By Graham Summers, MBA

Buyers must be praying for a inventory market crash.

From a systemic perspective, the markets have entered a interval of “threat off”. This has been the case since March of 2022. And the one neatest thing for traders can be for the markets to get this example over with rapidly by way of a crash.

Sure, I’m absolutely conscious that crashes are extraordinarily painful and contain traders dropping some huge cash. Nonetheless, when the markets crash, they additionally backside rapidly, which suggests the ache is over FAST.

Take into account the 2020 Crash: the complete collapse was over in about 5 weeks. And shares had already begun to get well a lot of their losses inside just a few months. In truth, inside six months they had been at new all-time highs!

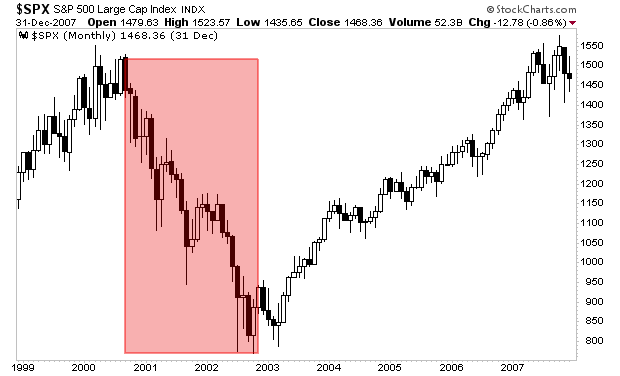

Now examine that to the Bear Market of 2000-2002.

That collapse took over TWO YEARS to finish. Not months… YEARS. Peak to trough the S&P 500 misplaced 50%. And on a yearly foundation the losses had been really worse with every successive 12 months. The market misplaced 10% in 2000, 13% in 2001, and 23% in 2002.

Worst of all, it took the S&P 500 FIVE years to recoup its losses. Buyers misplaced cash for years after which needed to wait half a decade to make these losses again.

So once more, the most effective factor for traders can be for the markets to crash quickly. A crash would imply the ache can be over rapidly and shares might backside.

Sadly, I don’t assume that’s going to be the case.

I’ll clarify why in tomorrow’s article… nevertheless, within the meantime for those who’ve but to take steps to arrange for what’s coming, we simply printed a brand new unique particular report The best way to Make investments Throughout This Bear Market.

It particulars the #1 funding to personal in the course of the bear market in addition to tips on how to make investments to probably generate life altering wealth when it ends.

To choose up your FREE copy, swing by:

phoenixcapitalmarketing.com/BM.html

See additionally Globalist Dinks in Ontario Canada: Each home ought to have a photo voltaic panel, and electrical car AND a “residential battery”

—>

Trending:

Views:

74