adamkaz/iStock by way of Getty Pictures

Due to rising rates of interest which are getting used to fight inflation, in addition to a decline in client spending capabilities which are closely associated to broader financial circumstances, just about every thing associated to the house constructing market is taken into account scary territory so far as traders are involved. Actually, there may be some ache being skilled on this market. Besides, one firm that’s holding up pretty properly is a agency referred to as Tri Pointe Properties (NYSE:TPH). Within the close to time period, if information is any indication, this regionally targeted dwelling builder is more likely to expertise some ache on its prime and backside strains. Regardless that that’s the case although, for traders who’re targeted on the lengthy haul, it is precisely this ache which will make the corporate a worthy prospect to contemplate right now.

Ache is constructing and constructing is painful

Again in June of this yr, I wrote an article that took a somewhat bullish stance on Tri Pointe Properties. In that article, I talked about how good a job the corporate had completed over the prior few years to develop its prime and backside strains. Even at the moment, deliveries, backlog, and the pricing that it costs for its companies, have been all coming in pretty sturdy. To prime all of it off, shares have been buying and selling at enticing ranges that made me suppose as if long-term upside might be somewhat materials. Due to that, I ended up ranking the corporate a ‘purchase’ to replicate my view that shares ought to outperform the broader market transferring ahead. Quick ahead to at this time, and that decision has not gone precisely as deliberate. Whereas the S&P 500 is down roughly 1%, shares of Tri Pointe Properties have declined 9.8%.

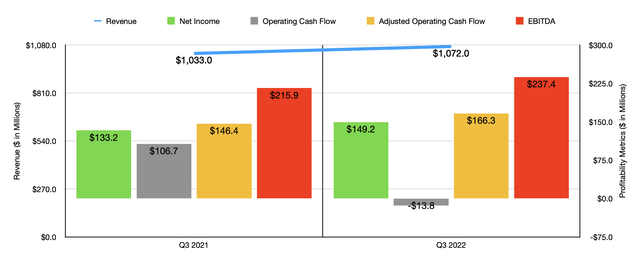

Creator – SEC EDGAR Knowledge

In case you have a look at the corporate based mostly solely on its income, profitability, and money flows, you’ll be perplexed as to why share value efficiency has not remained not less than in keeping with the broader market. To see what I imply, we’d like solely have a look at the third quarter of 2022. Throughout that quarter, gross sales got here in at $1.07 billion. That represents a modest enhance over the $1.03 billion the corporate generated the identical time final yr. Along with seeing gross sales rise, profitability additionally improved. Internet revenue of $149.2 million beat out the $133.2 million reported one yr earlier. Sure, it’s true that working money circulate worsened yr over yr, dropping from $106.7 million to destructive $13.8 million. But when we regulate for modifications in working capital, it will have risen from $146.4 million to $166.3 million, whereas EBITDA for the enterprise expanded from $215.9 million to $237.4 million.

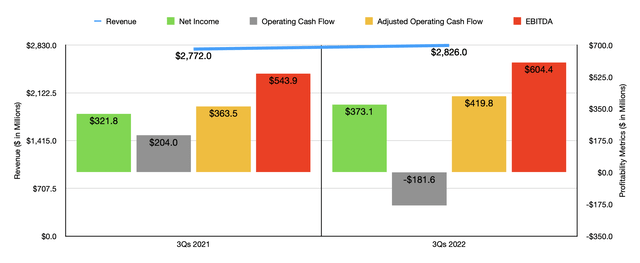

Creator – SEC EDGAR Knowledge

The info for the third quarter was not the one optimistic information for the corporate. For the primary 9 months of 2022 as an entire, gross sales got here in sturdy at $2.83 billion. That represents a rise of 1.9% over the $2.77 billion the corporate generated the identical time final yr. Simply as was the case within the third quarter alone, income and money flows adopted income larger. Internet revenue elevated from $321.8 million final yr to $373.1 million this yr. As soon as once more, working money circulate fell, falling from $204 million to destructive $181.6 million. However on an adjusted foundation, it elevated from $363.5 million to $419.8 million, whereas EBITDA grew from $543.9 million to $604.4 million.

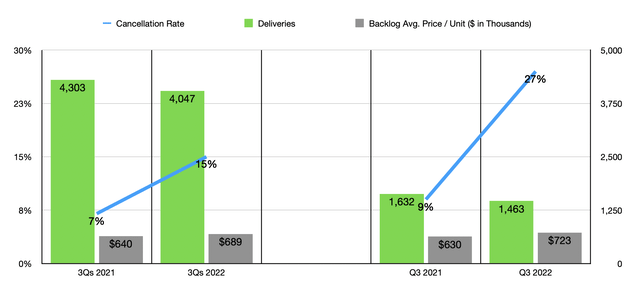

Creator – SEC EDGAR Knowledge

We do not actually know what to anticipate in the case of the long run for lots of various firms. However in the case of home-building companies, we do have some extra perception that’s of great worth. It’s because they sometimes present quite a lot of information relating to backlog, together with pricing, unit rely, and extra. These figures are sometimes main indicators that present what sort of potential the corporate has within the close to time period. And that’s the place the issues that traders occur to be. Take the third quarter once more. Throughout that point, the variety of houses delivered by the corporate totaled 1,463. That is really down from the 1,632 the corporate reported the identical time one yr earlier. It is solely as a result of the typical value of a property delivered throughout this time elevated considerably, climbing from $630,000 final yr to $723,000 this yr, that income managed to extend yr over yr for the agency.

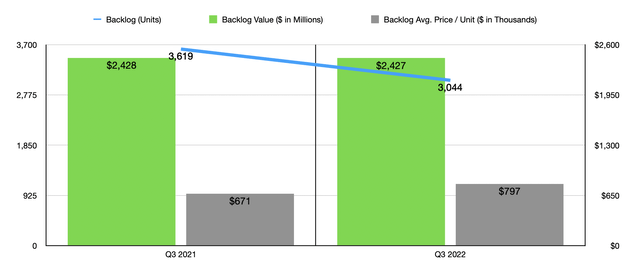

Creator – SEC EDGAR Knowledge

This weak point in the case of deliveries was not only a blip on the radar. It is a part of an unsettling development for the corporate. Contemplate whole backlog. As of the top of the newest quarter, the corporate had 3,044 models in its backlog. That is down from the three,619 models the corporate reported the identical time final yr. Along with the variety of deliveries decreasing backlog, the corporate additionally noticed its cancellation price spike to 27% within the third quarter. That is triple the 9% reported the identical time final yr. To make issues worse, that image appears to be getting progressively worse. For the primary 9 months of 2021, the cancellation price was solely 7%. And for the primary 9 months of this yr, it got here in at 15%. The one optimistic on this information is that the typical value of the houses in backlog stays strong, climbing from $671,000 within the third quarter of final yr to $797,000 the identical time this yr. It is also value mentioning that the variety of tons that the corporate has to construct on additionally decreased, dropping from 41,675 final yr to 37,269 this yr. If the image doesn’t worsen materially from right here, income and money flows can stay strong. In any case, the overall contract worth of its backlog is $2.43 billion. That is basically even with what the corporate reported the identical time final yr. However with rates of interest persevering with to extend, it is extremely inconceivable that the bleeding will cease.

After seeing these numbers, I can perceive why some traders may develop into bearish in regards to the firm. Actually, within the quick time period, the enterprise might expertise quite a lot of ache. It is not unthinkable that shares may fall additional in response to that. In the long run although, the housing market is destined to develop additional. Along with the inhabitants of the US persevering with to climb, it is also true that, in keeping with the latest estimates out there, there’s a housing scarcity of roughly 3.8 million models throughout the nation. On prime of this, shares of the corporate look somewhat low-cost at this time.

Creator – SEC EDGAR Knowledge

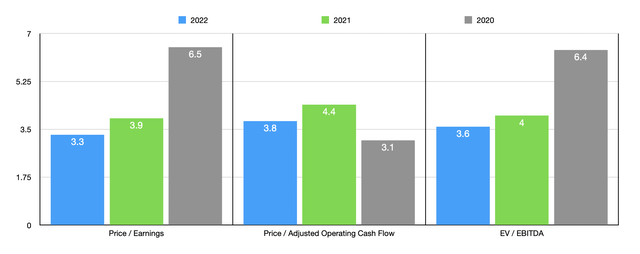

If we annualize outcomes skilled to date for 2022, we’d get internet revenue of $544.1 million, adjusted working money circulate of $484.5 million, and EBITDA totaling $754 million. As you may see within the chart above, this offers us some somewhat low buying and selling multiples for the corporate. On the similar time, nonetheless, this weak point the enterprise is experiencing ought to end in backside line efficiency worsening earlier than it will get higher. However even within the occasion that the corporate have been to revert again to 2020 ranges, shares would nonetheless look fairly low-cost on an absolute foundation. As a part of my evaluation, I additionally in contrast the corporate to 5 comparable companies. On a price-to-earnings foundation, these firms ranged from a low of two.8 to a excessive of 8.2. On this case, solely one of many 5 firms was cheaper than our prospect. Utilizing the value to working money circulate method, the vary was from 9.6 to 117.6. On this state of affairs, Tri Pointe Properties was the most cost effective of the group. And at last, utilizing the EV to EBITDA method, the vary was from 3.6 to 7, with two of the 5 firms tying with our goal as the most cost effective.

| Firm | Worth / Earnings | Worth / Working Money Stream | EV / EBITDA |

| Tri Pointe Properties | 3.3 | 3.8 | 3.6 |

| LGI Properties (LGIH) | 5.7 | 117.6 | 7.0 |

| Cavco Industries (CVCO) | 8.2 | 9.6 | 5.6 |

| Century Communities (CCS) | 2.8 | 25.7 | 3.6 |

| M.D.C. Holdings (MDC) | 3.6 | 10.4 | 3.6 |

| Dream Finders Properties (DFH) | 4.2 | 26.4 | 5.8 |

Takeaway

From what I see at this time, I perceive why traders is perhaps bearish within the near-term. For individuals who haven’t got not less than a five-year funding horizon, a good suggestion is perhaps to attend this out. On the similar time although, shares look extremely low-cost and I see no motive why, in the long run, we would not see some good upside for shareholders. This must be very true if present housing market circumstances end result within the housing scarcity rising much more extreme. On account of these components, I nonetheless price the enterprise a ‘purchase’ right now.