Gold (XAU/USD) Value Outlook:

- Gold futures retest $1,950 earlier than easing again into slim vary.

- XAU/USD gaps on opening, diving the RSI deeper into overbought territory

- USD stays constricted in anticipation of the FOMC and NFP’s later this week.

Really useful by Tammy Da Costa

Obtain Your Recent Q1 Forecast

Gold Futures Run into Technical Resistance – Opening Hole Helps Larger Costs

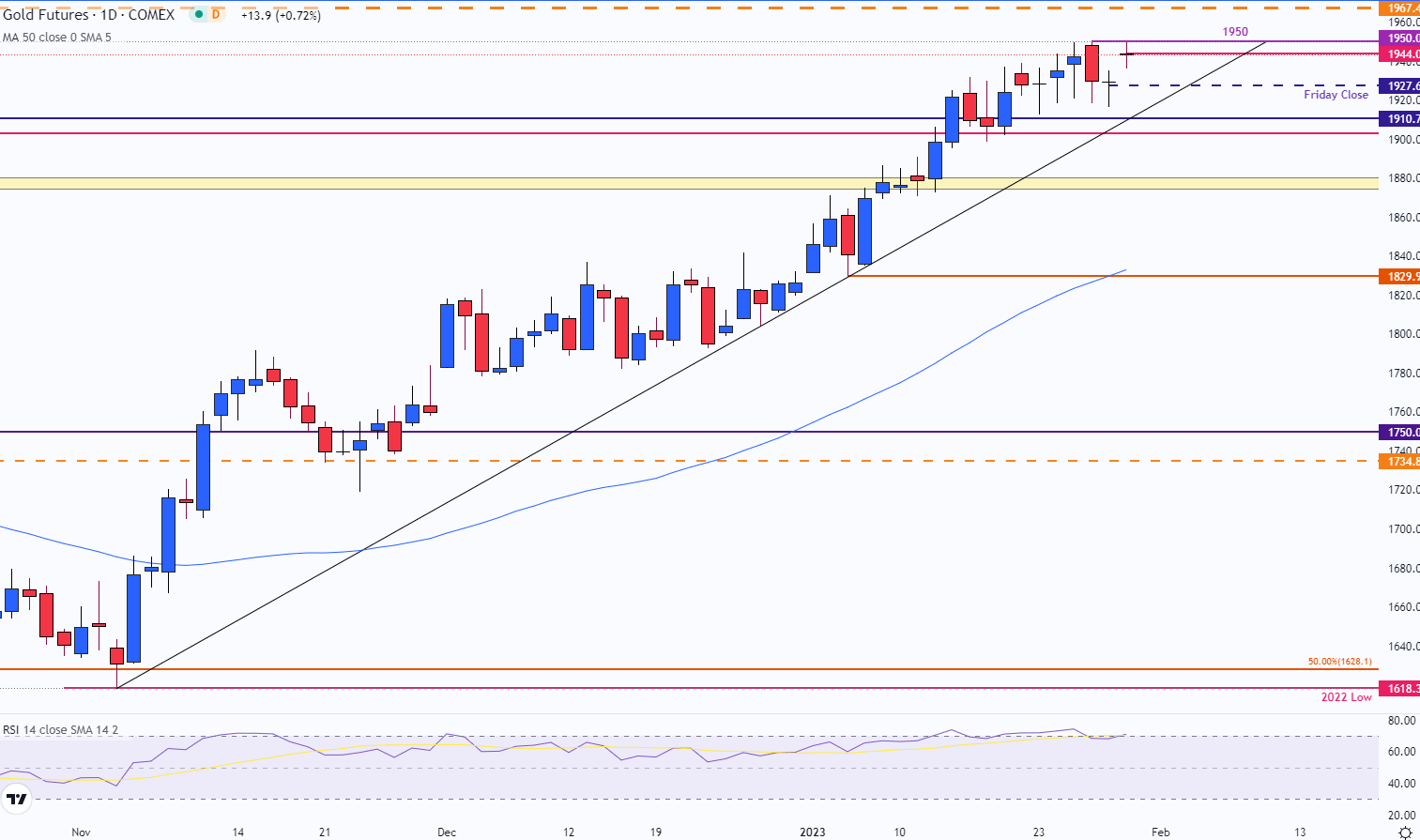

Gold costs are buying and selling over 6% increased for the month of January, driving XAU/USD right into a barrier of resistance at $1,950. All through final week, the identical psychological stage that restricted the upside transfer got here into play after gold opened the session at a stage of $1,944.

This was 0.85% increased than Friday’s shut of $1,927.6. Whereas the discrepancy between the 2 costs resulted in a gap hole, costs pulled again barely earlier than peaking at $1,950.1.

Gold (GC1!) 4-hour Chart

Chart ready by Tammy Da Costa utilizing TradingView

Nevertheless, whereas central banks put together for an additional spherical of price hikes, the every day chart displays highlights the hole that at present stays intact.

Go to the DailyFX Instructional Middle to find how financial coverage impacts Foreign currency trading

Gold (GC1!) Day by day Chart

Chart ready by Tammy Da Costa utilizing TradingView

Really useful by Tammy Da Costa

Futures for Rookies

Gold (XAU/USD) Technical Evaluation

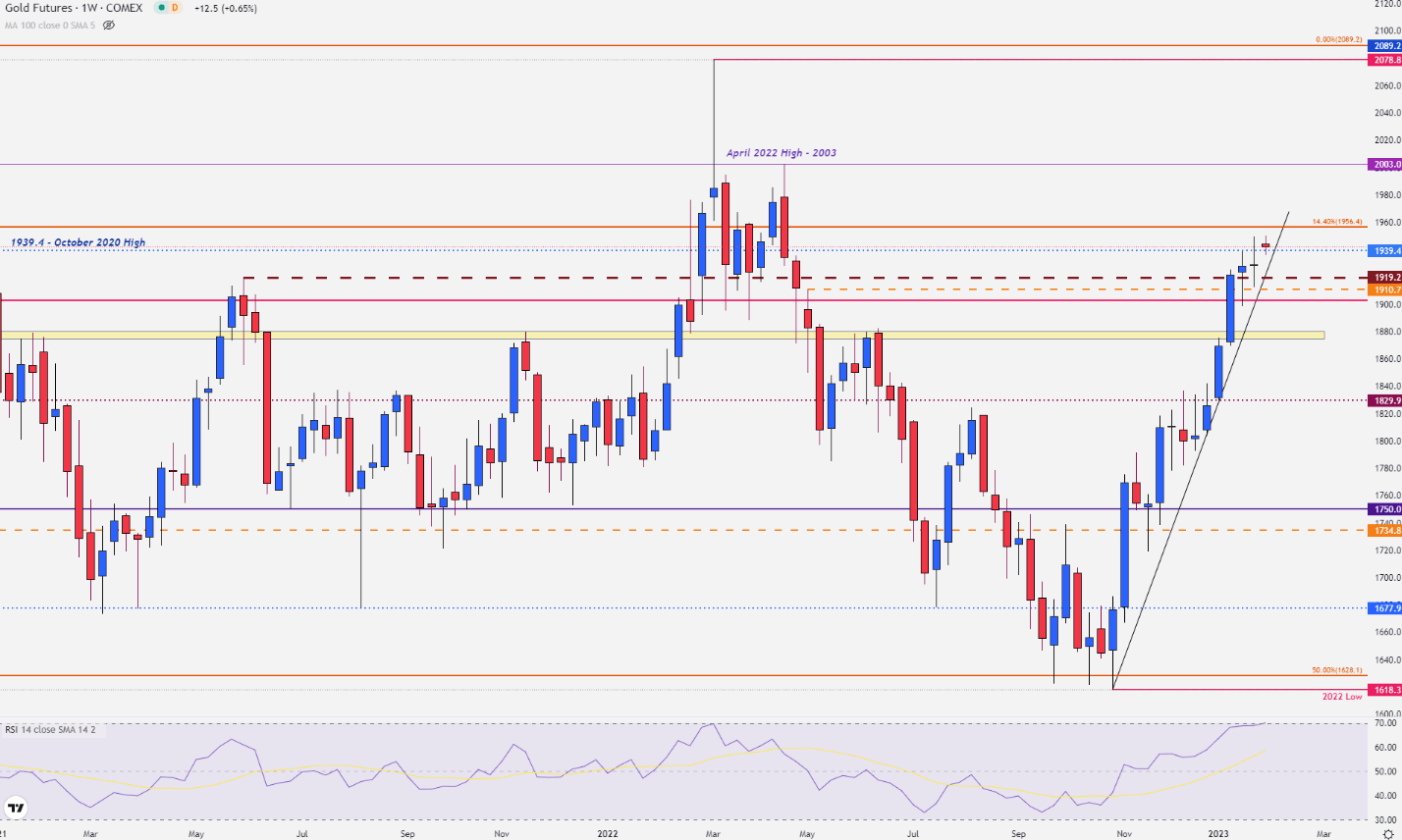

After three consecutive months of good points, a return to April 2022 ranges has pushed the weekly and every day RSI (relative power index) into overbought territory.

Since reaching a low of $1,618 in October final yr, the 20% rally has been supported by decrease price expectations and rising recession dangers. Though the shift in rhetoric and hopes of a slowdown within the tempo of tightening (QT) has helped facilitate the rebound, technical headwinds stay agency.

Gold (GC1!) Weekly Chart

Chart ready by Tammy Da Costa utilizing TradingView

With gold futures at present buying and selling across the October excessive of $1,939.4, value motion briefly stalled, making a doji candle on the weekly chart. Because the RSI continues to threaten the higher sure of the ‘regular vary’, the technical indicator means that bullish momentum could also be reaching an excessive.

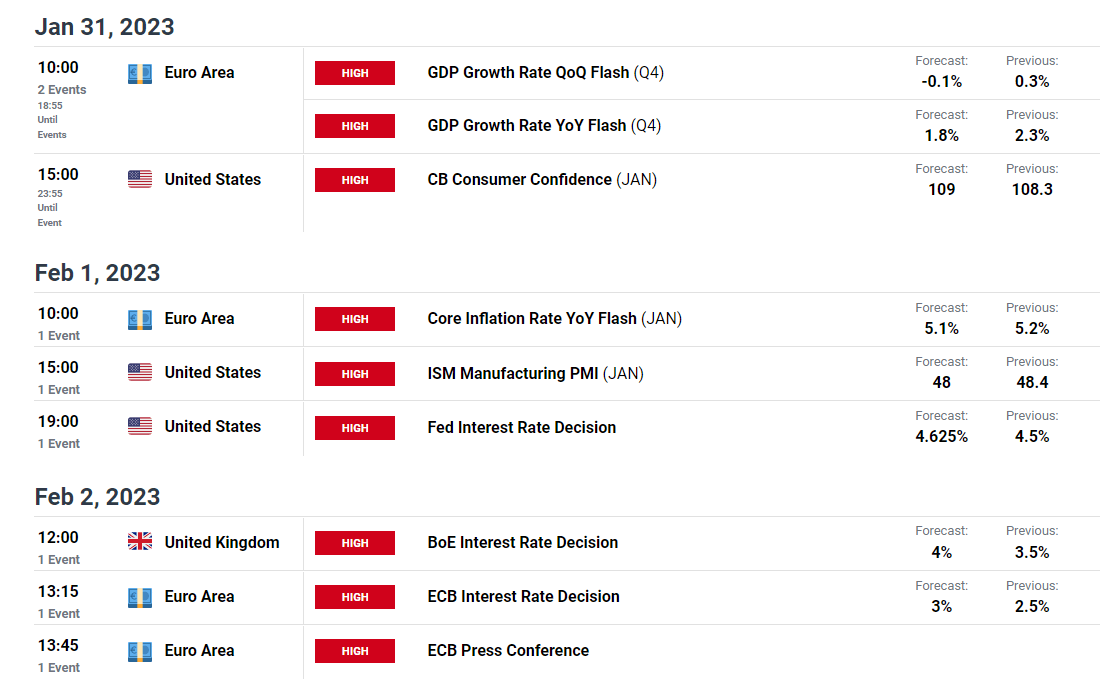

Whereas central banks put together for an additional spherical of price hikes, this week’s financial docket might present a further catalyst for value motion.

Really useful by Tammy Da Costa

Buying and selling Foreign exchange Information: The Technique

If the Fed, ECB or BoE hike charges announce a price hike that’s increased than forecasts, gold costs might ease. Equally, if financial information suggests {that a} world recession could also be unavoidable and development forecasts fade, gold costs may benefit.

DailyFX Financial Calendar

If costs stay above $1,944, the $1,950 deal with stays as resistance which might convey the following stage of resistance into play on the November 2020 excessive of $1,961.8.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and observe Tammy on Twitter: @Tams707