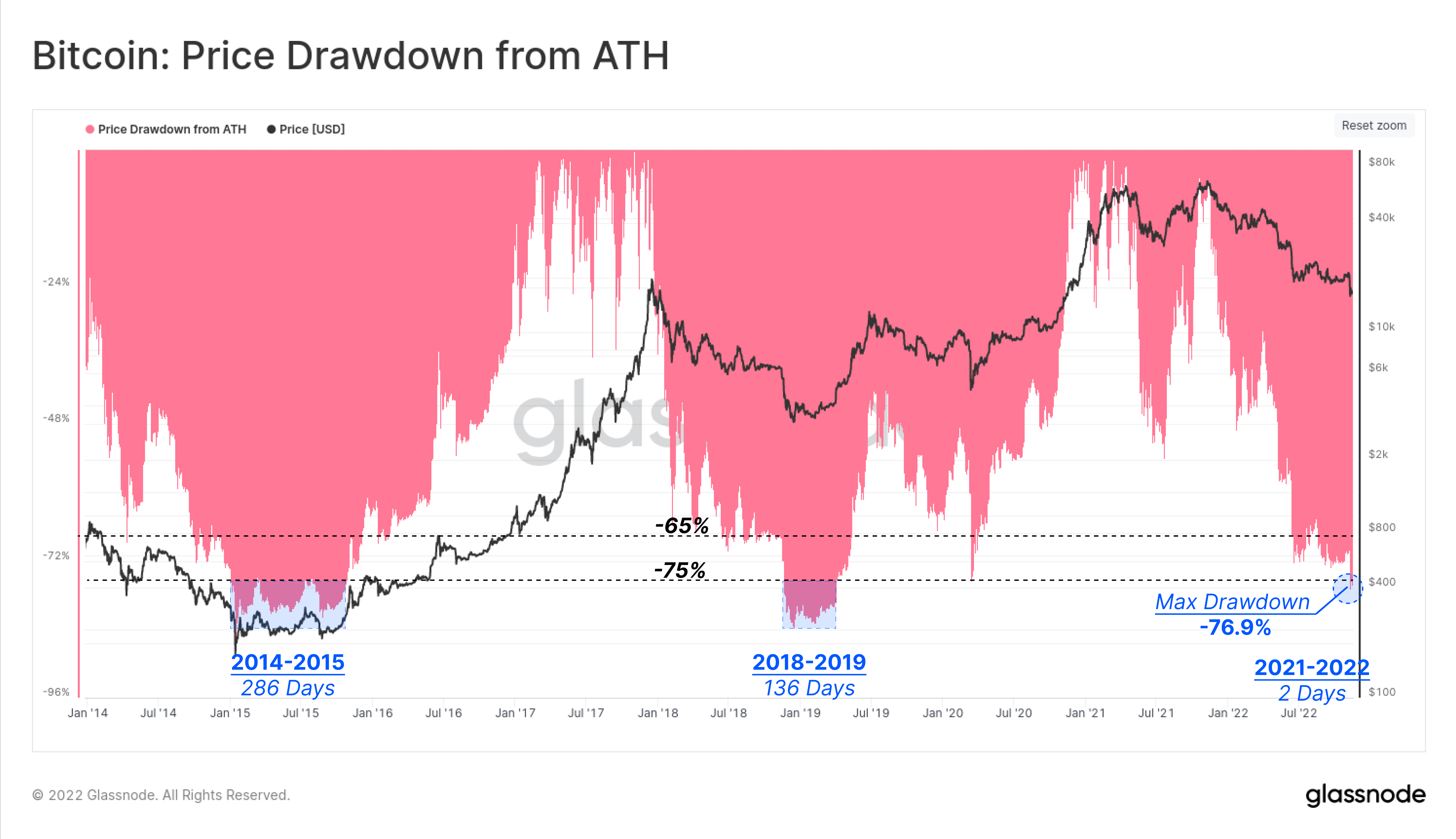

Worth drawdown from ATH in comparison with earlier bear markets

Bitcoin is at present down 75% from its all-time excessive (ATH), with a max drawdown of 76.9% from the fallout of FTX on Nov. ninth. Nonetheless, this isn’t uncommon in Bitcoin’s historical past. Through the 2014-15 bear market, Bitcoin retracted over 85% from its ATH, and lasted for round 286 days in max capitulation.

The same occasion occurred throughout the 2018-19 bear market, which additionally noticed an 84% drawdown for 136 days. The 76% drawdown began in mid-November, so based mostly on historical past, this might proceed into Q1 2023.

2022, a distinct bear market in comparison with 2014 and 2018

The present 2022 bear market is dissimilar from the bear markets of 2014 and 2018 for a lot of totally different causes, primarily on account of Bitcoin changing into a mainstream forex.

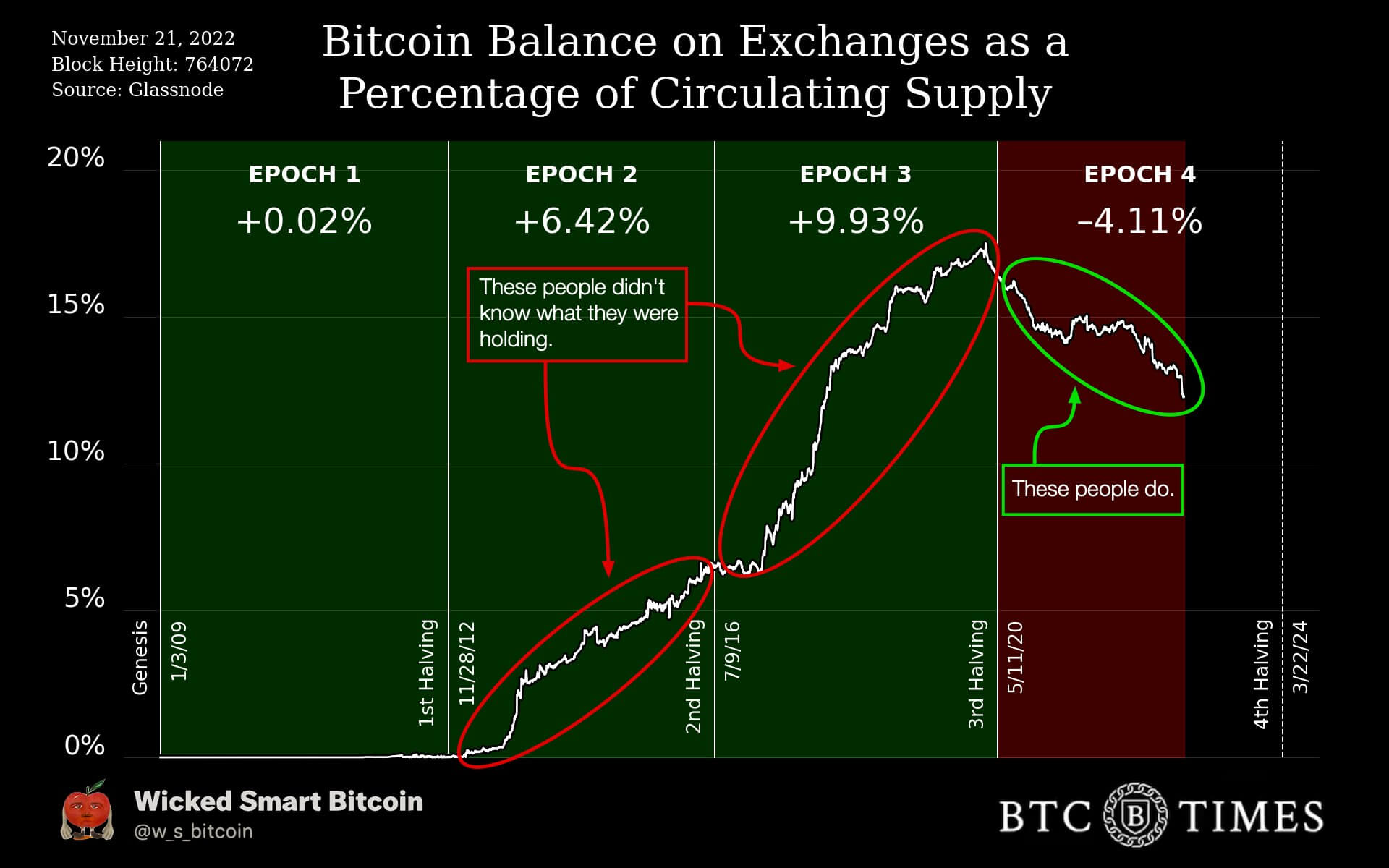

Epoch 2 – Second Halving (2012-2016)

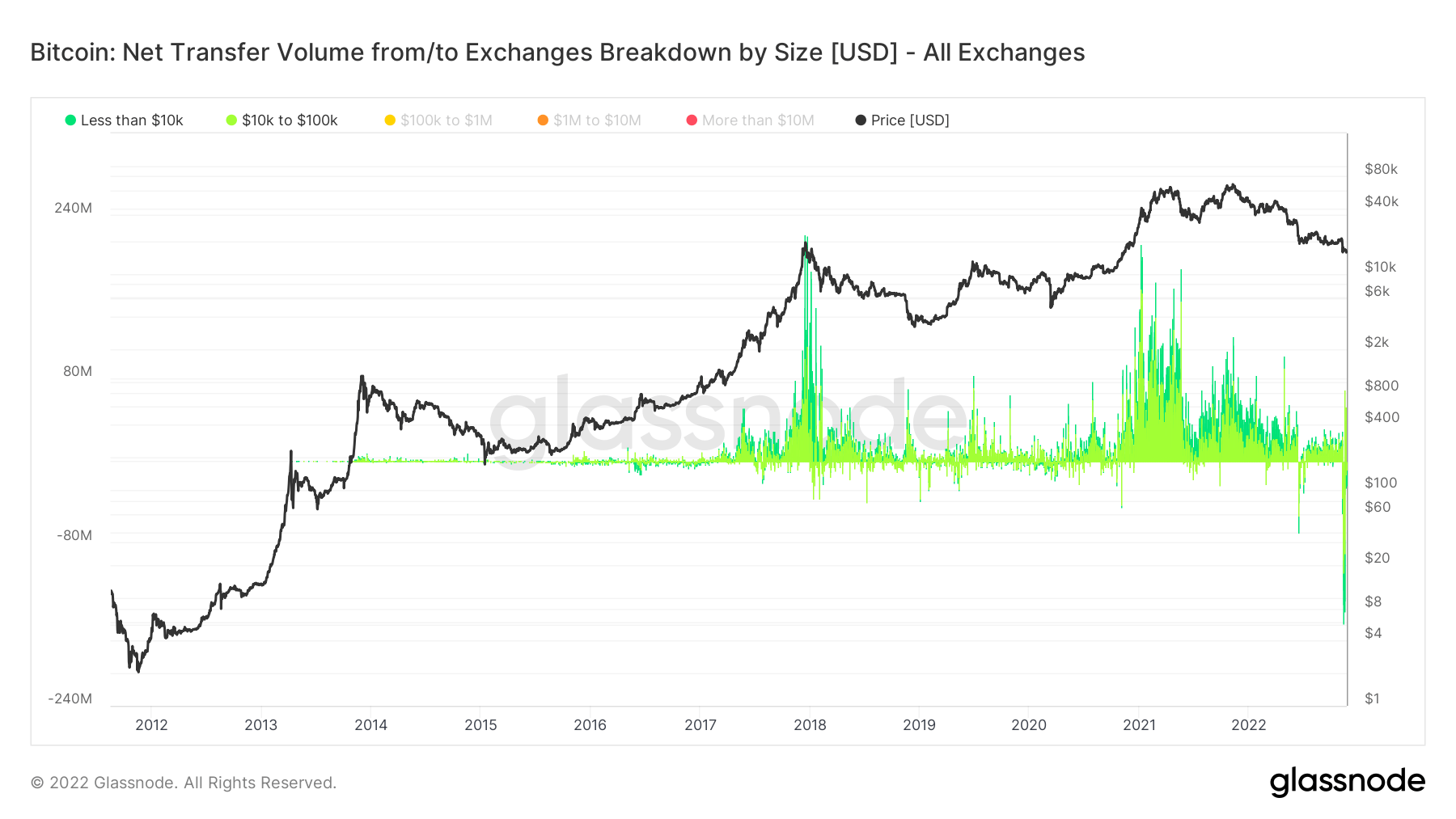

Through the 2013 bull run, when Bitcoin spiked to over $1,000 – and in 2017, when the worth hit $20,000 – cash had been going onto exchanges quickly.

Through the second halving, or epoch 2 – which noticed Bitcoin declare a excessive of $1,000 – virtually 6.5% of Bitcoins returned to centralized exchanges. From the start to the tip of Epoch 2, a few hundred Bitcoin to over a thousand Bitcoin ended up on exchanges.

Epoch 3 – Third Halving

The third epoch began in the course of 2016, which noticed round 1 million Bitcoin on exchanges. On the finish of the third halving, exchanges held over 3 million Bitcoin, simply earlier than Covid 2020. This noticed the worth of Bitcoin rally to $20,000 on the finish of 2017 however noticed a low of $3,000.

Epoch 4 – Fourth Halving

Since covid and the beginning of the fourth halving, exchanges have seen a decline of over 4% of Bitcoin provide, leaving round 12% of provide left on exchanges. Up to now 30 days, over 135k Bitcoin has been withdrawn from exchanges — a 1% deduction of Bitcoin provide. That is the primary epoch that cash are being eliminated in a bear market. Up to now, Bitcoin has seen a low of $15,500 from its peak of $69,000.

This time is totally different, retail are withdrawing their cash

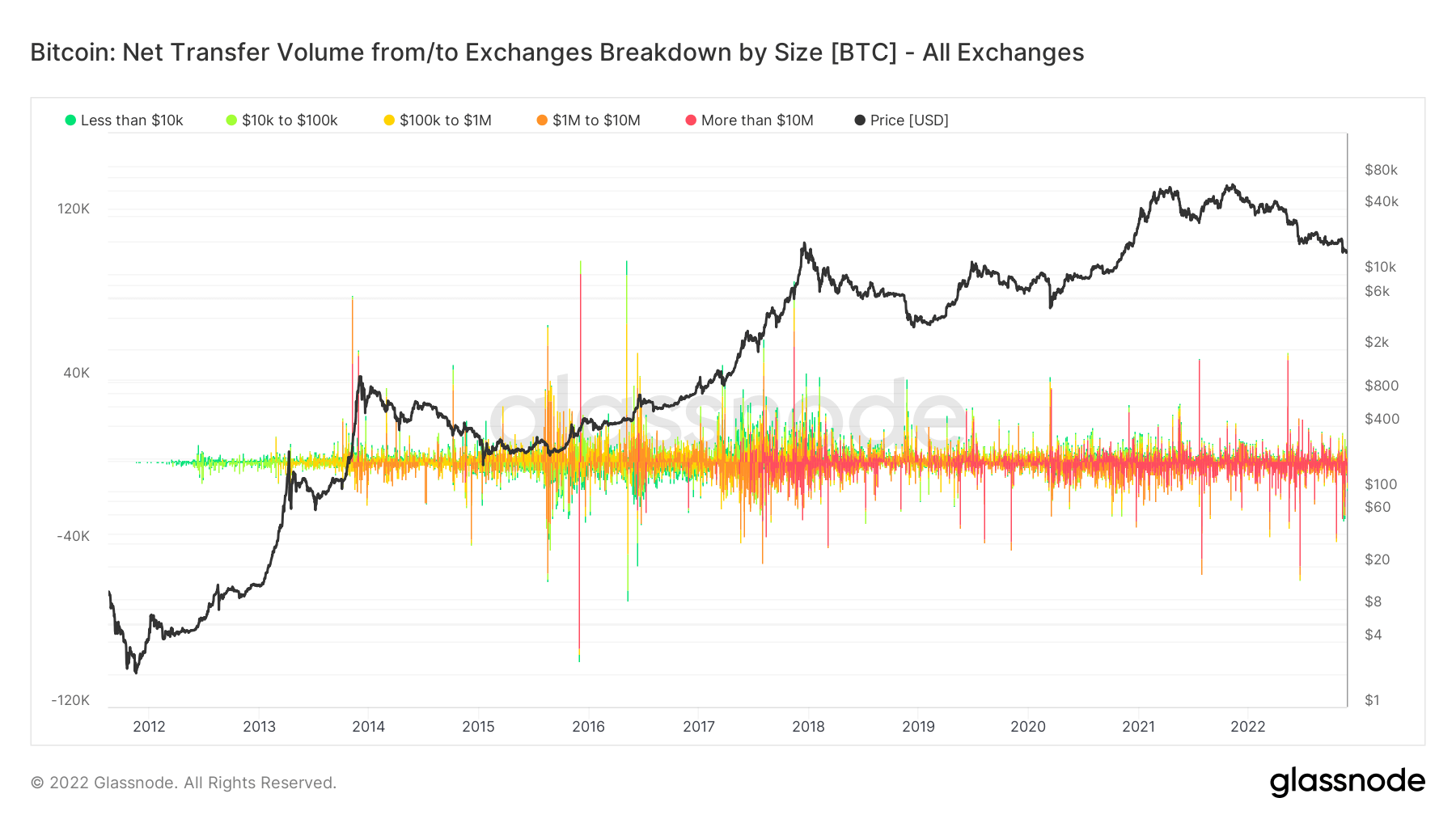

An additional deep dive into what cohorts are withdrawing their Bitcoin from exchanges:

As may be seen since Bitcoin’s inception, a flurry of inexperienced to yellow transactions has signaled small transactions. As time went on and as much as round 2017, a storm of purple transactions began to happen, signaling institutional adoption coming into the house.

Nonetheless, filtering to indicate retail transactions beneath $100K, it’s obvious that they FOMO’ed throughout the peak bull runs of 2017, and 2021 — with over $200 million throughout peak days. Then again, over the previous 30 days, the community has seen probably the most withdrawals from retail ever, surpassing $180 million. Retail could have discovered a large lesson with the fallout of FTX and the which means “not your keys, not your cash.”

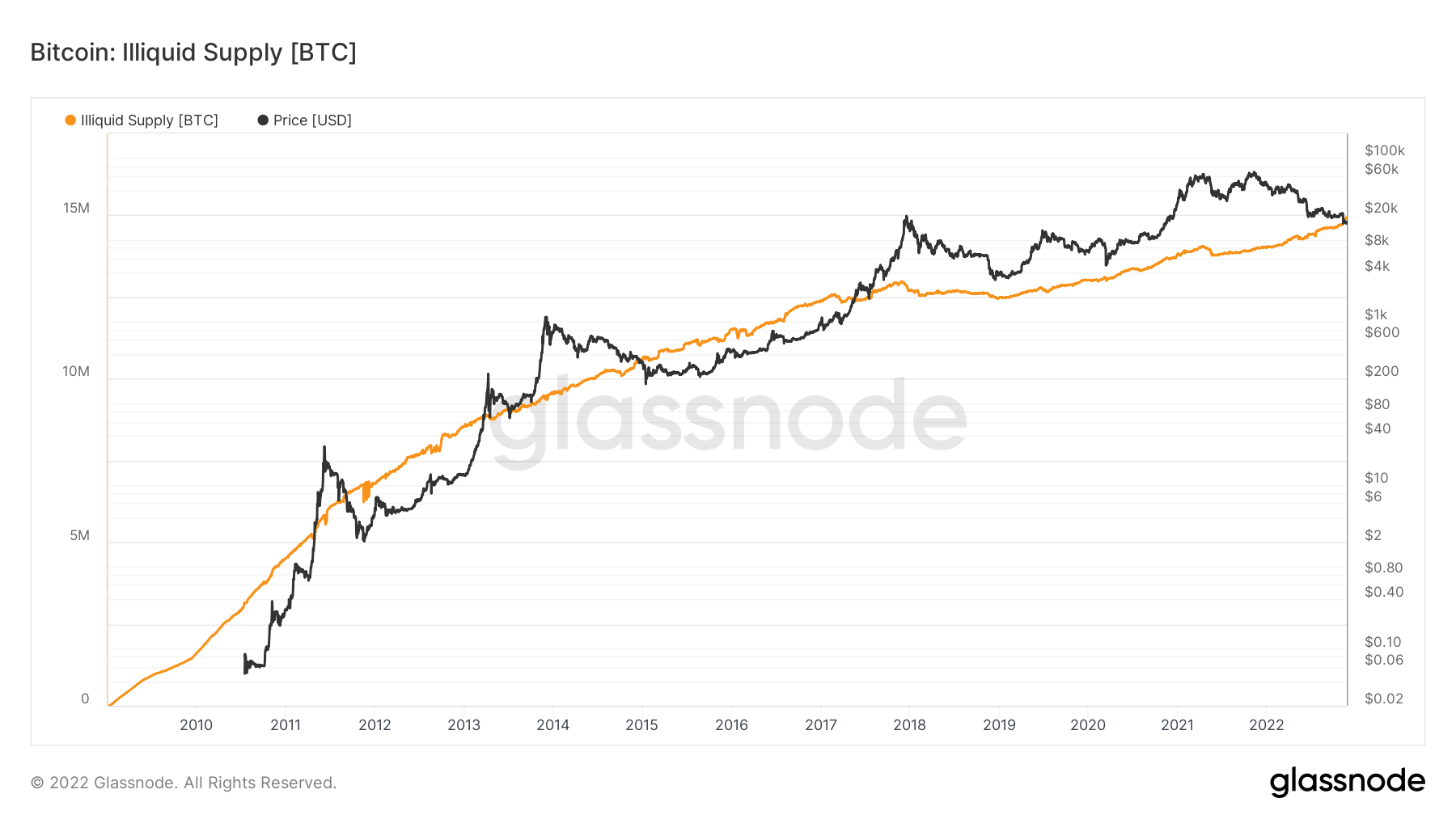

As a result of collapse of FTX and different centralized entities inside the crypto house, self-custody has been a sizzling matter, and the variety of cash in self-custody has grown exponentially in 2022 (from 14 million to fifteen million). The present circulating provide of 19.2 million would put self-custody cash at 78%.

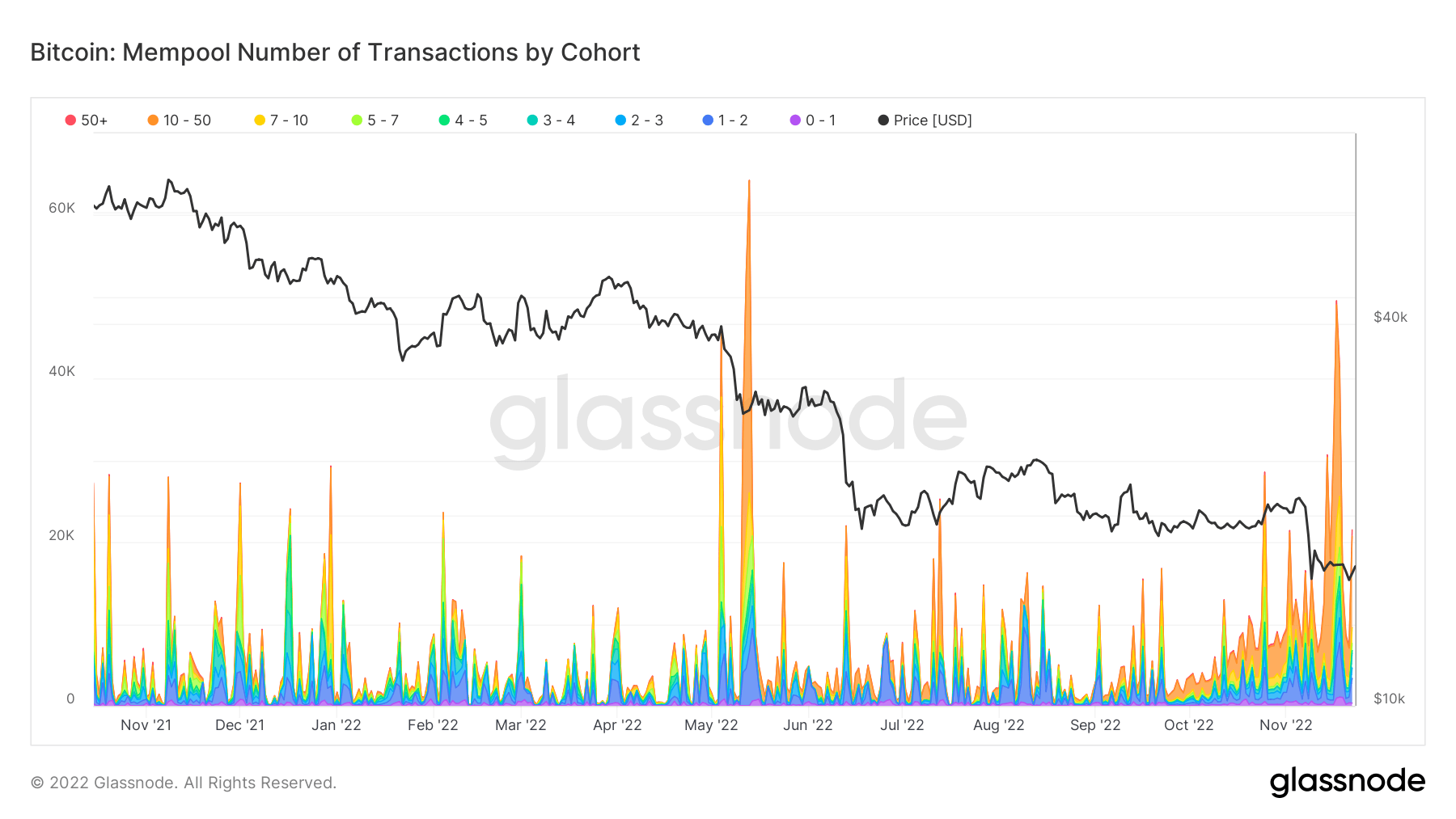

Mempool was packed, individuals aren’t ready for proof of reserves

As a result of variety of cash leaving exchanges, the mempool has seen a considerable enhance in transactions — most notably in June and November. A transparent correlation may be seen in capitulation from the fallout of FTX and Luna.

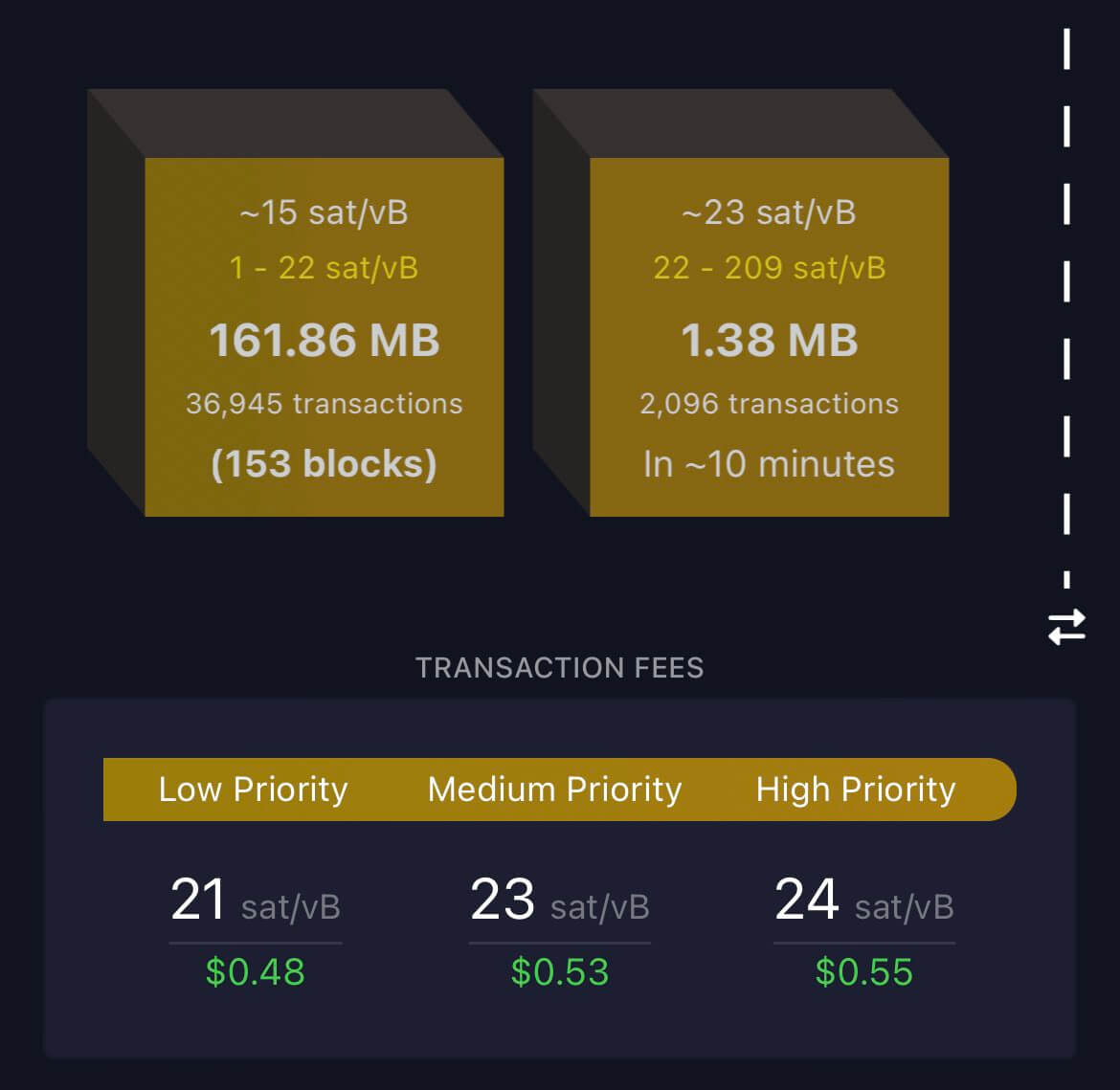

What occurred final week noticed a large quantity of community quantity and visitors increase on-chain. When the mempool will get backlogged, nodes prioritize these with larger charges throughout excessive volumes.

On Nov. 14th, 154 blocks had been ready within the mempool. This was probably the most appreciable backlog since Could 2021 and such huge exercise has hardly ever been seen exterior of a bull market.

New entities coming into the ecosystem

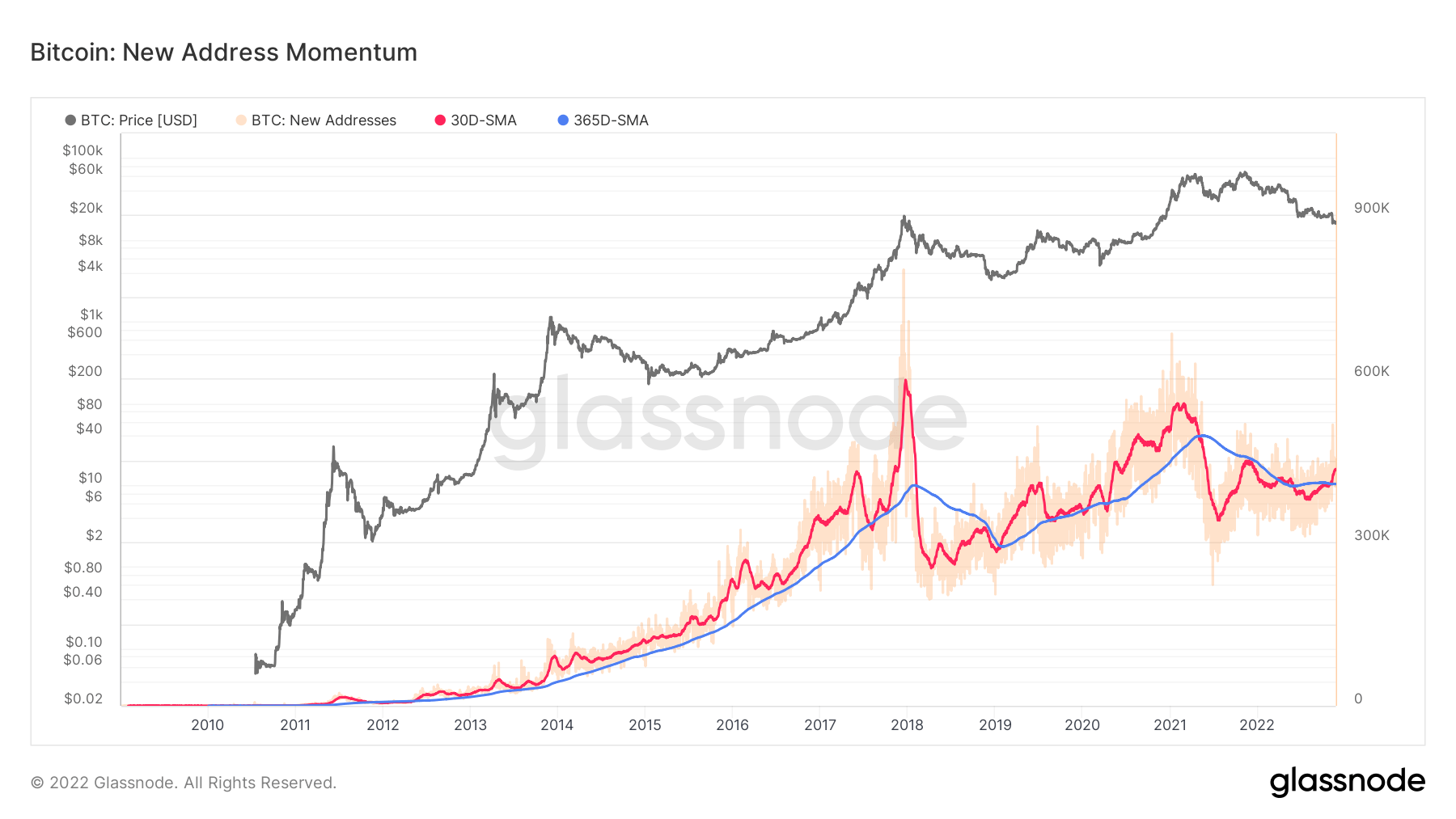

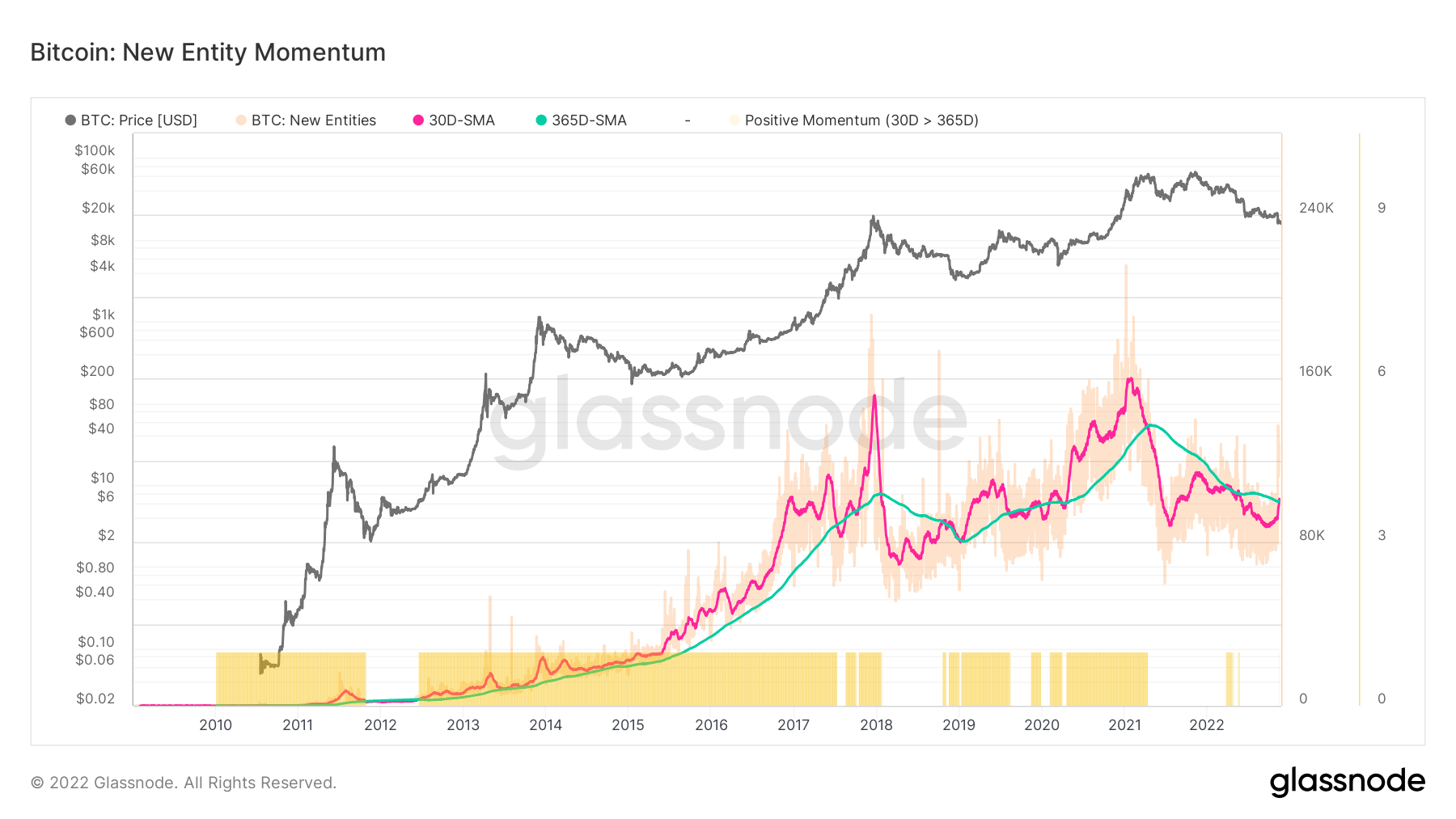

Wholesome community adoption is usually characterised by an uptick in every day energetic customers, extra transaction throughput, and elevated demand for block house (and vice-versa). The variety of New Entities on-chain makes use of our entity-adjustment strategies to extra precisely gauge the magnitude, pattern, and momentum of exercise throughout the community.

Digging deeper into on-chain information exhibits that almost all non-zero addresses had been created previously month. The 30-day easy transferring common (SMA) of latest addresses surpassed the 365-day SMA, flatlining for the higher a part of 2022.

The expansion within the variety of new addresses transferred into a better entity momentum. All new non-zero stability addresses needed to purchase that stability previously month, drastically growing new entities onto the community.

The final time each new entity and new addresses had been above their 365DMA was throughout the 2020-2021 bull run.

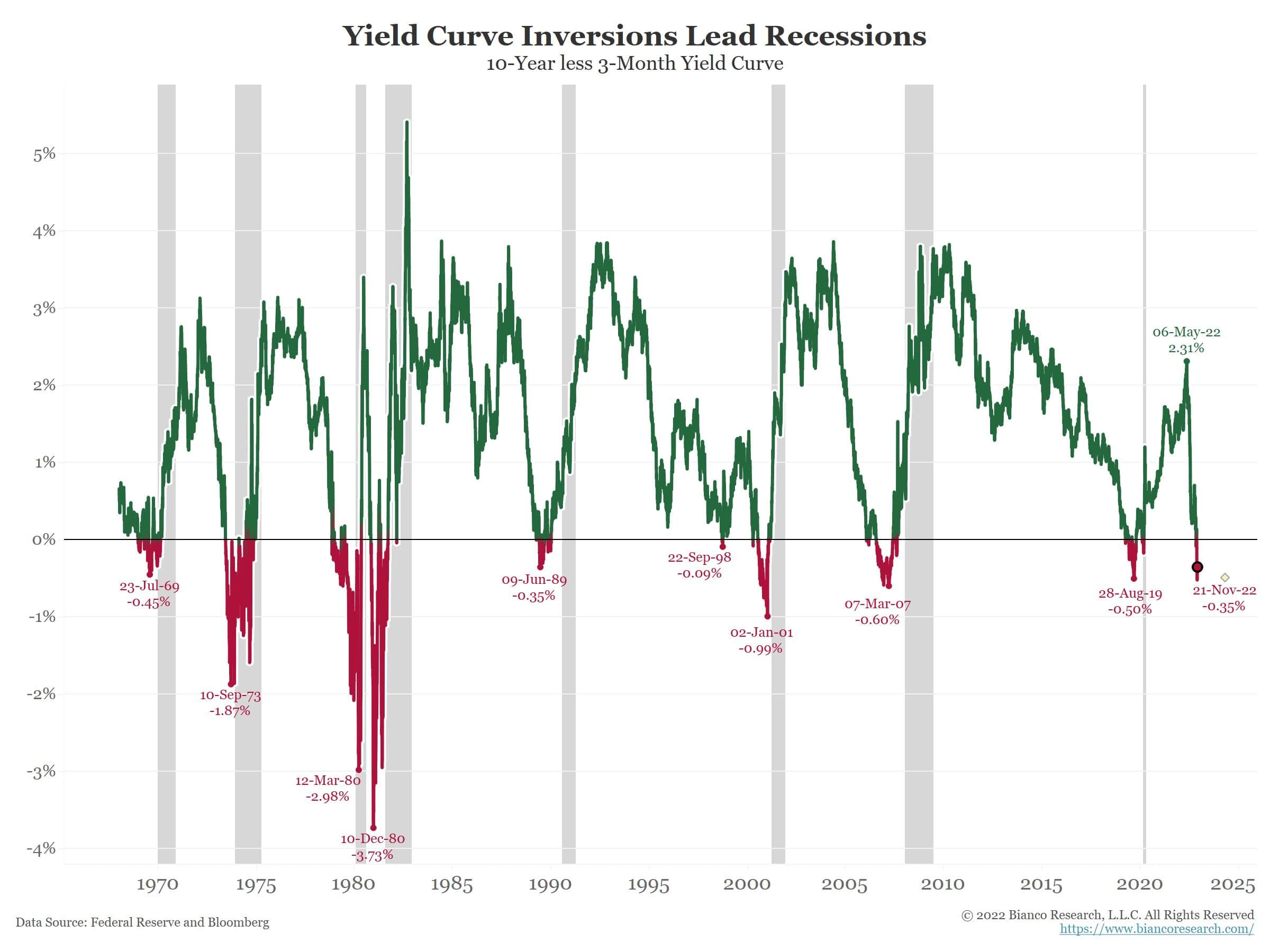

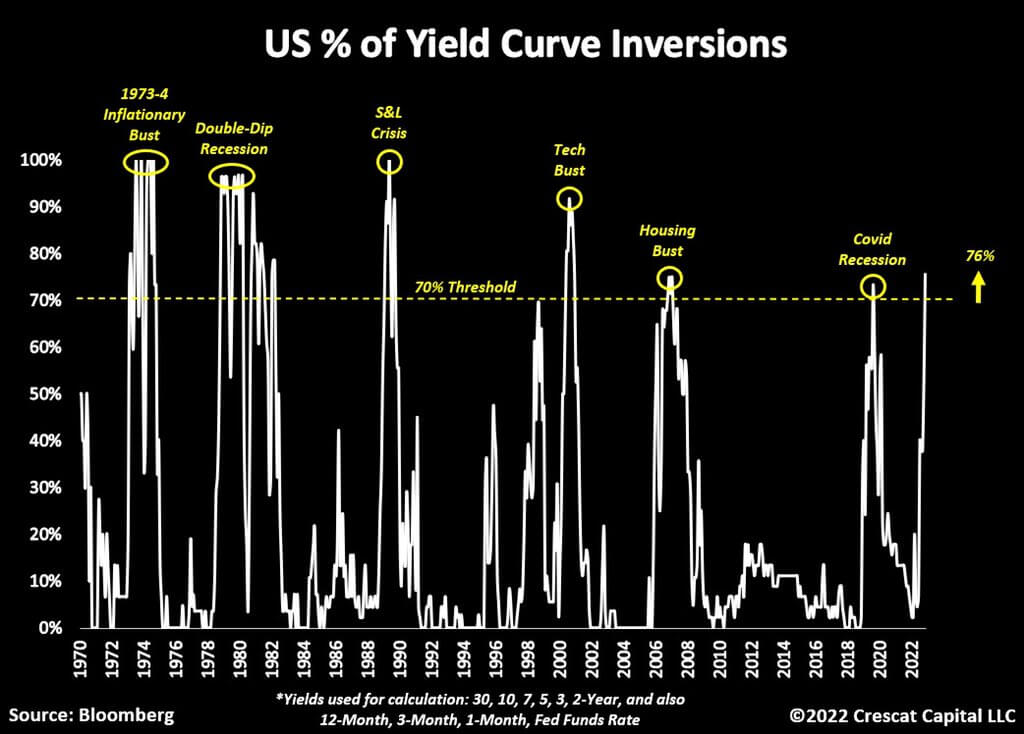

A historic inverted U.S. yield curve

An inverted yield curve is when brief charges are larger than lengthy charges, and the market tells the fed that they’re too tight.

What causes the curve to invert? Brief charges enhance as a result of market believing the fed will maintain growing charges, whereas lengthy charges fall beneath brief charges on the idea that the financial system will, sooner or later, see inflation fall.

Many various inverted yield curves are checked out to establish recessions, most notably the ten-year minus two 12 months and ten-year minus three months.

At the moment, over 75% of all the U.S. treasury curve is inverted; anytime above 70%, a recession has occurred previously 50 years.

Economists imagine the ten-year much less 3-month yield unfold is probably the most correct for figuring out recessions as most analysis has gone into it. The curve has been inverted for nearly two weeks which indicators “persistent inversion.”

When the 3mo/10yr yield curve inverts for ten consecutive days, it’s 8 for 8 in predicting recessions during the last 50+ years. The typical lead time is 311 days or about ten months. – Jim Bianco (Bianco analysis)