piranka

U.Ok.-based crypto miner Argo Blockchain (NASDAQ:ARBK) has seen some robust worth motion in its shares in current weeks. Nonetheless I stay bearish and certainly took benefit of a current sharp worth rise to promote my current place (at a big loss).

In round a 12 months and a half of overlaying the title I’ve moved between constructive, impartial and damaging positions on the corporate. (That in itself maybe should have made me assume tougher about my analytical framework). For now, I stay bearish.

Excellent news

On the finish of final 12 months, the corporate introduced some necessary information. It bought its giant mining facility in Texas for $65 million (£54 million), refinanced its asset-backed loans, and entered right into a internet hosting settlement to take care of its mining machines on the Texas facility. Fuller particulars of the transaction will be discovered right here.

The corporate described these as “transformational strategic transactions” and I feel that’s truthful. I additionally see it as excellent news. I beforehand had doubts about Argo’s capacity to take care of a going concern if it didn’t enhance its funds. In October, it introduced a collection of “strategic actions to strengthen the corporate’s steadiness sheet”, together with diluting shareholders and promoting hundreds of its mining machines (“new in field”). These transactions had been anticipated to make sure that Argo had ample working capital for a 12 months.

This smells like a fireplace sale to me. I feel the newest transaction is sweet information for Argo as a result of it bolsters liquidity and helps increase the corporate’s working capital. However I additionally see it as a foul sign. It’s lower than a 12 months because the Texas facility opened (or “energised” within the firm’s jargon, which itself should have been a warning to me). This was the centrepoint of the agency’s technique, but it has now been bought, together with hundreds of machines the corporate purchased however didn’t even take out of their containers. Both the technique is deeply flawed, administration is incompetent or each (which is my take).

Dangers and potential reward

Argo has been hit like its friends by falling crypto costs, with Bitcoin (BTC-USD) down round three fifths up to now 12 months. If costs come again, that would assist the agency’s profitability.

On the half 12 months degree the corporate reported a £30.5m loss after taxation, in comparison with a £7.2m post-tax revenue on the similar stage the prior 12 months. Rising crypto costs may assist increase profitability whereas additional falls may harm it.

The present market cap is round $67m. The newest transactions “will cut back complete indebtedness by $41 million” though it’s unclear to me what the corporate’s present internet debt is. However may the shares be a discount if Argo survives as a going concern (which the newest transactions make extra possible, in my opinion) and advantages from the subsequent upswing in crypto pricing? I undoubtedly assume it may.

Nonetheless, the dangers listed here are manner too excessive for my tolerance. Crypto pricing is central to Argo’s valuation and it has no management over it. I’ve grave doubts in regards to the firm’s administration and technique. Additional shareholder dilution to spice up liquidity is a transparent danger and I additionally proceed to see final chapter as a danger, though for now at the very least the current transactions have bolstered the steadiness sheet.

My errors analysing Argo

Given how I now really feel about Argo, how did I ever determine to purchase it?

My stake was a small certainly one of just some hundred {dollars} which I purchased partly to have some pores and skin within the recreation analytically, a motivation I now query.

Usually when investing I look for an organization that has already confirmed it may be constantly worthwhile, even when on the time I purchase it could be lossmaking. Two of my largest investing errors over the previous couple of years as judged by share loss didn’t clearly meet this criterion (in addition to Argo, the opposite is kidney diagnostic agency Renalytix (RNLX)). Within the case of Argo, although, it got here shut: it recorded post-tax income in each 2020 and 2021. Whereas the 2020 revenue was pretty small (£1.4m), 2021 got here in at £30.8m. I noticed that as an indication of quick development fairly than a scarcity of long-term constant profitability. Sooner or later I feel I might search for extra than simply a few years of income as proof of constant profitability.

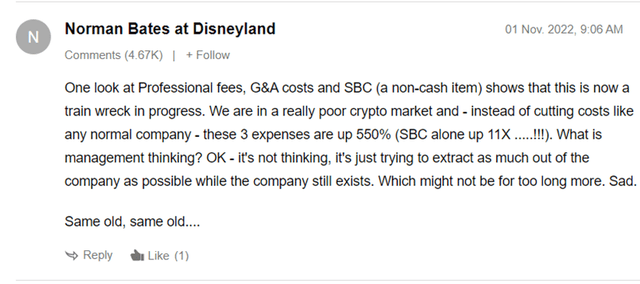

However I additionally missed or ignored different pink flags. Take this insightful remark from November on an article I wrote in Could, by SA person Norman Bates at Disneyland:

touch upon article (Searching for Alpha)

In 2021, authorized, skilled and regulatory charges jumped 1,344% from the 12 months earlier than to £1.5m. Whole administrative bills that 12 months jumped practically fourfold. Admittedly this was throughout a interval of firm enlargement however looking back that form of bounce now appears to be like like a pink flag.

Extra data on charges within the October and December transactions is missing, however will hopefully emerge on the full 12 months degree. Nonetheless, Norman Bates at Disneyland’s consideration to such metrics appears helpful and I should have paid nearer consideration myself.

I additionally considerably deluded myself by believing that one may separate the dangers of investing in crypto (which I see as a Ponzi scheme) from investing in an organization with a enterprise mannequin closely linked to crypto pricing, which I did for instance by contemplating different makes use of to which Argo’s knowledge centres could possibly be put to make use of.

Valuing Argo Blockchain shares

It has been attainable to make large cash on Argo up to now a number of weeks, with the shares doubling in a single day’s buying and selling at one level and different large strikes. Nonetheless, I see that as akin to hypothesis fairly than funding.

The hyperlink to crypto pricing stays, the corporate’s technique now appears to be like uncertain (and on the tactical degree appears to be survival) and I’ve no confidence in its administration. On that foundation, whereas a turnaround in its fortunes may conceivably result in an enormous share worth bounce, I ascribe no worth to the shares.

Editor’s Observe: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.