaaS startups?

Why put money into Ukrainian startups right now?

This was a type of weeks that was full of energizing conversations with entrepreneurs, each seasoned and recent, who remind me what an bold world tech is. Even with the hurdles dealing with techies from fairly presumably each angle, it’s rejuvenating to see how the hope of an concept can push farther than actuality.

On that earnest observe, at all times,

N