USD/JPY ANALYSIS

- All eyes on BoJ on the subject of YCC and potential for future rate of interest hikes.

- USD/JPY hits 7-month lows with growing ‘demise cross’ probably hinting at additional draw back.

Really helpful by Warren Venketas

Get Your Free JPY Forecast

JAPANESE YEN FUNDAMENTAL FORECAST: MIXED

The Japanese Yen ended final week on the entrance foot from each USD weak point pushed by softening inflation within the U.S. in addition to market hopefulness round a extra aggressive Financial institution of Japan (BoJ). Subsequent week kicks off the key point of interest for USD/JPY with the BoJ’s rate of interest resolution (see financial calendar under) scheduled on Wednesday.

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX group

Subscribe to E-newsletter

ECONOMIC CALENDAR

Supply: DailyFX financial calendar

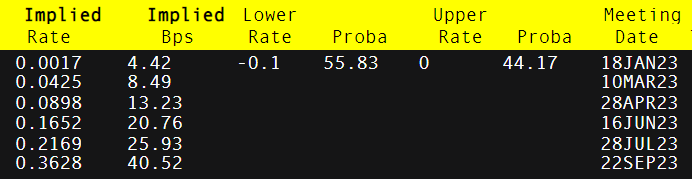

A change from the present ultra-loose financial coverage because of elevated inflationary pressures may very well be one thing that may happen subsequent week by revising Yield Curve Management (YCC) measures and even scrapping all of it collectively. To this point in what has been a principally international charge climbing cycle for many central banks, the BoJ has remained dovish in its strategy however cash markets are favoring a graduation of charge hikes round June/July this yr. Relying on what occurs in subsequent week’s announcement, this date may very well be pushed ahead as early as March. Quite the opposite, an unchanged outlook from the BoJ might actually damage the Yen significantly after the keenness proven by market pricing on Friday.

BANK OF JAPAN (BOJ) INTEREST RATE PROBABILITIES

Supply: Refinitiv

From a USD perspective, the dollar extends its downward trajectory however any optimistic financial knowledge subsequent week might present some assist contemplating markets have nearly cemented the 25bps increment within the February Fed assembly.

TECHNICAL ANALYSIS

Introduction to Technical Evaluation

Shifting Averages

Really helpful by Warren Venketas

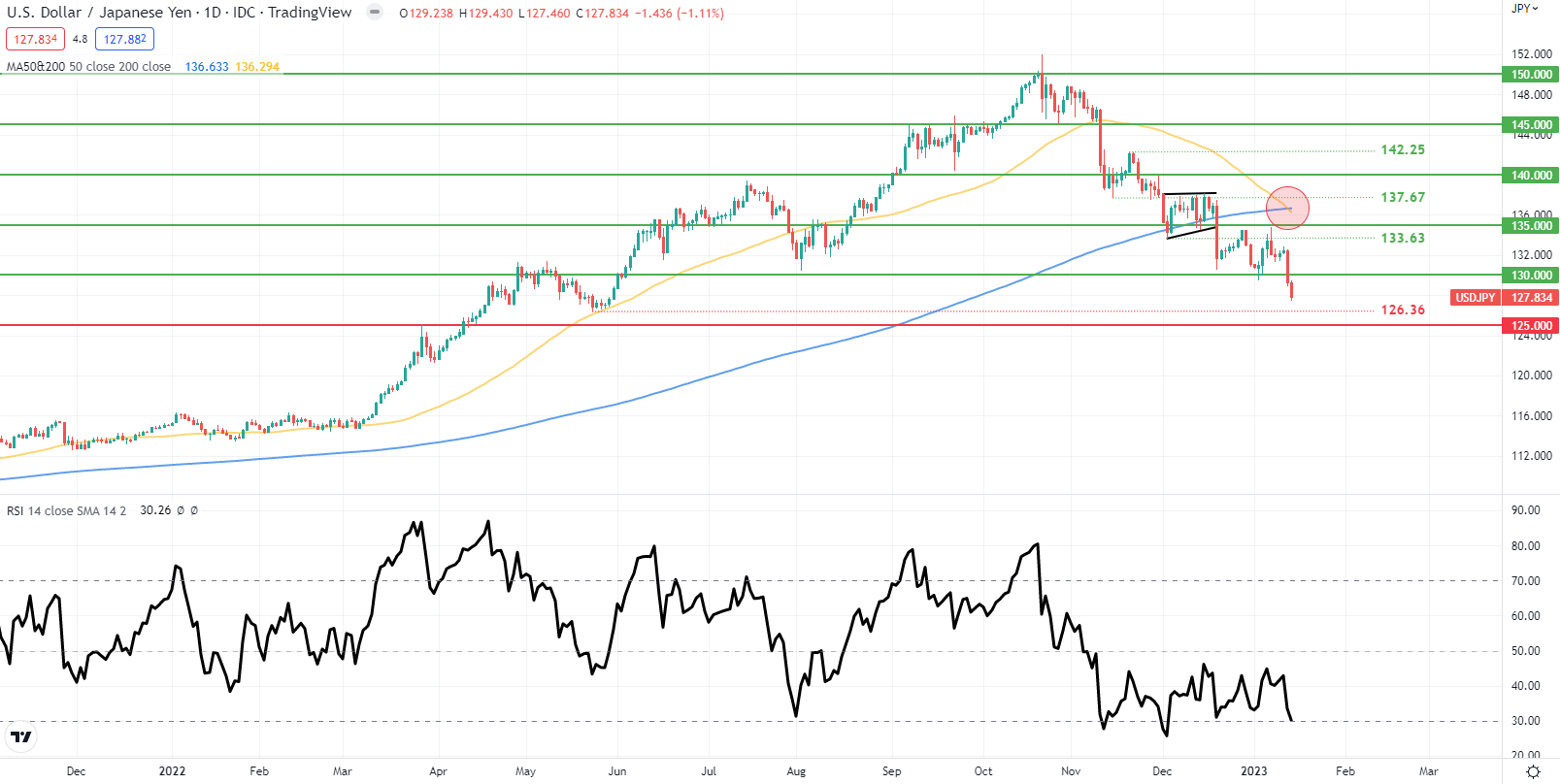

USD/JPY DAILY CHART

Chart ready by Warren Venketas, IG

The day by day USD/JPY chart reveals value motion falling under the 130.00 psychological deal with now turned resistance. Recent yearly lows final seen in Could 2022 and will take a look at the swing assist low at 126.36. If the BoJ assembly concludes with minimal change, the pair will possible rally; nonetheless, with fundamentals favoring the JPY going ahead, there may very well be alternative round pullbacks to the upside.

Technical shifting averages are exhibiting extraordinarily bearish indicators by way of the ‘demise cross’ the place the 50-day SMA (yellow) crosses under the 200-day SMA (blue). This preliminary transfer might have already performed out because of the Shifting Common (MA) indicator being lagged and searching on the bullish/optimistic divergence current on the Relative Power Index (RSI), a short-term rebound larger may very well be in retailer earlier than a subsequent leg decrease.

Key resistance ranges:

Key assist ranges:

IG CLIENT SENTIMENT POINTS TO IMPENDING DOWNSIDE

IGCS reveals retail merchants are at the moment internet LONG on USD/JPY, with 58% of merchants at the moment holding lengthy positions (as of this writing). At DailyFX we take a contrarian view on sentiment, leading to a short-term bearish bias.

Contact and followWarrenon Twitter:@WVenketas