British Pound Speaking Factors:

Really helpful by James Stanley

Get Your Free GBP Forecast

It’s been a powerful This autumn for the British Pound, and in case you may return to the start of the quarter, that most likely would’ve been a tough truth to return to grips with. It was in late-September when the foreign money put in a collapse-like transfer after Liz Truss got here beneath fireplace. Her tenure didn’t final lengthy and British Pound weak point dried up as she was hitting the exits.

After which for many of the subsequent two and a half months, GBP/USD rallied, finally re-claiming the 1.2000 psychological stage after which this week, pushing as much as a contemporary six-month-high. To make certain, a big portion of that transfer was pushed by USD-weakness; however GBP was robust elsewhere, resembling in GBP/JPY, which closed Q3 beneath the 162 deal with and in the present day sits above the 168 stage.

GBP/USD

The 1.2500 stage is taking a toll and it hasn’t even actually come into the equation but. GBP/USD put in a breakout on Tuesday, crossing above the Fibonacci stage at 1.2203 to set that contemporary six-month-high. This set a higher-high at 1.2445. Bulls put in a second try and breakthrough that stage yesterday, across the FOMC charge determination however have been equally stifled beneath 1.2445, setting the stage for a barely lower-high, and that’s prolonged into this mornings bearish push which has despatched costs back-below that 1.2303 stage.

There’s some potential assist nearing: The 1.2217 stage is a previous swing low that got here in as assist on Monday, and beneath that’s one other swing-low at 1.2156 that’s most likely extra significant as this helped to point out because the month-to-month low in Might after which the month-to-month excessive for November. Under that, the 200 day transferring common comes again into the image and this held two separate assist bounces earlier in December. Sellers breaking-below that opens the door for greater image reversal potential of the This autumn bullish pattern.

Really helpful by James Stanley

The right way to Commerce GBP/USD

GBP/USD Every day Chart

Chart ready by James Stanley; GBPUSD on Tradingview

GBP/JPY

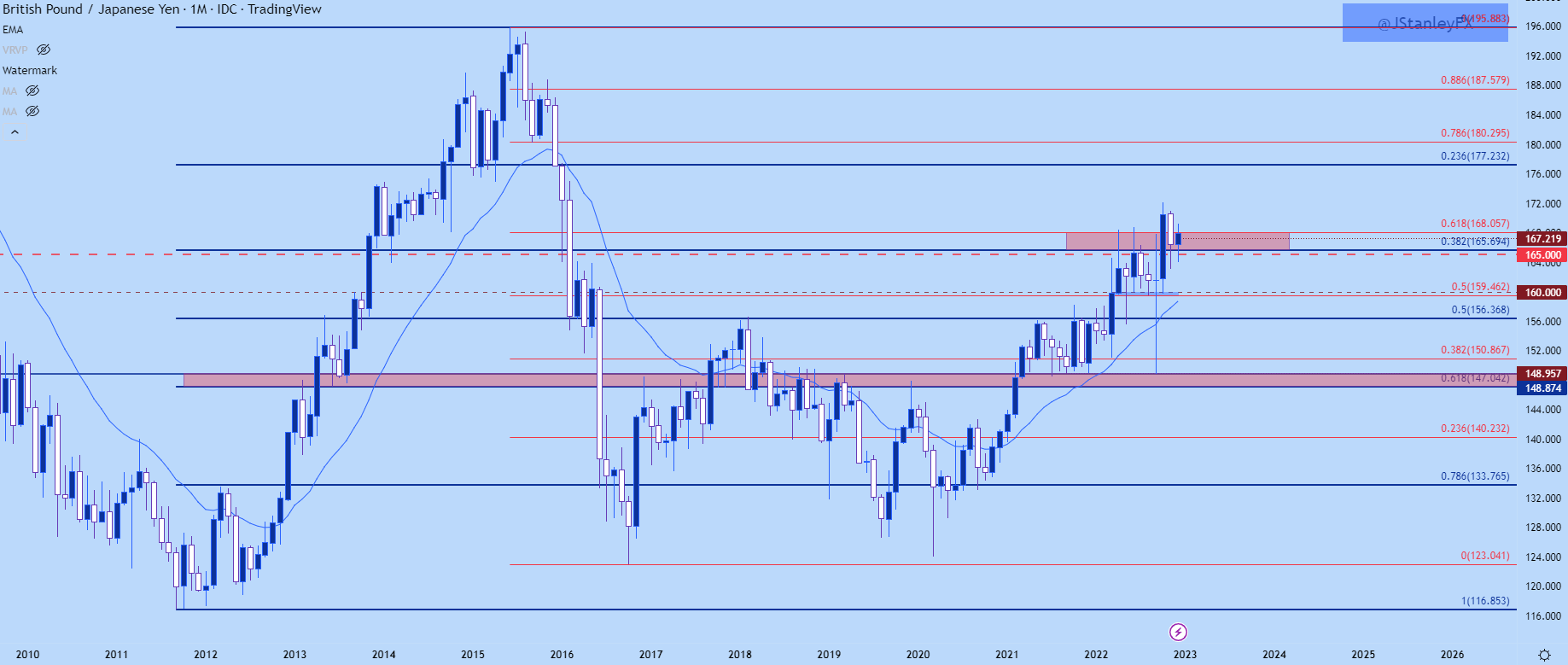

GBP/JPY has equally seen energy in This autumn. The large query there’s whether or not GBP/JPY is getting nearer to a high or, maybe the highest is already in-place. The pair examined above the 170 deal with in early-This autumn commerce and wasn’t capable of substantiate a lot drive past that stage, pulling back-below in early-November and never venturing again above since.

Taking a step again, and there’s an enormous zone of resistance that’s been tough for bulls to interrupt this yr across the 168 stage. That is the 61.8% retracement of the 2015-2016 main transfer, and it helped to carry resistance in April, June and September till bulls made that failed enterprise above 170 in October. The corresponding pullback has since held assist at 165, however there could also be one thing to work with right here earlier than too lengthy.

GBP/JPY Month-to-month Value Chart

Chart ready by James Stanley; GBPJPY on Tradingview

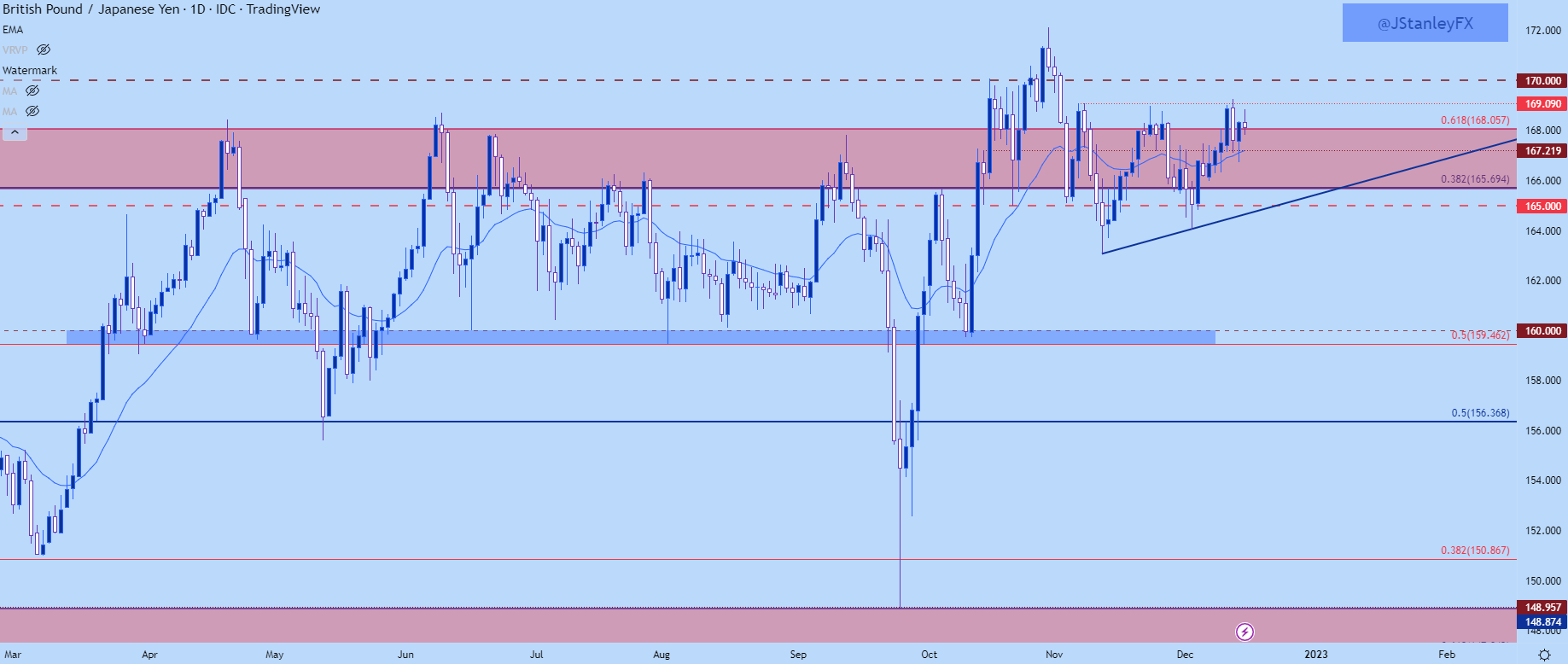

GBP/JPY Shorter-Time period

Taking place to the every day exhibits that resistance zone being in-play over the previous month, serving to to average a variety with resistance holding across the 169.09 stage. And simply above that’s the 170.00 psychological stage.

This units the stage for a breakout which will open the door for fades. If bulls can poke above the 169.09 stage, 170 resistance turns into an element, and if there’s an extended wick response on the every day chart, that may open the door for bearish setups. However – if that bearish run stalls at a higher-low, holding above 165, the door very a lot stays open for bullish tendencies as the present setup is also construed as an ascending triangle.

Really helpful by James Stanley

Buying and selling Foreign exchange Information: The Technique

GBP/JPY Every day Chart

Chart ready by James Stanley; GBPJPY on Tradingview

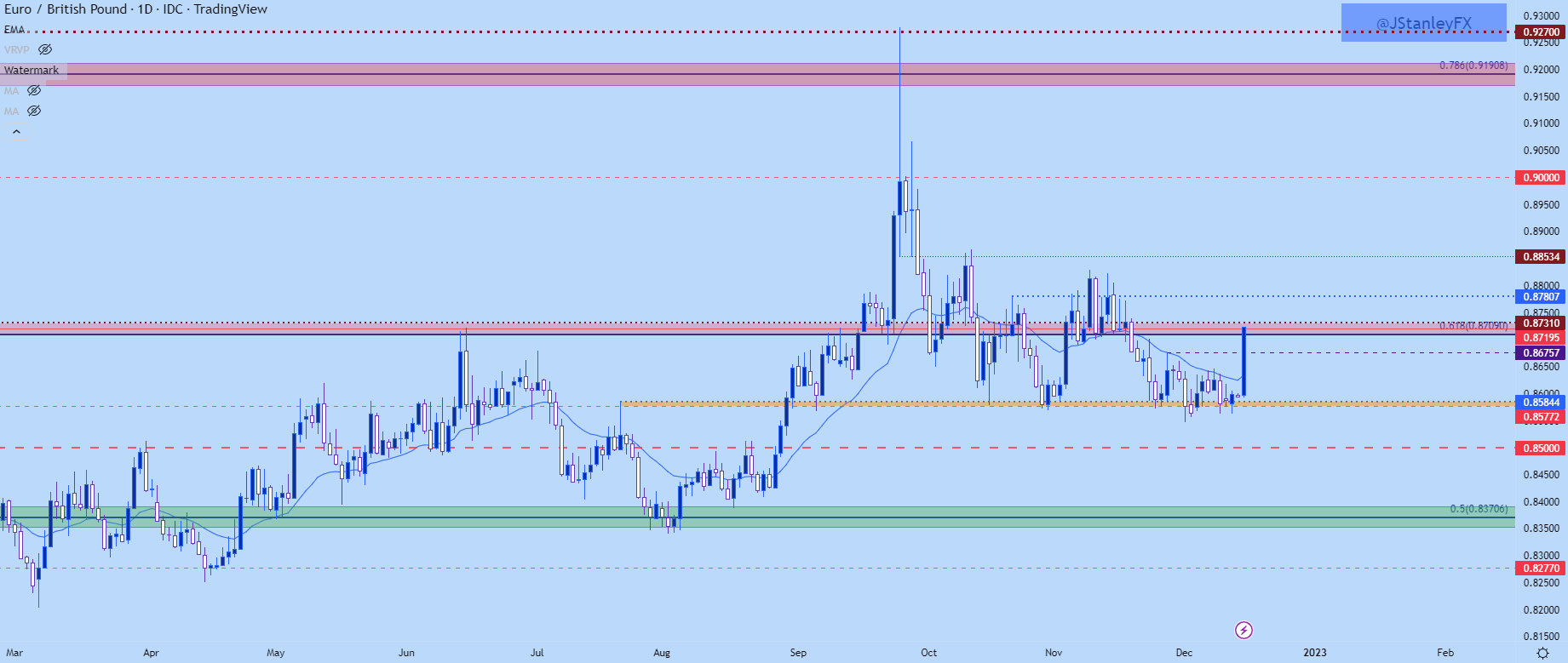

EUR/GBP to Vary Resistance

I’ll preserve this one moderately quick because the vary stays in-play right here. I had regarded into the pair final week as a part of a Euro Value Motion Setups article, highlighting that vary with give attention to resistance across the .8709 Fibonacci stage. This morning’s charge choices have pushed value into that zone, so we at the moment are nearing vary resistance.

With that stated, resistance hasn’t been as constant as assist, and this run might final for a short while longer particularly given the tempo of momentum on this bounce. There’s extra resistance potential across the .8781 stage. However, at this level, there would have to be some aspect of vendor response earlier than that theme may turn out to be workable once more, as value is sitting nearer to the mid-point of the vary versus any actionable edges of the formation.

Really helpful by James Stanley

Constructing Confidence in Buying and selling

EUR/GBP Every day Chart

Chart ready by James Stanley; EURGBP on Tradingview

— Written by James Stanley, Senior Strategist, DailyFX.com & Head of DailyFX Training

Contact and observe James on Twitter: @JStanleyFX