On-chain analytic agency Glassnode has damaged down which Bitcoin cohorts have been accumulating and which have been distributed throughout the previous 12 months.

Bitcoin Whales Distributed Cash Equal To 60% Of Mined Provide In The Final 12 Months

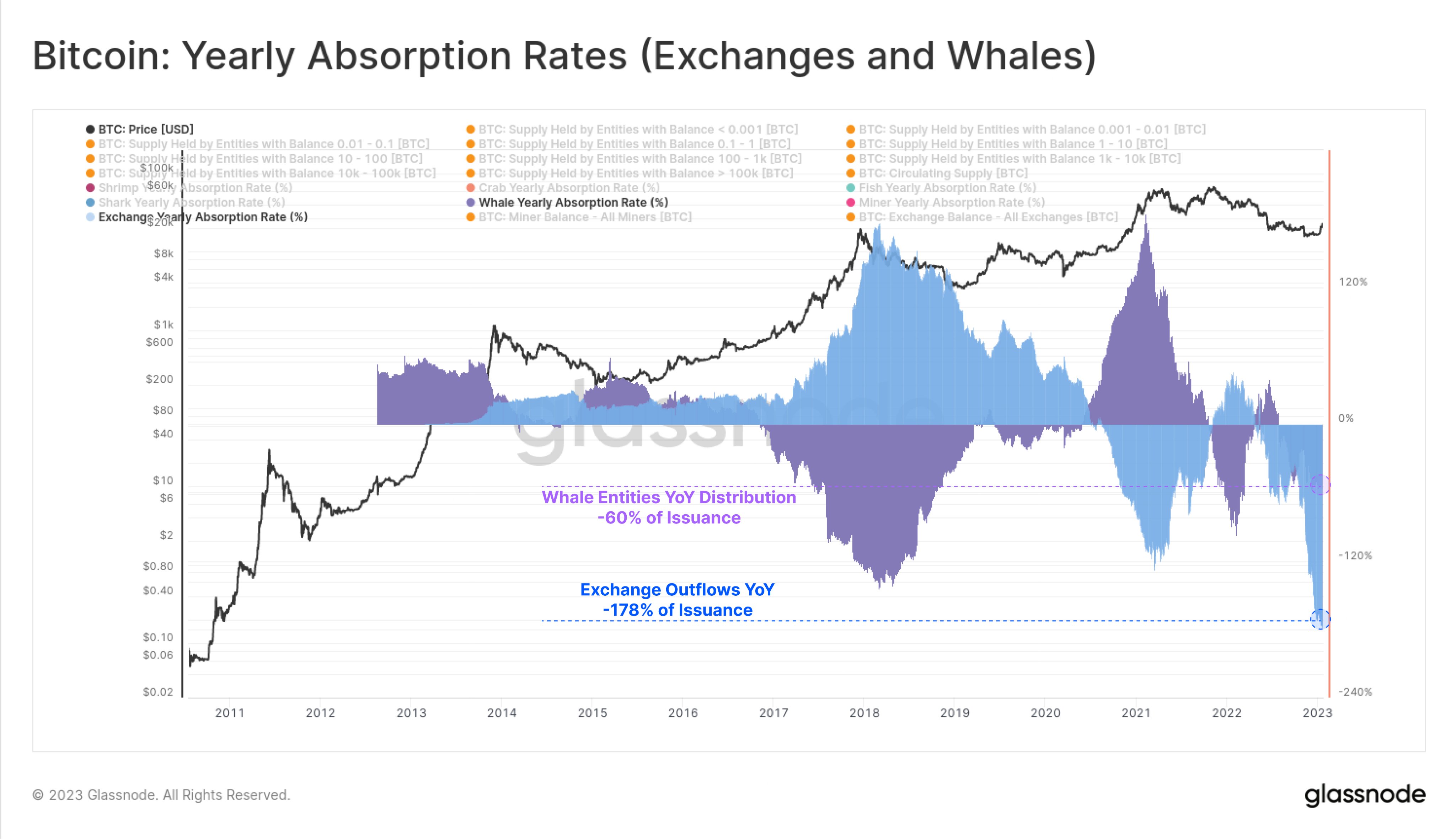

As per information from Glassnode, whales, miners, and trade outflows have been the first distribution sources up to now 12 months. The related indicator right here is the “yearly absorption charges,” which measures the yearly Bitcoin stability adjustments of the totally different cohorts out there and compares them with the variety of cash issued over this era.

The “cash issued” consult with the full quantity BTC miners obtain as block rewards for mining a block. These new cash produced need to go someplace, and that’s what the yearly absorption charges metric tries to color an image of the BTC provide circulate.

The cohorts that Glassnode has thought of are the shrimps (buyers holding lower than 1 BTC), crabs (between 1 to 10 BTC), whales (greater than 1,000 BTC), and miners. Moreover, the agency has additionally included information for the “trade outflows,” which measure the full variety of cash withdrawn from the wallets of all centralized exchanges.

Now, first, under there’s a chart that exhibits which of those investor teams have been absorbing a constructive quantity of the yearly coin issuance:

The worth of the metrics appear to have been fairly excessive in current weeks | Supply: Glassnode on Twitter

As proven within the above graph, the Bitcoin yearly absorption charge of the shrimps is 107% proper now, which means that this investor group added 107% of the full variety of cash issued on the community to their holdings throughout the previous 12 months.

The indicator’s worth has been even increased for the crabs at round 120%. From the chart, it’s obvious that the metric has noticed a really fast rise in the previous couple of months, suggesting that a variety of accumulation happened on the lows following the FTX collapse.

For the reason that quantities added by these cohorts are increased than what the community issued up to now 12 months, it appears cheap to imagine that some teams will need to have distributed or bought their cash to make up for the distinction. The under chart exhibits which cohorts displayed distribution habits throughout the previous 12 months.

Seems to be like these metrics have been deeply destructive lately | Supply: Glassnode on Twitter

Plainly the yearly absorption charge of the whales is 60% underwater, which means that these humongous holders have shed cash equal to 60% of the issued provide from their wallets over the previous 12 months.

Exchanges additionally distributed an enormous quantity of Bitcoin because the metric’s worth was destructive 178% for trade outflows. These platforms noticed giant withdrawals on this interval partly due to the FTX collapse, which made BTC holders extra conscious of the dangers of protecting their cash in centralized wallets. This led to an enormous migration of the BTC stored on centralized entities.

Customers switch giant quantities of BTC from exchanges to maintain their holdings in privately owned {hardware} wallets. Although not displayed within the chart, Glassnode additionally mentions within the tweet that miners distributed 100% of the cash they mined (which suggests 100% of the issuance), plus an extra 2% from their current reserves.

BTC Value

On the time of writing, Bitcoin is buying and selling round $22,600, up 8% within the final week.

BTC continues to maneuver sideways | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com