WTI Crude Oil, US Production, China, Covid, EIA, Inventory, Technical Analysis – Talking Points

- Crude oil prices face mounting macroeconomic headwinds after prices rise in October

- US inventory data, the FOMC rate decision and the US jobs report to set oil direction

- WTI prices look set for a potential spike in volatility as prices coil in triangle pattern

WTI and Brent crude oil prices are marginally lower in early Asia-Pacific trading, extending Monday’s drop as Chinese Covid lockdowns and rising interest rates weigh on the commodity’s demand outlook. Crude oil finished 8.86% higher in October despite Monday’s 2.18% decline. That broke a four-month losing streak that pushed prices below the $80 level.

On Monday, a surprise contraction in China’s manufacturing sector for October sent prices lower, with the purchasing managers’ index falling to 49.2 from 50.1, according to the National Bureau of Statistics (NBS). A reading below 50 indicates contraction. It was the latest fallout from the country’s “Zero-Covid” policy, which some hoped would ease after China’s National Congress.

President Xi Jinping remains committed to the policy despite its economic ramifications. That is bearish news for oil prices. According to a Reuters survey, Saudi Arabia’s Aramco may cut its official selling price (OSP) for light crude by around .30 to .40 per barrel next month. Those price updates should cross the wires later this week.

Meanwhile, a new wave of Covid infections across China has put dozens of cities under lockdown. For October 31, China reported 2,626 new community cases. On Monday, Shanghai’s Disney closed its theme park and shopping areas. Macau authorities closed the MGM Cotai resort on Sunday and ordered testing for all residents. And, in Zhengzhou, Foxconn’s iPhone factory is under a closed-loop system, and portions of the city are locked down. While domestic demand is low, refineries have increased export quotas for fuel, which may underpin Chinese imports.

In the United States, oil production hit a post-pandemic high at 11.975 million barrels per day (bpd), according to the Energy Information Administration (EIA). The all-time record was in November 2019 at 13 million bpd. While encouraging, supply remains very tight, especially in distillate fuels, which includes diesel. US distillate stocks are far below their 5-year average, according to the EIA.

Those numbers are due for a weekly update on Wednesday. Analysts expect to see crude oil stocks increase by 267k barrels for the week ending October 28, while distillate stocks are seen falling by 733k barrels. week also brings the FOMC rate decision and US job numbers, both of which may move oil markets, given the macro implications of the datas. For now, don’t expect a strong rebound in prices amid China’s worsening lockdowns.

WTI Crude Oil Technical Outlook

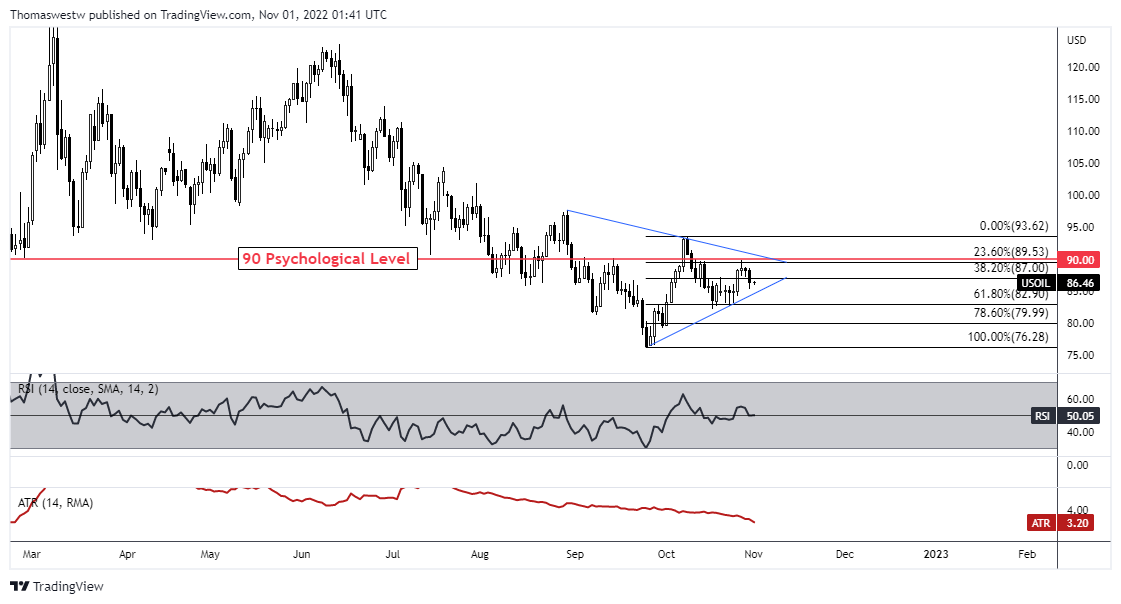

Prices failed to clear the 90 psychological level last week before falling from the level on Monday. A period of consolidation, which has carved out a not-so-clean Symmetrical Triangle, has dragged volatility lower. The average true range (ATR) is at 3.20, the lowest since February. That, along with the triangle, suggests that prices may see a breakout soon. The question is, which way?

WTI Crude Oil Daily Chart

Chart created with TradingView

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter