BOE Rate Decision Key Points:

- 75bp Hike by the Bank of England to Meet Expectations.

- Vote Split of 7-2 in Favor of the 75bp Hike.

- Majority of MPs Believe 75bp Hike Would Reduce Risk of Future Costly Tightening.

Recommended by Zain Vawda

Get Your Free GBP Forecast

The Bank of England unleashed its biggest interest-rate hike in 33 years as it warned that inflation is likely to peak around 11% in Q4. The vote was unanimous in terms of a hike, however, policymaker Dhingra voted for 50bp while Tenreyro voted for a 25bp hike. The bank predicts the UK economy will contract by 1% in 2024 compared to previous estimates of 0.25%. The forecasts are based on a peak market rate of around 5.25%.

The BOE insist that the peak rate is probably less than markets are currently pricing while warning they will act forcefully on persistent inflation. The central bank says the recession began in the third quarter as GDP dropped 0.5%, with it expected to last until 2023.

For all market-moving economic releases and events, see the DailyFX Calendar

While markets continue to wait on the new medium-term fiscal plan, pressure on the Bank of England (BoE) has been reduced. The bank did not deliver a 75bp hike in September and since then the pound has strengthened against the greenback. Recent rhetoric from the BoE and some policymakers have hinted at their uneasiness at the amount of hikes markets are pricing. BoE policymaker Mann (a hawk) recently stated that markets are too aggressively priced at this stage. The BoE forecast from August of a recession was based on a peak rate of 3% with markets now pricing around 5%. According to deputy Governor Broadbent this could result in a near 5% hit to GDP over the coming years.

Recommended by Zain Vawda

Trading Forex News: The Strategy

Focus will now shift to the ‘Autumn Statement/Fiscal plan’ scheduled for November 17 as the government looks to plug the borrowing gap. Markets are a lot calmer with PM Sunak and Chancellor Hunt at the wheel of the fiscal plan, with taxes and energy price guaranteed to be key points. Given yesterday’s Fed meeting it seems the US will continue hiking rates albeit in smaller increments, which could add further afflictions to the pound.

Market reaction

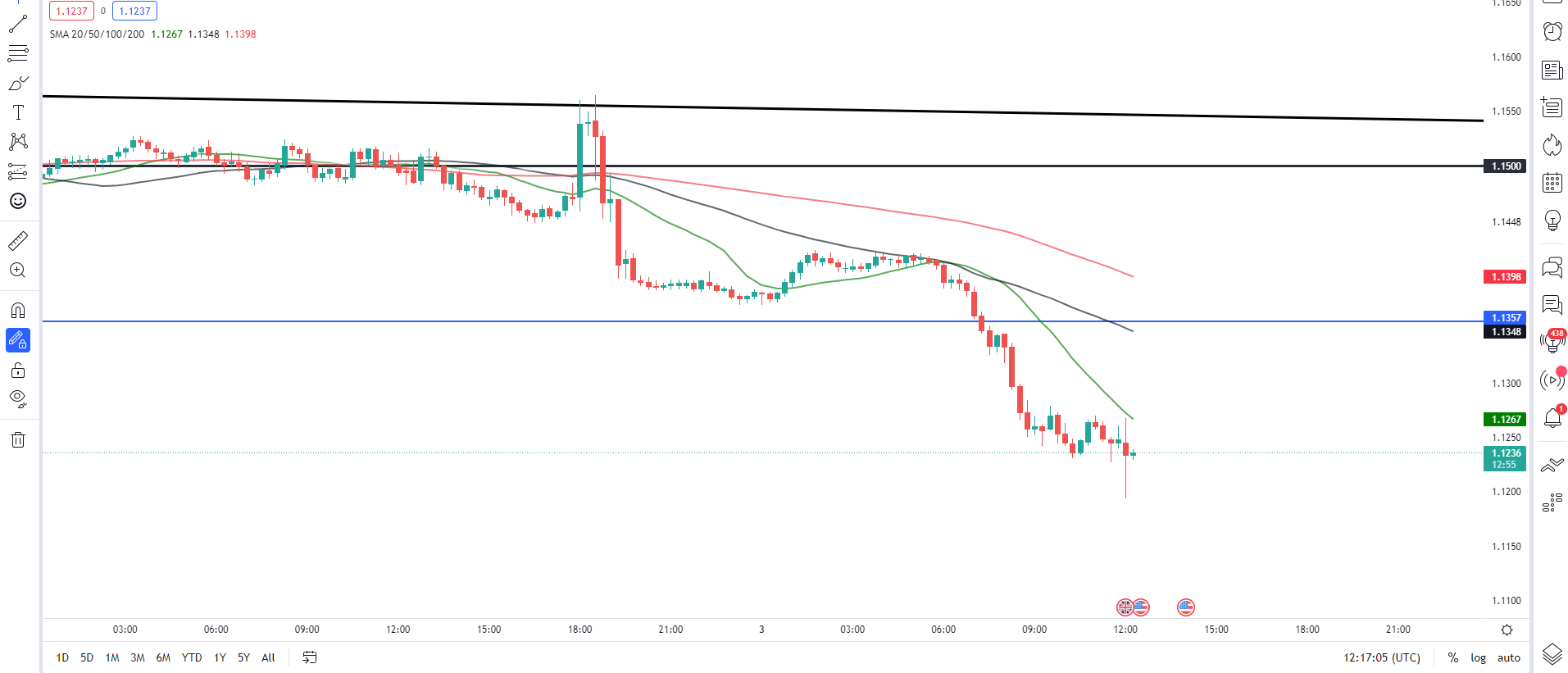

GBPUSD 15M Chart

Source: TradingView, prepared by Zain Vawda

GBPUSD initial reaction saw a spike lower before recovering to trade relatively flat. Downside pressure remains on the pair as the dollar index continues its move higher.

Key Intraday Levels Worth Watching:

Support Areas

Resistance Areas

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda