Though there have been hints that the worst of the promoting has handed, there’s nonetheless loads of room for skepticism, based mostly on tendencies for key markets through a set of ETF pairs for costs via Thursday’s shut (Nov. 17).

Let’s begin with the ratio of an aggressive asset allocation technique (AOA) to conservative (AOK). Though the development for this proxy has popped these days, the draw back bias stays intact, based mostly on 50- and 200-day transferring averages and so it’s untimely to imagine that the bear market has been exhausted.

The draw back bias for medium-term Treasuries, through iShares 7-10 Yr Treasury Bond (NYSE:), relative to short-term Treasuries, iShares 1-3 Yr Treasury Bond ETF (NASDAQ:), definitely hasn’t modified, which means that the urge for food for security stays sturdy.

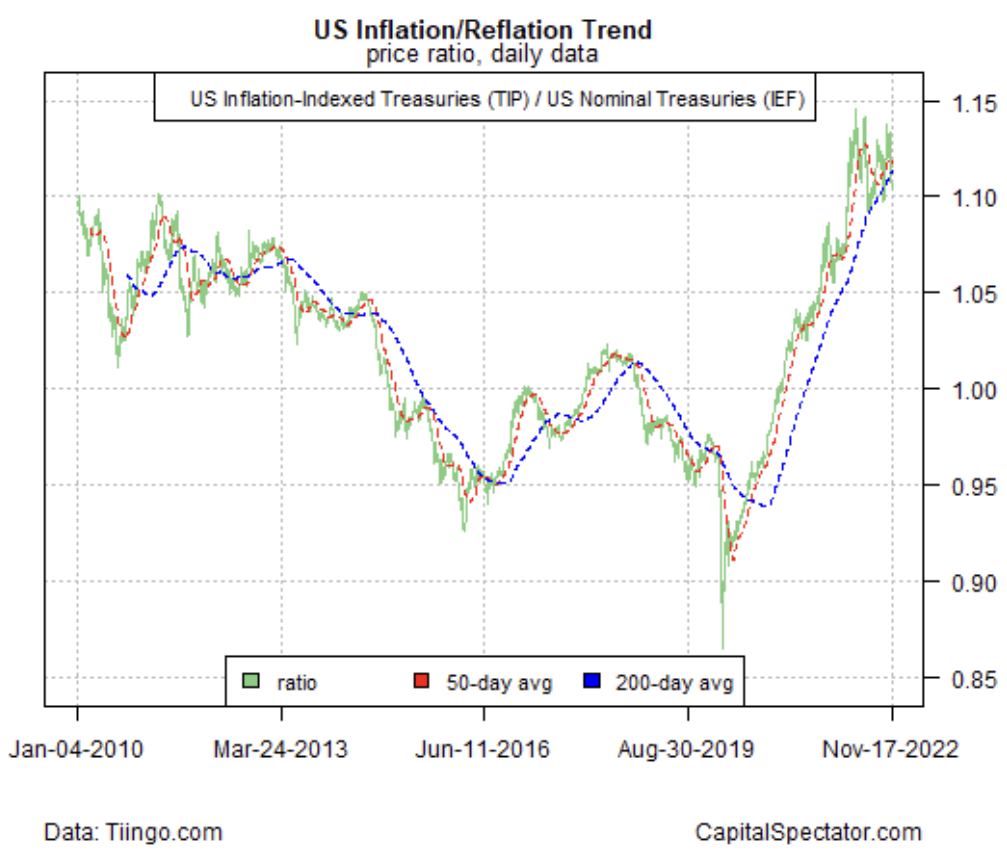

Danger-on for the inflation/reflation commerce continues to carry its floor, based mostly on the ratio for inflation-indexed Treasuries, through iShares TIPS Bond ETF (NYSE:), vs. their normal counterparts (IEF), however the development is wanting drained and is susceptible if the financial system continues to weaken.

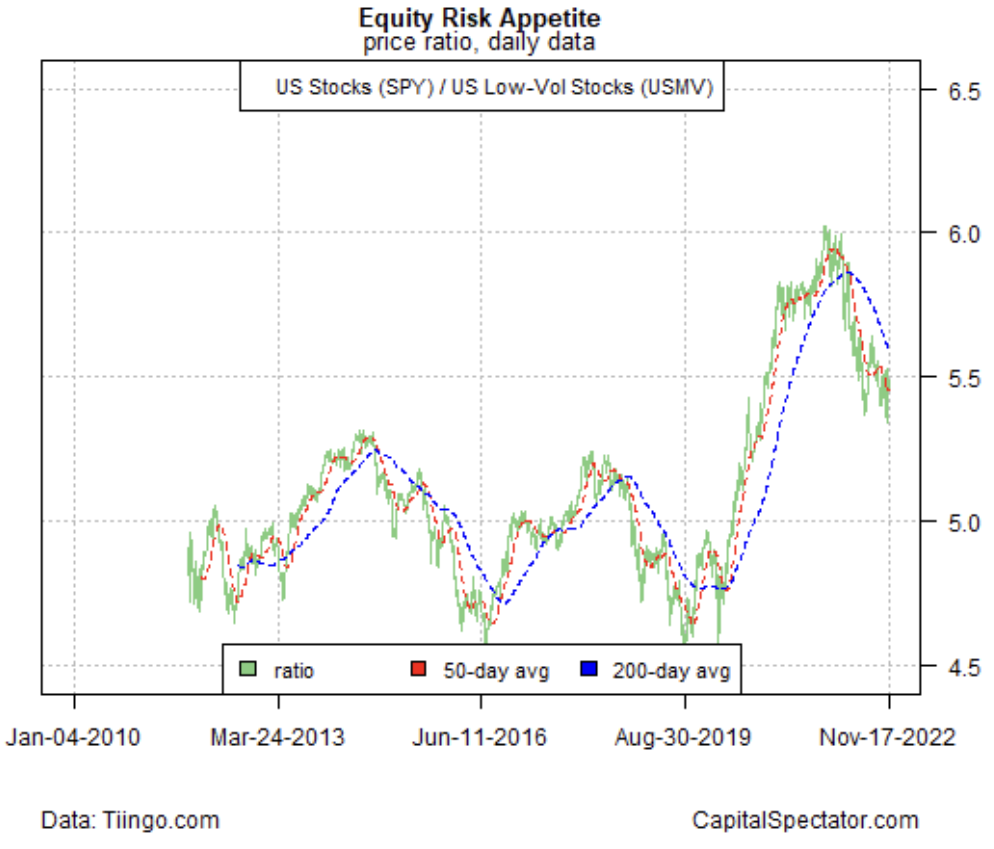

Estimating the chance urge for food for US equities, through SPDR S&P 500 (NYSE:), relative to a portfolio of low-volatility shares, through iShares MSCI USA Min Vol Issue ETF (NYSE:), continues to sign risk-off.

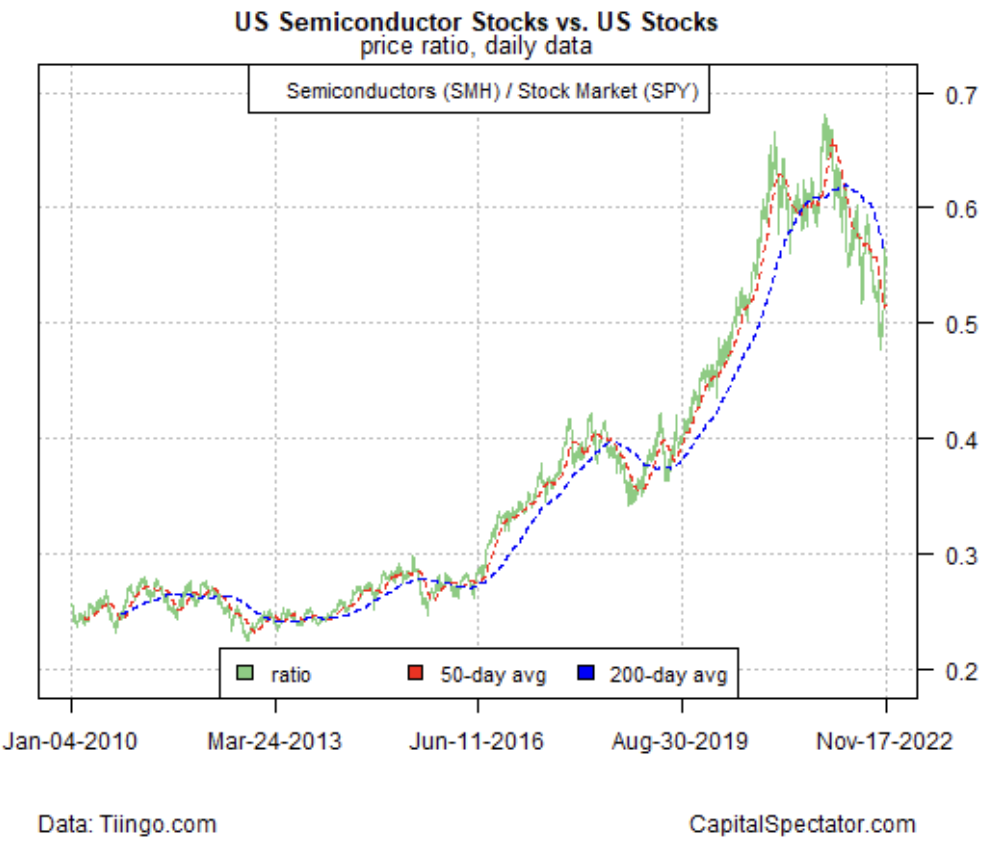

A proxy for financial exercise – semiconductor shares, through VanEck Semiconductor ETF (NASDAQ:), vs. equities general (SPY) – has loved a aid rally these days, however it’s too early to say that the bearish development for this proxy has ended.

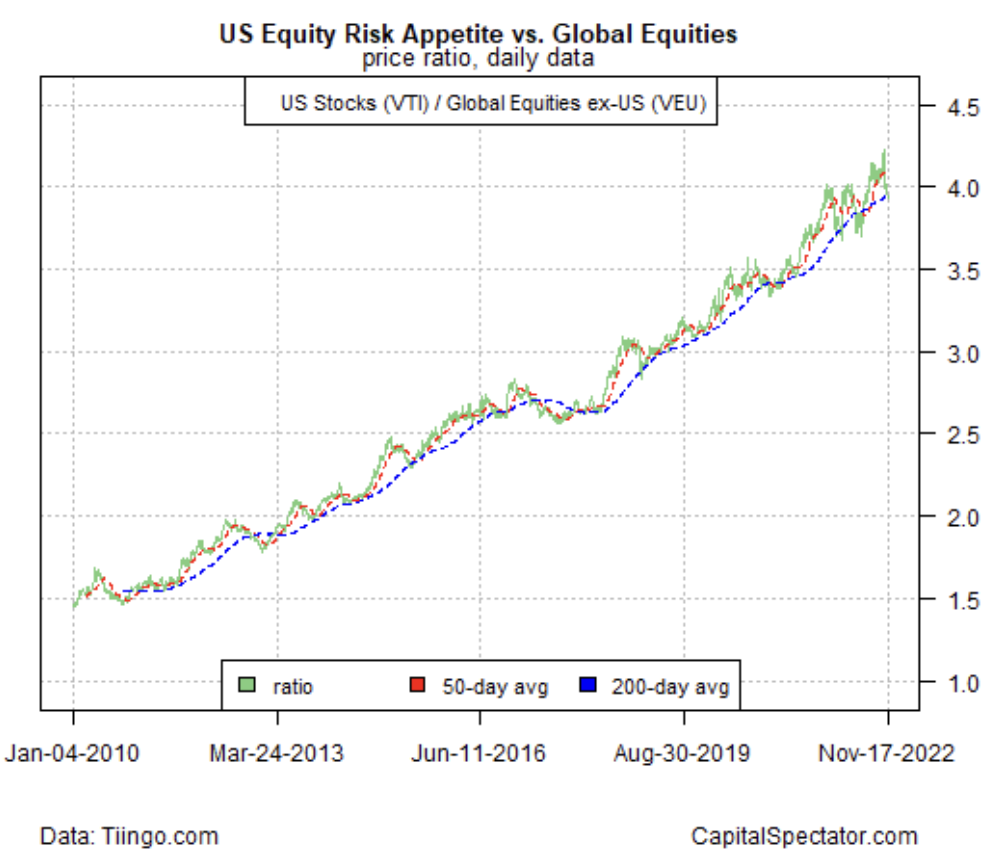

Regardless of the bearish bias for shares usually, the urge for food for US equities, through Vanguard Complete Inventory Market Index Fund ETF Shares (NYSE:), over overseas shares, through Vanguard FTSE All-World ex-US Index Fund ETF Shares (NYSE:), persists.

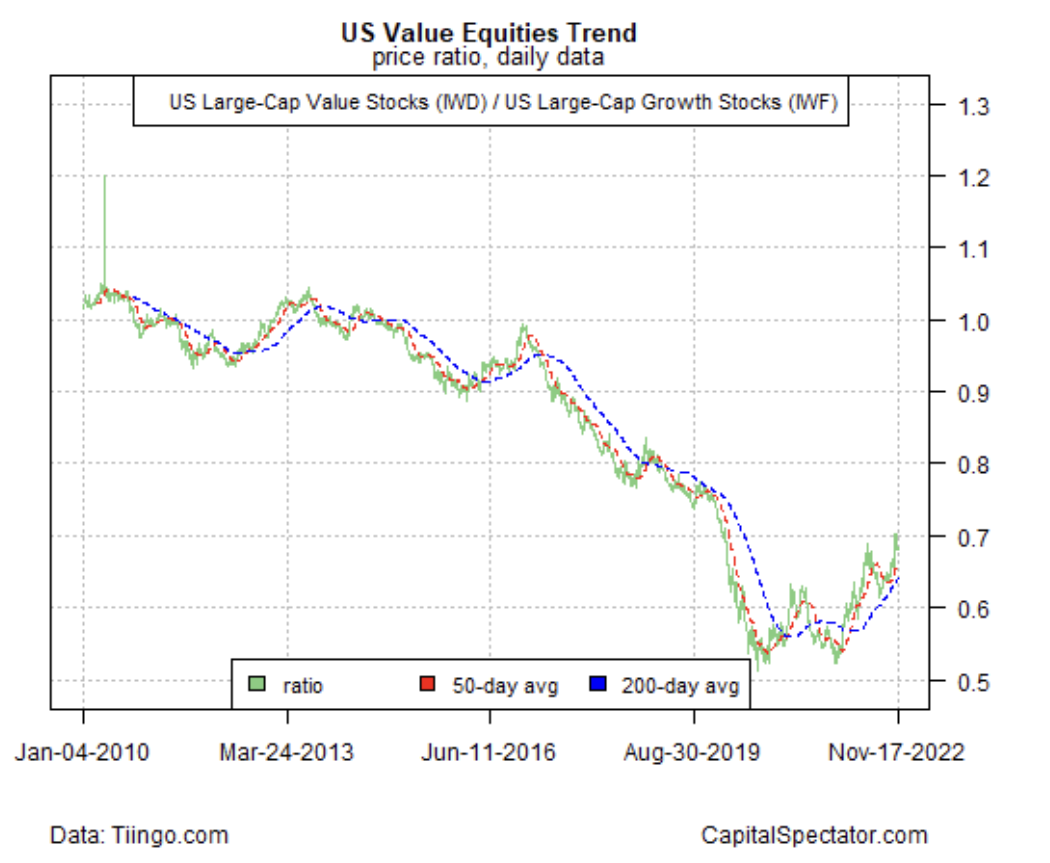

Lastly, relative power for worth shares, through iShares Russell 1000 Worth ETF (NYSE:), vs. development shares, through iShares Russell 1000 Progress ETF (NYSE:), continues to run. The logic is the broadly held view that worth shares are inclined to outperform when rates of interest are rising. On that foundation, expectations that the Federal Reserve will proceed to hike charges within the close to time period suggest that worth will proceed to outperform.