Printed on January seventh, 2023 by Quinn Mohammed

BCE Inc. pays a excessive dividend yield of 6.0%, and the corporate has elevated its dividend for 13 consecutive years. The corporate’s payout ratio as a p.c of earnings could also be stretched, however BCE has recession-resistant qualities and aggressive benefits that ought to defend the dividend.

Deep evaluation must be accomplished to confirm the security of high-yield shares, notably when their payout ratios eclipse 100%, which might spell an oncoming dividend reduce.

We’ve created a spreadsheet of excessive dividend shares with dividend yields of 5% or extra…

You possibly can obtain your free full record of all securities with 5%+ yields (together with essential monetary metrics corresponding to dividend yield and payout ratio) by clicking on the hyperlink beneath:

This text will analyze the Canadian telecom large BCE Inc. (BCE).

Enterprise Overview

BCE Inc. is a telecommunications and media firm that gives communications providers within the following enterprise items: Bell Wi-fi, Bell Wireline, and Bell Media.

The company addresses residential clients, small- and medium-sized companies, and enormous enterprise clients.

BCE was based in 1970 and is headquartered in Verdun, Canada. Shares are listed on each the New York Inventory Change (NYSE) and on the Toronto Inventory Change (TSX).

BCE reported third quarter 2022 outcomes on November third, 2022. Income rose by 3% year-over-year to C$6.0 billion, and adjusted internet earnings rose 7% to C$801 million.

Adjusted EBITDA elevated by 1.2% to C$2.6 billion, and adjusted earnings-per-share elevated by 7.3% year-over-year to C$0.88. BCE additionally generated money flows from working actions of practically C$2.0 billion and free money circulation of C$642 million, will increase of 12.5% and 13.4%, respectively.

The Bell Wi-fi and Wireline segments noticed income progress of seven% and 1%, respectively. Then again, the Bell Media section skilled roughly flat income progress.

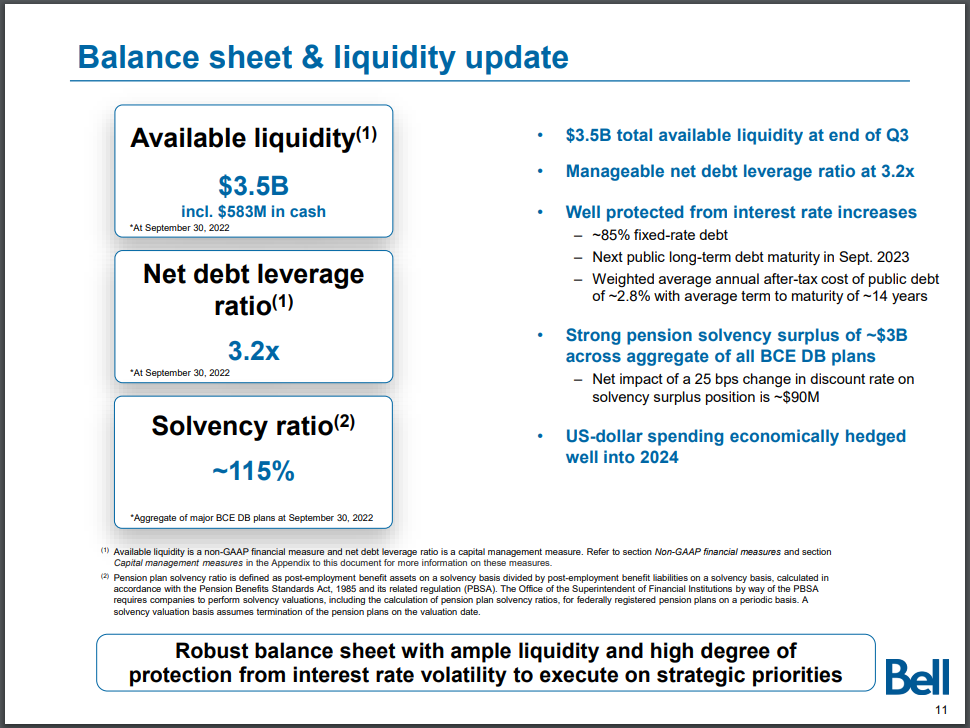

Supply: Investor Presentation

BCE reiterated its 2022 outlook and expects income progress of 1% to five%, adjusted EBITDA progress of two% to five%, adjusted EPS progress of two% to 7%, and FCF progress of two% to 10%.

Our 2022 EPS estimate for BCE stands at US$2.66.

Progress Prospects

BCE has seen declining earnings per share in U.S. {dollars} during the last decade. Earnings per share fell by about 3.2% yearly from 2012 to 2021. In Canadian {dollars}, nevertheless, earnings per share have been basically flat throughout the identical time interval. Since BCE is concentrated on the Canadian market and experiences its ends in Canadian {dollars} when translated into US forex, outcomes can fluctuate considerably.

BCE is concentrated on rising its subscriber base and has made a number of investments to facilitate this. Capital expenditures are on observe to succeed in over $5 billion for the fiscal yr 2022, the very best quantity ever by a Canadian telecom in a single yr.

The corporate’s important investments in its infrastructure have led to it proudly owning the fastest-ranked and largest wi-fi community in Canada. Moreover, its LTE and 5G protection envelop greater than 90% and 75% of Canadians, respectively. Lastly, the corporate’s industry-leading speeds may even draw clients in and support in rising the subscriber base.

Whereas BCE has seen its earnings per share decline within the final decade on a U.S. greenback foundation, for the subsequent 5 years, we estimate that the corporate can develop earnings per share by roughly 4.5% yearly.

Aggressive Benefits & Recession Efficiency

BCE Inc., being the biggest Canadian telecom firm, enjoys its entrenched place within the profitable area. The Canadian telecom {industry} is just not threatened by new entrants, as huge obstacles to entry defend the present telecom corporations. BCE Inc. additionally has one of the best community as a consequence of its important capital spending, which might be extraordinarily tough to copy as we speak.

The corporate additionally has excessive recession resiliency, as the corporate’s services are virtually requirements in as we speak’s day and age, by all financial cycles. Whereas the corporate noticed outcomes fall throughout COVID-19, they nonetheless held up fairly properly and have elevated since.

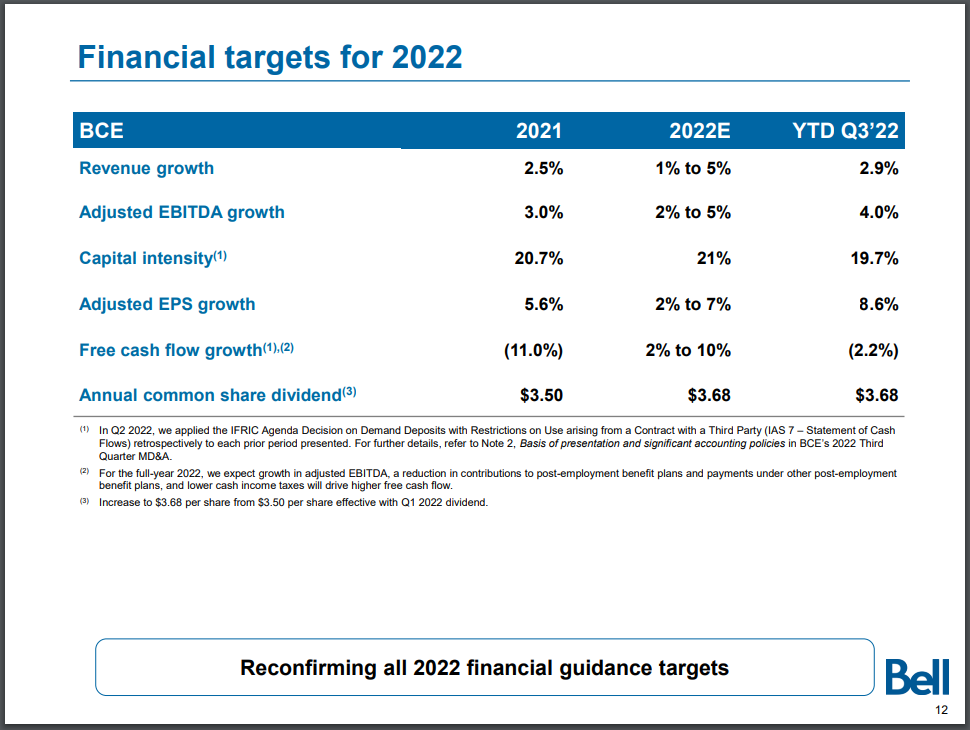

Supply: Investor Presentation

On the finish of the third quarter, BCE had C$3.5 billion of obtainable liquidity, which included $583 million in money. Moreover, its internet debt to adjusted EBITDA ratio was 3.2x.

Dividend Evaluation

BCE Inc. pays a C$3.68 annual dividend. The corporate final elevated its dividend by 5% in February 2022, representing its thirteenth consecutive annual dividend improve. On the present share worth, BCE has a excessive dividend yield of 6.0%, which is 80 foundation factors above its ten-year common yield of 5.2%.

Based mostly on our EPS estimate of US$2.66 for 2022, the corporate is forecasted to pay out about 102% of earnings in dividends. This can be a dangerous payout ratio, which signifies that the dividend might be at risk.

Nevertheless, BCE invests closely in its infrastructure and in addition experiences excessive ranges of depreciation and amortization, which negatively skews earnings. In consequence, calculating the corporate’s payout ratio as a p.c of free money circulation might be extra insightful. Nevertheless, BCE’s FCF has been lowered within the brief time period from intensive capital investments and is about to rebound in 2023 and past.

Given our earnings progress estimate, which outstrips the dividend progress estimate, we consider that the corporate’s dividend payout ratio will average within the years to come back.

Closing Ideas

BCE Inc. has not seen a lot progress within the final decade on a U.S. forex foundation. Nevertheless, going ahead, we anticipate the corporate to develop by mid-single digits. Immediately, BCE has a excessive dividend yield of 6.0%.

The corporate has elevated its dividend for 13 consecutive years. Whereas the payout ratio was favorable within the first half of the final decade, the payout ratio as a share of earnings has eclipsed 100% because the COVID-19 disaster. If the corporate can develop its earnings sooner than its dividends going ahead, the payout ratio ought to average.

BCE must be petering out its capital investments within the coming years, which ought to see a major improve in free money circulation, from which the corporate might safely pay its dividend.

If you’re keen on discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases shall be helpful:

The main home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them commonly:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].