LUHUANFENG

China Life Insurance coverage emblem (China Life Insurance coverage)

Funding thesis

As we identified in our earlier article on China Life Insurance coverage (OTCPK:LFCHY) “Fundamentals Stays Intact”, and the place we gave it a steady purchase stance, there’s not a lot change to its enterprise fundamentals.

Since our first purchase stance, it’s down virtually 25%. Nevertheless, the share worth is at all times going to be a voting machine and we can’t predict the place it’s going.

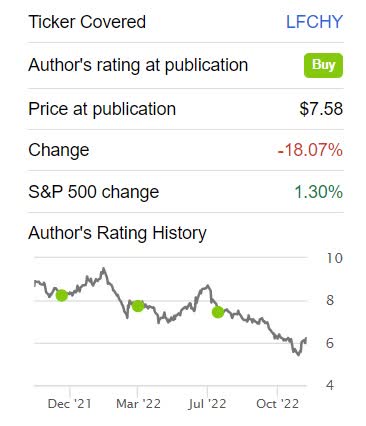

LFCHY was down 18% [SA]

This graph is displaying us the drop solely as much as the purpose the place LFCHY not traded on the New York Inventory Trade.

It seems to be higher as soon as we shift our consideration to its itemizing in Hong Kong.

China Life Insurance coverage (02628.HK) – 1 12 months share growth (Yahoo Finance)

Simply after it received delisted within the U.S., the share worth began to go up.

We concentrate on the basics and attempt to purchase firms which have robust fundamentals and the place we imagine that there’s a excessive chance of future.

On that subject, we nonetheless are of the opinion that China’s financial system will proceed to carry extra individuals from decrease earnings into center earnings and that the demand for all times insurance coverage merchandise will develop with an getting older inhabitants and a necessity for higher well being and retirement plans. China Life Insurance coverage is the primary firm on this section.

Allow us to have a look at how they did of their newest monetary report.

Q3 2022 and the primary 9 months’ monetary outcomes

Their newest monetary outcomes covers Q3 and the primary 9 months of 2022. It got here out on the twenty seventh of October.

On the highest line, the income from insurance coverage companies over the primary 9 months of 2022 was steady and just like that of final 12 months. The income was RMB 554 billion. Premiums from new insurance policies had been RMB 171 billion, which was a rise of 6.3% 12 months on 12 months.

The online revenue in Q3 attributable to shareholders was down 24% to RMB 5.74 billion as in contrast with the identical interval final 12 months. Over the primary 9 months, the web revenue was RMB 31.18 billion. That’s 36% decrease than that of 2021.

EPS in Q3 was RMB 0.20, and the 9 months’ EPS was RMB 1.10 The lower in funding earnings got here largely from the rising volatilities within the fairness market.

Please take observe that China Life Insurance coverage as an insurance coverage and funding firm is just not required to incorporate non-recurring objects similar to honest worth positive factors/(losses) from monetary belongings of their revenue or loss statements.

Internet money movement from operation for the primary 9 months was RMB 288.7 billion, which was 17% larger 12 months over 12 months.

Importantly, the solvency of China Life Insurance coverage continued to remain at a better stage. The core solvency ratio and the great solvency ratio of the Firm had been 161.93% and 230.26%

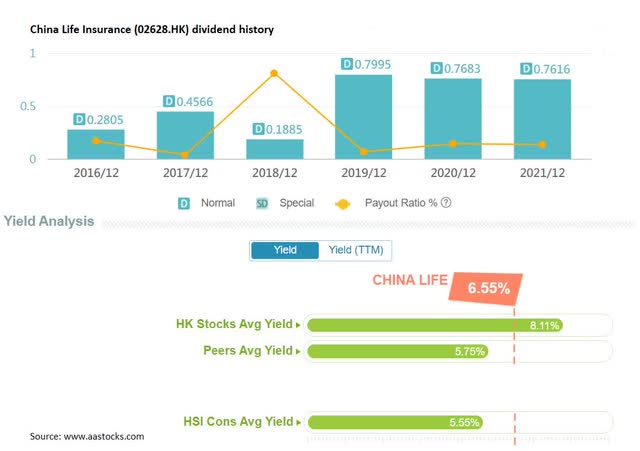

When it comes to returning capital to shareholders, China Life Insurance coverage pays out a dividend yearly. Right here is the dividend for the final 6 years.

China Life Insurance coverage dividend historical past (Aastock.com)

Presently, the yield is 6.55% which is kind of acceptable and barely larger than that of its friends.

Some common followers have complained to me this 12 months about their Hong Kong inventory portfolio. It’s comprehensible because the market did go down about 38%, however has since recovered about 35% of this.

However what’s attention-grabbing from the graph above, the net portal aastocks.com claims that the common dividend yield for Hong Kong shares is 8.11%.

That’s fairly excessive, and almost definitely a results of depressed share costs regardless of worthwhile companies. We have a look at this as a possibility.

Delisting of the ADS from NYSE

The opposite day we acquired an e-mail from considered one of our readers that requested:

Pricey sir, I’ve shares of LFCHY within the inventory market of America. After the inventory has delisted and stopped buying and selling, what’s the best resolution a) to be transferred to the Hong Kong inventory trade b) to be offered and in what manner? Trying ahead to your recommendation. Thanks “

On the twenty sixth of August, China Life Insurance coverage introduced that it had determined to exit the US inventory market after taking into consideration two foremost components – the restricted buying and selling quantity of its American depositary shares (ADSs) relative to the worldwide buying and selling quantity of its underlying abroad listed shares (H shares) and the appreciable administrative prices of sustaining the itemizing of the ADSs on the New York Inventory Trade.

The actual cause may maybe be the then unresolved auditing dispute between Chinese language firms and U.S. regulators.

A number of massive Chinese language state-owned firms determined they don’t must be listed within the U.S. to draw capital, because the capital market in China, together with Hong Kong, does this properly.

Buyers who held the ADS ought to contact their brokers for settlement. It shouldn’t be tough for them to promote via the identical brokers they bought the shares. They will then select a reduction dealer within the nation of their residence to buy shares in these firms listed in Hong Kong.

Danger to the thesis

In our final article, our foremost concern was whether or not the federal government would limit their massive state-owned firms, like China Life Insurance coverage as to how a lot cash they need to make.

There are a lot of methods they will do that. They might intervene and put “worth caps” on sure insurance coverage merchandise, or because the western world now could be doing to the power trade, simply add on a “windfall tax”.

Xi Jinping has secured his place and it stays to be seen what they do of their pursuit of “widespread prosperity”. It isn’t a nasty factor to deal with the inequality in society and the rising distinction between the wealthy and poor.

From studying the tea leaves, it does look like preferential therapy might be given to massive state-owned firms over smaller non-public firms.

Conclusion

Long run, the wealth creation that’s going down in China will, in my private opinion, proceed.

China Life Insurance coverage is properly positioned to supply service merchandise to cater to this demand.

Traditionally, individuals in China have used actual property as their type of saving for previous age, however I do assume the final couple of years with a lot of them shedding cash in that asset class, and the media consideration it received, may maybe change individuals’s notion of what good investments are. Different types of investments might profit from this.

China Life Insurance coverage ought to profit from this

My purchase stance stays intact.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.