Worth drawdown from ATH

2022 approaches year-end; it has been a historic 12 months for all asset courses because of the fast tightening of financial coverage worldwide and the energy of the U.S. greenback. It had extreme implications on the crypto ecosystem, which has seen a variety of liquidations and margin calls, in addition to the collapse of FTX and Luna.

A blended 12 months for the Ethereum ecosystem noticed a profitable merge in September, and, consequently, ETH was web deflationary for October. Nevertheless, the magnitude of losses from an investor standpoint has been monumental within the DeFi ecosystem.

Ethereum is at the moment 73% off its all-time excessive, floating round $1,200; vital liquidations and deleveraging have occurred in 2022 with the autumn out of Luna again in Could and FTX collapse in November.

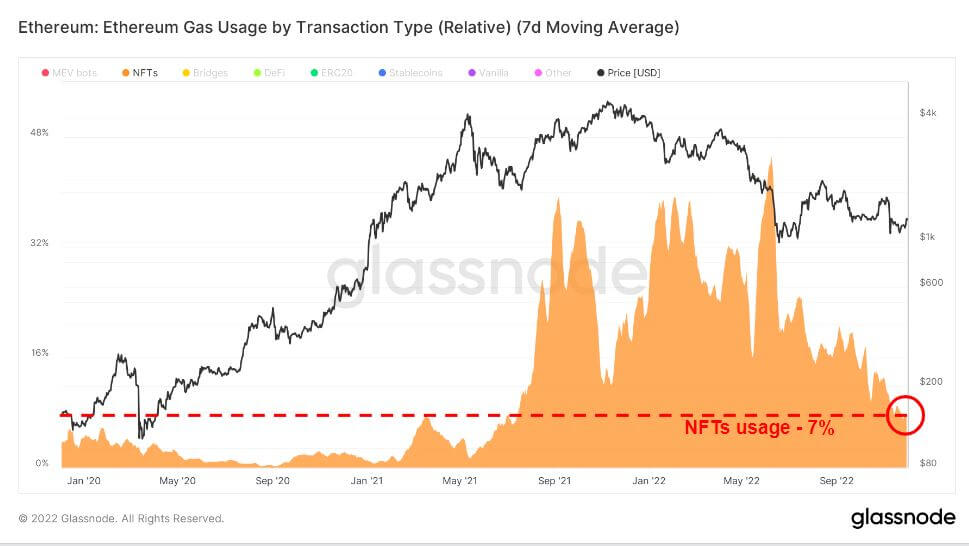

Ethereum gasoline utilization from 2020 – 2022

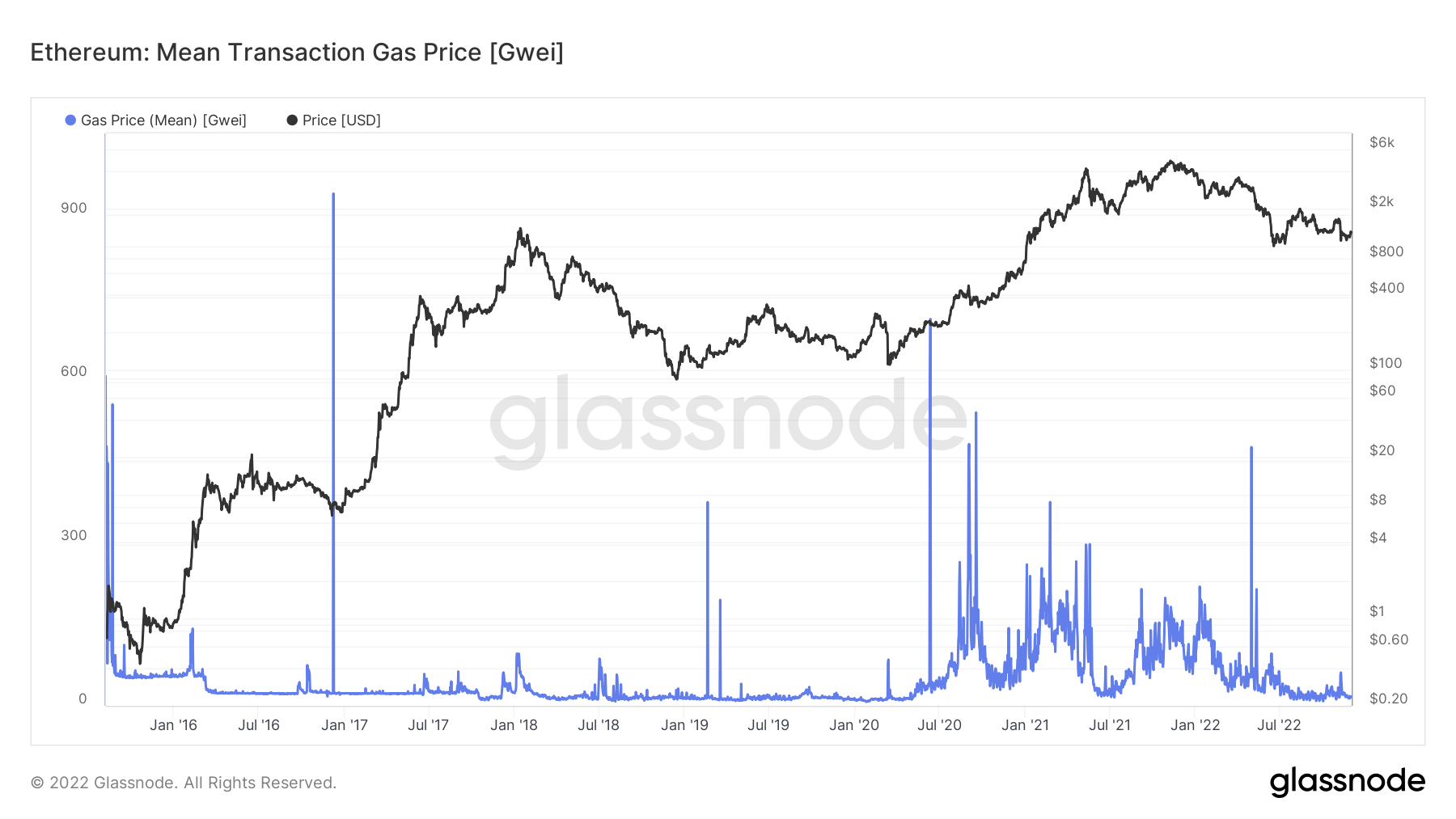

Fuel charges are the price of conducting a transaction or executing a contract. For instance, this might see exchanging right into a stablecoin or minting an NFT.

Because the summer season of 2020, Ethereum gasoline charges have taken off primarily because of the explosion of DeFi use on chain.

Though community exercise has tailed off considerably for the reason that summer season of 2021, the problem of Ethereum being an costly chain nonetheless prevails.

Ethereum gasoline charges are priced in gwei, a unit of measure equal to one billionth of 1 ETH. Fuel prices fluctuate relying on the community’s congestion, with intervals requiring increased gasoline charges throughout peak demand to push via a transaction.

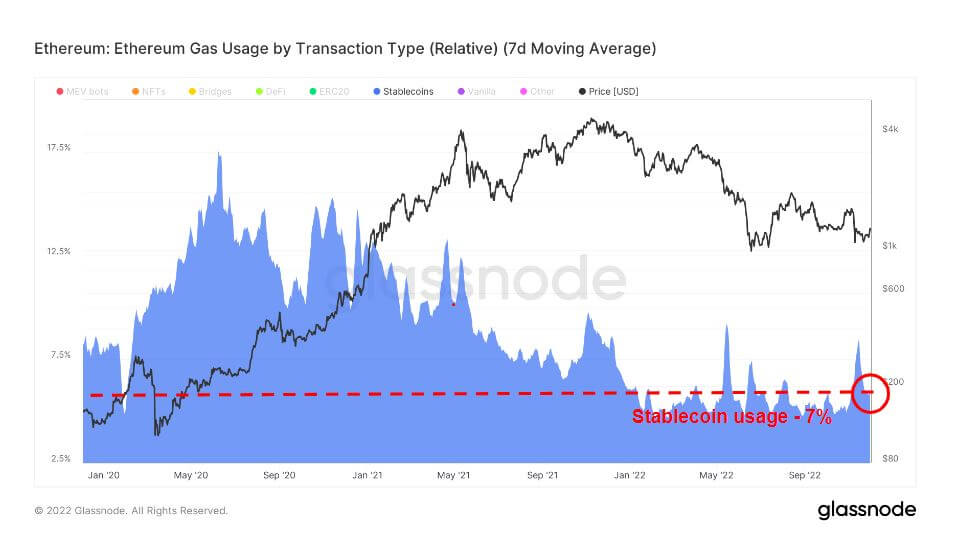

Stablecoins are cryptocurrencies designed to attenuate worth volatility by being pegged to a reference asset. The reference asset might be a commodity, cryptocurrency, or fiat cash.

The market affords numerous stablecoins, comparable to asset-backed, together with fiat, crypto, or valuable steel belongings, and algorithmic, which add to or subtract from circulating token provide to peg the value on the desired degree.

The present gasoline utilization for stablecoins is 7% which has been roughly flat for 2022; nonetheless, stablecoin mass adoption began initially of 2020, hitting a peak of just about 20% of Ethereum gasoline utilization.

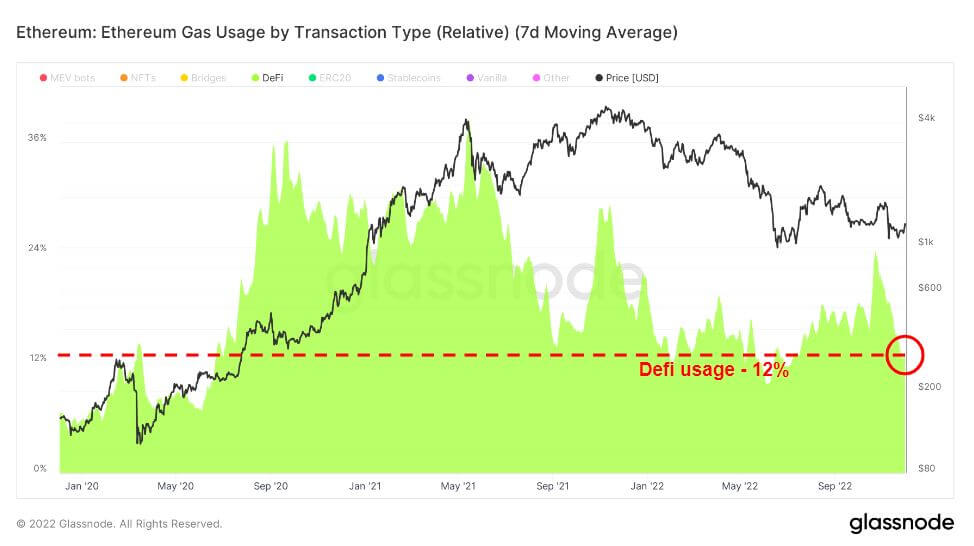

Decentralized finance (DeFi) is an rising expertise that cuts out banks and monetary establishments, linking customers straight with monetary merchandise, usually lending, buying and selling, and borrowing.

DeFi adopted shortly after the stablecoin growth; from July 2020, Uniswap emerged because the main DeFi gasoline consumer, peaking round June 2021 earlier than tapering downwards. DeFi utilization has maintained a tough 12% common for 2022, above the early 2020 utilization.

Out of the trifecta, NFTs have been the final to growth on this cycle, exploding on the finish of 2021. In consequence, through the 2021 bull run, OpenSea noticed essentially the most vital spikes in gasoline utilization from NFT demand. Nevertheless, from June 2022, demand has cooled considerably but stays considerably elevated in comparison with earlier years.

Decline in transaction rely and gasoline worth

Ethereum gasoline utilization and transaction counts are at year-to-date lows; the imply gasoline worth has been considerably muted for the previous 4 months, with slight upticks because of the current merge and FTX collapse. Whereas transaction rely is approaching year-to-date lows, suggesting the bear market has taken its toll on customers.

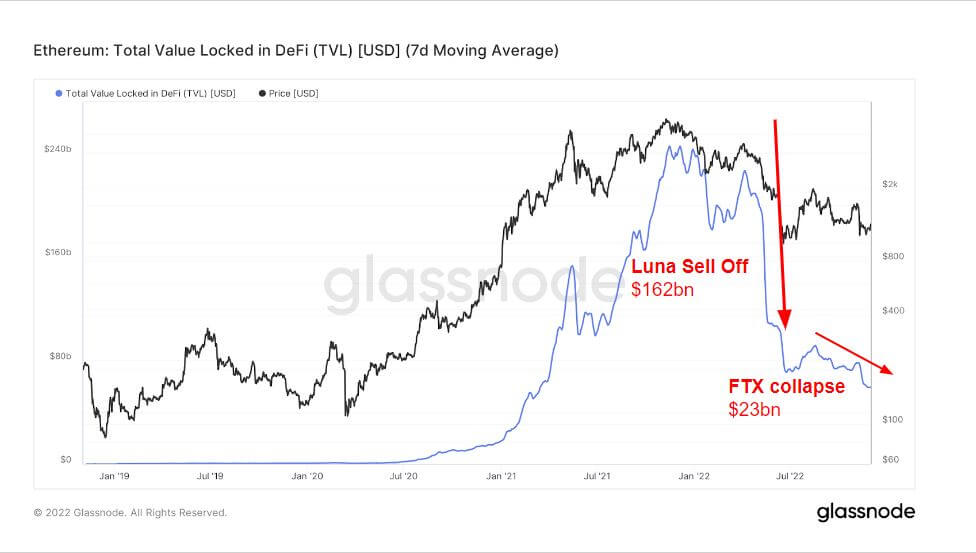

The rise and fall of TVL in DeFi (USD)

Complete Worth Locked (TVL) measures the full worth of all belongings locked into DeFi protocols. TVL is denominated in USD or ETH, whereas DeFi protocols supply lending, liquidity swimming pools, staking, and extra.

The chart under reveals the full worth locked in all of DeFi, which surpassed $240bn again in the summertime of 2021, because of the nature of DeFi protocols having the ability to get hold of leverage and using borrowing and utilizing your crypto as collateral.

The bull of 2021 and the bear of 2022 have been unprecedented by any 12 months because of the huge stimulus supplied by the central banks in 2020, which noticed the vast majority of leverage and borrowing get worn out in 2022.

In the course of the Luna sell-off, TVL went down over $160bn; admittedly, a sell-off occurred simply earlier than Luna through the peak of the bull run in Nov 2021, more than likely buyers withdrawing from the ecosystem. Moreover, the FTX collapse resulted in an extra $23bn sell-off, placing TVL at round $70bn, much like early 2021.

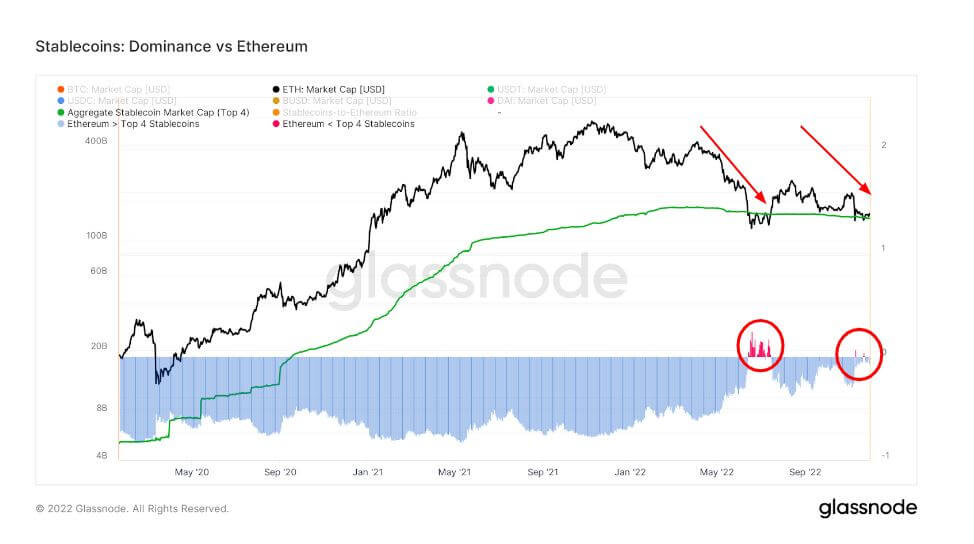

Stablecoin efficiency because of FTX collapse

Ethereum’s dominance excessive 4 stablecoins has been on a downtrend since Could, with stablecoins changing into extra dominant in June — when ETH hit its lowest worth for the 12 months.

This chart compares the Ethereum Market Cap to the combination worth of the highest 4 stablecoins USDT, USDC, BUSD, and DAI. Observe that the provides of those stablecoins are distributed between a number of host blockchains, together with Ethereum.

In June, the ETH market cap was decrease than the highest 4 stablecoin market caps because of Luna, and the identical occurred through the FTX collapse; nonetheless, a a lot smaller drop for under a short interval.

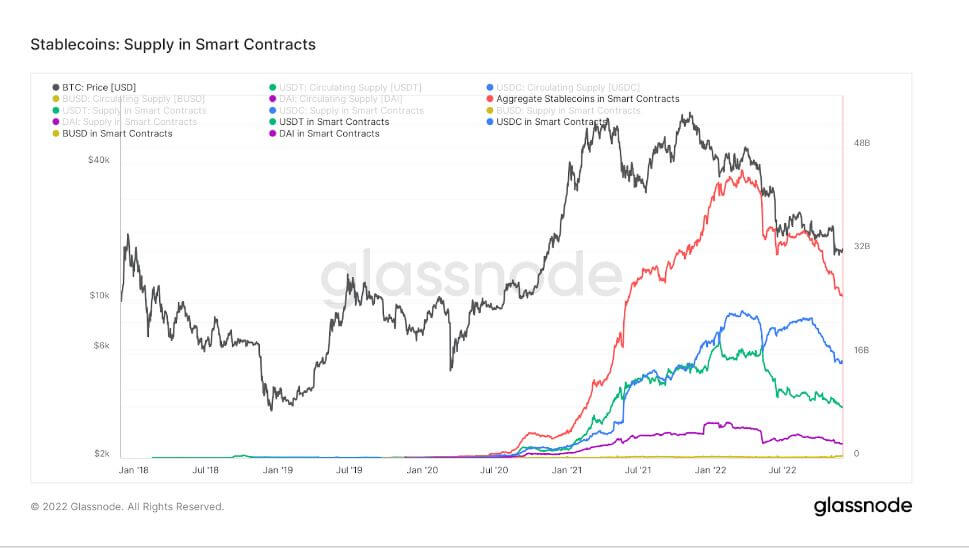

The chart under reveals the full provide issued on and held inside Ethereum sensible contracts. This chart reveals the combination provide held in sensible contracts alongside particular person traces for the highest 4 stablecoins USDT, USDC, BUSD, and DAI.

One other noticeable development within the stablecoin ecosystem is the extreme decline within the provide of sensible contracts. Mixture provide throughout its peak was at $44bn; for the reason that Luna and FTX collapse, it’s now hanging round $25bn. A major decline in all high 4 stablecoins as effectively.

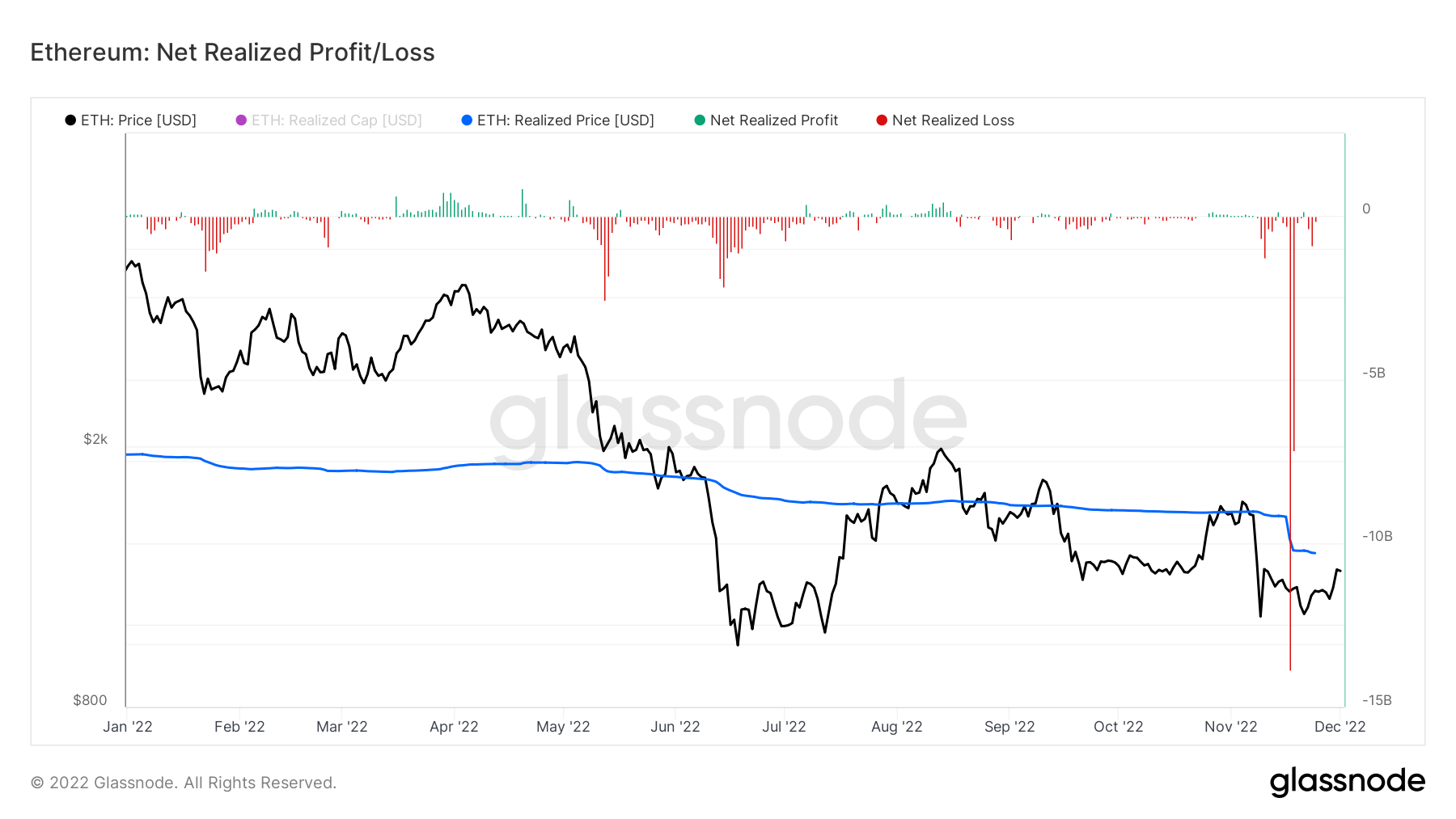

Substantial losses for Ethereum

Web realized revenue/loss is the web revenue or lack of all cash spent that day. The value at which every spent coin was final moved and the present worth permits the calculation of the USD worth the proprietor realized in revenue or loss.

Over the week through the FTX collapse, Ethereum realized losses amounted to over $20bn, with $14bn approaching Nov. 17, a number of occasions worse than the Luna collapse for buyers.