Chinese Yuan, USD/CNH, PBOC, Industrial Profits, Market Sentiment – Talking Points

- Asia-Pacific markets eye a mixed open after US stocks fall alongside US Dollar

- Chinese industrial profits are on tap as the Yuan gains amid USD bank selling

- USD/CNH may threaten the 7 psychological level as prices test moving averages

Thursday’s Asia-Pacific Outlook

Asia-Pacific markets are set for a mixed open on Thursday. The US Dollar fell against most of its peers after the Bank of Canada hiked rates by 50 basis points instead of the expected 75-bps hike, which dragged on FOMC rate hike bets. Fed funds futures see a 50-bps hike being the most likely outcome at the December FOMC meeting.

Meta Platforms Inc. posted disappointing earnings results for the third quarter, sending the stock more than 15% lower in after-hours trading. Alphabet and Microsoft fell around 10% and 8% in cash trading hours. The Nasdaq-100 Index fell 2.26%. The US Dollar DXY Index fell over 1% to its lowest level since September.

Gold and silver rose as Treasury buyers entered the market. The UK government’s decision to delay its spending plan to November assuaged wary investors following the market calamity earlier this month. The British Pound rose on the news, benefiting from a broadly weaker Dollar as well. The Euro was higher as the European Union’s natural gas coffers hit near-full levels.

Recommended by Thomas Westwater

Get Your Free Top Trading Opportunities Forecast

South Korea’s third-quarter gross domestic product (GDP) growth rate is due this morning. The advance reading is expected to post a 2.8% increase from the year before. That would be down from 2.9% in Q2. USD/KRW fell to a two-week low overnight. Japan’s foreign bond investment data for the week ending Oct 22 is on the calendar for 23:50 UTC. Australia’s Q3 export and import prices and Chinese industrial profits for September will wrap up the day.

The Chinese Yuan gained over 1.5% against the Dollar, posting one of the largest one-day percentage changes for USD/CNH on record. Reuters reported that Chinese state-owned banks sold USDs on Tuesday, citing direct sources. The People’s Bank of China (PBOC) set the USD reference rate at 7.1638 on Wednesday, stronger than estimated. China’s foreign direct investment for September is set to cross the wires before the weekend. Iron ore prices fell around 0.5% on Wednesday. Optimistic industrial profits reading for September may help China-sensitive metal prices catch a bid.

USD/CNH Daily Chart Overlaid With the 1-Day Percentage Move

Chinese Yuan Technical Outlook

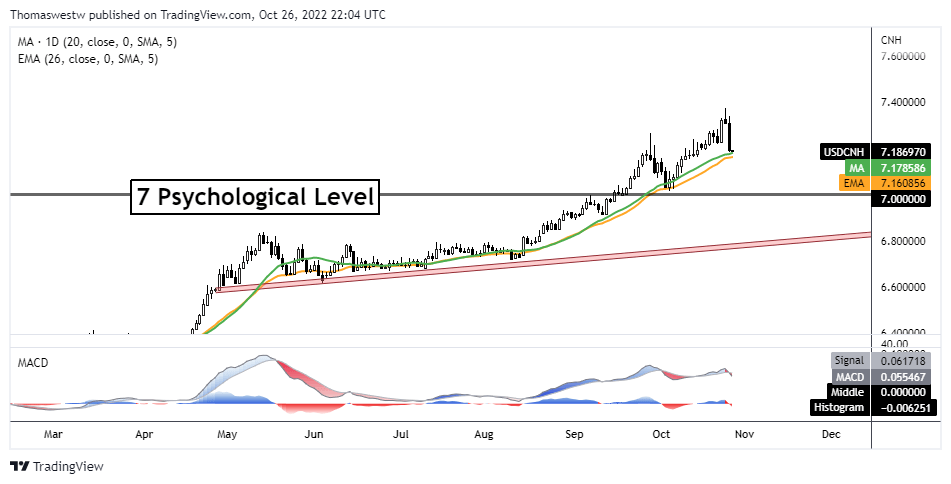

A drop to the 20-day Simple Moving Average (SMA) and the 26-day Exponential Moving Average (EMA) puts USD/CNH bulls on the back foot. A break below those moving averages could see prices accelerate lower, which would expose the psychological 7 level. MACD crossed below its signal line, a bearish addition to price action.

USD/CNH Daily Chart

Chart created with TradingView

Discover what kind of forex trader you are

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter