Sakorn Sukkasemsakorn

Once I noticed that the InfraCap Fairness Revenue Fund ETF (NYSEARCA:ICAP) solely had 553 followers on In search of Alpha and that Brad Thomas was the one contributor who had written an article about ICAP, I reloaded the web page. I used to be perplexed that the outcomes remained the identical. Infrastructure Capital Advisors, also called InfraCap isn’t a small store, and manages standard funding merchandise, together with the Virtus InfraCap US Most well-liked Inventory ETF (PFFA), and the InfraCap MLP ETF (AMZA). In an surroundings the place 4% yields had been generally discovered amongst CDs and T-bills, I figured ICAP would have gained recognition in the identical approach that the JPMorgan Fairness Premium Revenue ETF (JEPI) had, because it provided a a lot greater yield than different funding merchandise for taking over fairness danger. I used to be incorrect, and I am fairly stunned. For revenue buyers all for producing month-to-month revenue and alpha by means of an actively managed portfolio that evaluates international macroeconomic components whereas conducting intensive elementary evaluation on its positions, ICAP is a fund well worth the time to analysis.

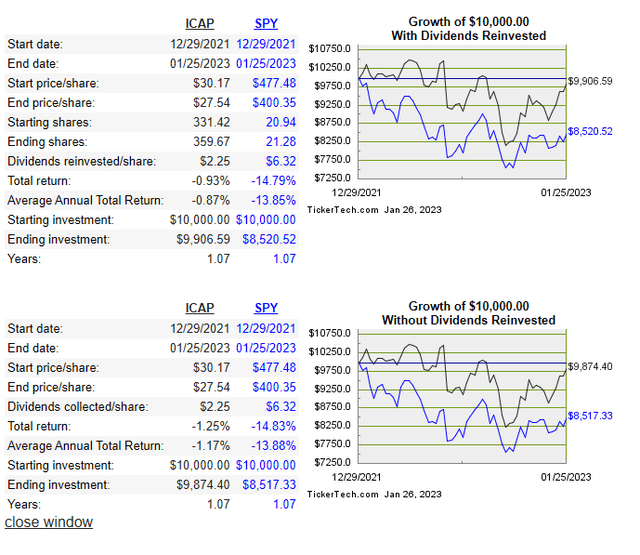

ICAP Vs. The Market which I monitor utilizing SPY

2022 was a troublesome yr for a lot of buyers because the bear market got here out of hibernation. Buyers with elevated ranges of publicity to expertise had fewer locations to cover as large tech was now not a protected haven to experience out the storm. A shift from income progress to free money stream being a driving funding issue occurred, and standard profitless tech firms that had been pandemic standouts watched their share costs drop off a cliff.

ICAP’s inception date was 12/29/21, which can have been the worst time to launch an ETF as few buyers escaped 2022 with an annualized achieve. I like to check the whole lot to the SPDR S&P 500 Belief ETF (SPY) as its probably the most well-known S&P 500 index funds. Regardless in the event you had taken the revenue as money or reinvested the month-to-month dividends, an funding in ICAP would have considerably outperformed SPY since its inception (1.07 years).

In case you had invested $10,000 in ICAP on 12/29/21 and had taken all of the distributions in money, your preliminary funding could be value $9,874 in comparison with $8,517.33 in the event you had positioned that $10,000 in SPY. The full return from ICAP would have been -1.25% in comparison with -14.83% from SPY.

In case you had determined to reinvest all of the dividends, ICAP would have declined by solely -0.93% over this era, whereas SPY declined by -14.79%. The $10,000 funding in ICAP could be value $9,906.59, whereas reinvesting the dividends in SPY would have left buyers with $8,520.52. ICAP’s share rely would have elevated by 8.52% to 359.67 from 331.42. ICAP simply raised its month-to-month dividend by 3% from $0.175 to $0.18. The mix of the primary annual dividend enhance and the extra 28.25 shares from reinvesting the dividends would have elevated the projected annual revenue from ICAP by $80.91 or 11.62%. Previous to compounding curiosity and quick/long-term achieve distributions, ICAP’s ahead annual revenue would now be projected to generate $776.89 in comparison with $695.98 from when the preliminary funding was made.

Dividend Channel

ICAP doesn’t have a protracted monitor file, however I imagine it made its bones throughout the bear market. ICAP’s actively managed technique and dividend revenue proved that ICAP might mitigate draw back stress, protect capital, and outperform the market in periods of uncertainty. It is going to be attention-grabbing to see what ICAP can do throughout occasions of appreciation, however the extra essential query has already been answered as to what would happen in a bear market. ICAP definitely handed with flying colours.

How the InfraCap Fairness Revenue Fund works and what its goals are

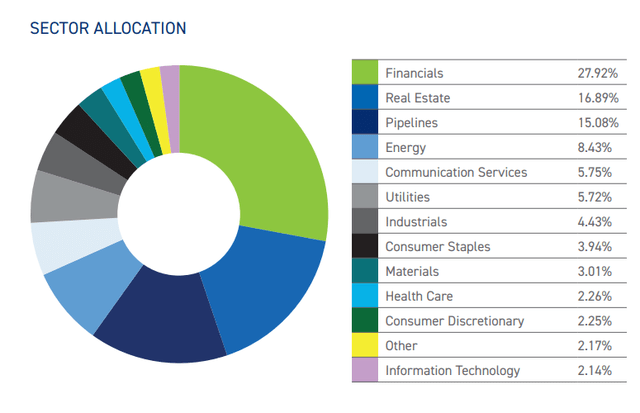

ICAP seeks to maximise revenue for its buyers whereas actively managing its portfolio to pursue complete return alternatives. ICAP will make investments at the very least 80% of its internet belongings in fairness securities of firms that pay dividends throughout regular market circumstances. The Equities that ICAP might allocate capital towards embody frequent shares, most well-liked shares, and convertible securities. ICAP has not positioned a limitation on market cap and might spend money on firms of any dimension. ICAP will make investments primarily in U.S. equities however might allocate capital towards international securities, together with securities of firms situated in rising markets. Along with conventional equities, ICAP doesn’t exclude REITs or MLPs from its funding combine.

By ICAPs energetic administration, the advisors can make the most of put and name choices to generate extra revenue and scale back volatility within the portfolio, take away or add securities from the portfolio, hedge towards market danger, and improve complete return alternatives. Along with writing places and calls, ICAP reserves the precise to enter into swap agreements, together with complete return swaps. ICAP might make the most of swap agreements to achieve publicity to the securities in a market with out truly buying these securities.

ICAP might make investments as much as 20% of its internet belongings in fixed-income securities of various length, maturity, and credit score high quality, together with debt securities which have been rated beneath funding grade by a nationally acknowledged statistical rankings group. ICAP makes use of leverage and is permitted to borrow as much as 33.33% of its complete belongings from banks for funding functions. Underneath regular market circumstances, ICAP appears to be like to deploy between 20-30% of its leverage capability.

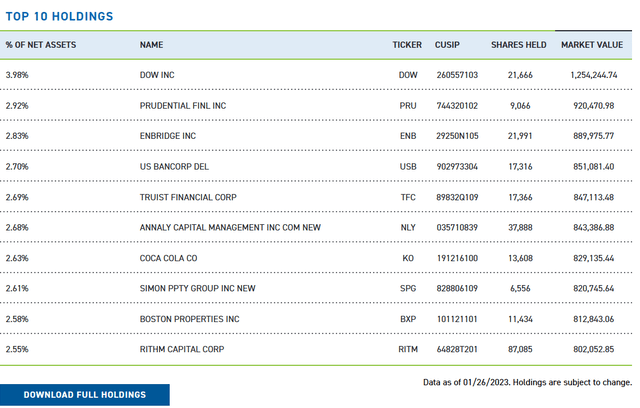

The InfraCap Fairness Portfolio, and why I’ve turn into a fan

I downloaded the entire holdings of ICAP and am impressed with the general portfolio. I’m presently a shareholder of Enbridge (ENB), The Coca-Cola Firm (KO), and Simon Property Group (SPG), which will be discovered of their top-ten holdings. Wanting by means of the remainder of the portfolio, I’m a shareholder of Kinder Morgan (KMI), Power Switch (ET), AT&T (T), Verizon (VZ), Altria (MO), Southern Firm (SO), AGNC Funding Corp (AGNC), Nationwide Retail Properties (NNN), Kraft-Heinz (KHC), Vornado Realty (VNO), Realty Revenue (O), Starwood Property Belief (STWD), AbbVie (ABBV), Citigroup (C), ONEOK (OKE), New York Group Financial institution (NYCB), Walgreen Boots Alliance (WBA), STAG Industrial (STAG), 3M (MMM), VICI Properties (VICI), Exxon Mobil (XOM), and Algonquin Energy Utilities (AQN).

InfraCap

ICAP has 108 particular person positions and has written 80 units of name choices towards its positions. I like the best way administration has staggered the choices. As an example, they bought coated calls towards MO at a $47 strike worth, expiring on 2/23 and three/23, and at a $49 strike worth expiring on 1/23 and a couple of/23. In some instances, it appears to be like like administration has written places to guard the draw back in positions similar to T and XOM, however the majority of the choices are coated calls throughout a number of expiration dates and strike costs.

Personally, I like funds like this. I’m invested in conventional S&P 500 index funds, however I additionally need publicity to various kinds of investments. I’m more than pleased to allocate capital towards funds like ICAP as a result of administration is incomes their expense ratio of 0.80% by assessing the macroenvironment and using a name overlay technique to generate extra revenue. I write coated calls towards a number of the dividend shares that I really feel are going to commerce sideways and cash-backed places on positions I wish to personal at a cheaper price level. I look favorably upon actively managed funds that take a methodical method to producing revenue by means of these strategies, as covered-call methods are properly inside my danger threshold.

InfraCap

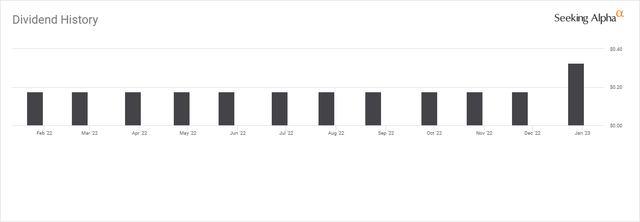

The InfraCap Fairness Portfolio generated month-to-month revenue in 2022, and supplied an annual dividend enhance in 2023

In 2022, ICAP delivered on its revenue guarantees and produced a month-to-month dividend of $0.175. In December of 2022, the dividend was bumped as much as $0.326 as lengthy, and short-term capital good points had been distributed at yr’s finish. Total, ICAP generated $2.25 in revenue all through 2022, a ahead yield of 8.15% based mostly on the present share worth. ICAP additionally supplied shareholders with its first annualized dividend enhance in 2023 of three%, pushing the month-to-month dividend to $0.18. ICAP is establishing a constructive revenue monitor file, and after a full yr since its inception, the advisors have left no motive to doubt ICAPs revenue producing capabilities.

In search of Alpha

Conclusion

I’m a shareholder of PFFA and AMZA, and after conducting my due diligence on ICAP, I’m able to make this an upcoming addition to my Dividend Harvesting Collection on In search of Alpha along with my bigger dividend portfolio. As I write this text, I’m not presently invested in ICAP, however there’s a robust chance that by the point this text is printed, will probably be a part of my dividend funding combine. Earlier than making any investments, please conduct your due diligence and make sure that it matches your funding standards. I’ve a lot overlap between my portfolio and ICAPs, and I agree with how they make the most of leverage and write their choices. Simply because this funding meets my wants and is inside my danger tolerance doesn’t imply it should meet your wants, so please do your individual analysis. ICAP has outperformed SPY since its inception, supplied month-to-month revenue, has a ahead yield that exceeds 8%, and simply raised its dividend. Similar to PFFA and AMZA, ICAP has gained my vote of confidence.