skynesher

Pricey readers/followers,

Recall my article on Aon plc (NYSE:AON)? I went “HOLD” on the enterprise at a time when it, primarily based on historicals, was neither grossly overvalued, but in addition wasn’t appealingly undervalued. Effectively, my selection, on this case, prevented a ten% complete RoR in lower than 6 months, which on this kind of market must be seen as very enticing. As such, my stance was too conservative.

I revisit Aon plc to see if there’s worth in altering my stance as we have a look at the corporate at the next valuation.

Aon plc – An replace

Aon plc is not an insurance coverage firm, as some would consider. Aon is a 40-year-old firm however with a historical past that goes again to the acquisition of a Detroit-based insurance coverage company that specialised in low-cost low-benefit accident insurance coverage, underwriting, and on-site coverage gross sales.

The corporate has existed by way of thick and skinny and has been delivering worth for its prospects and shoppers for many years. Aon started constructing a world presence by way of M&As of assorted insurance coverage brokerages and teams. Aon was truly, for a short time frame and because of a merger, the biggest insurance coverage dealer on the planet.

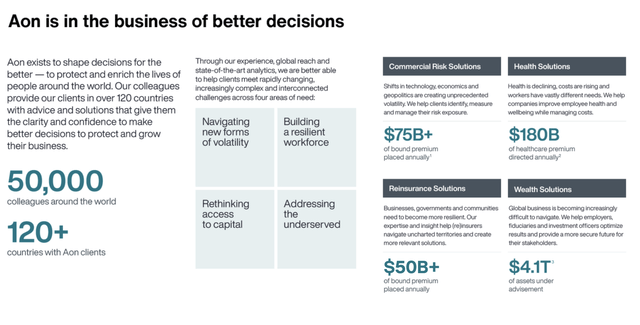

AON IR (AON IR)

I famous how the corporate was up 22% YTD in my final article. Add one other 10% to that, and a 32% outperformance up to now in an atmosphere that has seen indices fall by nearly the identical, which implies that Aon can declare a unfavourable correlation to the marketplace for this yr, which is one thing that is extraordinarily uncommon general.

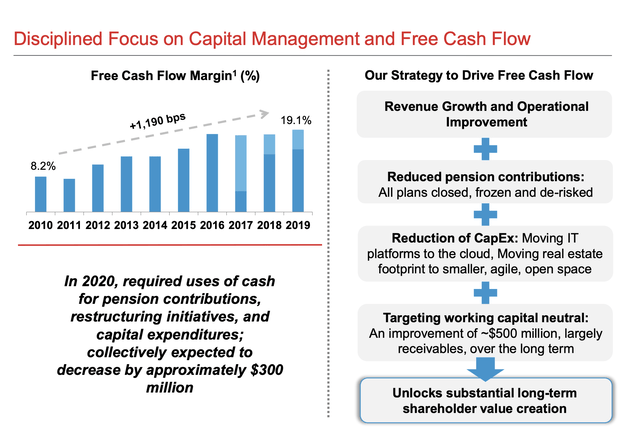

AON IR (AON IR)

The corporate’s enterprise is concentrated on Danger, reinsurance, well being, and wealth options, the place it does retail brokering, specialty options, reinsurance, and capital markets, consulting and brokerage for well being, and retirement, pensions, and investments.

The corporate’s revenues are a product of its commissions, compensation from its collaborative companions in insurance coverage and reinsurance, and buyer charges. These fluctuate relying on premium, contract kind, and dimension. The corporate additionally earns curiosity revenue from the premiums, claims, and in-transit funds by investing them in interest-bearing securities, sometimes inside a short-term time interval. There is a first rate quantity of seasonality to firm earnings, with shopping for patterns giving a powerful 1Q and 4Q.

I truly observe lots of the firm’s direct rivals – resembling Marsh & McLennan. This phase is not any stranger to me, however Aon is without doubt one of the largest in it, with a market capitalization that is closing in on round/over $60B presently.

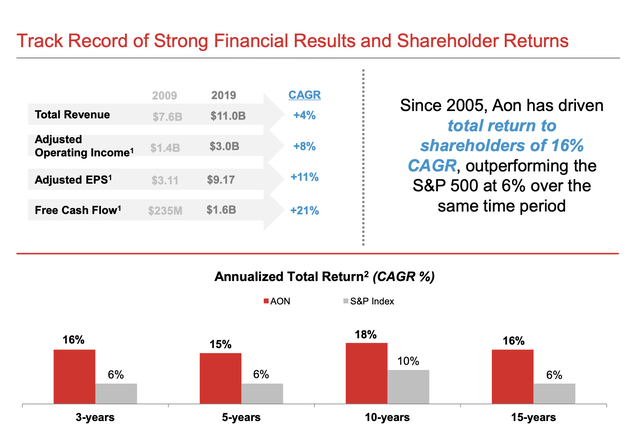

Aon can be used to doing what it did for the previous 6 months – outperforming the market, averaging 11% for the previous 20 years, which implies that anybody who invested in Aon, did much better than the market did.

Aon IR (Aon IR)

If the corporate had a yield that was above 2%, I might have been pushing capital to work right here ages in the past. But it surely would not. Aon’s largest downside to me as an funding is that it has a sub-1% yield. There are only a few issues that may work to make this fascinating to me in such a case.

That is specifically made difficult as a result of Aon would not present analysts resembling myself straightforward methods to research efficiency – Aon would not present a segment-by-segment breakdown of working revenue, even when they do present a income breakdown. This makes guesswork a extra than-preferred a part of forecasting and modeling the corporate.

We all know, for example, that Business Danger Options is the corporate’s by far largest generator of income, at over 50% of the corporate’s annual. Wealth Options is the smallest at round 12%. Apart from Wealth Options, all the firm’s revenue segments are fairly seasonal of their ebb and circulate. However we do not know sufficient or as many particulars as I am used to know. This at all times places Aon at a drawback, as a result of we’ve got to “belief” that the corporate is aware of what it is doing.

That is a tough place for me to be in as a result of I need extra management.

On the identical time, Aon has loads of benefits. It is well-placed in new markets, and issues like cyber threat and IP insurance coverage are very in “the now”, even when such new development segments are unlikely to de-throne industrial threat as a income generator.

The newest firm outcomes give us some coloration to the corporate’s newest bout of outperformance – or let’s consider, oddly sufficient, lack of coloration.

As a result of that is just about what I anticipated in my final piece. Inflationary pressures and different headwinds made top-line development 0% YoY, with an working margin for 3Q22 that is beneath 22%, which is to be in comparison with nearer to 30% for the total yr.

This isn’t to say the corporate did horribly. The corporate did enhance its margin growth from a Q-o-Q perspective, the identical with top-line income development, and the identical with adjusted EPS, regardless of FX impacts. I’ll have to regulate my expectations for inflation impacts right here as a result of because it appears, the corporate is managing issues decently, even when we’re not seeing 20%+ EPS development ranges as we did again in 2020-2021.

Nonetheless, a few of my bearishness relating to the underside line stays. I additionally do not see a convincing bullish case for the corporate’s argument for margin growth. Traditionally talking, Aon has achieved margin growth and efficiencies by restructuring prices, which appears to have the ability to be finished at solely restricted quantities from right here on ahead. Whereas the corporate has executed nicely in 1H22, the corporate’s latest outcomes appear to take a distinct cadence, margin variations of upwards of 600+ bps.

It is my stance that Aon’s development will likely be single-digit between 3-5% – presumably as a lot as 7%, however not more than that. This begs the query of how a lot we ought to be paying for a 0.8% yielding, A-rated firm.

The market is clearly saying that it is keen to pay extra – although I do not perceive this stance.

Let me make clear.

Aon Valuation

That Aon deserves some sort of premium, there is no such thing as a doubt or argument about. The corporate is just too good to commerce at a easy 14-15x P/E, too massive, and an excessive amount of of a moat in a world market.

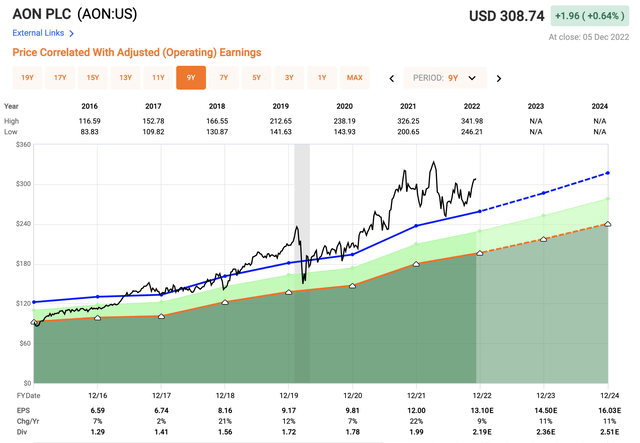

Nonetheless, the yield additionally influences how a lot we wish to be paying for the corporate right here. For the previous 5-7 years, the corporate’s premium has been increasing – from buying and selling at a premium of 16-18x P/E, to over 19-20x P/E. At present it trades at 23.71x.

Aon IR (Aon IR)

This, to me, makes for a really difficult funding thesis. The corporate is not value this a lot, as I see it, even with these development estimates. There are insurance coverage corporations, even brokers, that commerce at decrease multiples with higher upsides.

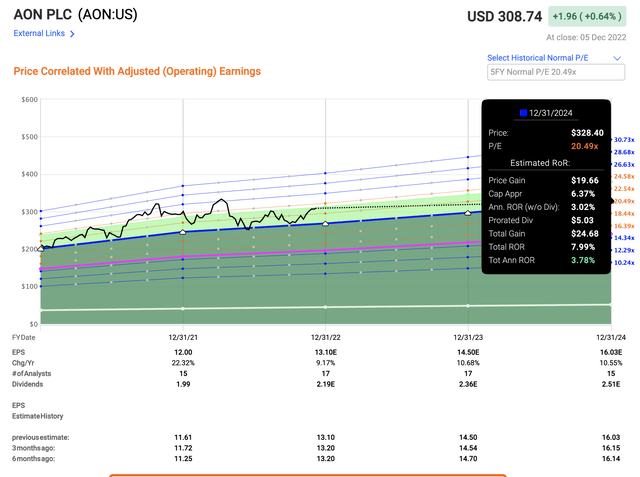

Even when we permit for the corporate’s 5-year common of 20.5x, the corporate’s 2024E RoR involves lower than 4% yearly with a share value goal of beneath $330/share. The 0.73% yield would not precisely assist issues right here.

Aon Upside (F.A.S.T graphs)

The very fact is that the upside and thesis at the moment are far worse than it was just a few months again. There isn’t a doubt in my thoughts that the corporate is without doubt one of the main insurance coverage and threat gamers in the marketplace. That is why it regularly outperforms.

Nonetheless, do not child your self in which you could’t lose cash or underperform when investing in a enterprise like this. You fairly simply can. In the event you had invested at 22X+ P/E again in 2002, your annual RoR would have been beneath 3% per yr for 10 years because of the valuation that you just invested in. I proceed to consider that such issues are potential when you had been to speculate at this valuation.

Valuation is gospel for me – it ought to be a minimum of a consideration for you if you have a look at an organization. as a result of you do not have dividends to offset the sluggish development, that you’ve got in higher-yield corporations.

For that purpose, my present thesis on Aon plc stays like this:

The corporate should not be invested in above a 20x P/E – on the very least it is best to watch for 19.9x earlier than placing cash to work right here. Under 20X P/E, you are investing beneath the 5-year P/E common – that is the costliest I might take into account enticing right here as a result of that is after we can get these double-digit returns.

Let’s take a look at analyst targets for the corporate and the way, and in the event that they’ve shifted.

S&P International considers the corporate a “HOLD” with a variety of $250 as much as $360, with a median of round $300 – but solely 2 out of 13 analysts are at a “BUY” right here, with 12 at both “HOLD” or “SELL”. These suggestions converse louder than the general value goal averages with their 3% present draw back. The quick and straight of it’s, that even analysts take into account the corporate overvalued at 23x+ P/E – and for as soon as, we’re in full settlement right here.

Me, I might take into account the $250 low-end goal a superb value to begin accumulating shares. I might stretch as excessive as $255, however no increased than that.

Regardless of outperformance, I am subsequently at a “HOLD” in the interim and would take into account the next as my thesis.

Thesis

- Aon plc is an excellent, basic firm in monetary companies and insurance coverage, and threat brokering. It is one of many leaders in its discipline and deserves your consideration on the proper value. That value is round $250/share, as I see it.

- A mixture of near-term challenges associated to macro, inflation, and premium headwinds calls into query how excessive an upside on a 3-year foundation the corporate truly has.

- As issues stand, I do not consider administration forecasts a bullish perspective fairly as a lot and would go extra conservative right here.

- Aon plc is a “HOLD” to me in the interim.

Keep in mind, I am all about:

- Shopping for undervalued – even when that undervaluation is slight and never mind-numbingly huge – corporations at a reduction, permitting them to normalize over time and harvesting capital beneficial properties and dividends within the meantime.

- If the corporate goes nicely past normalization and goes into overvaluation, I harvest beneficial properties and rotate my place into different undervalued shares, repeating #1.

- If the corporate would not go into overvaluation however hovers inside a good worth, or goes again right down to undervaluation, I purchase extra as time permits.

- I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed below are my standards and the way the corporate fulfills them (italicized).

- This firm is general qualitative.

- This firm is basically secure/conservative & well-run.

- This firm pays a well-covered dividend.

- This firm is at the moment low-cost.

- This firm has a sensible upside that’s excessive sufficient, primarily based on earnings development or a number of growth/reversion.

The corporate doesn’t fulfill my valuation standards – and subsequently it warrants not more than a “HOLD”.