Ethereum (ETH/USD) Fundamentals and Technicals Look Promising

The outlook for Ethereum, both technically and fundamentally, is starting to look rosy and this should feed through into its price over the coming quarter. Between late November 2021 and late January this year, Ethereum fell by around 50% to a low of just $2,200 as the whole crypto market mood turned sour. Since then the second-largest coin by market capitalization has been moving steadily higher, highlighted below by a series of higher lows on the daily chart. Ethereum is now in a zone of prior resistance – between $3,050 and $3,410 – and if this area can be navigated safely then a prior swing-long at just over $3,800 will become the next target. The 50-day simple moving average is supporting the move higher and as long as support at $2,800 remains untouched then Ethereum should move noticeably higher during the second quarter.

Ethereum Daily Price Chart

Chart via TradingView

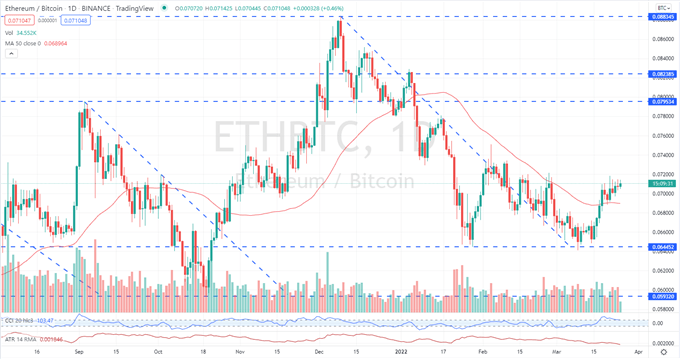

The recent bout of strength in Ethereum is also seen in the ETH/BTC spread with the pair bouncing off prior support around 0.06500 and back to levels last seen around one month ago. The prior break of a strong downtrend – between early September and late October 2021 – sparked a sharp rally, not just in Ethereum but across the whole alt-coin space.

Ethereum/Bitcoin (ETH/BTC) Spread Chart

Chart via TradingView

The fundamental outlook for Ethereum over the coming months is also bullish with the expected Proof-of-Stake and Proof-of-Work merge expected in late Q2-mid Q3. Latest reports suggest that testing of the merge, Ethereum 2.0, has been successful and that the main launch will be announced in the next three to four months. Ethereum will then become exponentially more energy-efficient, a major source of governmental concern, as holders of Ethereum will be able to stake their coins to validate transactions instead of consuming vast amounts of energy mining coins to get rewards when validating. Current market quotes suggest that staking rewards will be in the range of 8% to 15%.

A combination of bullish fundamentals and technicals should see Ethereum perform strongly in the second quarter of this year.