onurdongel

Funding thesis

Provided that there are fairly a couple of articles that already gave background info and thesis on Symbotic (NASDAQ:SYM), which I largely agree with, I’m specializing in what occurred in 1FQ23 earnings and my ideas on SYM transferring ahead.

For 1Q23, I assumed the report was constructive, with outcomes barely above expectations and Q2 forecasts falling in step with expectations. Its non-GAAP EBITDA of ($16.3) million and income of $206 million for the 1FQ23 had been each greater than the $194 million and ($22.6) million anticipated by consensus. As well as, administration guided income between $205 and $230 million and adjusted EBITDA between ($13) and ($17) million for 2QFY23, whereas consensus estimates had been for $220 million in income and ($16) million in EBITDA.

Income for 1QFY23 was up 168% 12 months over 12 months, and the corporate’s backlog elevated to round $12 billion, each of which give me motive to be optimistic in regards to the firm’s future top-line progress. I feel these numbers are consultant of the long-term progress potential for warehouse automation because of the efficiencies it might carry to prospects.

1FQ23 earnings overview

Income of $206 million was reported by SYM for the 1FQ23, which was down 16% sequentially and up 168% 12 months over 12 months however was nonetheless above the excessive finish of steering of $170 million to $200 million and 6% above consensus estimate of $194 million. Administration additionally reported a rise within the backlog to $12 billion attributable to rising demand for his or her options and the launch of six new system deployments.

Segments particularly, SYM reported:

- Programs income of $197.9 million, which was a sequential decline of 17% however a rise of 178% in comparison with final 12 months

- Software program Subscriptions income of $1.2 million, which was a sequential enhance of 33% and annual progress of 27%

- Operation Companies income of $7.2 million, which was a sequential enhance of 24% and annual progress of 47%.

Revenue smart, SYM reported non-GAAP EBITDA of ($16.3) million, which was higher than consensus estimates. As for stability sheet, SYM ended the quarter with $448 million in money.

Steering

SYM guided income for 2FQ23 between $205 million and $230 million, which is 1% beneath the consensus at $220 million. SYM additionally guided a variety of ($13 million) to ($17 million) for adjusted EBITDA for 2FQ23.

SYM’s dedication to increasing its community of outsourcing companions is one thing I respect. That is very important as a result of it reduces SYM’s publicity to threat whereas permitting for elevated system supply charges by means of outsourcing. Whereas the speedy enhance in outsourcing could have a adverse short-term influence on gross margins, it’ll have a constructive long-term impact. That agrees with the administration’s feedback in the latest earnings commentaries.

The revenue from software program subscriptions is one thing else I regulate. Provided that the present run price is lower than $10 million, it is sensible that administration would count on recurring income to be modest compared to programs income within the close to to medium time period. My prediction is that the corporate’s recurring income stream will increase over time and ultimately outpace the gross margin of its programs income.

Key catalyst

Elevated manufacturing of key elements and speedy set up of SYM’s programs at prospects may very well be a game-changer for the corporate’s enterprise and inventory efficiency. There are solely a handful of SYM programs which have been totally put in, however the firm has orders to put in a whole lot extra. I count on this quantity to develop quickly over the subsequent few years. If SYM can produce and set up these programs extra rapidly than anticipated, it may have a vastly constructive impact on the corporate’s backside line.

Key long-term secular driver

When wanting on the massive image, I consider the enlargement of on-line purchasing shall be an important issue. It does not take a rocket scientist to determine that as eCommerce continues to increase, the quantity and number of merchandise saved in warehouses will develop in complexity. After we issue within the business’s ongoing labor shortages and rising price of labor, I consider we’ve a compelling case for the necessity to automate warehouse processes, which bodes properly for the way forward for warehouse automation.

SYM’s robust buyer connections, significantly with Walmart (WMT) (which plans to put in their system in its regional distribution facilities), put them in place to benefit from this growth. The corporate additionally has partnerships with a number of different main logistics corporations. In my view, SYM’s connections and backlog put it able to expertise speedy enlargement within the coming years. The collaboration between SYM and Walmart not solely gives a stable foundation for future income progress, but in addition solidifies SYM’s place as a market chief.

Although SYM has had success with purchasers aside from WMT, the heavy backlog and anticipated operational emphasis from WMT might restrict their capacity to increase with different prospects within the brief to medium time period.

Valuation

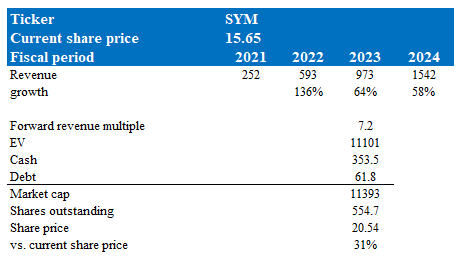

Based mostly on consensus estimates, which I consider is achievable given the robust backlog and progress runway, I consider the upside from right here is round 31%.

Mannequin walkthrough:

- Income is predicted to proceed rising at a excessive tempo as SYM fulfils its backlog, from $593 million in FY22 to $1.5 billion in FY24

- Provided that there aren’t any indicators of progress deceleration and the whole lot (together with FCF and OPEX administration) appears positive, I don’t see any near-term threat to push down the valuation from the place it’s as we speak (7.2x ahead income)

Personal estimates

Threat

Buyer focus

Since WMT accounts for the overwhelming majority of SYM’s backlog, any changes to the speed at which buildouts are continuing may have a significant impact on SYM’s backside line.

Conclusion

I consider that SYM has a promising future due to its revolutionary warehouse automation resolution and since its administration staff has the mandatory abilities to quickly scale the enterprise and switch a revenue.