EUR/USD ANALYSIS TALKING POINTS

- U.S. labor data unlikely to deter Fed officials.

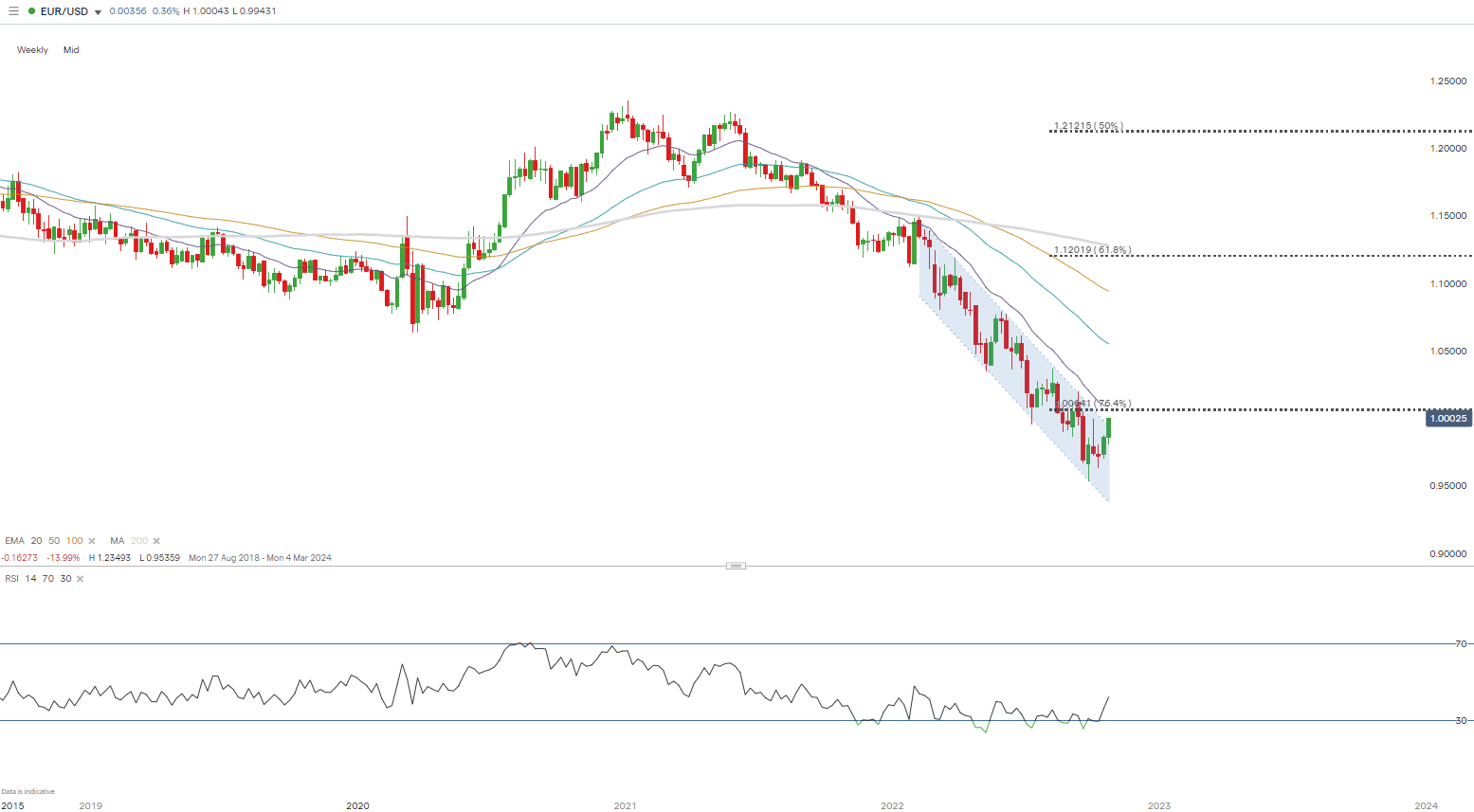

- EUR/USD weekly long upper wick a concern for euro bulls.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

EURO FUNDAMENTAL BACKDROP

The euro has been steadily appreciating against the USD over the last few weeks with dovish bets mounting against the Fed, backed by U.S. economic data as well as weaker natural gas prices. The focus for the EUR this week will come from tomorrow’s ECB meeting to announce their interest rate. Money markets are currently pricing in a 75bps rate hike with almost 93% certainty which in isolation may not see a marked shift in EUR/USD but the post-announcement press conference will hold the key for short-term directional bias. Any hawkish slant accompanying the decision could give parity a test once more.

Recommended by Warren Venketas

Get Your Free EUR Forecast

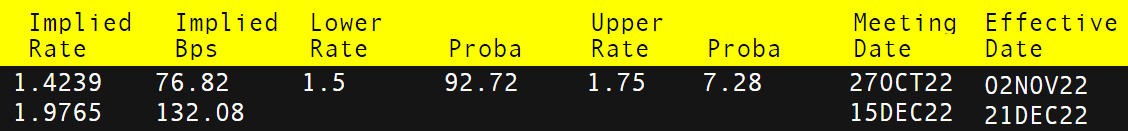

ECB INTEREST RATE PROBABILITIES

Source: Refinitiv

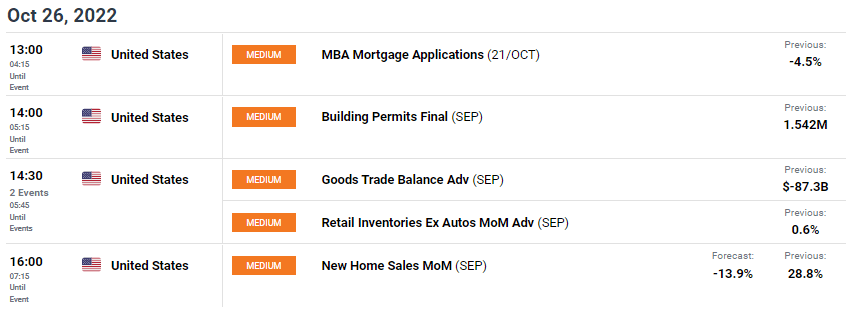

The economic calendar today is dominated by U.S. housing data (see economic calendar below) which may not be extremely market moving but could garner additional support for a less aggressive Fed should the housing market show signs of decline.

EUR/USD ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

EUR/USD WEEKLY CHART

Chart prepared by Warren Venketas, IG

The weekly chart above shows bulls now looking to pierce through the long-term descending channel

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily price action this week showed yet another rejection by bears at the medium-term trendline (black) which coincides with the psychological parity level. Since then, the euro has slipped back below the 0.9854 December 2002 swing low while the Relative Strength Index (RSI) echoes short-term fundamental uncertainty (NFP) at this point.

Resistance levels:

- 1.0000

- 50-day EMA (blue)

- 0.9854/20-day EMA (purple)

Support levels:

- 0.9685

- 0.9601 (September 2002 swing low)

- 0.9500

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Warren Venketas

IG CLIENT SENTIMENT DATA: BULLISH

IGCS shows retail traders are currently SHORT on EUR/USD, with 54% of traders currently holding short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term upside bias.

Contact and followWarrenon Twitter:@WVenketas